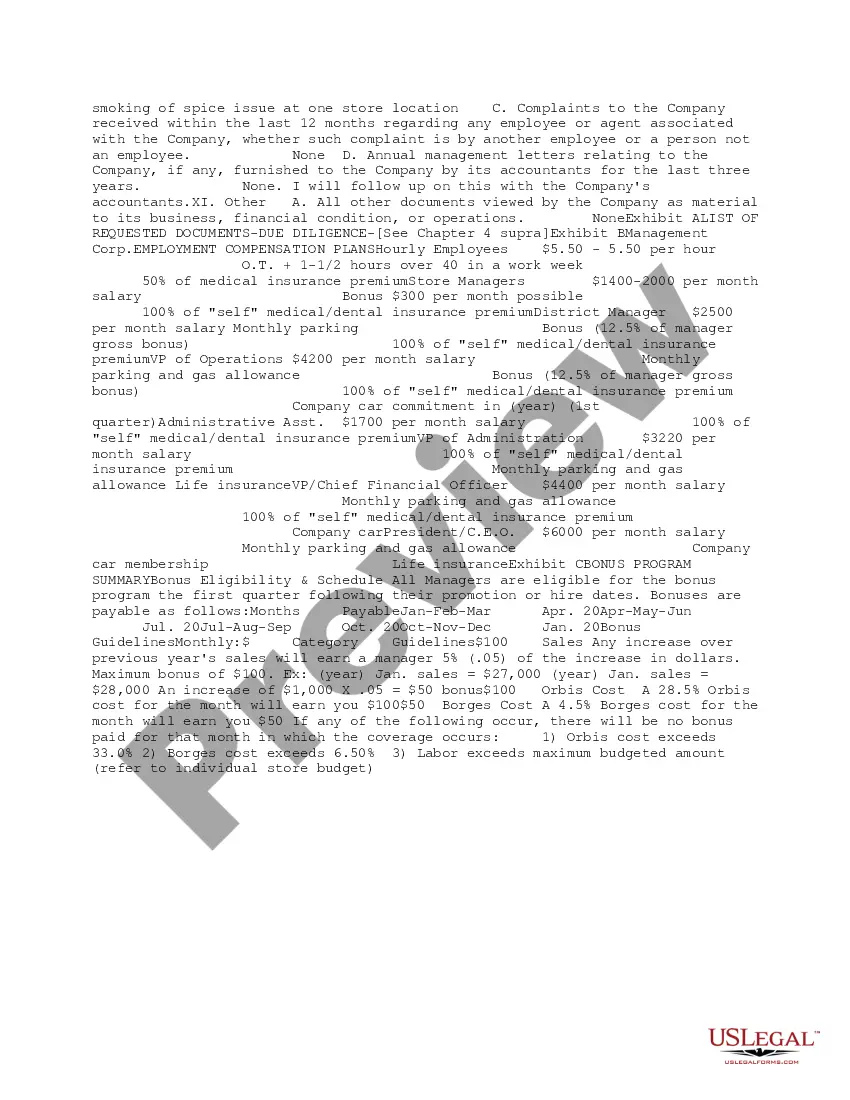

This due diligence form is a memorandum that summarizes the review of documents and the formation produced by a company in response to a list of requested materials.

Wisconsin Summary Initial Review of Response to Due Diligence Request

Description

How to fill out Summary Initial Review Of Response To Due Diligence Request?

If you need to finalize, acquire, or generate sanctioned document templates, utilize US Legal Forms, the leading compilation of legal forms that can be accessed online.

Leverage the site’s straightforward and convenient search function to locate the documents you require.

A wide range of templates for business and personal purposes are sorted by categories and states, or keywords.

Step 4. Once you have located the form you need, click the Get now button. Select the pricing option you prefer and enter your details to create an account.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the payment.

- Use US Legal Forms to discover the Wisconsin Summary Initial Review of Response to Due Diligence Request in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to retrieve the Wisconsin Summary Initial Review of Response to Due Diligence Request.

- You can also access forms you have previously obtained from the My documents section of your account.

- If this is your first time using US Legal Forms, refer to the instructions below.

- Step 1. Ensure you have selected the form for the correct region/state.

- Step 2. Utilize the Preview option to review the content of the form. Be sure to read the summary.

- Step 3. If you are not satisfied with the form, take advantage of the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

Typically, the waiting period for an occupational license in Wisconsin can range from a few weeks to a couple of months. This timeframe often depends on the complexity of your application and the efficiency of the reviewing body. Providing a clear and detailed Wisconsin summary initial review of response to due diligence request can significantly impact processing times. To aid your application, leverage the resources available through USLegalForms.

To secure an occupational license in Wisconsin, applicants generally need to complete specific educational requirements, pass relevant examinations, and submit a thorough application that includes supporting documents. Each occupation may have unique criteria, so it's essential to research your specific field. Understanding how to provide a detailed Wisconsin summary initial review of response to due diligence request will enhance your application. Our platform offers step-by-step templates to assist you.

Obtaining an occupational therapy license in Wisconsin typically takes around 4 to 8 weeks, assuming all documents are submitted correctly and the application is straightforward. Be prepared for additional time if the reviewing board requests more information. For an efficient process, complete your Wisconsin summary initial review of response to due diligence request with proper guidance. With USLegalForms, you can access tools to efficiently manage your paperwork.

In Wisconsin, aspiring Licensed Clinical Social Workers (LCSWs) must complete a minimum of 3,000 hours of post-graduate supervised experience. This supervision must include at least 1,500 hours of direct client contact. It’s important to document every hour thoroughly, especially when preparing your Wisconsin summary initial review of response to due diligence request. Using our resources at USLegalForms can help ensure your compliance with supervision standards.

The waiting period for an occupational license in Wisconsin can vary based on the specific occupation and the completion of required documentation. Generally, you should expect a processing time of several weeks. To expedite your application, ensure that you submit a comprehensive response to the due diligence request. Utilizing our platform, USLegalForms, can streamline your submission process, reducing potential delays.

The 4 P's of due diligence include People, Processes, Products, and Performance. This framework helps evaluate different aspects of a business or initiative. By following the 4 P's in your Wisconsin Summary Initial Review of Response to Due Diligence Request, you gain a more in-depth understanding of the entity you are assessing, facilitating better decision-making.

Conducting a due diligence check requires a systematic approach to gathering and analyzing necessary information. Start with financial records, legal documents, and operational data to have a comprehensive view. Utilizing the Wisconsin Summary Initial Review of Response to Due Diligence Request can enhance your efficiency and ensure that you do not overlook critical aspects.

DSPS stands for the Department of Safety and Professional Services in Wisconsin. This agency manages various professional licensing and regulatory requirements. When conducting a Wisconsin Summary Initial Review of Response to Due Diligence Request, understanding the role of DSPS is vital for ensuring compliance in your review processes.

The 3 P's of due diligence are People, Process, and Product. Understanding the people involved gives insights into the strengths and weaknesses of a business. Each element plays a critical role in the Wisconsin Summary Initial Review of Response to Due Diligence Request, ensuring you obtain a well-rounded overview of the company or investment.

Making a due diligence checklist involves identifying the key areas you need to investigate. Start by compiling a list of necessary documents and information, then categorize them for clarity. By implementing the Wisconsin Summary Initial Review of Response to Due Diligence Request, you can streamline the process and improve compliance with your investigation requirements.