Wisconsin Self-Employed Animal Exercise Services Contract

Description

How to fill out Self-Employed Animal Exercise Services Contract?

Are you in a situation where you require documents for possible business or specific purposes almost daily.

There are numerous authentic document templates accessible online, but finding trustworthy versions can be challenging.

US Legal Forms offers thousands of customizable templates, such as the Wisconsin Self-Employed Animal Exercise Services Contract, designed to meet state and federal requirements.

Once you find the right template, click Get now.

Select the payment plan you prefer, fill out the required information to create your account, and complete the transaction using your PayPal or credit card. Choose a convenient file format and download your copy. Access all the document templates you have purchased in the My documents section. You can retrieve an additional copy of the Wisconsin Self-Employed Animal Exercise Services Contract anytime if needed. Click the desired template to download or print the document format. Use US Legal Forms, the most extensive collection of legitimate forms, to save time and avoid errors. The service provides properly crafted legal document templates that can be utilized for various purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Wisconsin Self-Employed Animal Exercise Services Contract template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Locate the template you need and ensure it is for your correct city/region.

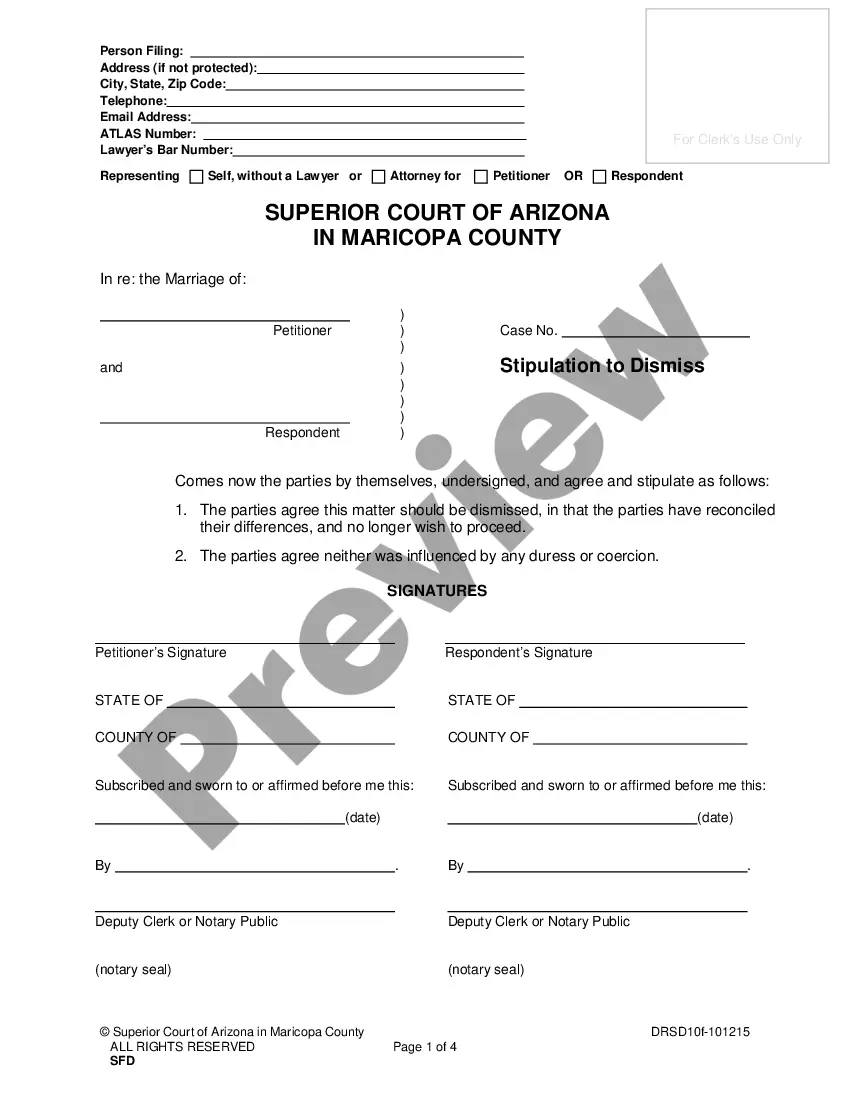

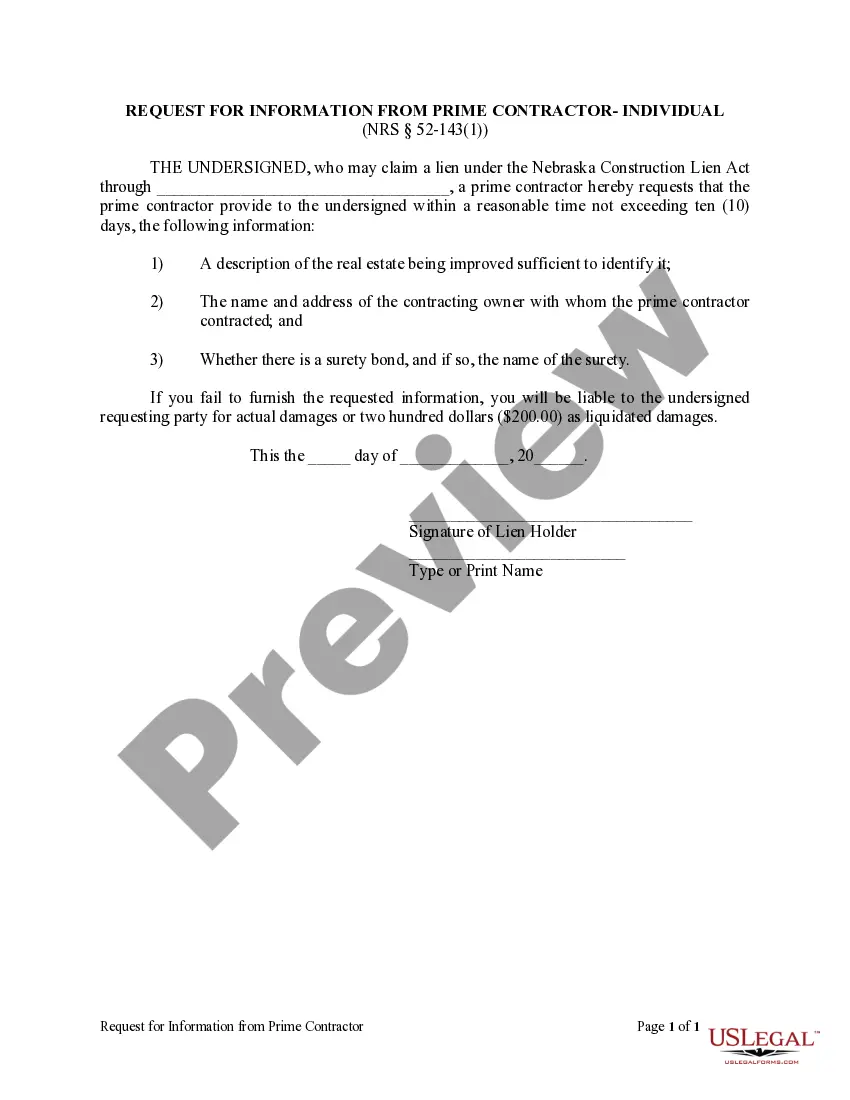

- Use the Review button to examine the form.

- Read the description to confirm that you have selected the correct template.

- If the template is not what you are looking for, use the Lookup field to find the template that suits your needs.

Form popularity

FAQ

You can show proof of self-employment by presenting documents like tax returns, invoices, and a Wisconsin Self-Employed Animal Exercise Services Contract. These items illustrate your business operations and earnings. Keeping your records organized helps ensure you can easily provide proof when needed.

To write proof of self-employment, create a letter or statement that includes your business name, contact information, and a description of services provided. Reference a Wisconsin Self-Employed Animal Exercise Services Contract if applicable. Include relevant dates and any supporting documents for added credibility.

Independent contractors in Wisconsin are responsible for paying self-employment taxes, federal income taxes, and state income taxes. Earnings from contracts, such as a Wisconsin Self-Employed Animal Exercise Services Contract, will be subject to these taxes. Understanding your tax obligations is vital for financial planning.

The best proof of self-employment typically includes a combination of documents such as tax returns, invoices, and a Wisconsin Self-Employed Animal Exercise Services Contract. These items collectively demonstrate your business activity and income. Always maintain organized records to support your status.

In Wisconsin, the self-employment tax consists of Social Security and Medicare taxes, which total approximately 15.3% of your net earnings. This tax applies to income earned as a self-employed individual, including income from a Wisconsin Self-Employed Animal Exercise Services Contract. It's crucial to budget for these taxes to avoid surprises during tax season.

You can prove your self-employment by presenting various documents, including a Wisconsin Self-Employed Animal Exercise Services Contract, bank statements, and receipts. These items provide evidence of your earnings and business operations. Consistent record-keeping is essential for establishing your self-employed status.

Filling out a self-employment income report requires you to list your income sources and expenses. Begin by detailing your earnings from services provided, such as those outlined in a Wisconsin Self-Employed Animal Exercise Services Contract. Ensure you keep accurate records to simplify this process.

To prove you are self-employed, gather documentation that verifies your business activities. This may include tax returns, invoices, and a Wisconsin Self-Employed Animal Exercise Services Contract. These documents demonstrate your income and ongoing business relationships.

Service animal laws in Wisconsin emphasize the rights of individuals with disabilities to be accompanied by trained service dogs in public spaces. These laws do not extend to emotional support animals, which have different regulations. By understanding and incorporating these service animal laws into your Wisconsin Self-Employed Animal Exercise Services Contract, you can provide clear guidelines that protect both your business and your clients.

Generally, you cannot deny service to someone with a service animal under Wisconsin law, as service animals are protected. However, you can refuse service if the animal is disruptive or poses a direct threat to safety. When developing your Wisconsin Self-Employed Animal Exercise Services Contract, it is crucial to outline your policies regarding service animals to inform clients of their rights and responsibilities.