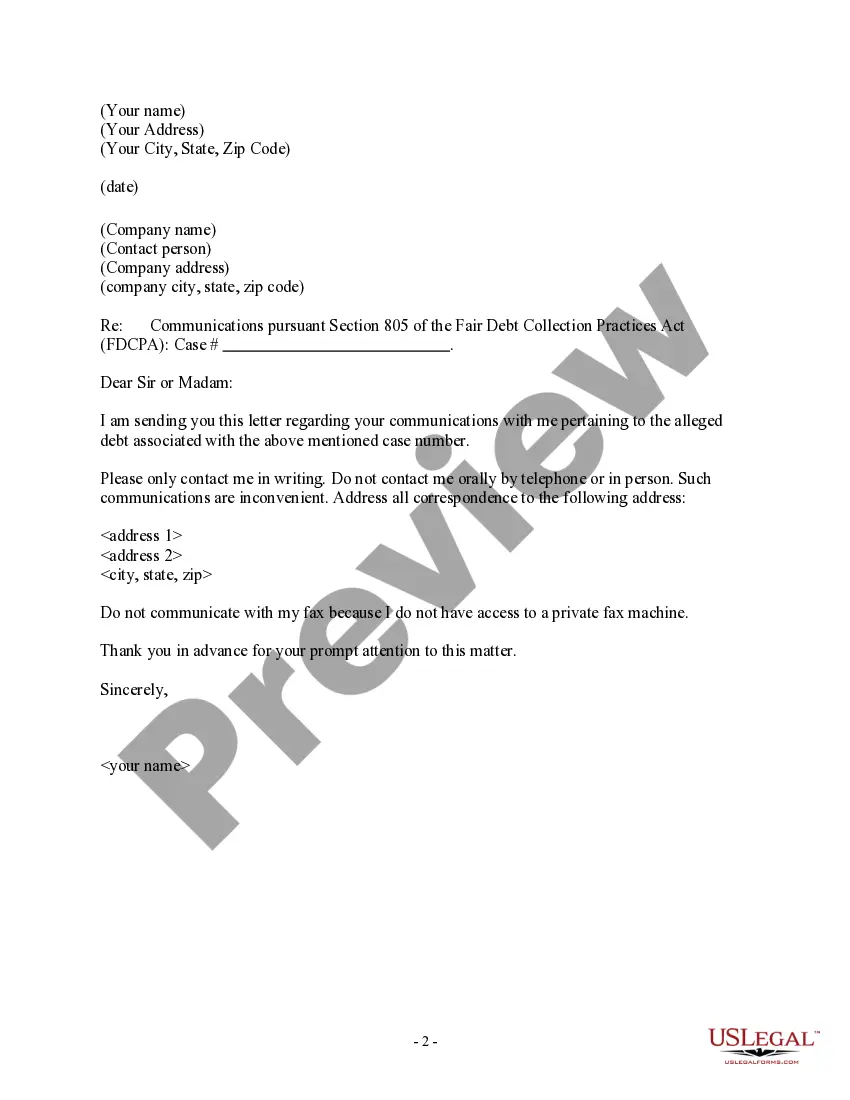

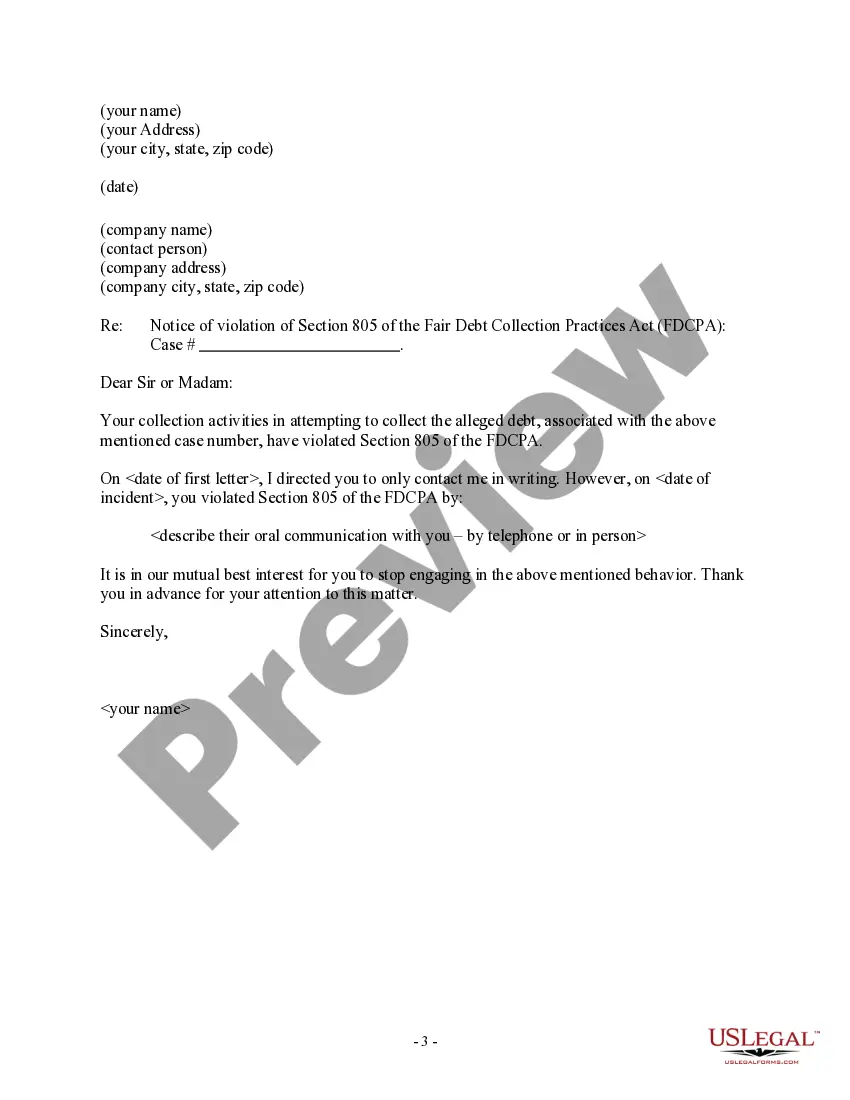

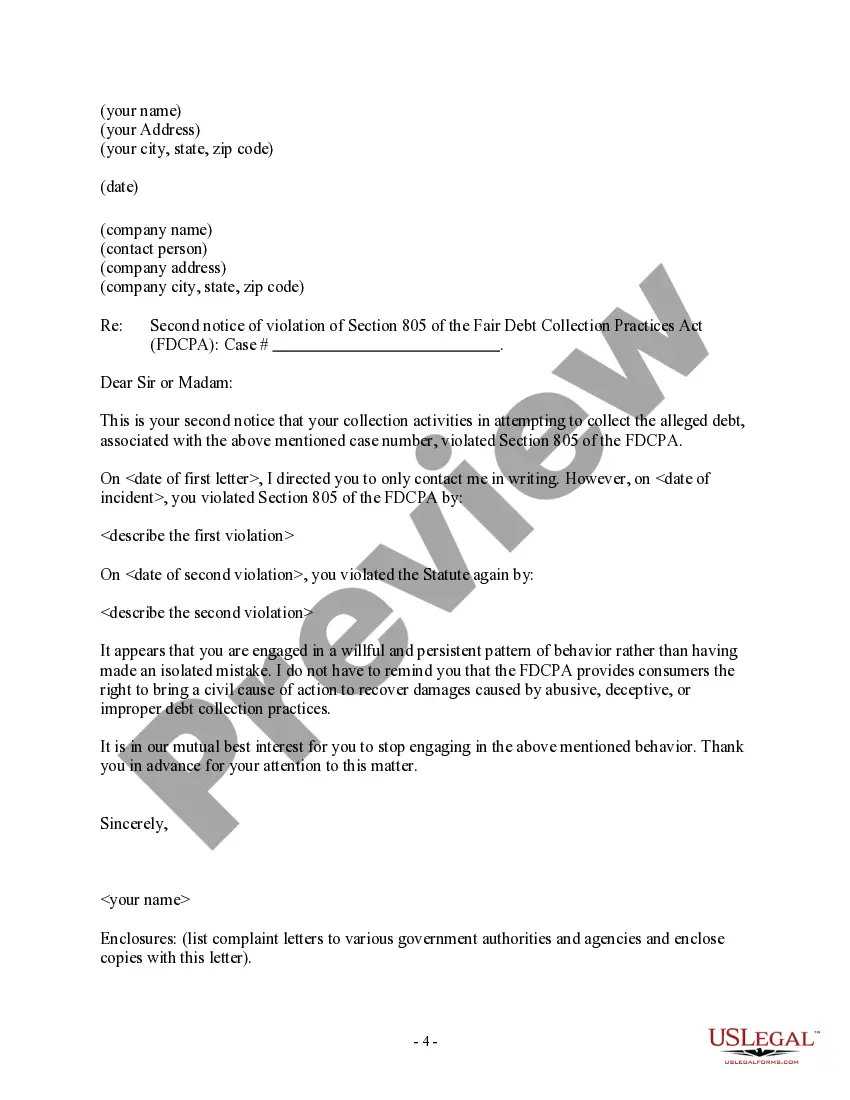

Wisconsin Letter to Debt Collector - Only Contact Me In Writing

Description

How to fill out Letter To Debt Collector - Only Contact Me In Writing?

If you want to finalize, retrieve, or print certified document formats, utilize US Legal Forms, the most extensive compilation of official templates available online.

Take advantage of the website's simple and efficient search function to locate the documents you require.

Various formats for commercial and personal purposes are organized by categories and suggestions, or keywords.

Step 3. If you are dissatisfied with the form, utilize the Search field at the top of the screen to find other versions of the legal document template.

Step 4. Once you have found the form you desire, select the Buy now button. Choose your pricing plan and input your information to register for an account.

- Utilize US Legal Forms to obtain the Wisconsin Letter to Debt Collector - Only Contact Me In Writing in just a few clicks.

- If you are currently a US Legal Forms user, Log In to your account and click the Download button to find the Wisconsin Letter to Debt Collector - Only Contact Me In Writing.

- You may also access documents you previously acquired in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the document for your appropriate city/state.

- Step 2. Use the Preview option to review the form's content. Don’t forget to read the description.

Form popularity

FAQ

Legally Speaking, Emails are Considered Writings If sent to a consumer by a third-party debt collector, emails must comply with the Fair Debt Collection Practices Act (or FDCPA). If the email communication pertains to healthcare debt, the Health Insurance Portability and Accountability Act (HIPAA) applies.

Debt collectors have no special legal powers. You may feel under pressure to pay more than you can afford, but don't feel threatened. Find out more about the difference between debt collectors and bailiffs. Debt collectors may work for your creditor, or they may work for a separate debt collection agency.

What Does a Debt Verification Notice Include? A debt collector has to send you a written statement outlining the specifics of your debt that is in collection. Within five days of contacting you, a debt collector must send you this written notice with the amount of money you owe and the name of the original creditor.

Debt collection agencies don't have any special legal powers. They can't do anything different to the original creditor. Collection agencies will use letters and phone calls to contact you. They may contact by other means too, such as text or email.

In Wisconsin, it is generally six years. Wisconsin and Mississippi are the only states where certain debts are completely extinguished once they are past that statute of limitations. Debt that is past that date but which creditors continue to pursue has been referred to as zombie debt.

What are debt collectors not allowed to do?Contact you at your workplace or via social media.Give you incorrect or misleading information.Contact you outside the hours of 8am-9pm on working days or at all on weekends and holidays.Tell other people such as family about your debt situation.More items...

No. Under federal law, a debt collector may contact other people but generally only to find out how to contact you. The CFPB's Debt Collection Rule clarifying certain provisions of the Fair Debt Collection Practices Act (FDCPA) became effective on November 30, 2021.

Debt collectors can call you on your mobile to discuss the debt, and if you happen to be at work when they call, this is not an offence. After all, they genuinely might not know you are at work. Moreover, debt collectors can call you at work as long as they do not reveal the reason they are calling.

It should be short, concise, to the point and very clear as to what you want. It's imperative that you say as much as you can with as little text as possible. Remember to include the exact amount owed, the invoice number and the due date.

Legally Speaking, Emails are Considered Writings If sent to a consumer by a third-party debt collector, emails must comply with the Fair Debt Collection Practices Act (or FDCPA).