Wisconsin Transfer by Affidavit Instructions

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Wisconsin Transfer By Affidavit Instructions?

Use US Legal Forms to get a printable Wisconsin Transfer by Affidavit Instructions. Our court-admissible forms are drafted and regularly updated by skilled lawyers. Our’s is the most comprehensive Forms catalogue on the web and provides affordable and accurate samples for customers and legal professionals, and SMBs. The templates are categorized into state-based categories and a few of them might be previewed prior to being downloaded.

To download templates, customers must have a subscription and to log in to their account. Click Download next to any form you want and find it in My Forms.

For those who do not have a subscription, follow the following guidelines to quickly find and download Wisconsin Transfer by Affidavit Instructions:

- Check out to make sure you have the correct form in relation to the state it’s needed in.

- Review the form by looking through the description and by using the Preview feature.

- Click Buy Now if it is the document you need.

- Create your account and pay via PayPal or by card|credit card.

- Download the form to your device and feel free to reuse it many times.

- Use the Search field if you want to get another document template.

US Legal Forms offers thousands of legal and tax samples and packages for business and personal needs, including Wisconsin Transfer by Affidavit Instructions. Above three million users have already utilized our platform successfully. Choose your subscription plan and obtain high-quality documents in just a few clicks.

Form popularity

FAQ

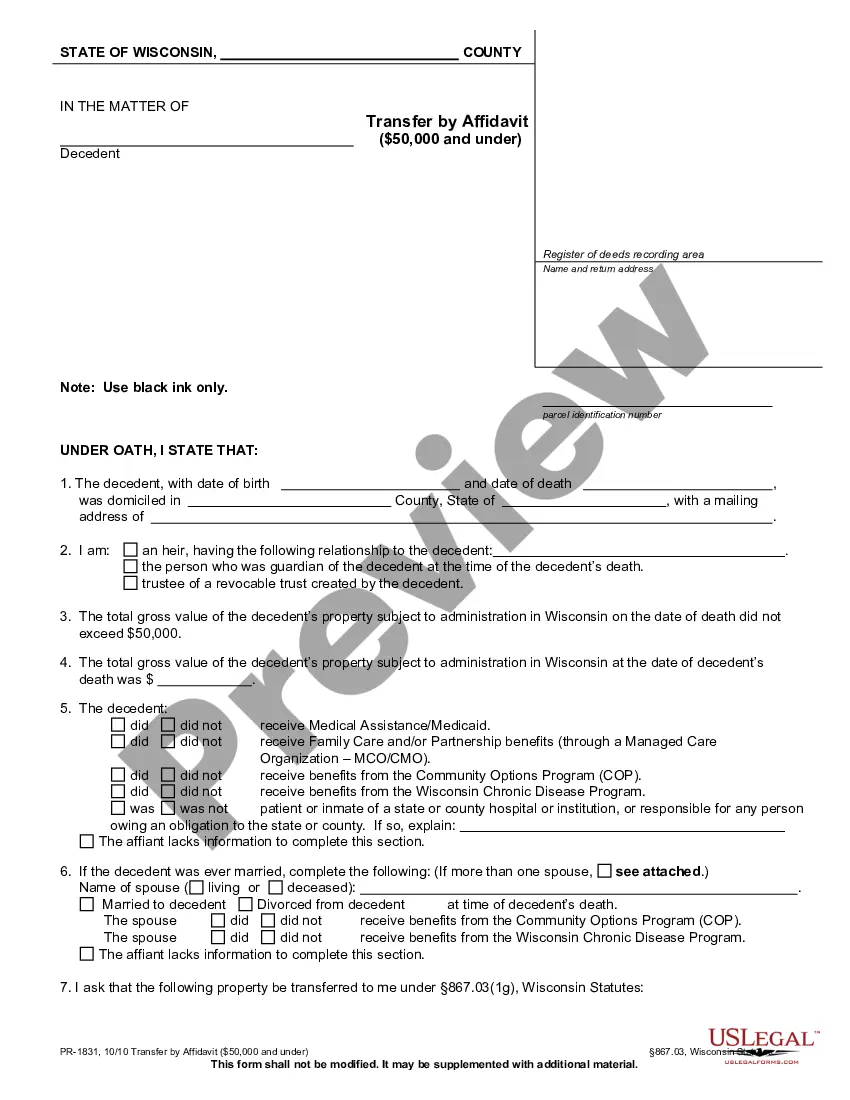

Probate is used to distribute a decedent's assets not only to beneficiaries but also to creditors and taxing authorities. Any Wisconsin estate that exceeds $50,000 in value must go through the probate process unless the property is subject to certain exemptions.

In accordance with Michigan State Law, a Property Transfer Affidavit must be filed with the local assessor's office whenever real estate or some types of personal property transfer ownership (a transfer of ownership is generally defined as: a conveyance of title to, or present interest in, a property, including

Affidavit must be filed by the new owner with the assessor for the city or township where the property is located within 45 days of the transfer.

The Domiciliary Letters shows that the probate court has given the authority to the named personal representative to act on behalf on the estate of the decedent and to perform all duties required to administer the estate according to statute.

Step 1 At the top, write in the name of the decedent. Step 2 Under Section 1, write in the date of birth, the date of death, the residential address of decedent. Step 3 In Section 2, check the box that describes you as the person filling out the affidavit.

Find the most recent deed to the property. It is helpful to begin by locating the most recent deed to the property (the deed that transferred the property to the current grantor). Create the new deed. Sign and notarize the deed. File the deed in the county land records.

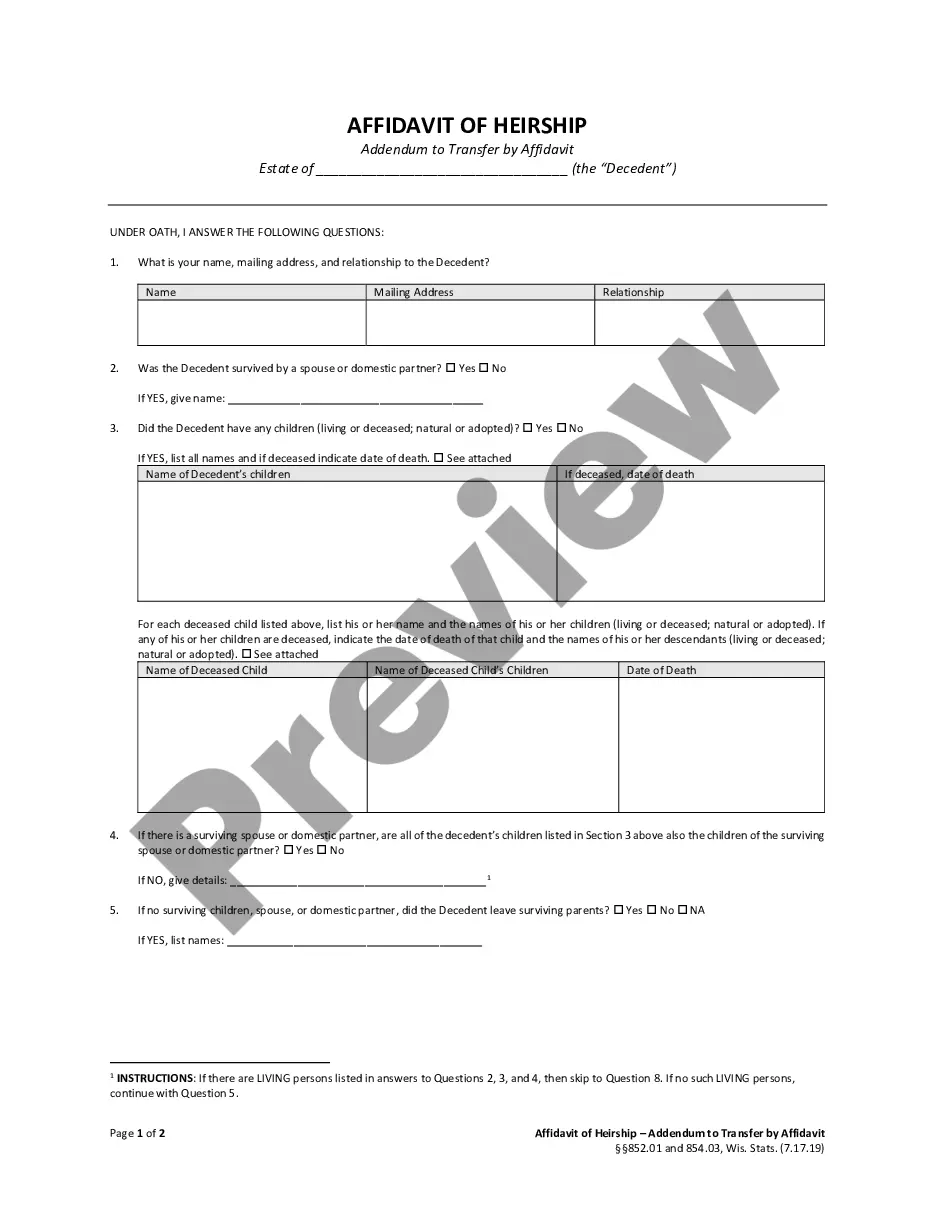

The transfer by affidavit process can be used to close a person's estate when the deceased has $50,000 or less in assets subject to administration in Wisconsin. It is an alternative to using a court process for smaller estates.