Wisconsin Nonqualified Stock Option Plan of Medicore, Inc., for officers, directors, consultants, key employees

Description

How to fill out Nonqualified Stock Option Plan Of Medicore, Inc., For Officers, Directors, Consultants, Key Employees?

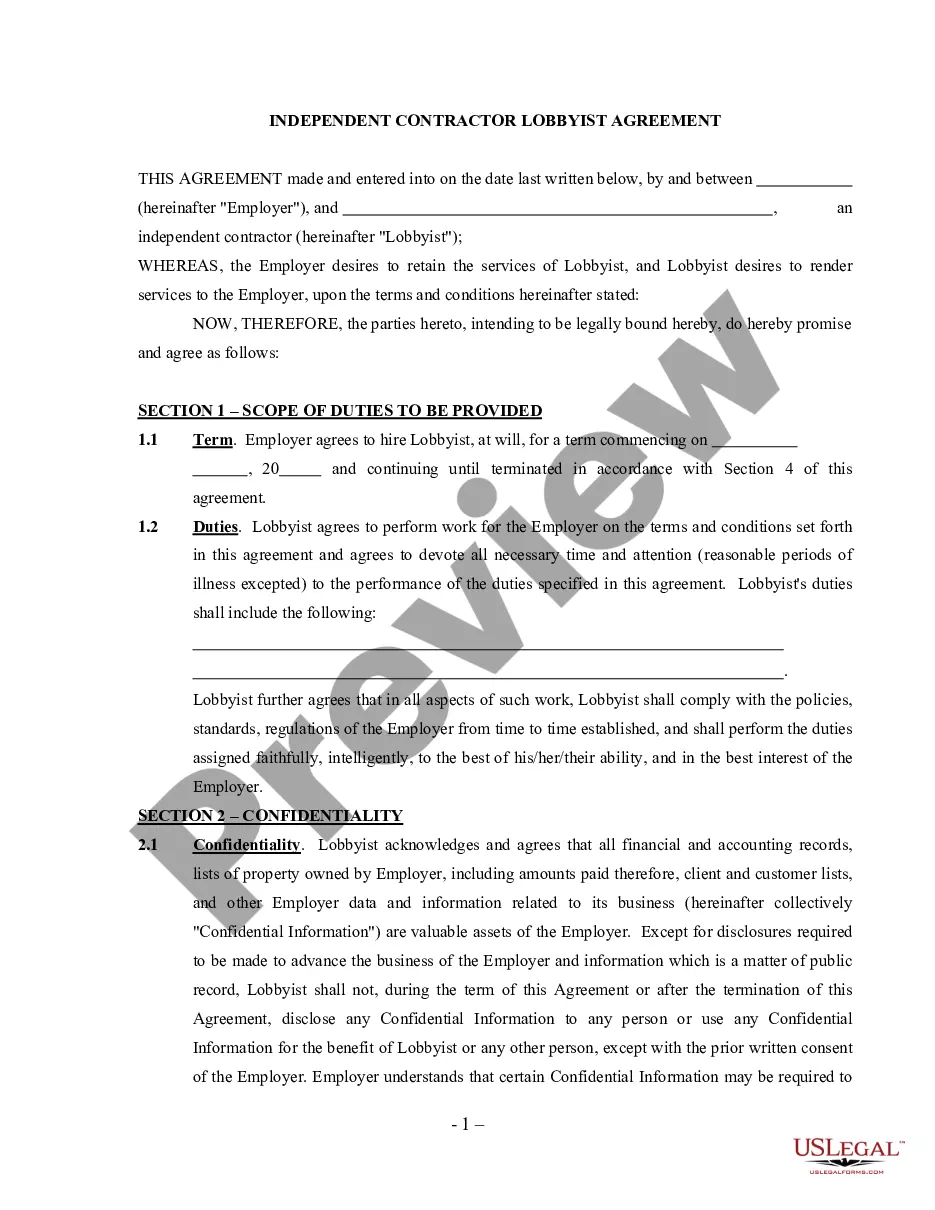

You are able to commit hours on the Internet searching for the legal document web template that meets the state and federal demands you will need. US Legal Forms gives 1000s of legal kinds that happen to be reviewed by specialists. It is possible to obtain or print the Wisconsin Nonqualified Stock Option Plan of Medicore, Inc., for officers, directors, consultants, key employees from my service.

If you currently have a US Legal Forms accounts, it is possible to log in and then click the Acquire key. After that, it is possible to full, edit, print, or signal the Wisconsin Nonqualified Stock Option Plan of Medicore, Inc., for officers, directors, consultants, key employees. Each and every legal document web template you purchase is the one you have forever. To get an additional copy of any obtained kind, proceed to the My Forms tab and then click the related key.

If you use the US Legal Forms internet site the first time, keep to the basic directions listed below:

- Initial, be sure that you have chosen the correct document web template for your region/city of your choice. Read the kind explanation to make sure you have picked out the appropriate kind. If accessible, utilize the Review key to search through the document web template at the same time.

- If you want to locate an additional model from the kind, utilize the Look for area to find the web template that fits your needs and demands.

- After you have identified the web template you would like, simply click Get now to move forward.

- Find the costs strategy you would like, enter your references, and register for a free account on US Legal Forms.

- Comprehensive the financial transaction. You should use your charge card or PayPal accounts to purchase the legal kind.

- Find the format from the document and obtain it for your system.

- Make modifications for your document if needed. You are able to full, edit and signal and print Wisconsin Nonqualified Stock Option Plan of Medicore, Inc., for officers, directors, consultants, key employees.

Acquire and print 1000s of document layouts using the US Legal Forms site, which provides the greatest selection of legal kinds. Use skilled and express-distinct layouts to take on your business or personal requirements.

Form popularity

FAQ

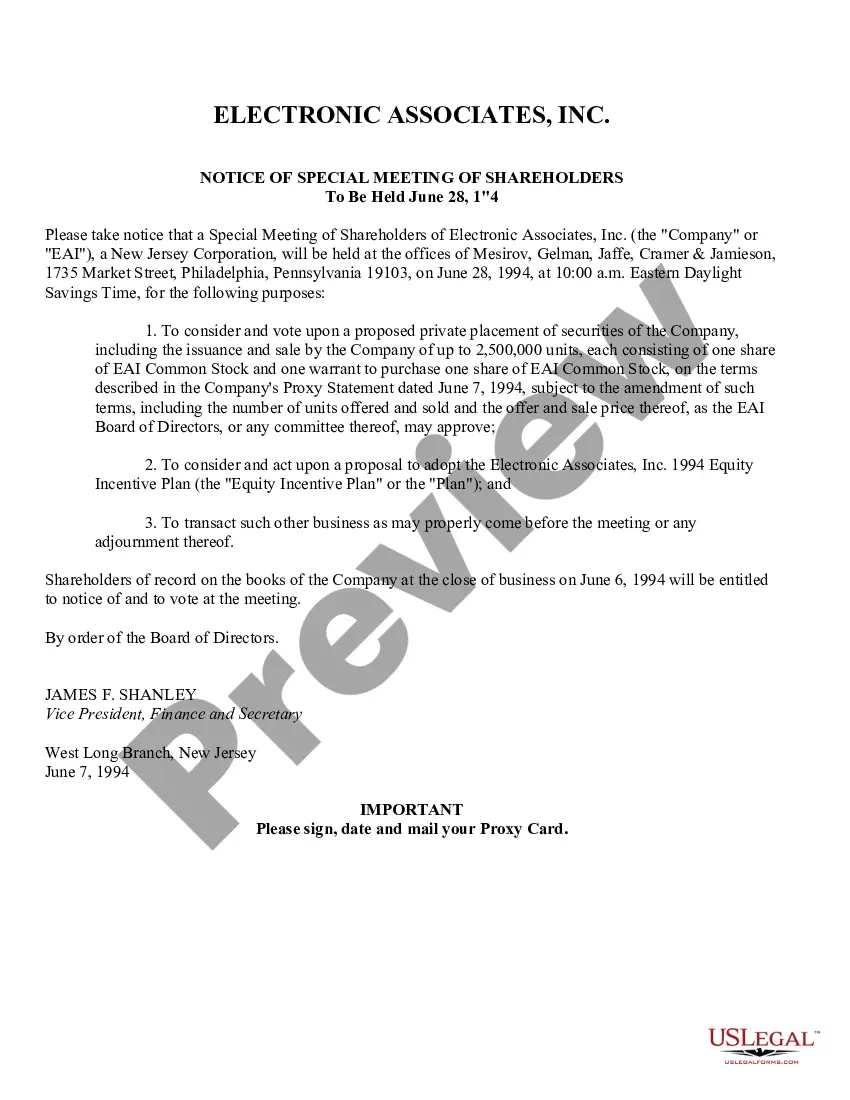

Wisconsin tax on retirement benefits: Wisconsin doesn't tax Social Security or Railroad Retirement benefits. Military pay that is exempt from federal taxation is also exempt in Wisconsin. Taxpayers age 65 and older in the state may deduct up to $5,000 of certain retirement income if they meet the following criteria.

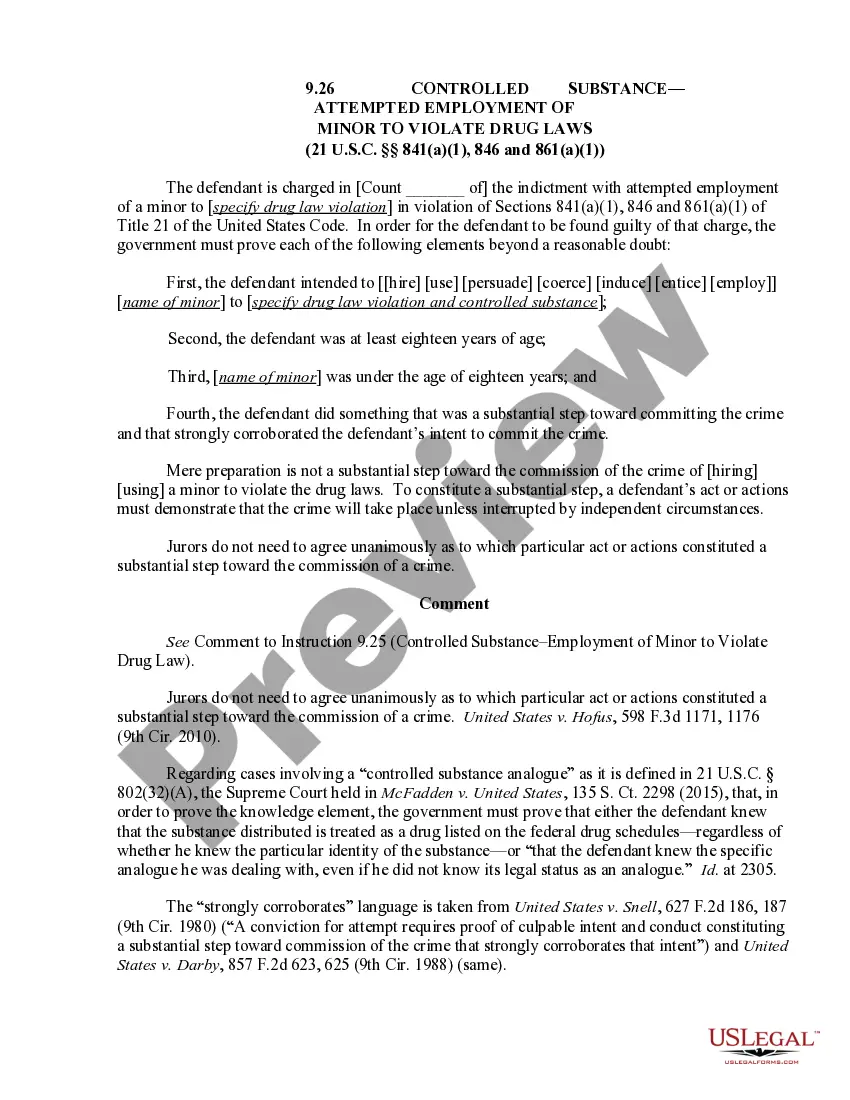

Income tax upon exercise When you exercise NSOs and opt to purchase company shares, the difference between the market price of the shares and your NSO strike price is called the ?bargain element.? The bargain element is taxed as compensation, which means you'll need to pay ordinary income tax on that amount.

Overview of Wisconsin Retirement Tax Friendliness Income from retirement accounts, including an IRA or a 401(k), is taxable at rates ranging from 3.54% to 7.65%. Income from a government pension is not taxed under certain circumstances.

The cost basis is your original cost (the value of the stock, consisting of what you paid, plus the compensation element that you have to report as compensation income on your 2023 Form 1040).

Between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. more than $34,000, up to 85 percent of your benefits may be taxable.

Social security and railroad retirement benefits are not taxable for Wisconsin. Use this publication in preparing your 2022 tax return. There are no substantive differences between the 2021 and 2022 versions of this publication.

An applicant must be 65 years of age or older on the date of applica- tion, or a qualifying veteran of any age. Any co- owner must be at least 60 years of age on the date of application. If married, the applicant's spouse must qualify as a co-owner.

Overview of Wisconsin Retirement Tax Friendliness Wisconsin does not tax Social Security retirement benefits, even those taxed at the federal level. Income from retirement accounts, including an IRA or a 401(k), is taxable at rates ranging from 3.54% to 7.65%.