This form is a deed of trust modification. It is to be entered into by a borrower, co-grantor, and the lender. The agreement modifies the mortgage or deed of trust to secure a debt described within the agreement. Other provisions include: renewal and extension of the lien, co-grantor liability, and note payment terms.

Wisconsin Change or Modification Agreement of Deed of Trust

Description

How to fill out Change Or Modification Agreement Of Deed Of Trust?

If you want to comprehensive, download, or printing authorized document layouts, use US Legal Forms, the greatest assortment of authorized types, that can be found online. Use the site`s simple and hassle-free look for to find the papers you will need. Different layouts for enterprise and specific uses are categorized by classes and says, or search phrases. Use US Legal Forms to find the Wisconsin Change or Modification Agreement of Deed of Trust in just a few mouse clicks.

In case you are currently a US Legal Forms customer, log in for your accounts and click the Obtain button to find the Wisconsin Change or Modification Agreement of Deed of Trust. You can even entry types you previously saved inside the My Forms tab of the accounts.

Should you use US Legal Forms the first time, follow the instructions under:

- Step 1. Make sure you have chosen the form to the appropriate area/country.

- Step 2. Utilize the Preview method to look through the form`s content. Don`t neglect to read the explanation.

- Step 3. In case you are unsatisfied together with the develop, take advantage of the Lookup field towards the top of the display screen to get other types in the authorized develop format.

- Step 4. After you have found the form you will need, go through the Purchase now button. Select the prices strategy you like and include your accreditations to sign up for an accounts.

- Step 5. Approach the financial transaction. You can utilize your charge card or PayPal accounts to complete the financial transaction.

- Step 6. Choose the formatting in the authorized develop and download it in your product.

- Step 7. Comprehensive, modify and printing or indicator the Wisconsin Change or Modification Agreement of Deed of Trust.

Every authorized document format you buy is your own property for a long time. You have acces to every single develop you saved with your acccount. Click the My Forms area and pick a develop to printing or download yet again.

Contend and download, and printing the Wisconsin Change or Modification Agreement of Deed of Trust with US Legal Forms. There are many expert and status-specific types you can utilize to your enterprise or specific requires.

Form popularity

FAQ

Legal instruments such as warranty deeds, quit claim deeds, etc., that convey title from one property owner to a new owner, are usually drafted by attorneys, or paralegals or legal secretaries under the supervision of an attorney.

A quitclaim deed is signed by the grantor but not always the guarantee, or person receiving the property.

A $30 filing fee is typically required. Transfer Tax: Yes: 30 cents for each $100 value or fraction of $100.

Real estate Obtain a new deed, prepared by an attorney, transferring the property from your name to the trust. Record the deed with the appropriate county recorder's office. Notify your mortgage lender and insurance company of the transfer.

Complete the deed form on your computer or print it and complete it in all black ink. The Grantors (current owners) must sign the deed before a notary public. 2. Go to the Wisconsin Department of Revenue's E-Return website at and complete an E-Return (eRETR).

How do I make a change to property ownership (add, remove or change someone's name)? To change ownership of real estate, a new conveyance document (deed) must be drafted and submitted for recording along with an Electronic Real Estate Transfer Return Receipt (e-RETR) We do not carry blank forms in our office.

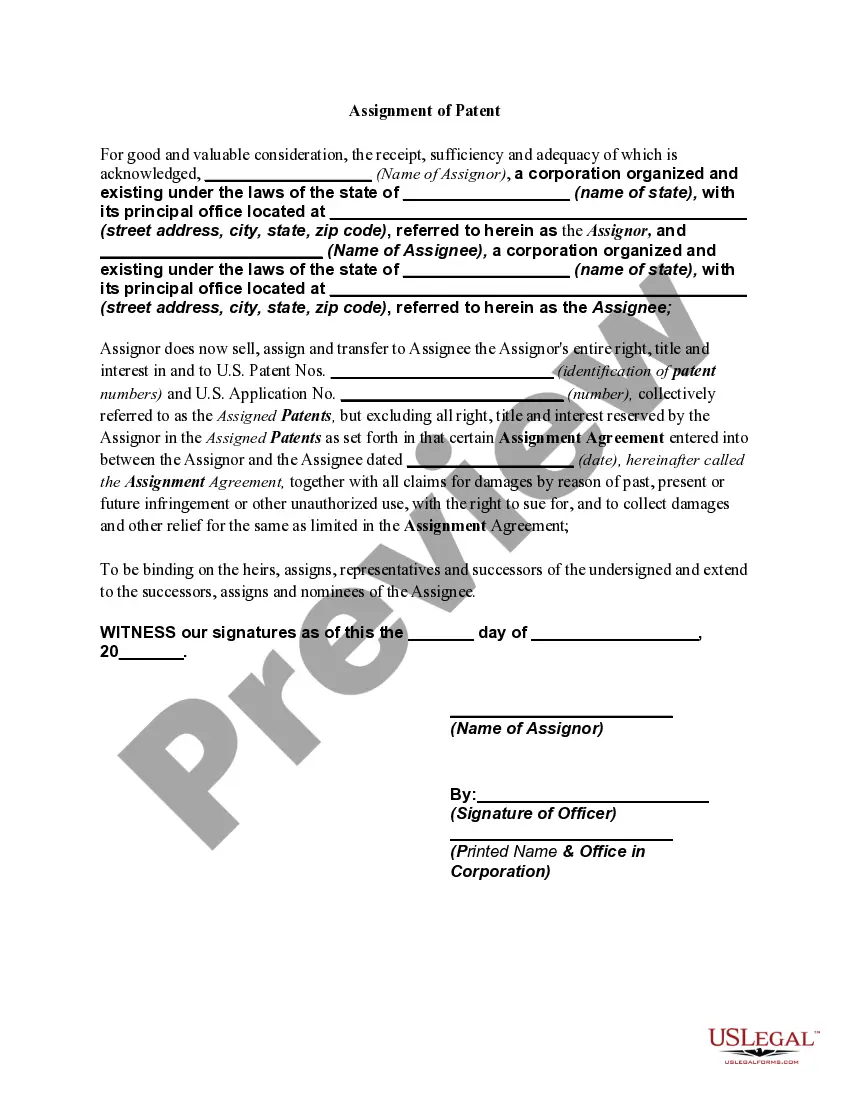

Deed of Trust Modification means, with respect to any Deed of Trust, a modification agreement entered into between the Borrower or the Project Owner, as applicable, and the Lender, modifying the terms and conditions of the Deed of Trust in order to (i) add to the lien of the Deed of Trust Additional Lots, or (ii) make ...

By adding another person to a deed, you are essentially gifting them a portion of the property's value, which may trigger the gift tax. Gift tax is a federal levy on transfers of money or property to another person while getting nothing, or less than full value, in return.