Wisconsin Notice of Violation of Fair Debt Act - Improper Contact at Work

Description

How to fill out Notice Of Violation Of Fair Debt Act - Improper Contact At Work?

If you need to download, retrieve, or print legitimate document templates, utilize US Legal Forms, the largest collection of legal forms that are accessible online.

Employ the site's simple and user-friendly search to find the documents you require. Various templates for business and personal uses are categorized by topics and claims or keywords.

Utilize US Legal Forms to acquire the Wisconsin Notice of Violation of Fair Debt Act - Improper Contact at Work with just a few clicks.

Every legal document template you purchase is yours indefinitely. You have access to each form you saved in your account. Select the My documents section and choose a form to print or download again.

Engage and download, and print the Wisconsin Notice of Violation of Fair Debt Act - Improper Contact at Work with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms customer, Log In to your account and then click the Download button to obtain the Wisconsin Notice of Violation of Fair Debt Act - Improper Contact at Work.

- You can also access forms you previously saved from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

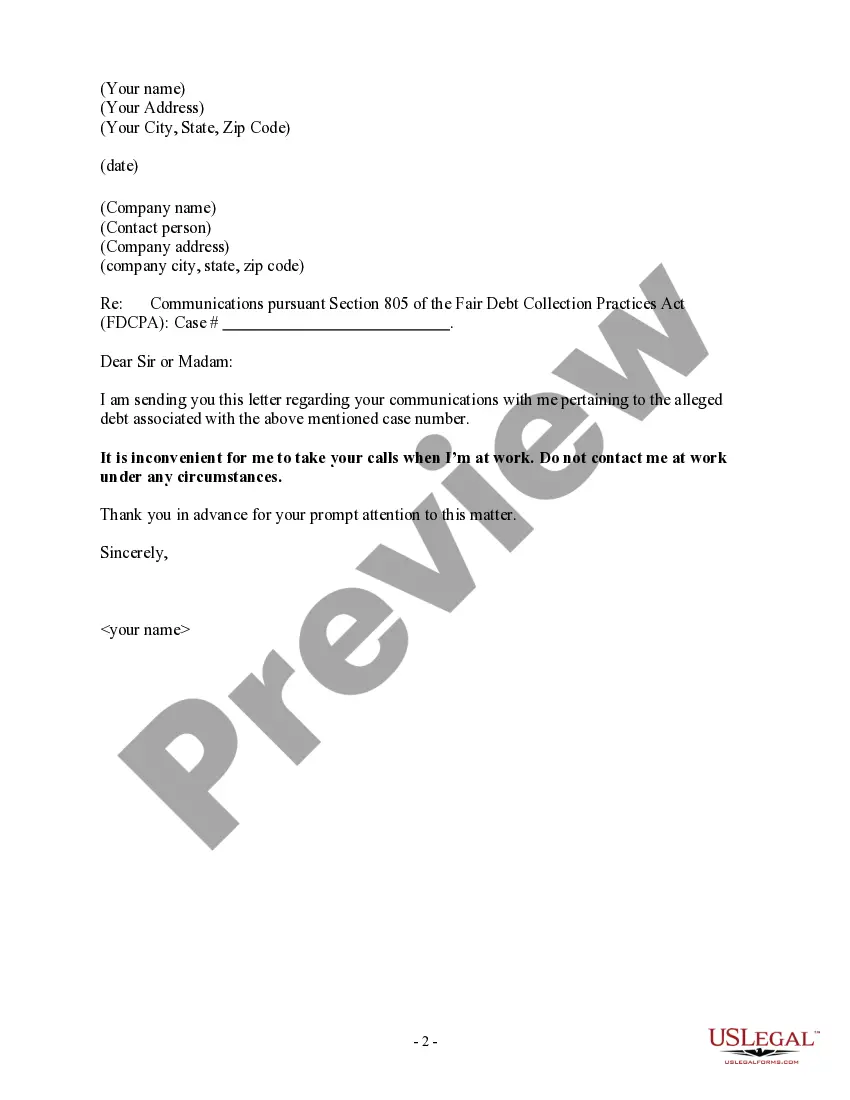

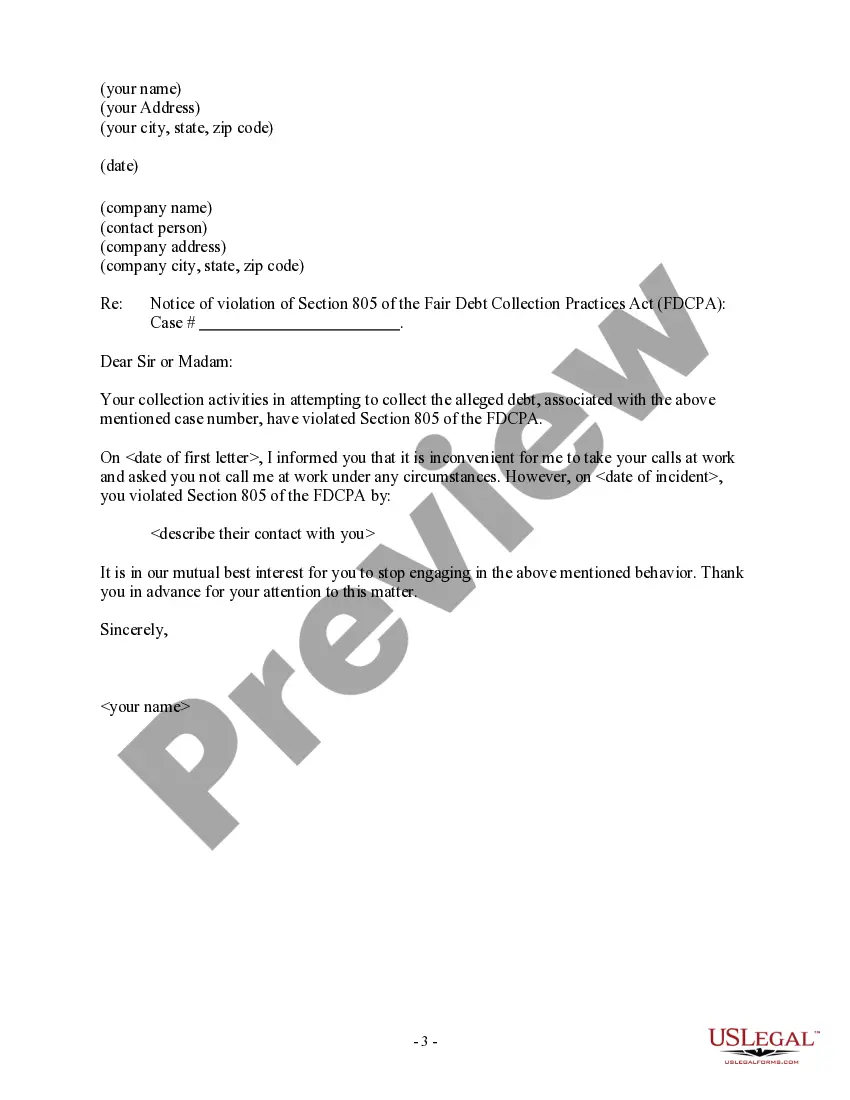

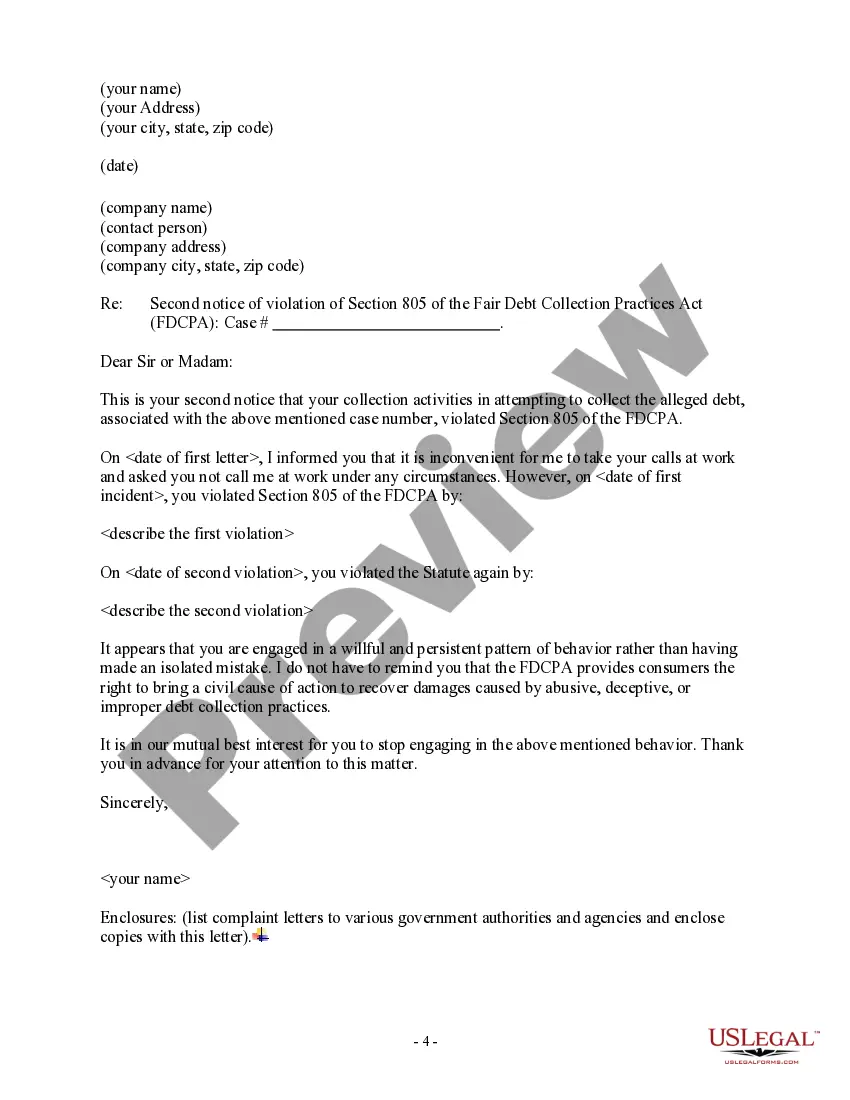

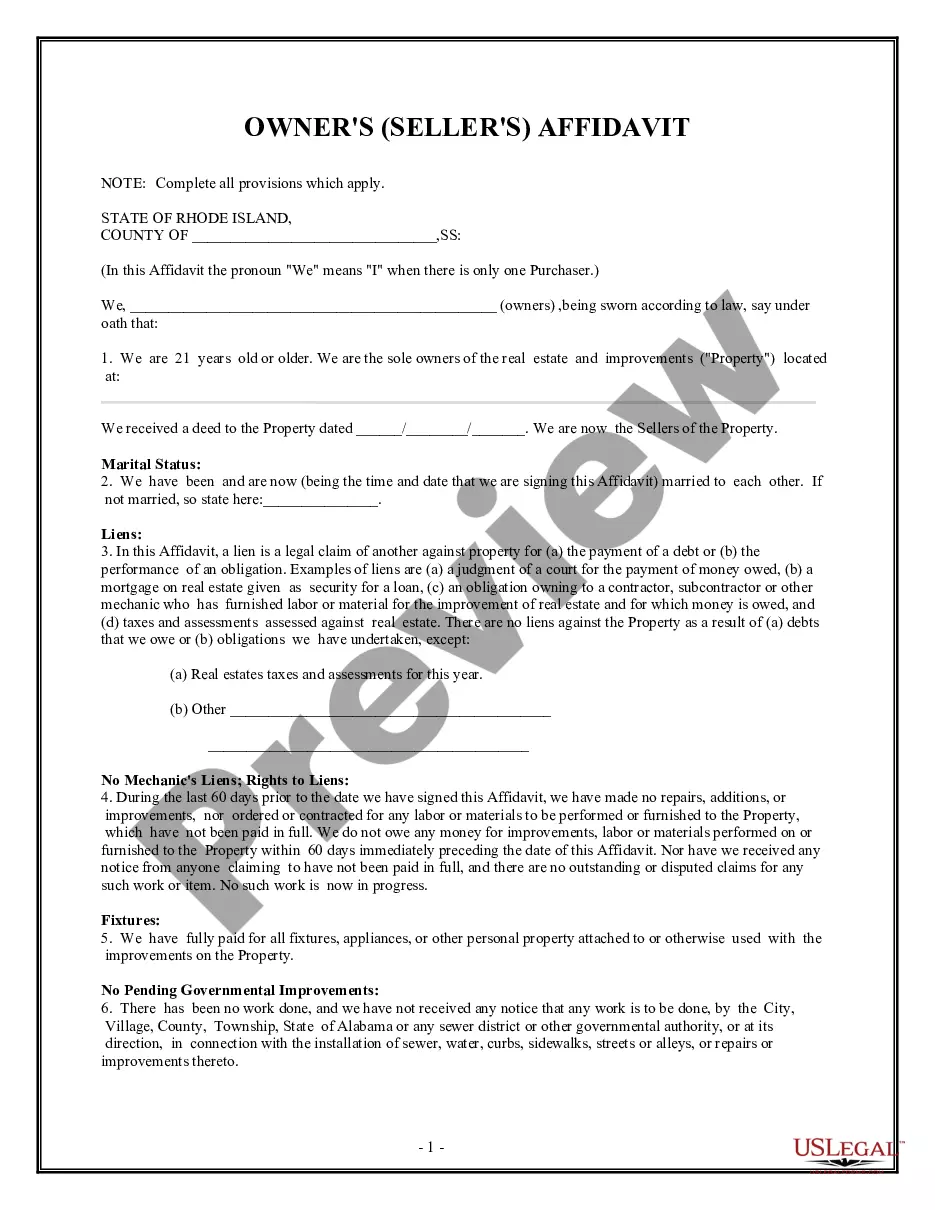

- Step 2. Use the Preview option to view the form’s details. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to discover alternative versions of the legal form template.

- Step 4. Once you have found the necessary form, click the Buy now button. Select your preferred pricing plan and enter your information to register for the account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Wisconsin Notice of Violation of Fair Debt Act - Improper Contact at Work.

Form popularity

FAQ

Debt collectors must be truthful The Fair Debt Collection Practices Act states that debt collectors cannot use any false, deceptive or misleading representation to collect the debt. Along with other restrictions, debt collectors cannot misrepresent: The amount of the debt. Whether it's past the statute of limitations.

IN THIS ARTICLE: Wisconsin's statute of limitations for most consumer debts is 6 years. Collections is illegal after the statute of limitations expires.

Right to Fair and Honest Dealing; Right to Fair, Just and Reasonable Terms and Conditions; Right to Fair Value, Good Quality and Safety; and. Right to Accountability by Suppliers.

A judgment can remain on your credit report for seven years or until the statute of limitations expires, whichever is longer. In Wisconsin, the statute of limitations on a judgment can be up to 20 years.

That is why Congress enacted the federal Fair Debt Collection Practices Act, a 1977 law that prohibits third-party collection agencies from harassing, threatening and inappropriately contacting someone who owes money. U.S. debt collection agencies employ just under 130,000 people through about 4,900 agencies.

The Wisconsin Consumer Act is a state law that regulates consumer credit transactions and debt collection. Consumer credit transactions are transactions that include a finance charge or are payable in more than four installments.

The State shall ensure safe and good quality of food, drugs, cosmetics and devices, and regulate their production, sale, distribution and advertisement to protect the health of the consumer.

The Fair Debt Collection Practices Act (FDCPA) says debt collectors can't harass, oppress, or abuse you or anyone else they contact. Some examples of harassment are: Repetitious phone calls that are intended to annoy, abuse, or harass you or any person answering the phone. Obscene or profane language.

The Fair Debt Collection Practices Act (FDCPA) The FDCPA prohibits debt collection companies from using abusive, unfair or deceptive practices to collect debts from you.

The FTC enforces the Fair Debt Collection Practices Act (FDCPA), which makes it illegal for debt collectors to use abusive, unfair, or deceptive practices when they collect debts.