Wisconsin Aging of Accounts Payable

Description

How to fill out Aging Of Accounts Payable?

Are you presently in a role where you need documents for either business or personal purposes nearly every workday.

There are numerous legal document templates available online, but obtaining reliable versions can be challenging.

US Legal Forms offers thousands of template options, such as the Wisconsin Aging of Accounts Payable, designed to comply with federal and state requirements.

Once you find the appropriate form, click on Acquire now.

Choose the payment plan you prefer, fill out the necessary information to create your account, and pay for the order using your PayPal or Visa or Mastercard.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- After logging in, you can download the Wisconsin Aging of Accounts Payable template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you require and ensure it corresponds to the correct city/area.

- Use the Preview feature to view the document.

- Read the description to confirm you have selected the right template.

- If the form does not meet your needs, use the Search field to find the form that fits your requirements.

Form popularity

FAQ

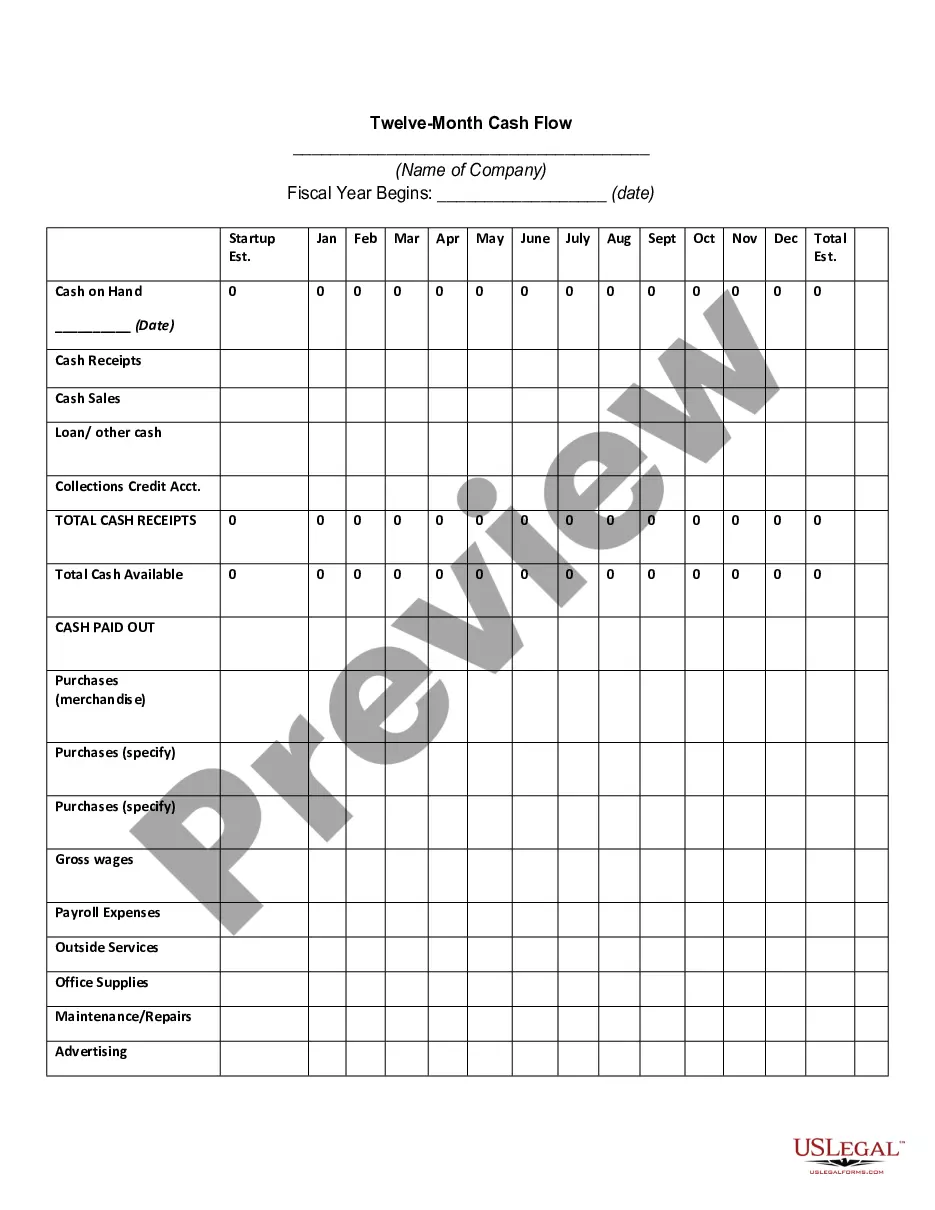

To age accounts payable, businesses categorize unpaid invoices based on how long they have been outstanding. Typically, invoices are sorted into categories such as current, 30 days, 60 days, and 90 days past due. Using solutions like U.S. Legal Forms can simplify the Wisconsin Aging of Accounts Payable process, enabling efficient tracking and management of your company's financial commitments.

You are not required to send a copy of your federal return with your Wisconsin state return. Each return is processed separately, simplifying your submission process. However, it is wise to keep a thorough internal record, particularly when considering the financial health aspects of Wisconsin Aging of Accounts Payable.

You should mail your Wisconsin state tax return to the Wisconsin Department of Revenue, PO Box 8933, Madison, WI 53708-8933. This address is specifically designated for processing state returns, ensuring your documentation is directed to the right place. Timely submission benefits your overall management of Wisconsin Aging of Accounts Payable.

Yes, Wisconsin Form 3 does accept a federal extension for filing. If you already have an accepted federal extension, you may automatically qualify for an extension for Wisconsin. This can provide you valuable time to manage issues related to Wisconsin Aging of Accounts Payable without penalties.

You do not need to send a copy of your Wisconsin state return along with your federal return. Each return is submitted separately to its appropriate office. However, keeping records of both returns is essential for your accounting practices, particularly if you are addressing aspects of Wisconsin Aging of Accounts Payable.

To mail your Wisconsin tax return, address it to the Wisconsin Department of Revenue, PO Box 8949, Madison, WI 53708-8949. Make sure to check the latest postage requirements and use proper filing methods. Proper submission is crucial for timely processing, especially as it relates to Wisconsin Aging of Accounts Payable.

Yes, Wisconsin is a mandatory withholding state for employers. This means that employers must withhold state income tax from employee wages. If you’re managing Wisconsin Aging of Accounts Payable, understanding these requirements can help you maintain compliance and manage your financial obligations effectively.

The PO box for the Wisconsin Department of Revenue is essential for sending your tax-related documents. Direct your correspondence to PO Box 8933, Madison, WI 53708-8933. By using this address, you ensure that your inquiries regarding Wisconsin Aging of Accounts Payable are correctly directed to the appropriate department.

To file an extension in Wisconsin, you should complete Form 1-ES to request extra time for your return. This extension allows you to take advantage of more time to organize your financial documents, especially if you are dealing with Wisconsin Aging of Accounts Payable. You can submit this form online or through the mail, ensuring you meet the necessary deadlines to avoid penalties.

An aging report showcases account balances organized by the length of time those balances have been outstanding, usually laid out in a well-organized table format. You will see side-by-side comparisons of amounts due across different time frames, making it clear which payments require immediate attention. Utilizing a platform like uslegalforms, you can effortlessly generate a Wisconsin Aging of Accounts Payable report tailored to your specific needs.