Mississippi Warranty Deed for Three Individuals to One Individual (Subject to Life Estate)

Description

How to fill out Mississippi Warranty Deed For Three Individuals To One Individual (Subject To Life Estate)?

Among numerous paid and free templates available on the web, you cannot guarantee their precision and dependability. For instance, who developed them or if they possess the expertise needed to address your requirements.

Stay calm and utilize US Legal Forms! Discover Mississippi Warranty Deed for Three Individuals to One Individual (Subject to Life Estate) samples crafted by experienced legal professionals and evade the costly and time-consuming task of searching for a lawyer and then compensating them to draft a document for you that you can easily obtain yourself.

If you have a subscription, Log In to your account and locate the Download button next to the file you need. You'll also have access to all your previously downloaded documents in the My documents section.

Download the form in the required file format. Once you've registered and purchased your subscription, you can use your Mississippi Warranty Deed for Three Individuals to One Individual (Subject to Life Estate) as many times as necessary or for as long as it remains valid in your state. Modify it in your preferred online or offline editor, complete it, sign it, and produce a hard copy. Achieve more for less with US Legal Forms!

- If you are using our service for the first time, adhere to the instructions below to obtain your Mississippi Warranty Deed for Three Individuals to One Individual (Subject to Life Estate) quickly.

- Confirm that the document you see is legitimate in your state.

- Examine the file by reading the description using the Preview feature.

- Click Buy Now to initiate the ordering process or search for another template using the Search bar in the header.

- Choose a pricing plan and register for an account.

- Make the subscription payment with your credit/debit card or Paypal.

Form popularity

FAQ

Adding someone to your house deed requires the filing of a legal form known as a quitclaim deed. When executed and notarized, the quitclaim deed legally overrides the current deed to your home. By filing the quitclaim deed, you can add someone to the title of your home, in effect transferring a share of ownership.

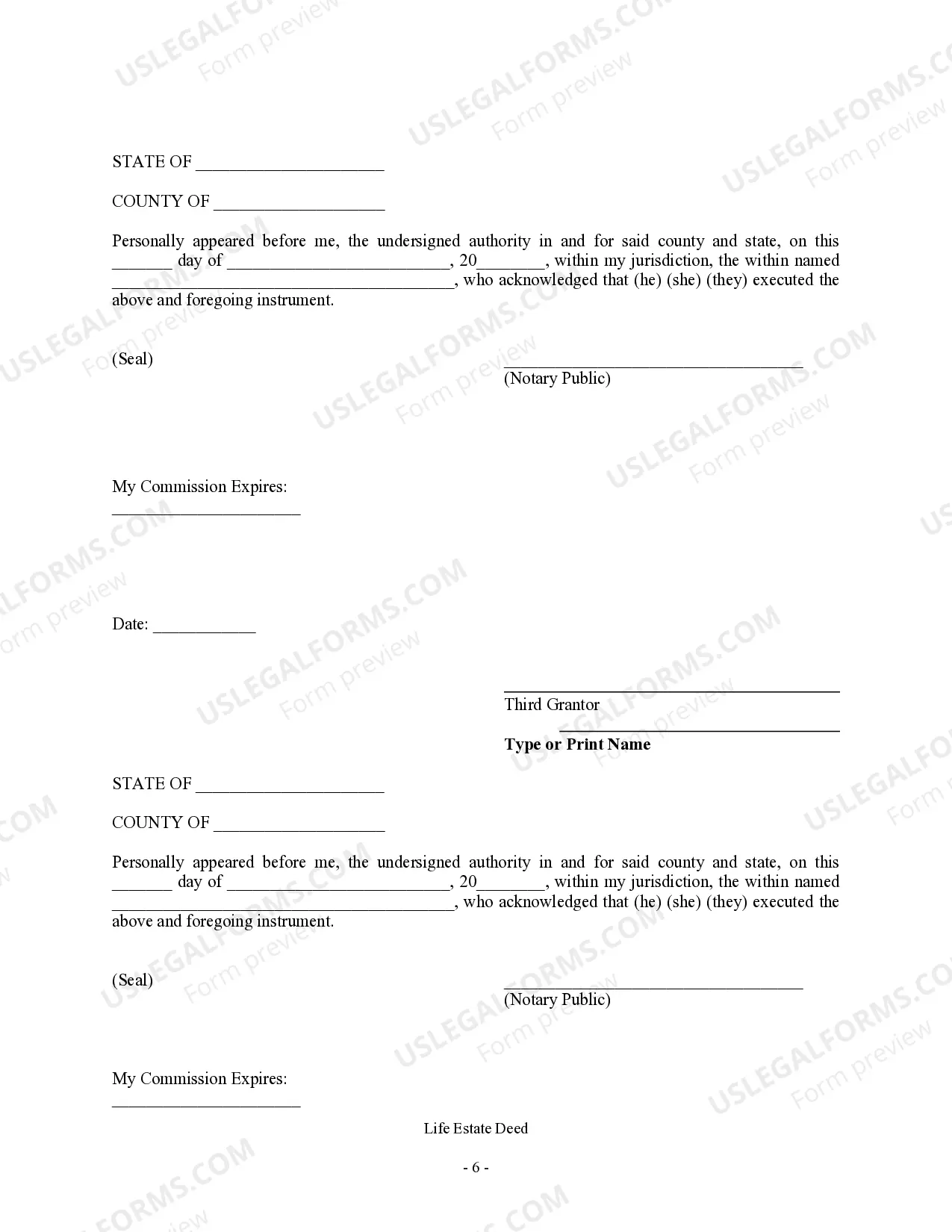

A life estate is where a natural person owns all the benefits of ownership in the property during their life, or the life of another, with the property going to a remainder person after the death of the life tenant.One common type of deed used to reserve a life estate is a warranty deed.

It is possible to be named on the title deed of a home without being on the mortgage. However, doing so assumes risks of ownership because the title is not free and clear of liens and possible other encumbrances. Free and clear means that no one else has rights to the title above the owner.

Remainderman Rights and Life Estates Typically, the deed will state that the occupant of property is allowed to use it for the duration of their life. Almost all deeds creating a life estate will also name a remaindermanthe person or persons who get the property when the life tenant dies.

If you've recently married and already own a home or other real estate, you may want to add your new spouse to the deed for your property so the two of you own it jointly. To add a spouse to a deed, all you have to do is literally fill out, sign and record a new deed in your county recorder's office.

A person owns property in a life estate only throughout their lifetime. Beneficiaries cannot sell property in a life estate before the beneficiary's death. One benefit of a life estate is that property can pass when the life tenant dies without being part of the tenant's estate.

The date the deed was made; The name of the party granting the life estate and their address; The name of the grantee and their address; The address and a legal description of the property that is subject to the life estate;

Yes you can. This is called a transfer of equity but you will need the permission of your lender. If you are not married or in a civil partnership you may wish to consider creating a deed of trust and a living together agreement which we can explain to you.

To add a co-owner, the bank would have to create a new home loan agreement, which must be registered after paying the due stamp duty and registration charges. The bank would also insist on making the co-owner a co-borrower in the home loan applicable.