Wisconsin Affidavit of Heirship - addendum to Transfer by Affidavit

Description

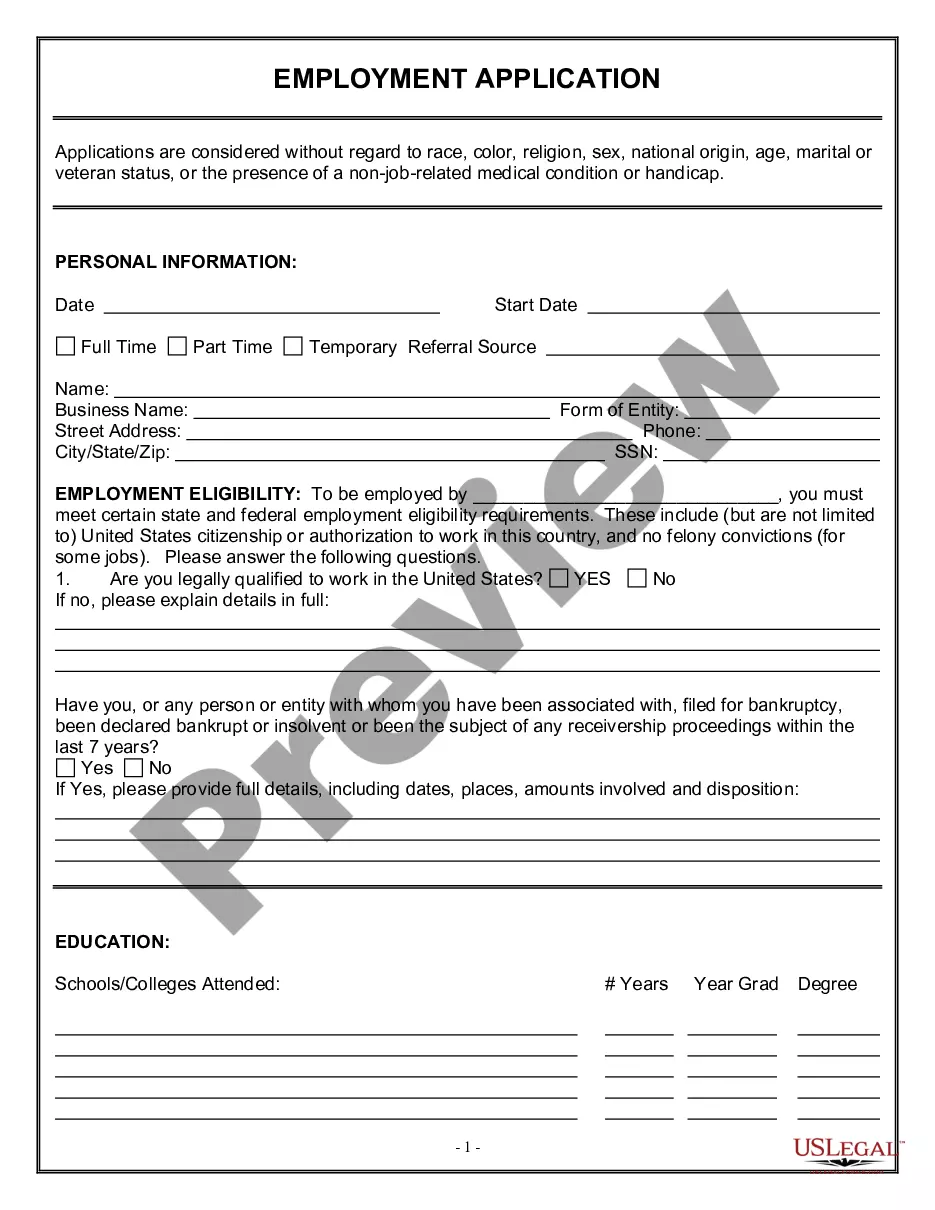

How to fill out Wisconsin Affidavit Of Heirship - Addendum To Transfer By Affidavit?

Use US Legal Forms to get a printable Wisconsin Affidavit of Heirship – addendum to Transfer by Affidavit . Our court-admissible forms are drafted and regularly updated by professional lawyers. Our’s is the most extensive Forms catalogue on the internet and provides affordable and accurate samples for customers and attorneys, and SMBs. The templates are categorized into state-based categories and some of them might be previewed prior to being downloaded.

To download templates, customers need to have a subscription and to log in to their account. Press Download next to any template you want and find it in My Forms.

For individuals who do not have a subscription, follow the following guidelines to easily find and download Wisconsin Affidavit of Heirship – addendum to Transfer by Affidavit :

- Check out to make sure you have the right template with regards to the state it’s needed in.

- Review the document by looking through the description and using the Preview feature.

- Click Buy Now if it is the template you want.

- Create your account and pay via PayPal or by card|credit card.

- Download the template to your device and feel free to reuse it multiple times.

- Use the Search field if you need to find another document template.

US Legal Forms offers a large number of legal and tax templates and packages for business and personal needs, including Wisconsin Affidavit of Heirship – addendum to Transfer by Affidavit . Over three million users have already utilized our service successfully. Select your subscription plan and have high-quality forms in a few clicks.

Form popularity

FAQ

Affidavit must be filed by the new owner with the assessor for the city or township where the property is located within 45 days of the transfer.

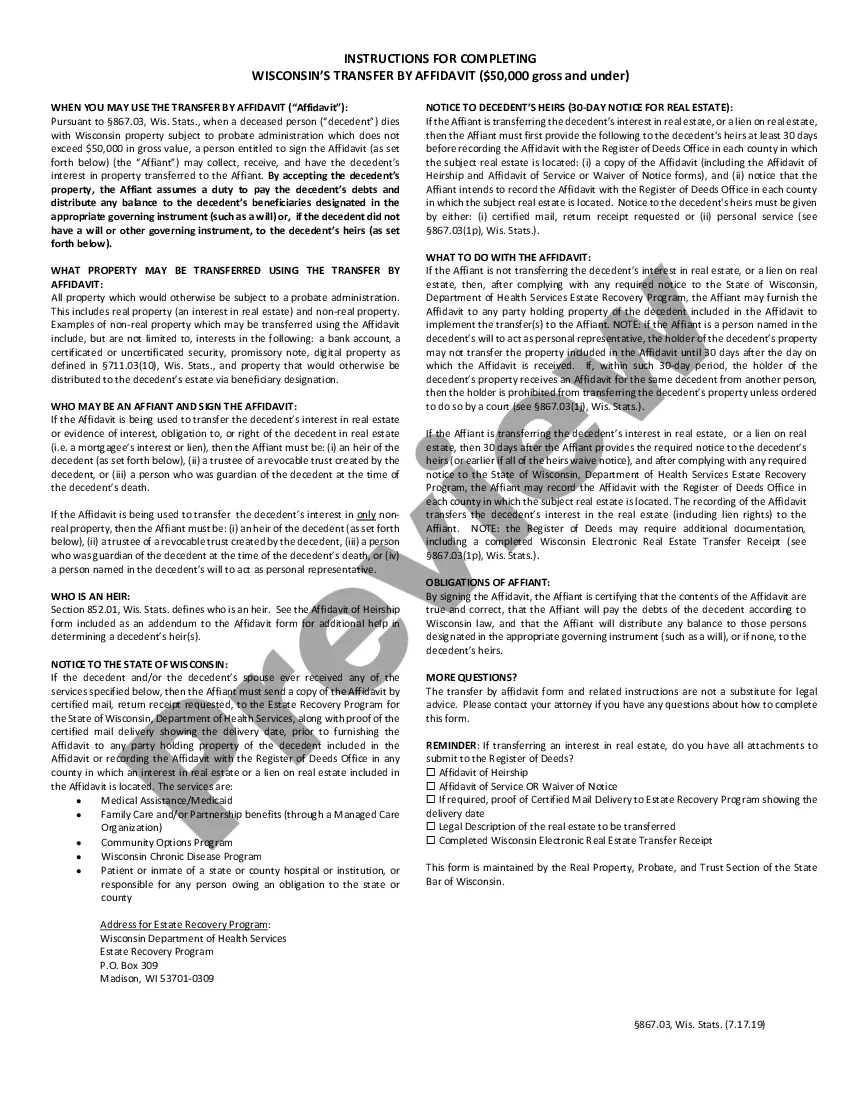

The transfer by affidavit process can be used to close a person's estate when the deceased has $50,000 or less in assets subject to administration in Wisconsin. It is an alternative to using a court process for smaller estates.

In Wisconsin, you can make a living trust to avoid probate for virtually any asset you own -- real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

Probate is used to distribute a decedent's assets not only to beneficiaries but also to creditors and taxing authorities. Any Wisconsin estate that exceeds $50,000 in value must go through the probate process unless the property is subject to certain exemptions.

Dying Without a Will in Wisconsin The court will then follow intestate succession laws to determine who inherits your assets, and how much they get. If there isn't a will, the court will appoint someone, usually a relative, financial institution, or trust company to fill the role of executor or personal representative.

Informal probate is the administration of a deceased person's estate without continuous court supervision.Formal probate is required in a number of instances and Wisconsin statutes require the estate's personal representative to procure the assistance of an attorney.

Although Wisconsin law requires that probate be completed within 18 months, a court may choose to grant an extension. On average, probate in Wisconsin takes no less than six months. The probate process must allow time for creditors to be notified, file required income tax returns, and resolve any disputes.

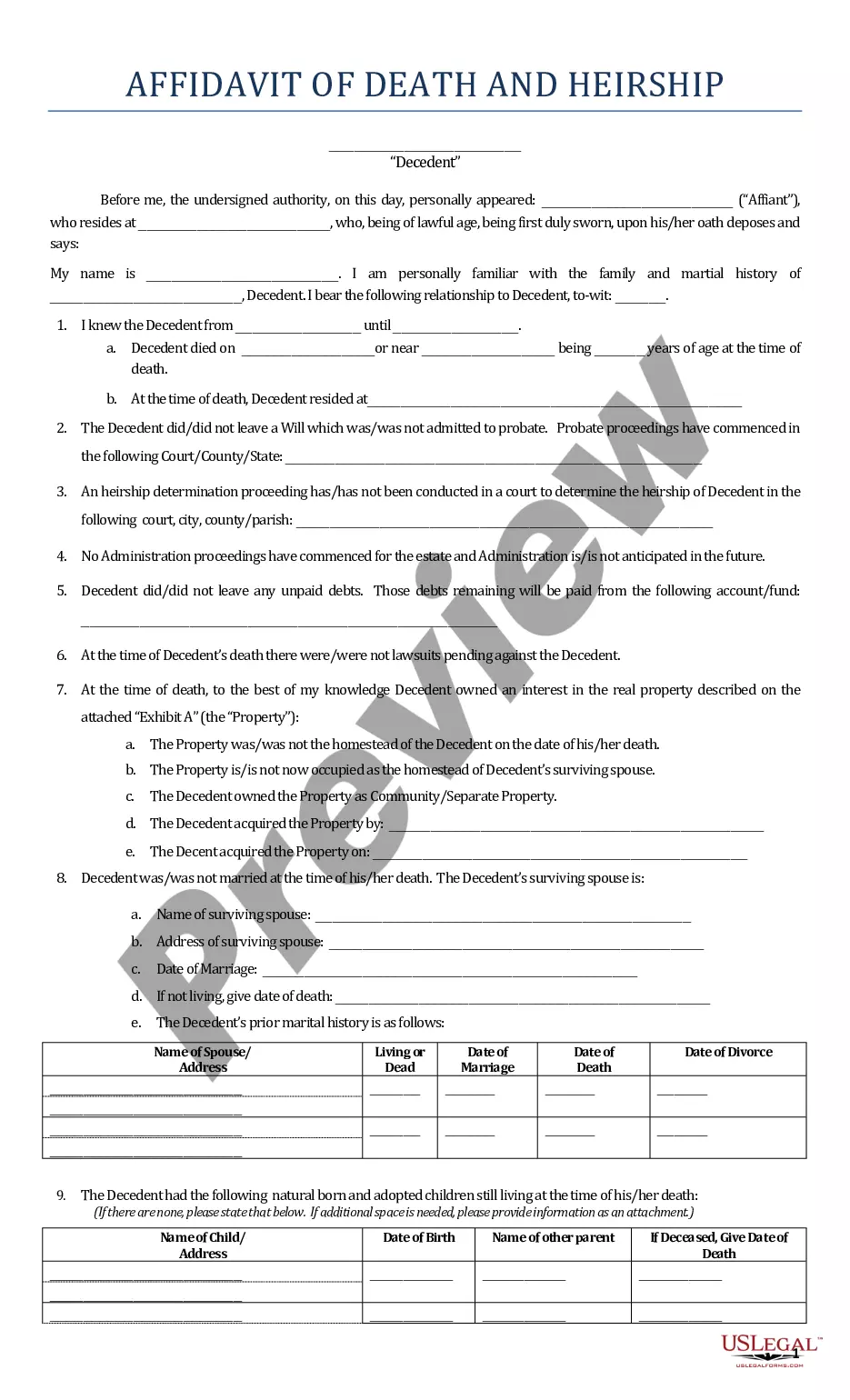

Step 1 At the top, write in the name of the decedent. Step 2 Under Section 1, write in the date of birth, the date of death, the residential address of decedent. Step 3 In Section 2, check the box that describes you as the person filling out the affidavit.