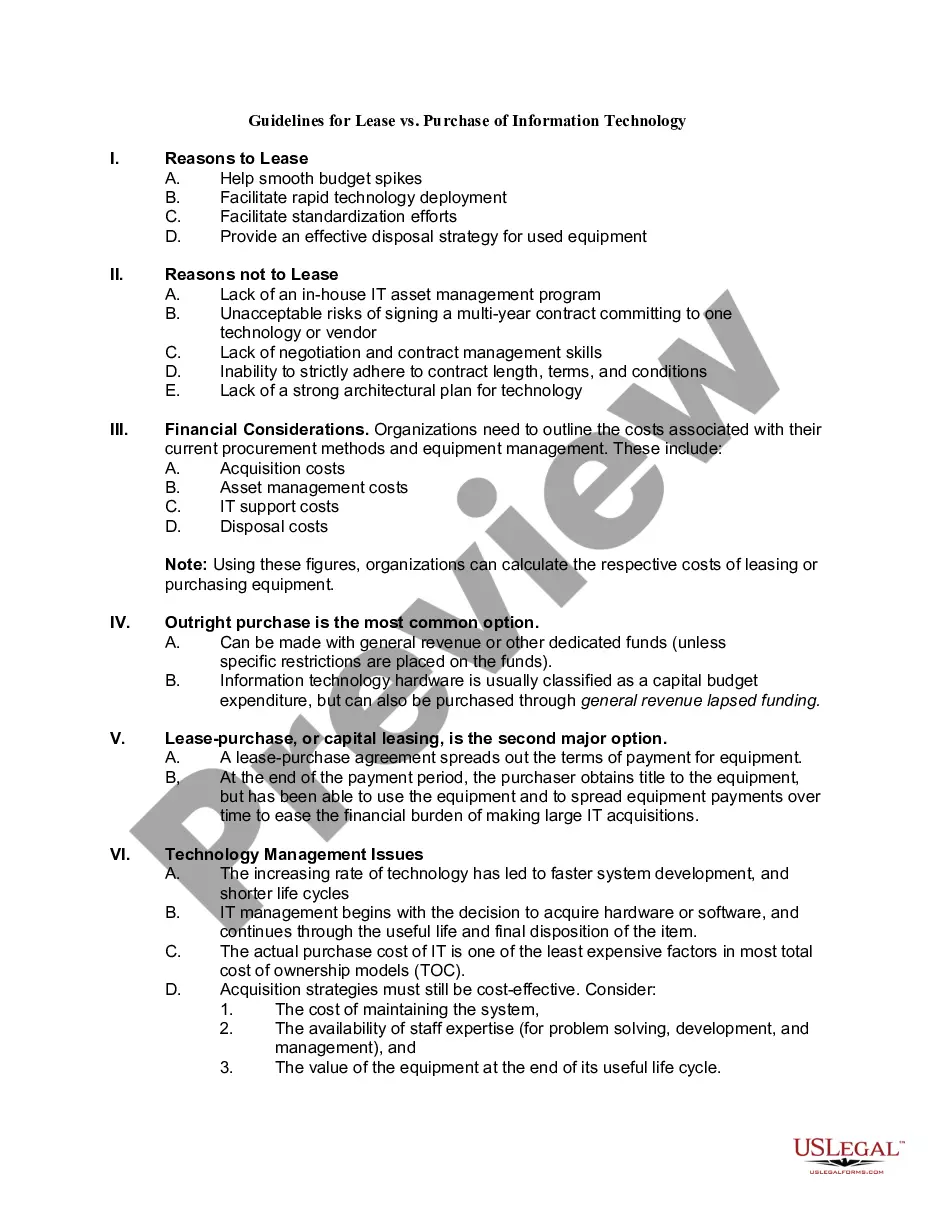

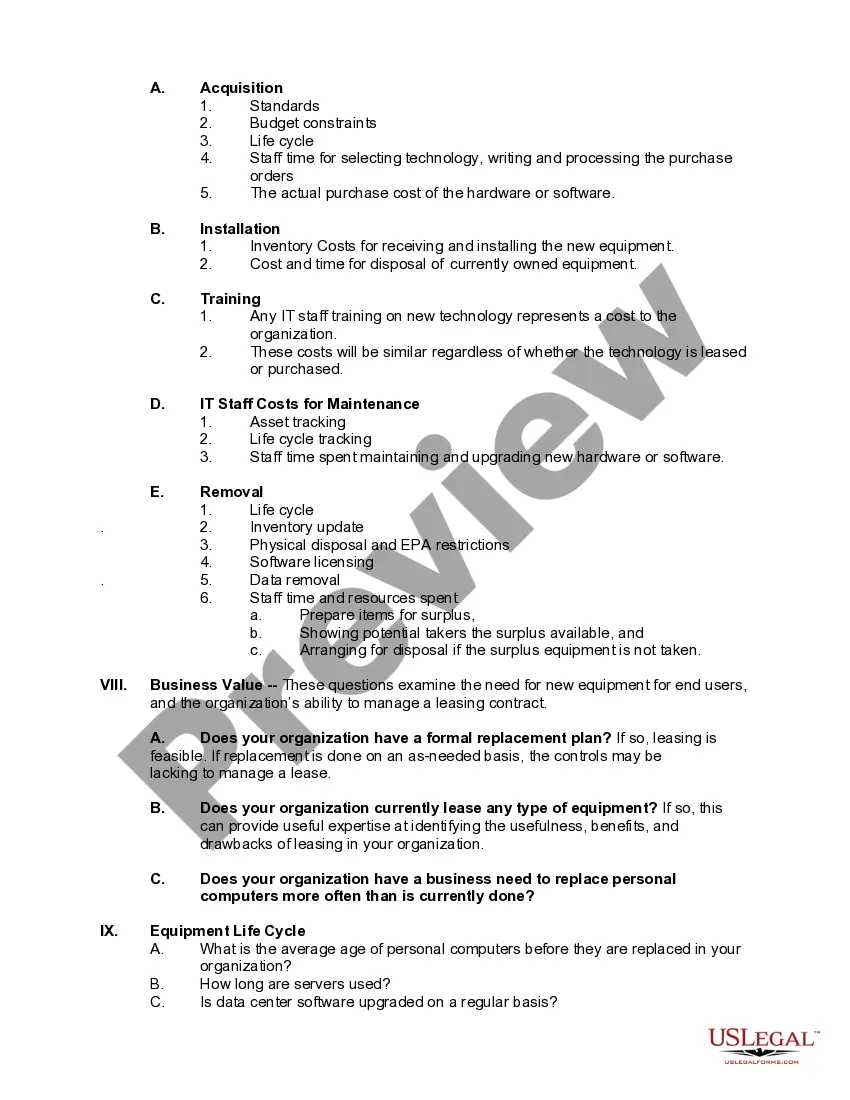

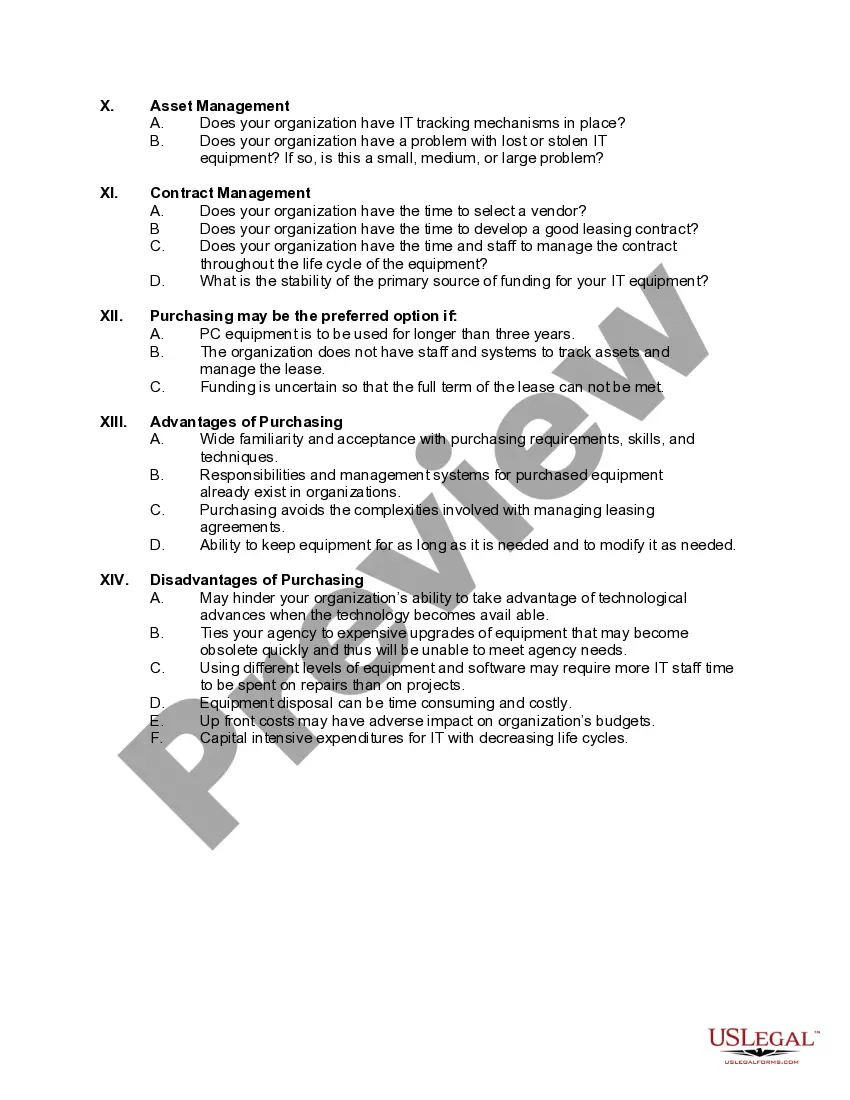

Wisconsin Guidelines for Lease vs. Purchase of Information Technology

Description

technology, faster system development, and shorter life cycles. This has led to spiraling information technology (IT) budgets, driving the need for a re-evaluation of IT management issues. Organizations must find new ways to accommodate technological change. Leasing has recently emerged as a feasible, cost-effective alternative to purchasing equipment, particularly in the desktop and laptop areas.

How to fill out Guidelines For Lease Vs. Purchase Of Information Technology?

Selecting the optimal valid document template can be quite a challenge.

Of course, there are numerous designs available online, but how can you find the authentic form you need.

Utilize the US Legal Forms site. The platform offers a vast array of templates, such as the Wisconsin Guidelines for Lease vs. Purchase of Information Technology, which can be utilized for both business and personal purposes.

If the form does not meet your requirements, use the Search field to locate the appropriate template. When you are confident that the document will suffice, select the Buy now button to obtain the form. Choose the payment plan you prefer and enter the required details. Create your account and complete the transaction using your PayPal account or credit card. Select the document format and download the valid document template to your device. Complete, modify, print, and sign the acquired Wisconsin Guidelines for Lease vs. Purchase of Information Technology. US Legal Forms is the largest library of valid forms where you can find countless document templates. Use the service to obtain properly drafted paperwork that meets state regulations.

- All the documents are verified by specialists and meet federal and state requirements.

- If you are already registered, Log In to your account and click the Obtain button to access the Wisconsin Guidelines for Lease vs. Purchase of Information Technology.

- Use your account to search for the valid forms you have previously purchased.

- Go to the My documents tab of your account and download another copy of the document you require.

- If you are a new user of US Legal Forms, here are simple instructions you should follow.

- First, ensure you have chosen the correct form for your region/county. You can preview the document using the Review button and read the form description to make sure this is suitable for you.

Form popularity

FAQ

Sales Tax Exemptions in Wisconsin There are many exemptions to state sales tax. This includes, burial caskets, certain agricultural items, certain grocery items, prescription medicine and medical devices, modular or manufactured homes, and certain pieces of manufacturing equipment.

The charge by Company C for listing properties is not subject to Wisconsin sales or use tax. Internet access services are not taxable beginning July 1, 2020.

When it comes to sales tax, the general rule of thumb has always been products are taxable, while services are non-taxable. Under that scenario, if your business sells coffee mugs, you should charge sales tax for those products.

If all of your sales in Wisconsin will be exempt from sales and use tax, you may sign Form A-006, Affidavit of Exempt Sales Form instead of registering.

Section 77.52 (2) (a) 13m., Stats., imposes Wisconsin sales tax on the sale of contracts, including service contracts, maintenance agreements, computer software maintenance contracts for prewritten computer software, and warranties, that provide, in whole or in part, for the future performance of or payment for the

Service fees for the installation of software are subject to sales tax. Moreover, charges for software maintenance services including delivery of updates for prewritten software are generally taxable. However, maintenance contracts that only provide support services for canned software are not taxable.

The purchase price of the prewritten computer software is not allocated; the sale of each license is taxable or not taxable to Wisconsin, depending on where it was delivered. Software as a Service (SaaS) is not treated as the sale or license of software.

Prescription medicine, groceries, and gasoline are all tax-exempt. Some services in Wisconsin are subject to sales tax.

The purchase price of the prewritten computer software is not allocated; the sale of each license is taxable or not taxable to Wisconsin, depending on where it was delivered. Software as a Service (SaaS) is not treated as the sale or license of software.

Specialized or non-repetitive cleaning services to tangible personal property are taxable. Specialized or non-repetitive services to real property are not taxable.