Are you currently in a place the place you need papers for both organization or specific reasons just about every time? There are a lot of legal papers layouts available on the Internet, but locating versions you can trust is not straightforward. US Legal Forms delivers thousands of form layouts, like the Wisconsin Agreement to Change or Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Deed of Trust, that happen to be written to satisfy federal and state specifications.

Should you be previously acquainted with US Legal Forms website and have an account, just log in. Next, you can down load the Wisconsin Agreement to Change or Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Deed of Trust template.

Should you not come with an bank account and need to begin using US Legal Forms, adopt these measures:

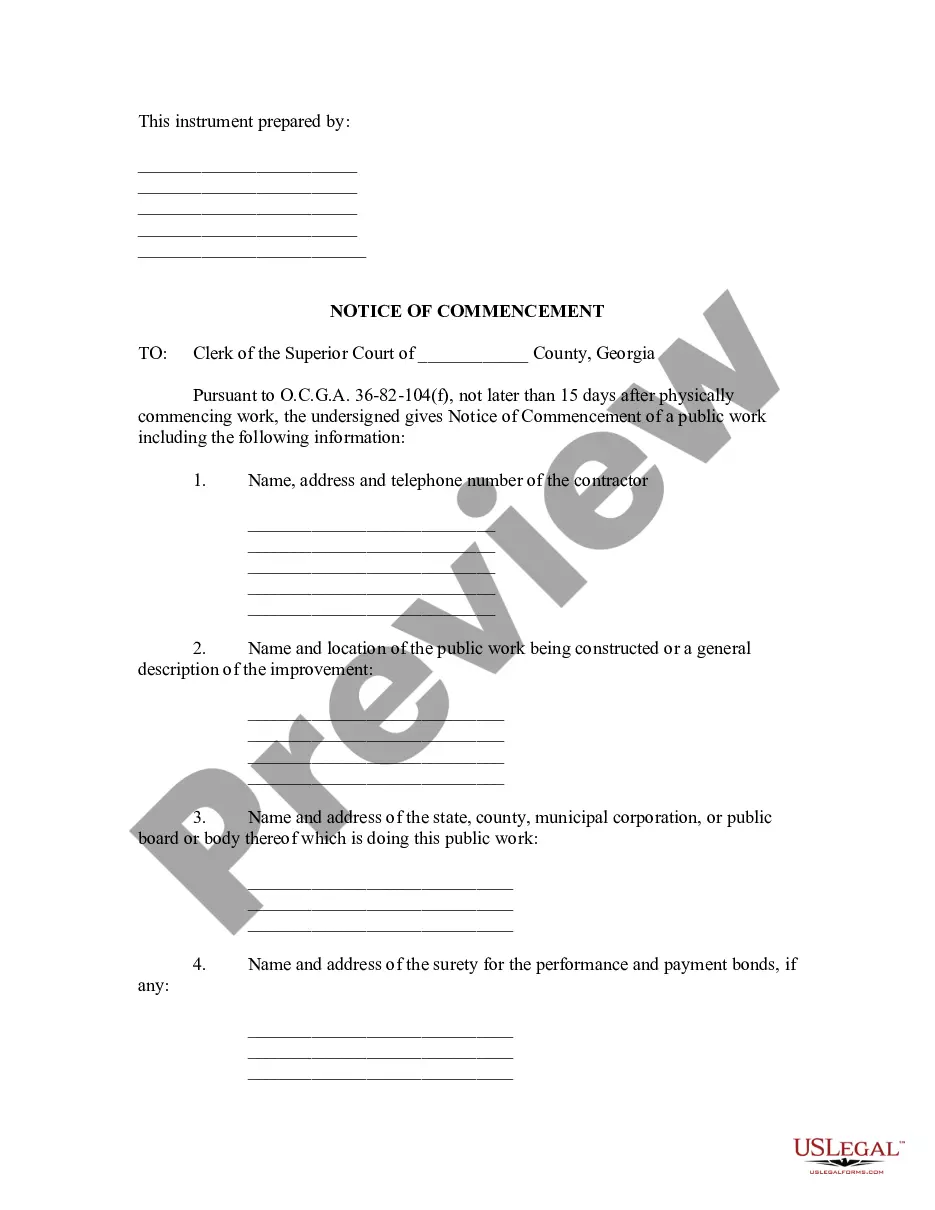

- Find the form you need and ensure it is for that proper city/state.

- Use the Preview key to review the form.

- See the explanation to actually have chosen the correct form.

- If the form is not what you are searching for, use the Search industry to find the form that meets your needs and specifications.

- Whenever you discover the proper form, click Buy now.

- Select the pricing plan you would like, fill in the specified details to make your money, and pay money for the transaction utilizing your PayPal or Visa or Mastercard.

- Pick a convenient document structure and down load your version.

Find every one of the papers layouts you possess purchased in the My Forms food selection. You can aquire a additional version of Wisconsin Agreement to Change or Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Deed of Trust at any time, if necessary. Just click on the necessary form to down load or print out the papers template.

Use US Legal Forms, one of the most comprehensive variety of legal varieties, in order to save time as well as steer clear of errors. The service delivers skillfully created legal papers layouts which can be used for a selection of reasons. Make an account on US Legal Forms and start creating your way of life a little easier.