Wisconsin Contract with Independent Contractor to do Custom Millwork Fabrication

Description

How to fill out Contract With Independent Contractor To Do Custom Millwork Fabrication?

Selecting the ideal legal document template can be challenging. Naturally, numerous templates can be found online, but how can you acquire the legal document you need? Utilize the US Legal Forms website. This service offers a vast array of templates, including the Wisconsin Contract with Independent Contractor for Custom Millwork Fabrication, suitable for both business and personal purposes. All forms are verified by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Obtain button to download the Wisconsin Contract with Independent Contractor for Custom Millwork Fabrication. Use your account to view the legal documents you have previously purchased. Go to the My documents section of your account and get another copy of the file you need.

If you are a new user of US Legal Forms, here are simple steps you can follow.

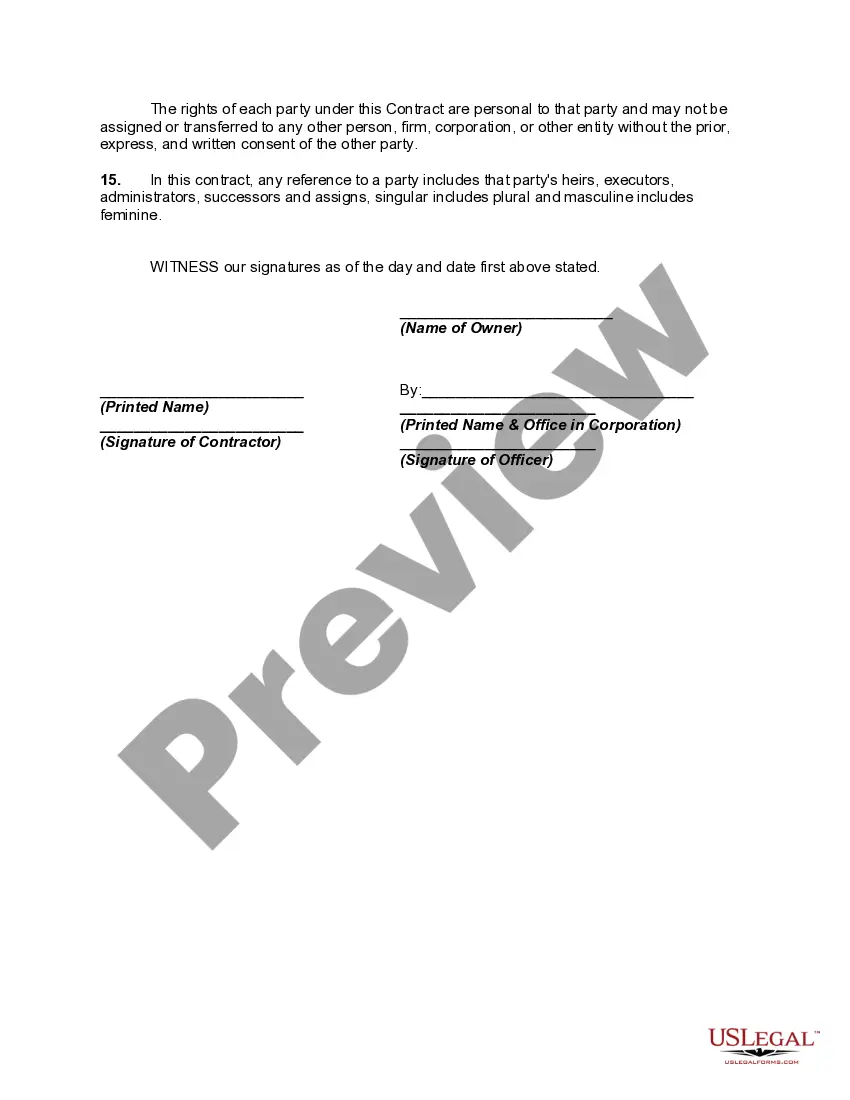

Choose the document format and download the legal document template to your device. Complete, modify, print, and sign the Wisconsin Contract with Independent Contractor for Custom Millwork Fabrication. US Legal Forms is the largest repository of legal documents where you can find various file templates. Take advantage of this service to download professionally crafted documents that meet state requirements.

- First, ensure you have selected the correct document for your city/county.

- You can review the document using the Preview button and read the document description to confirm this is suitable for you.

- If the document does not fulfill your requirements, utilize the Search field to find the appropriate document.

- Once you are confident that the document is suitable, click on the Acquire now button to download the document.

- Select the pricing plan you wish and enter the required information.

- Create your account and complete your purchase using your PayPal account or credit card.

Form popularity

FAQ

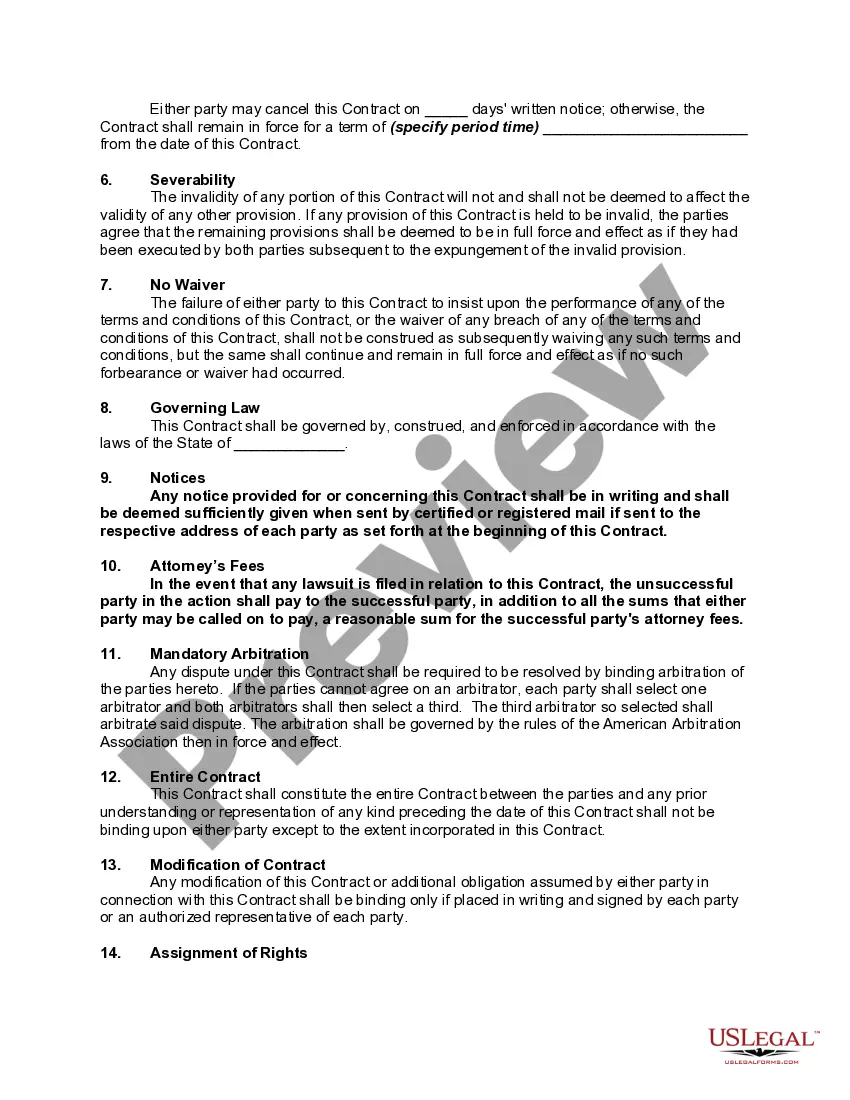

To write a construction contract agreement, begin with an introduction that states the parties involved and outlines the project details. Clearly define the scope of work, deadlines, payment terms, and any required permits or licenses. Including conditions for termination and dispute resolution will provide additional protections. You can also utilize uslegalforms, which offers templates that simplify the process of drafting a Wisconsin Contract with Independent Contractor to do Custom Millwork Fabrication.

Yes, the IRS requires a minimum of $600 in payments to independent contractors for issuing a 1099 form. This applies to various contractual agreements, including a Wisconsin Contract with Independent Contractor to do Custom Millwork Fabrication. Keeping accurate records of all payments will help clarify your tax responsibilities and ensure compliance.

The contractor minimum for receiving a 1099 form is $600 for the year. This requirement applies to payments made for services rendered, including those under a Wisconsin Contract with Independent Contractor to do Custom Millwork Fabrication. Therefore, staying organized with your financial records helps ensure compliance with these tax regulations.

For independent contractors, there's no official minimum salary for receiving a 1099 as long as your earnings reach $600 in one year. It's essential to understand that any payments totaling or exceeding this amount must be reported to the IRS. As you engage in a Wisconsin Contract with Independent Contractor to do Custom Millwork Fabrication, be proactive in monitoring payment totals to ensure proper reporting.

An independent contractor can earn up to $600 in a calendar year before a 1099 form becomes necessary. This amount is reported to the IRS and requires the business to issue the form if they exceed this threshold. If you are entering into a Wisconsin Contract with Independent Contractor to do Custom Millwork Fabrication, it’s important to keep track of payment records, ensuring compliance with tax obligations.

To fill out a Wisconsin Contract with Independent Contractor to do Custom Millwork Fabrication, start by identifying both parties and specifying the scope of work. Clearly outline payment terms, deadlines, and any necessary materials or equipment. Include clauses that address confidentiality and dispute resolution to protect both parties involved. By using online platforms like uslegalforms, you can easily customize a template that meets these requirements.

An independent contractor agreement in Wisconsin outlines the terms and conditions governing the working relationship between a client and contractor. This agreement is essential for services such as custom millwork fabrication, detailing aspects like payment, project scope, and deadlines. Using a Wisconsin Contract with Independent Contractor to do Custom Millwork Fabrication safeguards both parties and ensures clarity on all terms.

To create an independent contractor agreement, start by clearly defining the project's specifications, payment structure, and timelines. A comprehensive document should establish the relationship, ensuring both parties understand their obligations under a Wisconsin Contract with Independent Contractor to do Custom Millwork Fabrication. Solutions like those offered by USLegalForms can simplify this process and provide legally sound templates.

Forming an LLC can offer benefits such as personal liability protection and potential tax advantages. While it is not mandatory, having an LLC can enhance your professional appearance and reassure clients engaging in a Wisconsin Contract with Independent Contractor to do Custom Millwork Fabrication. Evaluate your business goals and consult a professional if you are uncertain.

An independent contractor must earn at least $600 from a client in a calendar year to receive a 1099 form. This threshold is crucial for tax reporting under a Wisconsin Contract with Independent Contractor to do Custom Millwork Fabrication. Tracking your income precisely is important for ensuring you meet reporting obligations.