Wisconsin Affidavit by an Attorney-in-Fact in the Capacity of an Administrator of an Estate

Description

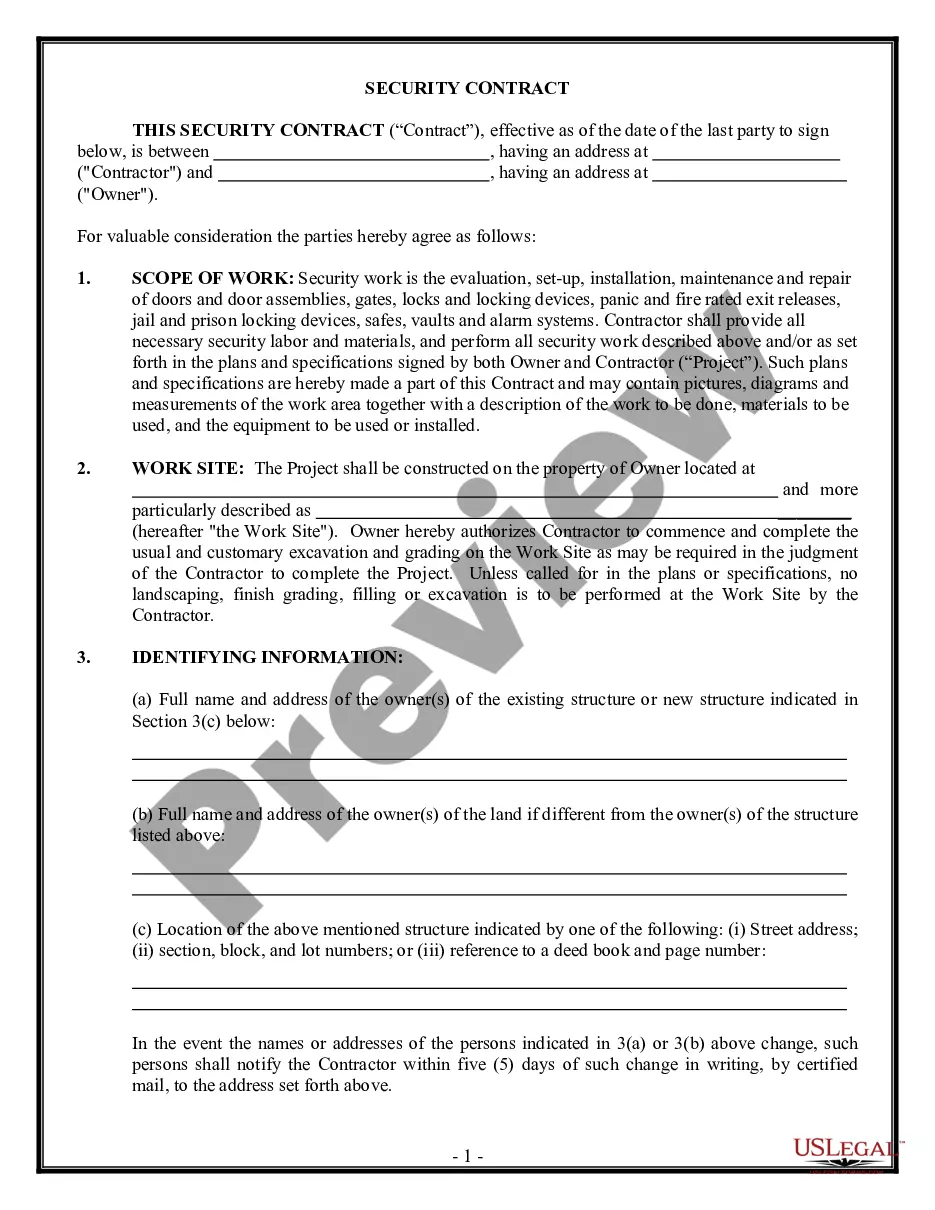

How to fill out Affidavit By An Attorney-in-Fact In The Capacity Of An Administrator Of An Estate?

You are able to devote hrs on the web attempting to find the legal document format which fits the state and federal demands you want. US Legal Forms supplies 1000s of legal forms which are reviewed by pros. You can actually download or produce the Wisconsin Affidavit by an Attorney-in-Fact in the Capacity of an Administrator of an Estate from my assistance.

If you currently have a US Legal Forms bank account, it is possible to log in and click the Download button. Following that, it is possible to comprehensive, modify, produce, or signal the Wisconsin Affidavit by an Attorney-in-Fact in the Capacity of an Administrator of an Estate. Every single legal document format you purchase is your own permanently. To get another backup of the acquired form, proceed to the My Forms tab and click the corresponding button.

If you work with the US Legal Forms website the very first time, keep to the simple guidelines beneath:

- Initial, be sure that you have chosen the proper document format for the region/metropolis of your choice. Browse the form outline to ensure you have picked the correct form. If accessible, utilize the Review button to check through the document format as well.

- If you wish to find another model of the form, utilize the Research area to obtain the format that meets your needs and demands.

- After you have discovered the format you need, just click Purchase now to carry on.

- Choose the rates program you need, key in your references, and sign up for an account on US Legal Forms.

- Complete the transaction. You may use your Visa or Mastercard or PayPal bank account to cover the legal form.

- Choose the formatting of the document and download it in your device.

- Make alterations in your document if necessary. You are able to comprehensive, modify and signal and produce Wisconsin Affidavit by an Attorney-in-Fact in the Capacity of an Administrator of an Estate.

Download and produce 1000s of document templates using the US Legal Forms site, which offers the biggest variety of legal forms. Use specialist and status-particular templates to deal with your small business or individual requirements.

Form popularity

FAQ

Wisconsin probate laws require an estate to be settled within 18 months. Generally, some counties in Wisconsin request that an executor settle an estate in 12 months. Executors should work toward completing probate within that time.

In Wisconsin, creditors must file any claims before the deadline set by the court clerk, typically 3-4 months after executor appointment.

Also exempt from probate is property titled in joint ownership, which automatically passes to the surviving owner. In addition, life insurance payments and funds in an IRA, pension, 401(k), or other retirement plan bypass probate ? if the decedent has named beneficiaries other than the estate.

Wisconsin's Small Estate Affidavit statute allows estates under $50,000 to avoid probate and instead be transferred via affidavit.

Personal Representative: Any person authorized to administer a decedent's estate. Evidence of this authorization is found in Domiciliary Letters granted by the court or by the Probate Registrar. A personal representative may be nominated in a Will or Codicil.

In the state of Wisconsin, the probate process triggers automatically if the estate is worth $50,000 or more. However, there are specific exemptions where probate can be avoided. The scenarios include jointly titled assets where a beneficiary has been declared.

You must be an heir of the decedent, trustee of a trust created by the decedent, or a guardian of the decedent at the time of decedent's death. The probate assets remaining in the estate must be $50,000 or less.

Pursuant to Wisconsin State Statute Section 867.03, Transfer by Affidavit is used for solely owned property within this state valued under $50,000. Any heir, trustee, or person who was guardian, may collect and transfer the solely owned assets by completing an affidavit in duplicate.