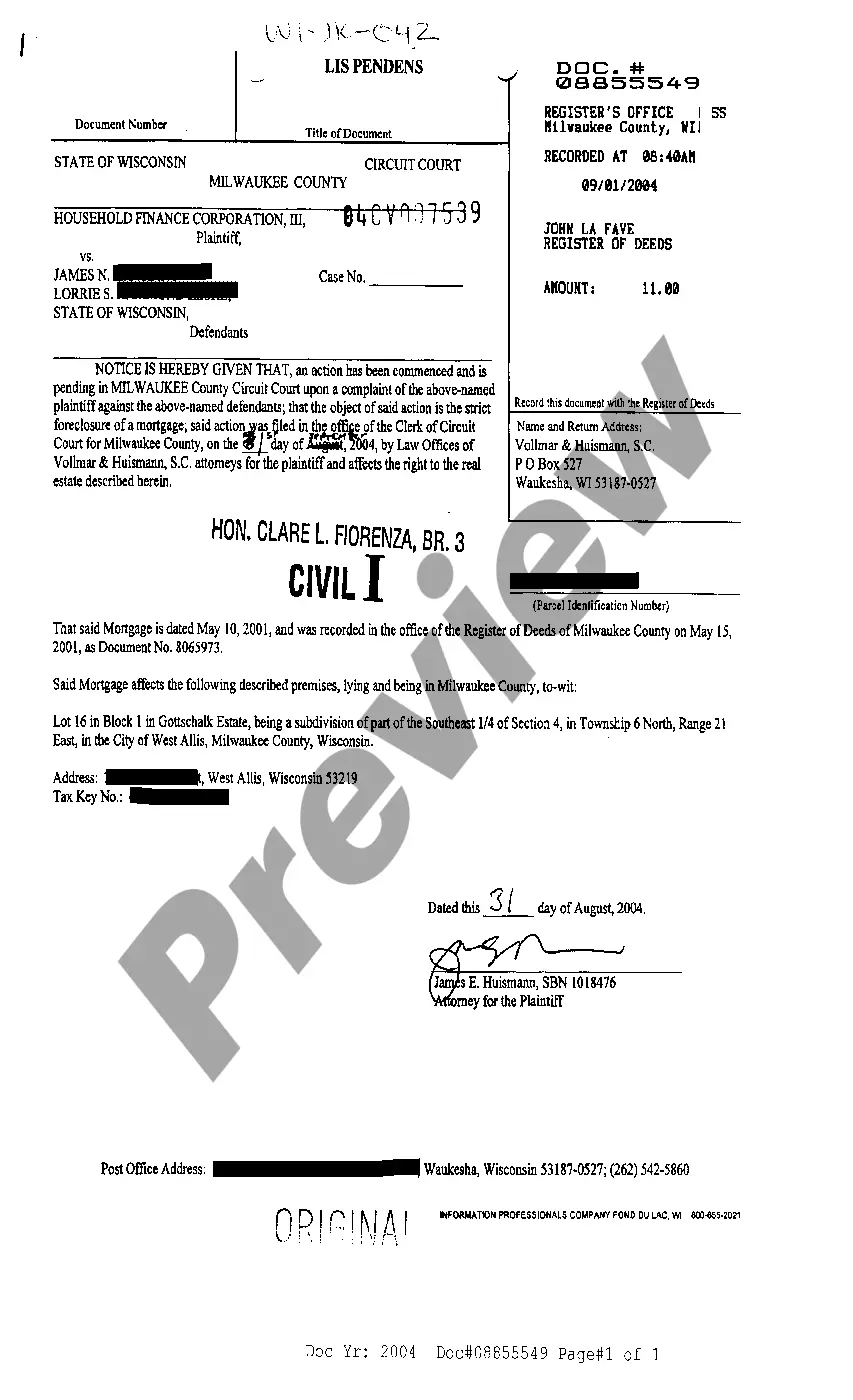

Wisconsin Lis Pendens regarding Strict Foreclosure Action

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Wisconsin Lis Pendens Regarding Strict Foreclosure Action?

Out of the multitude of services that provide legal samples, US Legal Forms offers the most user-friendly experience and customer journey while previewing templates before buying them. Its complete catalogue of 85,000 samples is categorized by state and use for simplicity. All of the forms available on the platform have been drafted to meet individual state requirements by accredited legal professionals.

If you already have a US Legal Forms subscription, just log in, look for the form, press Download and gain access to your Form name from the My Forms; the My Forms tab keeps all of your saved forms.

Keep to the guidelines listed below to get the document:

- Once you see a Form name, make sure it’s the one for the state you really need it to file in.

- Preview the form and read the document description just before downloading the template.

- Look for a new template via the Search field in case the one you have already found isn’t proper.

- Simply click Buy Now and choose a subscription plan.

- Create your own account.

- Pay using a credit card or PayPal and download the document.

After you’ve downloaded your Form name, you are able to edit it, fill it out and sign it with an online editor that you pick. Any form you add to your My Forms tab can be reused multiple times, or for as long as it remains to be the most up-to-date version in your state. Our service provides quick and easy access to samples that suit both lawyers and their customers.

Form popularity

FAQ

Phase 1: Payment Default. Phase 2: Notice of Default. Phase 3: Notice of Trustee's Sale. Phase 4: Trustee's Sale. Phase 5: Real Estate Owned (REO) Phase 6: Eviction. The Bottom Line.

Lenders are usually unwilling to finance a mortgage until the lis pendens has been removed from the title. In addition, while a property can still be sold while there is a lis pendens, title companies will not insure the property, and that alone should be a deterrent to purchasing.

The lender demands the borrower pay the full mortgage amount in 90 days or the borrower will be required to vacate the property. The lender files suit asking a court to order the borrower to pay the mortgage debt by a certain date or the lender will automatically gain full title to the property.

A Lis Pendens filed in California, as in other states, can, at least temporarily, stop foreclosure proceedings.The real estate could still be foreclosed upon or ownership transferred, but the rights of the lender or new owner could be affected by the court's decision.

How long it takes for your home to foreclose once you receive notice of lis pendens will depend on the state. In California, it might take a minimum of 120 days, and 180 days in Florida, while in New York it can take as long as 15 months after the notice is filed.

Negotiate With Your Lender. If you are having financial difficulties, the worst thing that you can do is bury your head in the sand. Request a Forbearance. Modify Your Loan. Make a Claim. Get a Housing Counselor. Declare Bankruptcy. Use A Foreclosure Defense Strategy. Make Them Produce The Not.

In a strict foreclosure, a lender takes title to the liened property directly. a lender receives the proceeds from the forced sale of the liened property. the defaulting owner does not have the opportunity to prevent the foreclosure by paying the amounts owed.

In a strict foreclosure, a lender takes title to the liened property directly. a lender receives the proceeds from the forced sale of the liened property. the defaulting owner does not have the opportunity to prevent the foreclosure by paying the amounts owed.

Strict Foreclosure. In strict foreclosure proceedings, the lender files a lawsuit on the homeowner that has defaulted. If the borrower cannot pay the mortgage within a specific timeline ordered by the court, the property goes directly back to the mortgage holder.