Wisconsin Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife

Description

How to fill out Testamentary Trust Of The Residue Of An Estate For The Benefit Of A Wife With The Trust To Continue For Benefit Of Children After The Death Of The Wife?

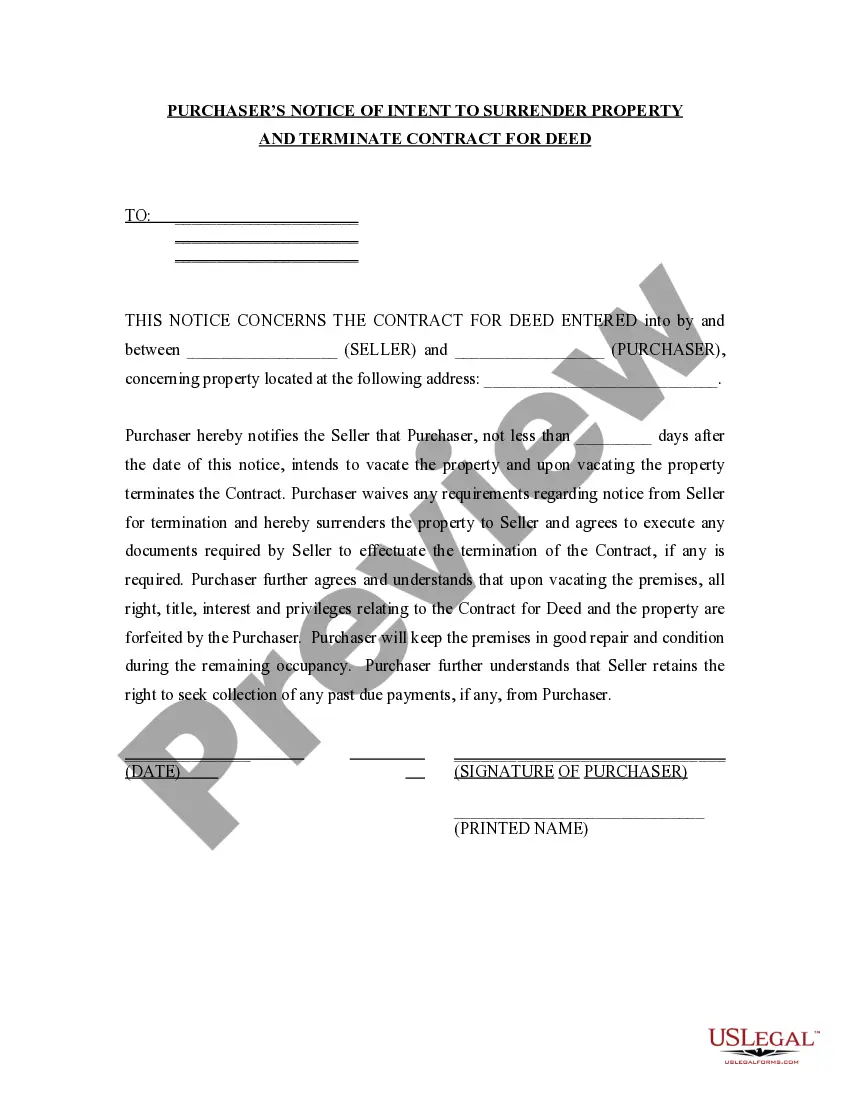

Are you currently in a position where you require documents for business or personal purposes almost every day? There are numerous legal document templates available online, but finding ones you can trust is not straightforward. US Legal Forms offers thousands of form templates, including the Wisconsin Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Wife's Death, which are crafted to comply with federal and state requirements.

If you're already familiar with the US Legal Forms website and have an account, just Log In. After that, you can download the Wisconsin Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Wife's Death template.

If you do not have an account and wish to start using US Legal Forms, follow these steps.

Access all the document templates you have purchased in the My documents menu. You can obtain an additional copy of the Wisconsin Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Wife's Death at any time, if needed. Click on the desired form to download or print the document template.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service offers professionally crafted legal document templates that you can use for various purposes. Create your account on US Legal Forms and start making your life a little easier.

- Obtain the form you need and ensure it is for the correct city/region.

- Use the Review option to examine the form.

- Read the description to ensure you have selected the correct form.

- If the form isn't what you're looking for, use the Search field to find the form that meets your needs and requirements.

- Once you find the appropriate form, click Purchase now.

- Select the pricing plan you want, fill in the required information to create your account, and complete the transaction using your PayPal or credit card.

- Choose a convenient document format and download your copy.

Form popularity

FAQ

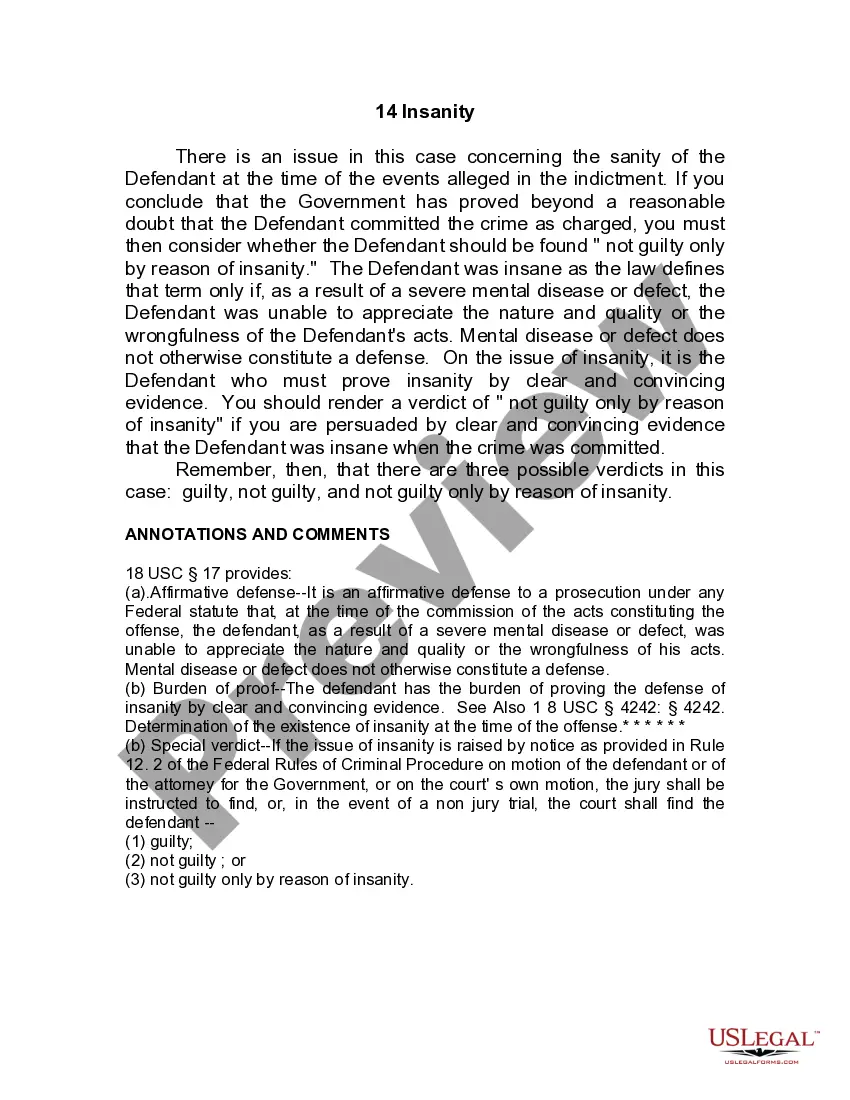

The clause will name the residuary beneficiary who is also sometimes known as a remainder beneficiary. For example, "I give my car to my niece, my rental property to my son, and the residue of my estate to my wife," or ".... I give the remainder of my estate, including any personal and real property, to my wife."

A residuary beneficiary receives the residue of an estate or trust that is, all of the property that's left after specific gifts are distributed.

In order for a trust to end, all debts must be paid and all trust property must be distributed. After the trustee has completed all actions required to administer a trust and there are no remaining assets in the trust except sufficient funds to pay any final expenses, the trustee may close the trust.

Key Takeaways. Revocable trusts, as their name implies, can be altered or completely revoked at any time by their grantorthe person who established them. The first step in dissolving a revocable trust is to remove all the assets that have been transferred into it.

It is actually quite a simple matter to dissolve a testamentary trust if you, the testator, are still alive. To do so, you need to draft a codicil, which is an amendment to a will. In the codicil specify the provisions of the testamentary trust that you wish to terminate.

A. No. The trust is activated by the will on the death of the first spouse/partner, and not at the time of executing the Will. If you are both alive and in care, the trust would not initiated, hence the local authorities can target the property when assessing liability for care fees.

If the terms of the trust regarding the trust investments no longer seem reasonable, the trustee can obtain a court order to deviate from the terms of the trust.

One of the drawbacks of a testamentary trust is the considerable responsibility it puts on the trustee. He must meet regularly with the probate court to demonstrate his safe handling of the trust, and depending on your wishes, his tasks may go on for many years.

Generally, a beneficiary designation will override the trust provisions. There are situations, however, in which the beneficiary designation will fail and the proceeds of the account will pass under the terms of the trust.

A testamentary trust (or will trust) is created when an individual dies and the trust is detailed in their last will and testament. Because the establishment of a testamentary trust does not happen until death, it is by nature irrevocable once death occurs.