The Wisconsin Certificate of Trust for Testamentary Trust is a legal document that serves as evidence of the existence and provisions of a testamentary trust. This certificate provides important information regarding the trust to third parties, such as financial institutions, creditors, and beneficiaries. A testamentary trust is a trust that is created under a person's will and comes into effect upon their death. It allows the granter (the person creating the trust) to have greater control over the distribution of their assets after their passing, ensuring they are managed and distributed according to their wishes. The Wisconsin Certificate of Trust for Testamentary Trust is typically issued by the trustee, who is responsible for administering the trust and ensuring its proper operation. This certificate verifies the trust's existence without the need to disclose all of its details, which may be deemed sensitive or private. The Wisconsin Certificate of Trust for Testamentary Trust contains various key elements, including the trust's name, the date of the granter's death, the trustee's name and contact details, and a statement affirming the trustee's authority to act on behalf of the trust. Additionally, it may include details about successor trustees, beneficiaries, and any special instructions or conditions specified in the trust document. While there are no distinct types of Wisconsin Certificates of Trust for Testamentary Trust, variations may occur depending on the specific requirements and provisions outlined in the original trust agreement. Some testamentary trusts may have complex terms and conditions, necessitating a more detailed certificate to adequately address its unique nature. In conclusion, the Wisconsin Certificate of Trust for Testamentary Trust is a crucial legal document that provides verification of a testamentary trust's existence and outlines its basic provisions. With this certificate, trustees can efficiently manage the trust's affairs, and interested parties can obtain necessary details while respecting the privacy and confidentiality of the trust's terms.

Wisconsin Certificate of Trust for Testamentary Trust

Description

How to fill out Wisconsin Certificate Of Trust For Testamentary Trust?

Are you presently in the situation in which you will need documents for both company or personal uses nearly every day? There are tons of legal file web templates available on the Internet, but discovering versions you can trust is not straightforward. US Legal Forms gives a large number of kind web templates, like the Wisconsin Certificate of Trust for Testamentary Trust, that happen to be published to fulfill federal and state demands.

When you are already familiar with US Legal Forms web site and get a free account, merely log in. After that, it is possible to download the Wisconsin Certificate of Trust for Testamentary Trust design.

Unless you come with an profile and need to begin to use US Legal Forms, follow these steps:

- Find the kind you need and ensure it is for that right metropolis/area.

- Use the Review option to check the form.

- Browse the outline to actually have selected the right kind.

- In case the kind is not what you`re seeking, use the Lookup area to get the kind that meets your requirements and demands.

- If you find the right kind, simply click Get now.

- Pick the rates program you need, fill in the required details to create your money, and pay for an order utilizing your PayPal or charge card.

- Select a practical paper formatting and download your backup.

Locate every one of the file web templates you may have purchased in the My Forms food list. You can aquire a additional backup of Wisconsin Certificate of Trust for Testamentary Trust anytime, if required. Just go through the needed kind to download or produce the file design.

Use US Legal Forms, one of the most comprehensive collection of legal varieties, to conserve time as well as prevent faults. The service gives professionally produced legal file web templates which can be used for a selection of uses. Generate a free account on US Legal Forms and begin producing your way of life a little easier.

Form popularity

FAQ

In Wisconsin, a trust is revocable unless it specifically states it is irrevocable in the trust document. Usually a living revocable trust becomes irrevocable (not open to changes) when you die. A trust involves three parties: The settlor or grantor is you, the person who creates the trust.

Understanding Irrevocable Trusts in Wisconsin An irrevocable trust is a trust that cannot be changed, amended, or terminated after it is created (with some limited exceptions). By creating an irrevocable trust, the grantor is relinquishing their control over the assets placed in the trust.

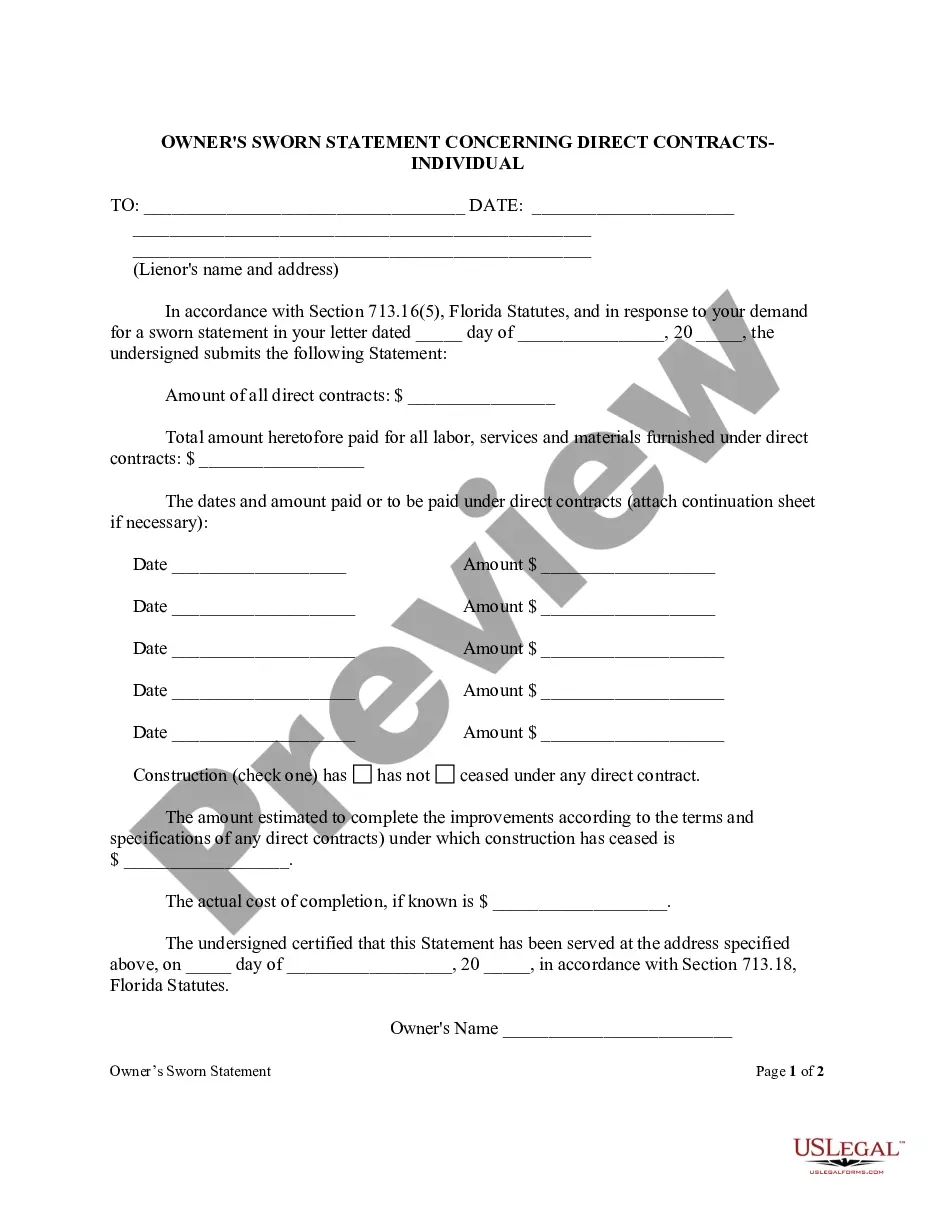

The trust agreement is the parent document that details anything and everything regarding the trust, including its agreements. Meanwhile, the certificate of trust is used in tandem to keep nonessential information confidential.

A Trust Certification gives a Trustee the ability to provide anyone who needs it (think: financial institutions or other third parties) important information about the Trust - like the date it was formed, the legal/formal name of the Trust, who the Trustee is (or Trustees are) and other information institutions may ...

701.0813 Duty to inform and report. (1) A trustee shall keep the distributees or permissible distributees of trust income or principal, and other qualified beneficiaries who so request, reasonably informed about the administration of the trust.

701.1013 Certification of trust. (1) Instead of furnishing a copy of the trust instrument to a person other than a beneficiary, the trustee may furnish to the person a certification of trust containing the following information: (a) That the trust exists and the date on which the trust instrument was executed.

The assets, beneficiaries, and terms of the trust are never public record. If you choose to pass your assets through a will, it must go through probate and then becomes public record. A trust is more difficult to challenge or contest than a will, offering additional security.