Wisconsin Ratification and approval of directors and officers insurance indemnity fund with copy of agreement

Description

How to fill out Ratification And Approval Of Directors And Officers Insurance Indemnity Fund With Copy Of Agreement?

Are you in the position where you require documents for either enterprise or person functions virtually every time? There are tons of lawful file themes available on the Internet, but getting kinds you can rely on isn`t effortless. US Legal Forms provides a large number of develop themes, much like the Wisconsin Ratification and approval of directors and officers insurance indemnity fund with copy of agreement, that happen to be created to satisfy federal and state needs.

If you are already informed about US Legal Forms web site and also have an account, basically log in. After that, you may down load the Wisconsin Ratification and approval of directors and officers insurance indemnity fund with copy of agreement template.

Unless you have an accounts and need to start using US Legal Forms, abide by these steps:

- Discover the develop you will need and ensure it is for that appropriate metropolis/area.

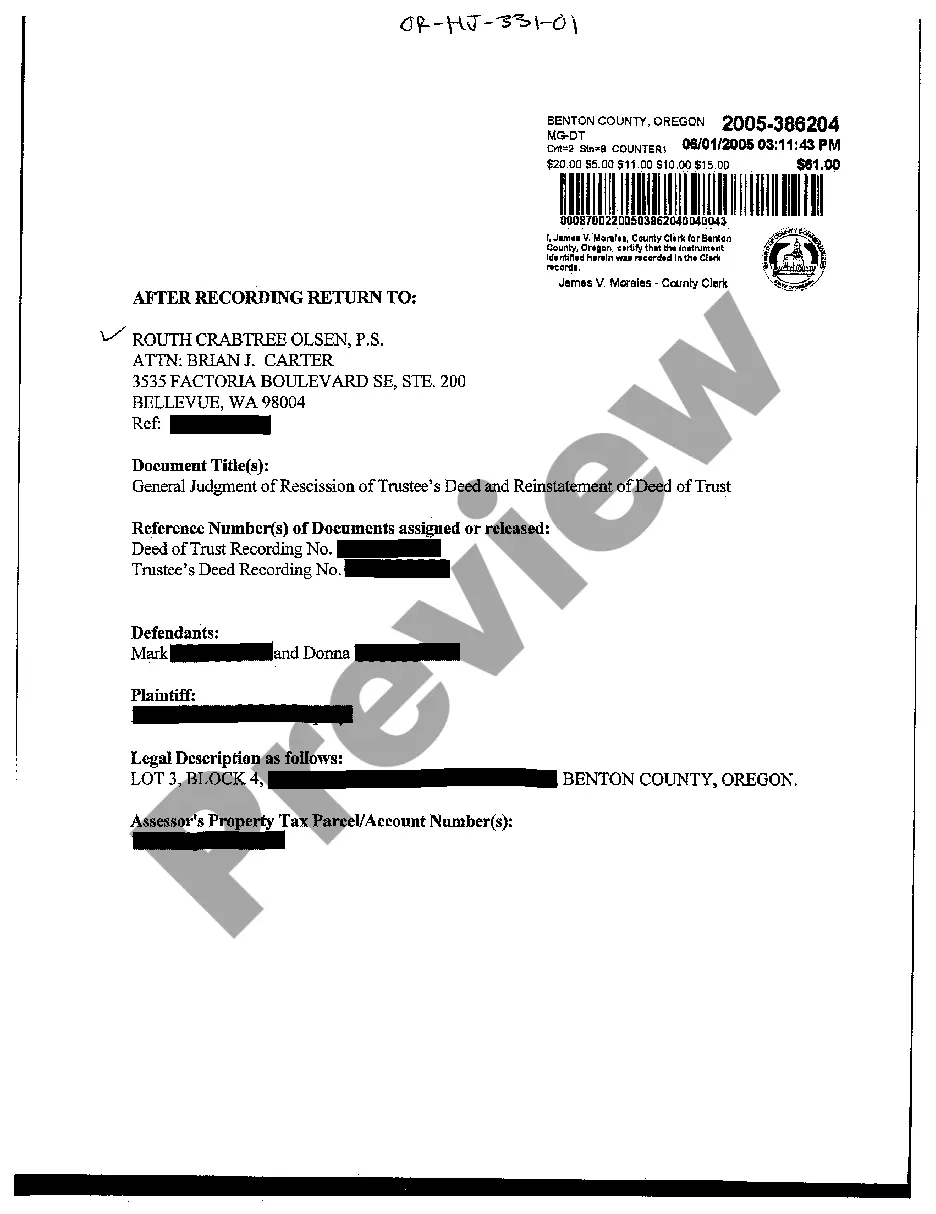

- Utilize the Review button to review the form.

- Look at the description to ensure that you have chosen the right develop.

- In case the develop isn`t what you are seeking, make use of the Lookup industry to obtain the develop that meets your needs and needs.

- Once you discover the appropriate develop, click Buy now.

- Pick the costs prepare you desire, complete the specified details to create your bank account, and purchase your order making use of your PayPal or credit card.

- Choose a practical document structure and down load your copy.

Find all the file themes you might have bought in the My Forms menu. You may get a further copy of Wisconsin Ratification and approval of directors and officers insurance indemnity fund with copy of agreement at any time, if necessary. Just click the essential develop to down load or print out the file template.

Use US Legal Forms, probably the most substantial variety of lawful varieties, in order to save some time and steer clear of blunders. The service provides skillfully produced lawful file themes that you can use for a selection of functions. Generate an account on US Legal Forms and commence making your daily life easier.

Form popularity

FAQ

Indemnity Agreement: Although similar to a hold harmless agreement, an indemnity agreement is an arrangement whereby one party agrees to pay the other party for any damages regardless of who is at fault.

An additional insured is a party to the insurance policy, giving them an independent right to enforce its rights under the insurance policy directly ? against the insurance company. indemnity expressly states that indemnitor is agreeing to assume liability for injuries to its own employees.

Indemnification is, generally speaking, a reimbursement by a company of its Ds&Os for expenses or losses they have incurred in connection with litigation or other proceedings relating to their service to the company.

With Indemnity, losses are transferred from one party to another through a contract. If there is no transfer of risk, there is no insurance coverage for the risk. In other terms, an insurance policy is a contract between two parties: the insurer and the insured.

A letter of indemnity (LOI) is a legal agreement that renders one or both parties to a contract harmless by some third party in the event of a delinquency or breach by the contracted parties. In other words, the party or parties are indemnified against a possible loss by some third party, such as an insurance company.

The Principle of Indemnity Indemnity is a guarantee to restore the insured to the position he or she was in before the uncertain incident that caused a loss for the insured. The insurer (provider) compensates the insured (policyholder).

Both indemnification and insurance transfer risk and guard against financial losses, but they do so differently: Indemnification transfers risk between contracting parties through a non-insurance agreement. Insurance transfers risk from one party to another in exchange for payment.

A D&O policy protects a director or officer's assets and reimburses them for settlements and legal expenses resulting from such litigation and cases. The purpose of professional indemnity insurance is to protect professionals against claims resulting from mistakes or omissions they have made.