Wisconsin Self-Employed Roofing Services Agreement

Description

How to fill out Self-Employed Roofing Services Agreement?

Finding the appropriate legal document format can be challenging. Certainly, there are numerous templates accessible online, but how can you acquire the legal document you require? Utilize the US Legal Forms website. The platform offers a vast array of templates, including the Wisconsin Self-Employed Roofing Services Agreement, which you can utilize for both business and personal purposes. All documents are vetted by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Download button to obtain the Wisconsin Self-Employed Roofing Services Agreement. Use your account to browse the legal documents you may have previously purchased. Visit the My documents section of your account and retrieve another copy of the document you need.

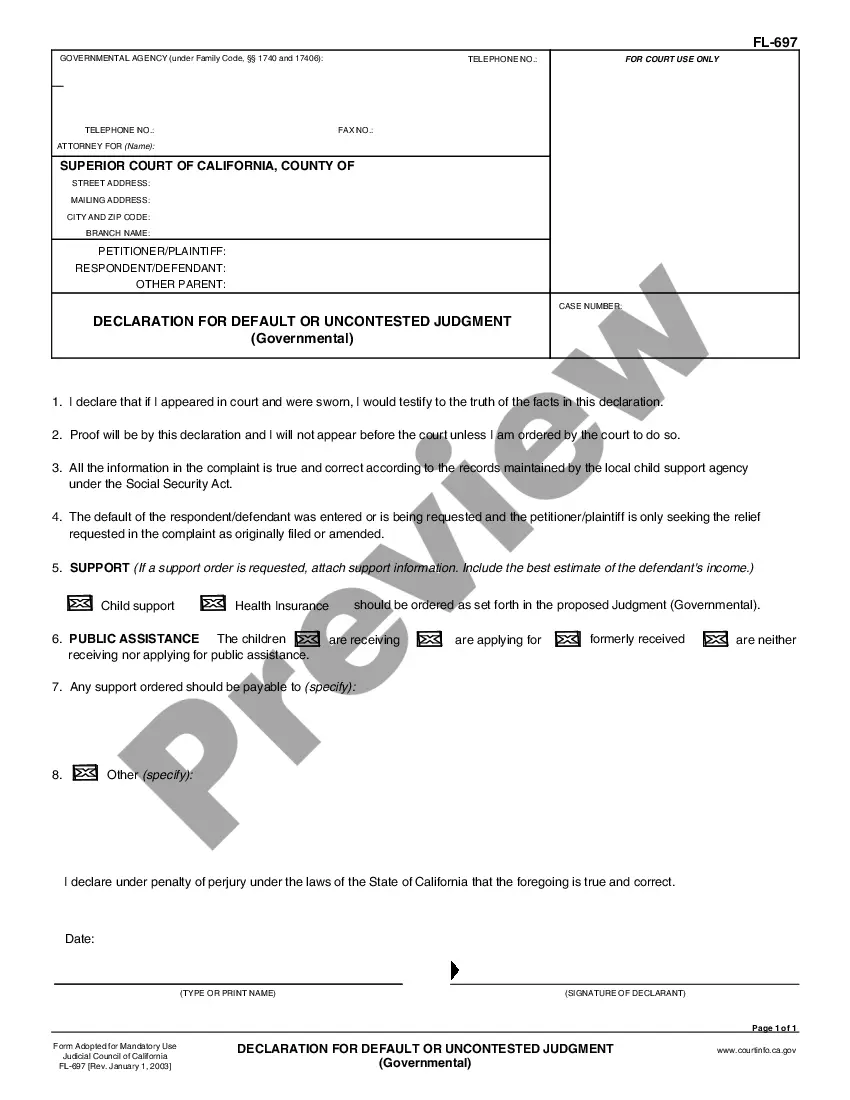

If you are a new user of US Legal Forms, here are some simple steps you should follow: First, ensure that you have selected the correct document for your area/region. You can review the document using the Preview button and read the document description to confirm it is the right one for you. If the document does not meet your needs, use the Search field to find the appropriate document. Once you are confident that the document is suitable, click the Get now button to obtain the document. Choose the pricing plan you desire and enter the necessary information. Create your account and complete the order using your PayPal account or credit card. Select the format and download the legal document format to your device. Complete, edit, print, and sign the acquired Wisconsin Self-Employed Roofing Services Agreement.

In summary, US Legal Forms provides a comprehensive solution for accessing legal documents tailored to your needs, ensuring compliance with all necessary regulations.

- US Legal Forms is the largest repository of legal documents available where you can access various document templates.

- Utilize the service to download professionally crafted paperwork that adheres to state requirements.

- Ensure you select the appropriate form for your specific needs.

- Always preview the document before making a decision.

- Check your account for any previously downloaded forms.

- Keep your information secure when making transactions.

Form popularity

FAQ

Yes, roofers in Wisconsin typically need to be licensed to operate legally. This requirement helps ensure that contractors meet state standards for safety and quality. When hiring a roofer, ask for their license information and consider documenting the agreement using a Wisconsin Self-Employed Roofing Services Agreement for added security.

Writing up a roofing contract involves outlining the project's scope, including materials, timelines, and payment schedules. Be sure to include any local regulations and warranties. For a comprehensive approach, consider using a Wisconsin Self-Employed Roofing Services Agreement to ensure that all necessary details are covered and to protect both parties.

An independent contractor agreement in Wisconsin outlines the working relationship between a contractor and a client. This document clarifies the expectations, responsibilities, and payment terms for both parties. Utilizing a Wisconsin Self-Employed Roofing Services Agreement can help ensure compliance with state laws and protect your interests.

To write a contract for a roofing job, start by detailing the scope of work, including materials and timelines. Specify payment terms and any warranties on the work. It's essential to include both parties' contact information, and you may want to use a Wisconsin Self-Employed Roofing Services Agreement template for clarity and legal compliance.

To start a roofing company in Wisconsin, you typically need a contractor's license. This license ensures that you meet safety regulations and have the necessary skills to perform roofing work. Additionally, obtaining a Wisconsin Self-Employed Roofing Services Agreement can help you outline your services and protect your business legally. By using platforms like US Legal Forms, you can easily access the necessary documentation to get your roofing business off the ground.

In Wisconsin, a roofing license is required for contractors who perform roofing work. This requirement ensures that contractors are qualified and knowledgeable about roofing practices and safety regulations. When you use a Wisconsin Self-Employed Roofing Services Agreement, you can confirm that your roofing contractor is properly licensed, which can provide peace of mind as you move forward with your roofing project.

Roofing laws in Wisconsin cover various aspects, including licensing, safety standards, and building codes. These laws ensure that roofing work is performed safely and meets local construction standards. By referring to a Wisconsin Self-Employed Roofing Services Agreement, you can familiarize yourself with the specific legal requirements that apply to your roofing project, thereby promoting a smoother process.

Yes, roofers need a license to operate legally in many states, including Wisconsin. Licensing requirements help ensure that roofers meet specific standards and regulations. By utilizing a Wisconsin Self-Employed Roofing Services Agreement, you can verify that your chosen contractor holds the necessary licenses, thereby safeguarding your investment and ensuring compliance with local laws.

A standard roofing contract outlines the terms and conditions agreed upon between the contractor and the client. It typically includes project specifics such as the scope of work, payment terms, and timelines. By using a Wisconsin Self-Employed Roofing Services Agreement, both parties can ensure clarity and protection throughout the roofing project. This agreement serves as a crucial document to prevent misunderstandings and disputes.

Yes, you can write your own legally binding contract as long as it meets the essential legal requirements. To ensure enforceability, include clear terms regarding the agreement, responsibilities, and payment details. A Wisconsin Self-Employed Roofing Services Agreement can serve as a useful guide, helping you include all necessary clauses. If you prefer, you can also use resources like US Legal Forms to create a contract that meets legal standards.