This form set up what is known as present interest trusts, with the intention of meeting the requirements of Section 2503(c) of the Internal Revenue Code.

Wisconsin Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children

Description

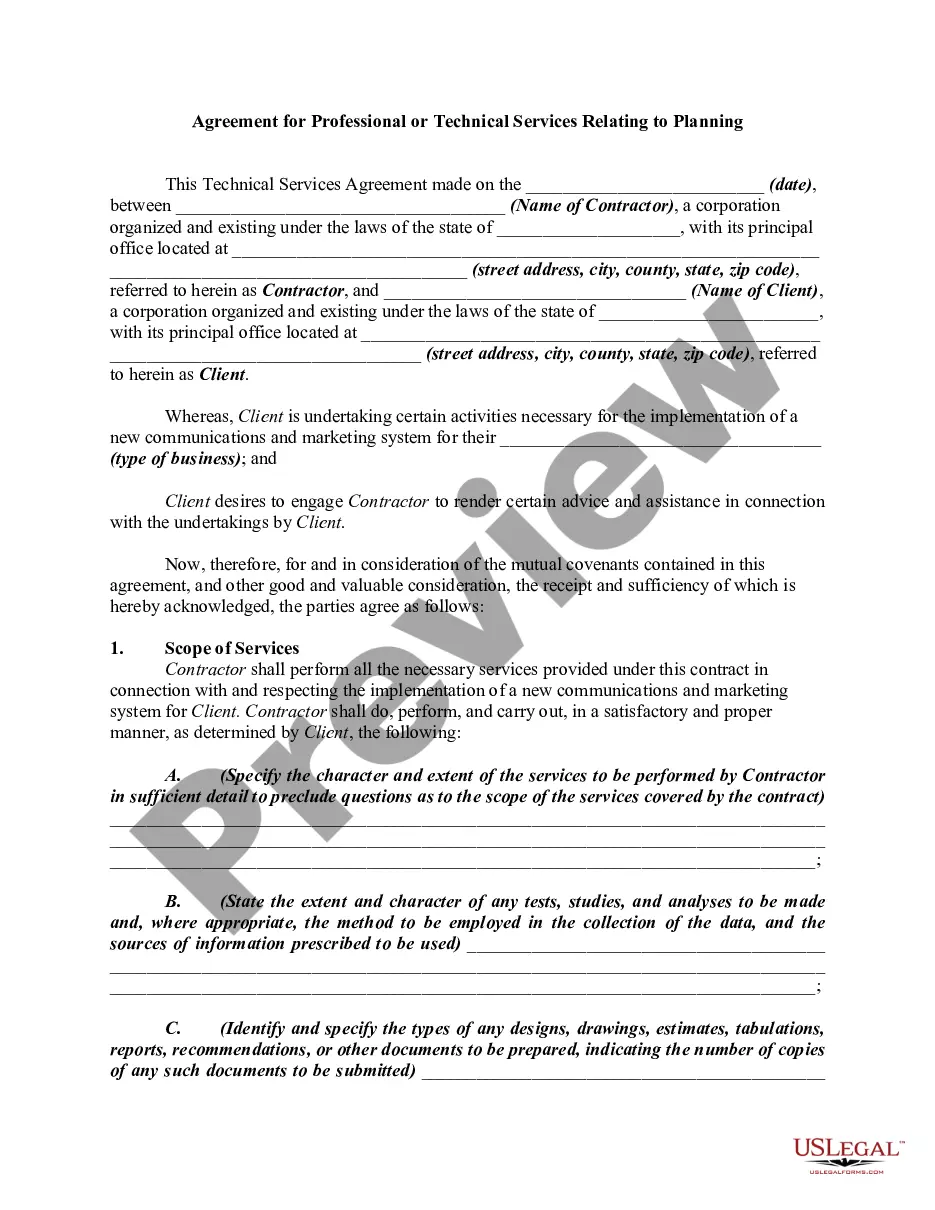

How to fill out Trust Agreement For Minors Qualifying For Annual Gift Tax Exclusion - Multiple Trusts For Children?

If you desire to thoroughly, download, or create official document templates, utilize US Legal Forms, the largest selection of legal forms, which are accessible online.

Take advantage of the site's straightforward and convenient search to locate the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

Step 6. Choose the format of the legal document and download it to your device. Step 7. Fill out, edit, and print or sign the Wisconsin Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children. Every legal document template you purchase is yours indefinitely. You will have access to every form you acquired in your account. Click on the My documents section and select a form to print or download again.

- Utilize US Legal Forms to find the Wisconsin Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and then click the Acquire button to obtain the Wisconsin Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children.

- You can also access forms you previously purchased in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview feature to review the form's content. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other templates in the legal form format.

- Step 4. Once you have found the form you need, click on the Get now button. Choose the pricing plan you prefer and enter your details to register for an account.

Form popularity

FAQ

Gifts that qualify for the Generation-Skipping Transfer (GST) annual exclusion include direct transfers to grandchildren or others two or more generations below you, as long as they are within the exclusion limit. For 2023, this amount is set at $17,000 per recipient. This can be strategically implemented in a Wisconsin Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children. By understanding these exclusions, you can maximize your family wealth across generations while minimizing tax burdens.

The Uniform Transfers to Minors Act (UTMA) in Wisconsin allows adults to transfer assets to minors without the need for a formal trust. Once the assets are transferred, they are managed by a custodian until the minor reaches the age of majority. This law complements a Wisconsin Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children by offering an additional way to benefit your children while ensuring future financial security. It's a flexible approach to managing gifts intended for minors.

Gifts that fall under the annual exclusion do not need to be reported on a gift tax return. However, it is crucial to keep proper records of these transactions in case of future audits. When establishing a Wisconsin Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children, maintaining accurate documentation simplifies your financial management and compliance. This way, you can focus on providing for your children while minimizing tax liabilities.

In Wisconsin, trust law ensures that trusts are established and managed according to clearly defined rules. For a trust to be valid, it must have a definite beneficiary, a lawful purpose, and competent trustees to administer the assets. For many families, setting up a Wisconsin Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children provides a straightforward method for asset management and tax efficiency. This not only protects your children's future but also ensures clarity in how assets are distributed.

The annual exclusion for gift splitting allows married couples to split gifts made to other individuals, effectively doubling the amount they can gift without incurring taxes. For 2023, the exclusion limit is $17,000 per recipient, making it $34,000 for couples. This can be particularly beneficial when considering a Wisconsin Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children. By utilizing this strategy, you can maximize gifts for your children while remaining compliant with tax regulations.

The Uniform Transfers to Minors Act (UTMA) and the 2503c Trust both serve to provide assets for minors but function differently. While UTMA allows for a more straightforward transfer of assets without a trust structure, the 2503c Trust under a Wisconsin Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children provides specific rules about asset distribution. Understanding these distinctions can help you choose the right approach for your child's benefit.

A minor trust is generally a type of trust established to manage assets until the beneficiary reaches a designated age. A Wisconsin Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children is designed specifically for this purpose. This type of trust allows you to control the funds and protect a child's financial future effectively until they are ready to manage it independently.

For minors, a trust that focuses on their financial future is essential. The Wisconsin Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children typically offers strong benefits. This trust allows you to specify how and when the minor can access the funds, providing peace of mind for both you and your child.

Indeed, Wisconsin has provisions for the federal gift tax exemption that apply to residents. Contributions made under the Wisconsin Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children can help minimize your taxable estate. It's crucial to understand the limits and conditions applicable to these exemptions to fully benefit from them.

The best type of trust to set up will ultimately depend on your financial and familial needs. For minors, a trust that incorporates the Wisconsin Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children is advantageous. This setup provides specific controls over distributions, making it easier to achieve your objectives while maximizing tax benefits.