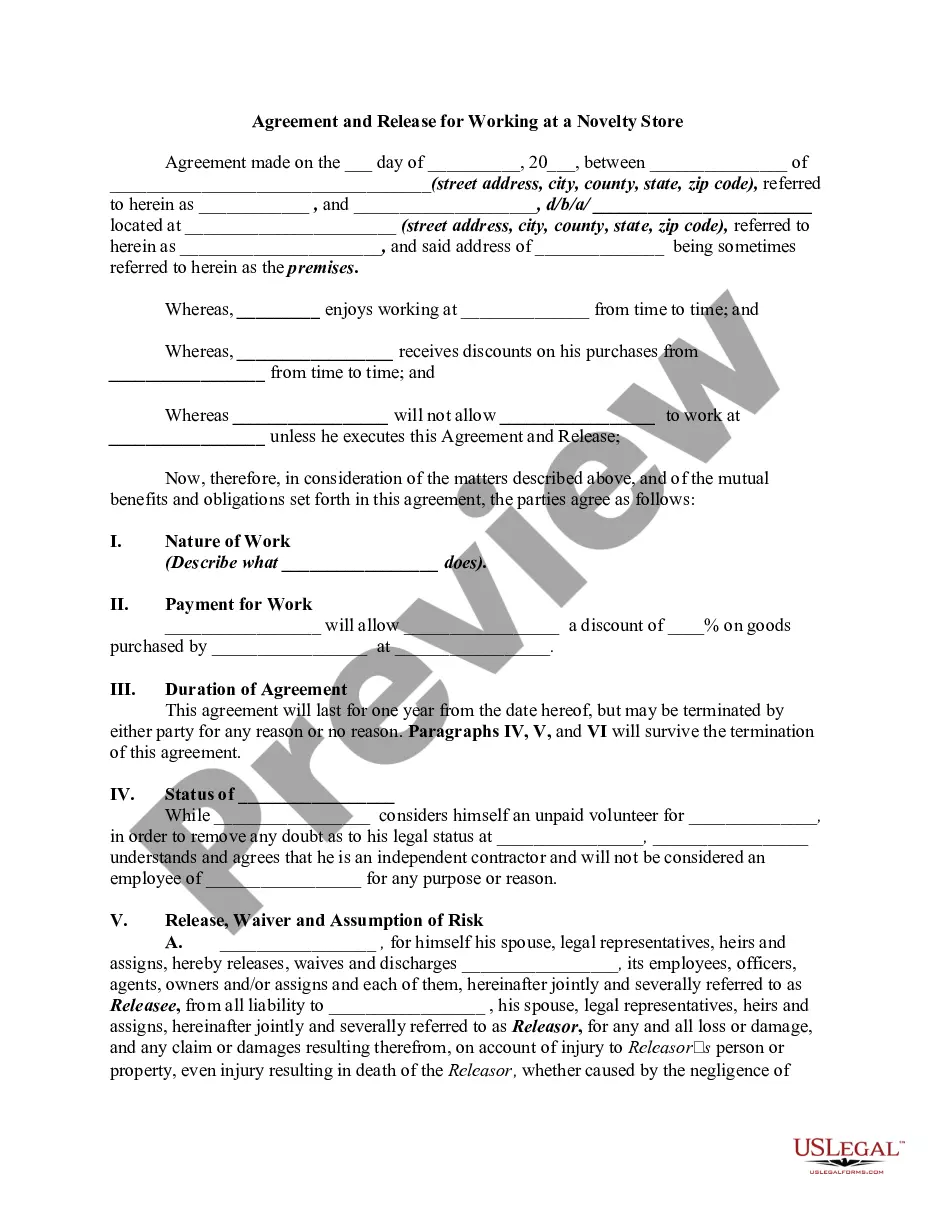

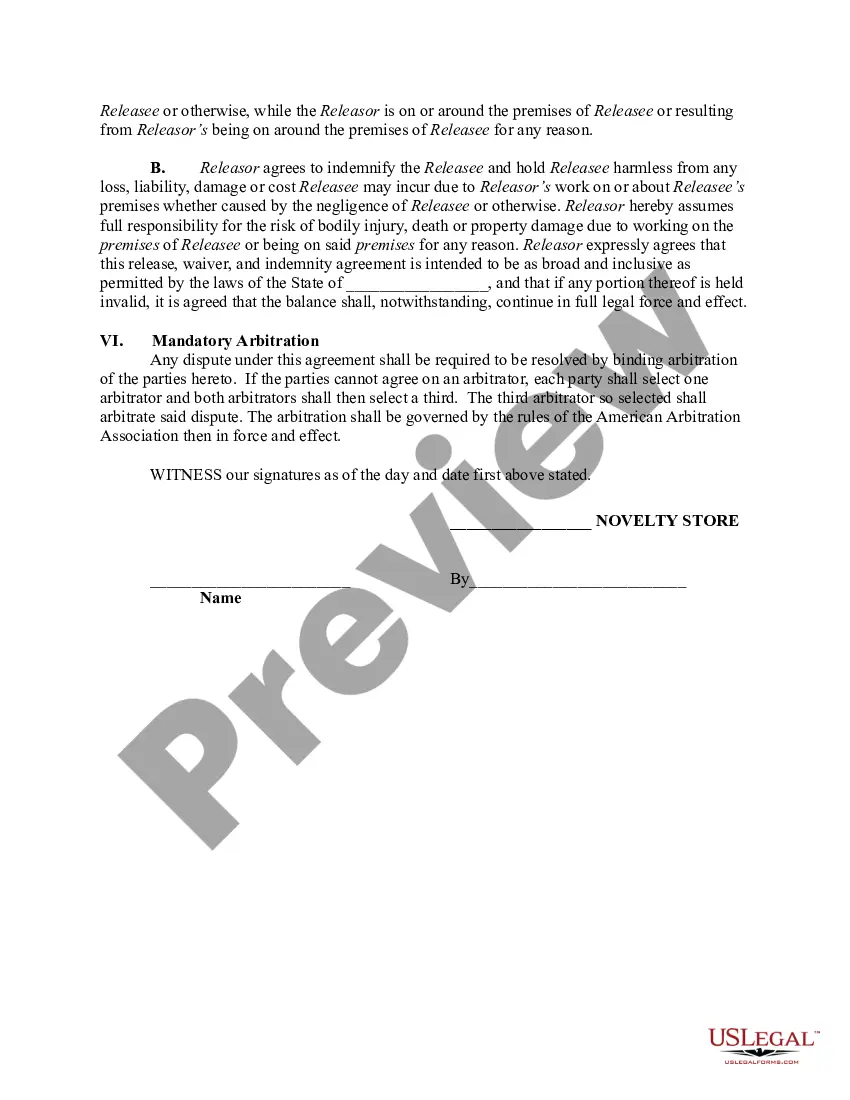

Wisconsin Agreement and Release for Working at a Novelty Store - Self-Employed

Description

How to fill out Agreement And Release For Working At A Novelty Store - Self-Employed?

It is feasible to spend hours online seeking the legal document template that meets the state and federal requirements you require.

US Legal Forms provides thousands of legal forms that are assessed by experts.

You can effortlessly obtain or print the Wisconsin Agreement and Release for Working at a Novelty Store - Self-Employed from their service.

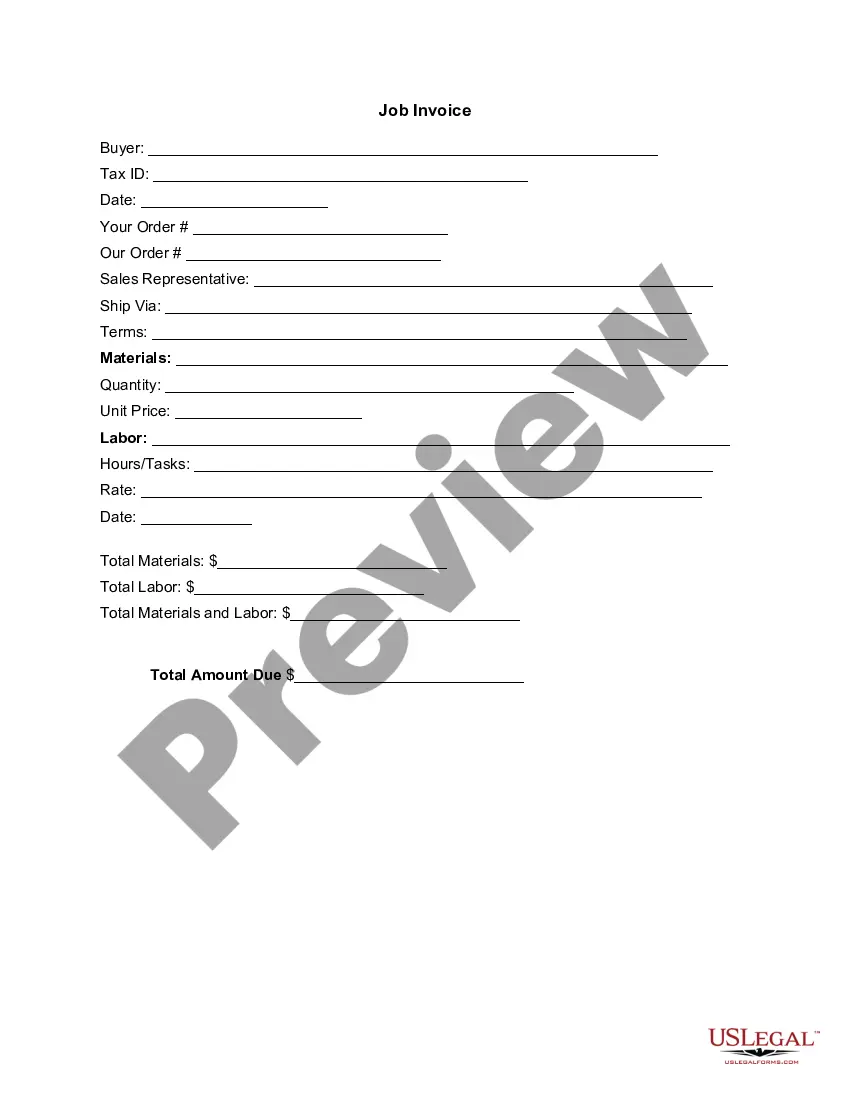

If available, utilize the Preview button to view the document template simultaneously.

- If you have a US Legal Forms account already, you can Log In and click the Download button.

- After that, you can complete, modify, print, or sign the Wisconsin Agreement and Release for Working at a Novelty Store - Self-Employed.

- Each legal document template you acquire is yours forever.

- To obtain another copy of any purchased form, go to the My documents tab and click the corresponding button.

- If you're using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you've selected the appropriate document template for the chosen county/city.

- Review the form summary to confirm you've chosen the correct form.

Form popularity

FAQ

employed person's job description varies widely but generally includes managing business operations, marketing services, and handling client relationships. This role requires individuals to wear many hats, from financial management to customer service. Utilizing a legally recognized document like the Wisconsin Agreement and Release for Working at a Novelty Store SelfEmployed can enhance your professional standing.

Your position as a self-employed individual typically identifies you as the sole proprietor or principal of your business operation. This means you manage all aspects of your venture. Documenting this through a Wisconsin Agreement and Release for Working at a Novelty Store - Self-Employed can clarify your ongoing responsibilities.

In Wisconsin, a contract becomes legally binding when both parties agree to its terms and conditions, there is mutual consent, and consideration is exchanged. For self-employed operators, understanding these elements is vital, especially when drafting agreements like the Wisconsin Agreement and Release for Working at a Novelty Store - Self-Employed.

Your position as a self-employed person typically revolves around your business’s nature. You can designate yourself as an owner, operator, or service provider depending on what fits your work. Ultimately, using documentation such as the Wisconsin Agreement and Release for Working at a Novelty Store - Self-Employed can define your role more formally.

When indicating self-employment on your resume, list your business name followed by your role, such as 'Owner' or 'Freelance Designer.' Include the dates of operation and key responsibilities to highlight your experience. Utilizing the Wisconsin Agreement and Release for Working at a Novelty Store - Self-Employed can add formality to your business activities.

Self-employed individuals can use various titles based on their profession and business type. Common titles include owner, freelancer, contractor, or independent consultant. When filing for documents, such as a Wisconsin Agreement and Release for Working at a Novelty Store - Self-Employed, using a clear title is essential for clarity.

The primary difference between an employee and an independent contractor in Wisconsin lies in the level of control and independence. Employees are generally subject to the direction of their employer, while independent contractors operate independently and have more control over how they perform their work. Understanding these differences can help you prepare a comprehensive Wisconsin Agreement and Release for Working at a Novelty Store - Self-Employed, ensuring clarity in your business relationships.

An independent contractor agreement in Wisconsin is a legal document that outlines the terms of work between a contractor and a client. This agreement typically includes details such as payment terms, project scope, and deadlines. Utilizing a Wisconsin Agreement and Release for Working at a Novelty Store - Self-Employed can help prevent misunderstandings and provide a clear framework for your working relationship.

In Wisconsin, whether you need a license as an independent contractor depends on your specific trade or service. Many occupations require a state-issued license, such as electricians and plumbers, while others may not. Therefore, it’s important to review the requirements for your specific field and consider using a Wisconsin Agreement and Release for Working at a Novelty Store - Self-Employed to ensure you meet compliance and licensing standards.

Independent contractors in Wisconsin are responsible for paying self-employment taxes, which include Social Security and Medicare taxes. You will also report your income and expenses on Schedule SE and file them with your annual tax return. To accurately manage your taxes, consider using a well-structured Wisconsin Agreement and Release for Working at a Novelty Store - Self-Employed to document your income and expenses clearly.