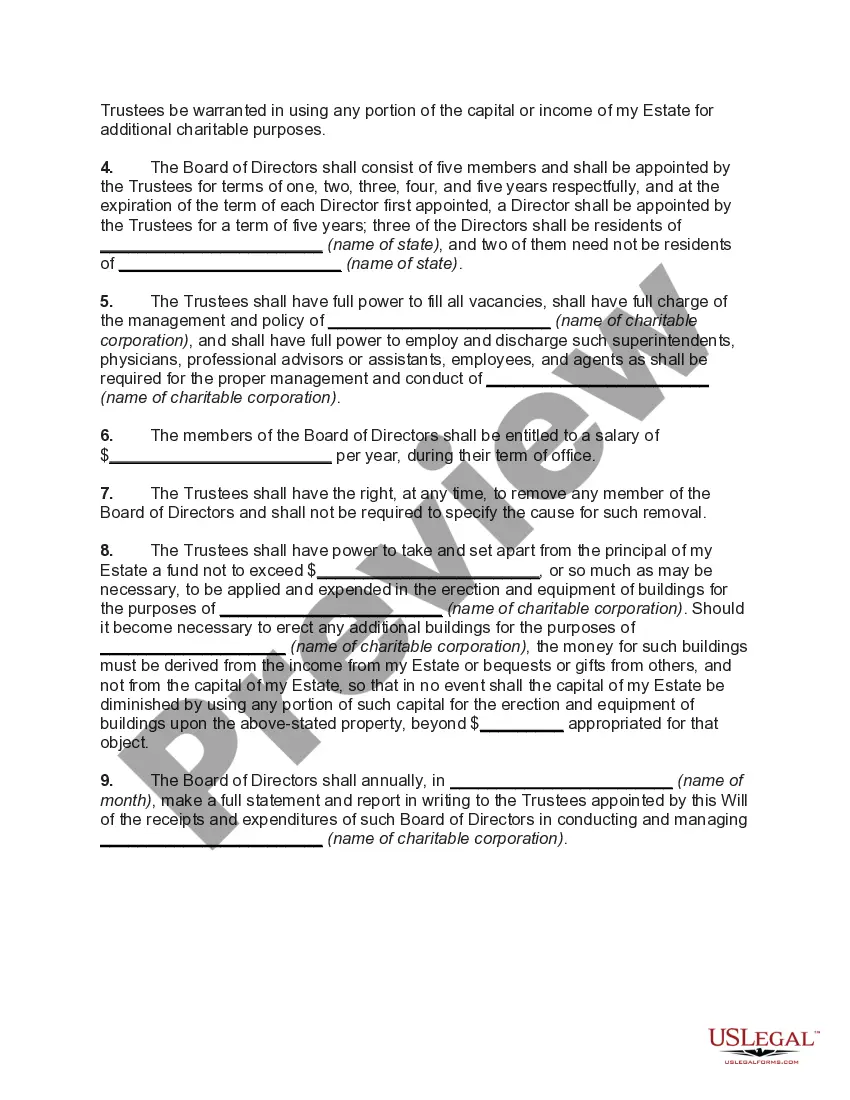

Wisconsin Testamentary Trust Provision for the Establishment of a Trust for a Charitable Institution for the Care and Treatment of Disabled Children

Description

How to fill out Testamentary Trust Provision For The Establishment Of A Trust For A Charitable Institution For The Care And Treatment Of Disabled Children?

It is feasible to spend hours online searching for the authentic document template that adheres to the federal and state requirements you need. US Legal Forms offers a vast collection of legitimate forms that are reviewed by professionals.

You can download or print the Wisconsin Testamentary Trust Provision for Establishing a Trust for a Charitable Institution devoted to the Care and Treatment of Disabled Children from my service.

If you already have a US Legal Forms account, you can Log In and click on the Obtain button. After that, you can complete, modify, print, or sign the Wisconsin Testamentary Trust Provision for Establishing a Trust for a Charitable Institution for the Care and Treatment of Disabled Children. Each legal document template you purchase is yours indefinitely.

Select the file format of the document and download it to your device. Make adjustments to your document if needed. You can complete, revise, sign, and print the Wisconsin Testamentary Trust Provision for Establishing a Trust for a Charitable Institution for the Care and Treatment of Disabled Children. Obtain and print a vast number of document templates using the US Legal Forms website, which offers the largest selection of legitimate forms. Utilize professional and state-specific templates to address your business or personal needs.

- To acquire an additional copy of a purchased form, navigate to the My documents tab and click the related button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the area/town of your choice. Review the form details to confirm you have selected the appropriate form. If available, use the Review button to examine the document template as well.

- If you wish to find another version of the form, use the Research section to locate the template that meets your needs and specifications.

- Once you have found the template you want, click Get now to proceed.

- Select the pricing plan you prefer, enter your details, and sign up for your account on US Legal Forms.

- Complete the transaction. You may use your credit card or PayPal account to pay for the legal form.

Form popularity

FAQ

All trusts are required to contain at least the following elements:Trusts must identify the grantor, trustee and beneficiary. The grantor and trustee must be identified because they are parties to the contract.The trust res must be identified.The trust must contain the signature of both the grantor and the trustee.

Testamentary trusts are discretionary trusts established in Wills, that allow the trustees of each trust to decide, from time to time, which of the nominated beneficiaries (if any) may receive the benefit of the distributions from that trust for any given period.

The trust can also be used to reduce estate tax liabilities and ensure professional management of the assets. A disadvantage of a testamentary trust is that it does not avoid probatethe legal process of distributing assets through the court.

Living trusts and testamentary trustsA living trust (sometimes called an inter vivos trust) is one created by the grantor during his or her lifetime, while a testamentary trust is a trust created by the grantor's will.

Benefits of a Testamentary TrustThese Trusts can protect assets against legal action or potentially irresponsible financial decisions made by beneficiaries. Income Tax Perks: Testamentary Trusts do not require beneficiaries to pay taxes on income distributed from the trust.

A testamentary trust is a trust contained in a last will and testament. It provides for the distribution of all or part of an estate and often proceeds from a life insurance policy held on the person establishing the trust. There may be more than one testamentary trust per will.

For maximum flexibility, a revocable trust is best because you can adjust it as many times as you like while you're alive. In general, irrevocable trusts are best for those who have extensive assets, since these trusts offer greater tax benefits and asset protection.

Creating a living trust in Wisconsin may be useful in your estate plan. Your trust offers privacy not available with a will. The assets, beneficiaries, and terms of the trust are never public record. If you choose to pass your assets through a will, it must go through probate and then becomes public record.