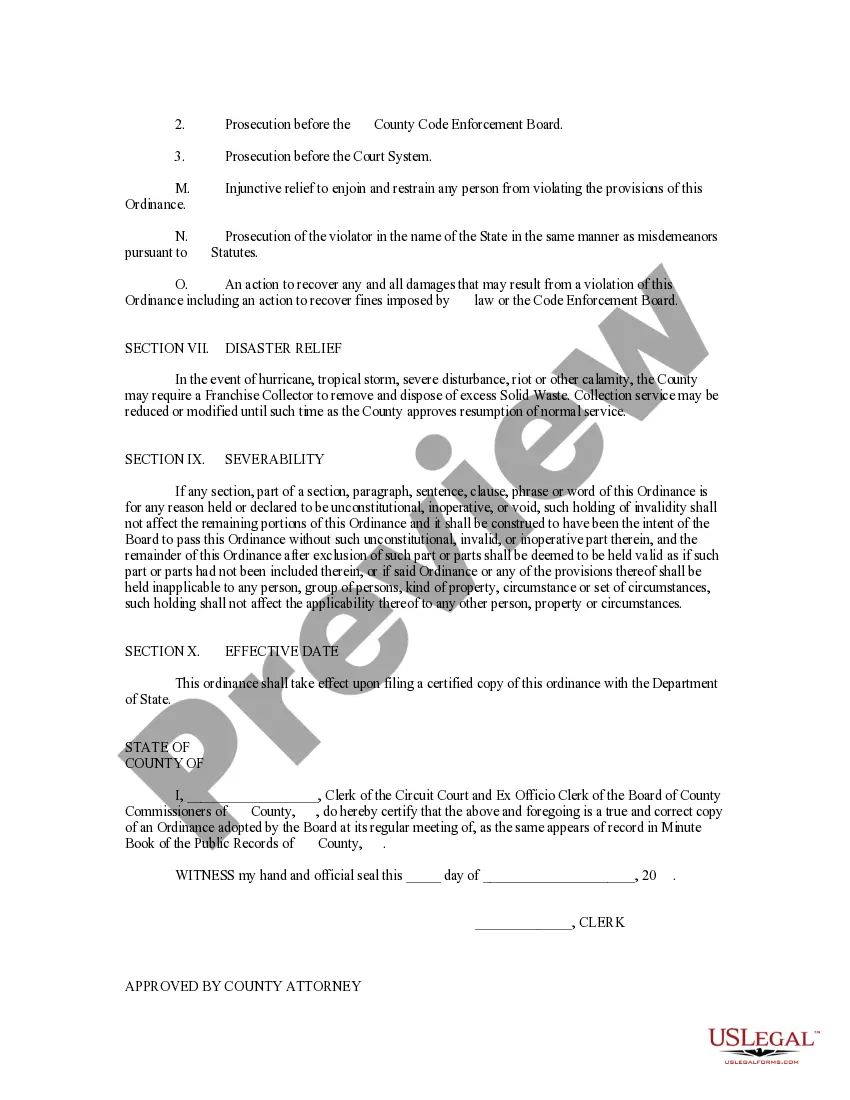

Washington Solid Waste Collection Ordinance

Description

How to fill out Solid Waste Collection Ordinance?

US Legal Forms - one of several greatest libraries of lawful forms in America - delivers an array of lawful document layouts it is possible to down load or printing. Utilizing the website, you will get thousands of forms for company and individual purposes, sorted by types, claims, or search phrases.You will find the newest models of forms just like the Washington Solid Waste Collection Ordinance in seconds.

If you already have a membership, log in and down load Washington Solid Waste Collection Ordinance from your US Legal Forms library. The Obtain option can look on every single type you view. You have accessibility to all earlier acquired forms inside the My Forms tab of your bank account.

If you want to use US Legal Forms the first time, allow me to share easy directions to help you get started out:

- Make sure you have chosen the right type to your city/state. Go through the Preview option to check the form`s information. See the type explanation to ensure that you have selected the appropriate type.

- In the event the type doesn`t satisfy your requirements, take advantage of the Lookup field at the top of the screen to find the the one that does.

- In case you are happy with the form, confirm your selection by visiting the Buy now option. Then, opt for the costs plan you want and give your credentials to sign up for the bank account.

- Procedure the deal. Use your Visa or Mastercard or PayPal bank account to complete the deal.

- Find the format and down load the form in your system.

- Make adjustments. Fill out, modify and printing and signal the acquired Washington Solid Waste Collection Ordinance.

Each design you included in your money lacks an expiration day and is your own forever. So, if you want to down load or printing another backup, just check out the My Forms segment and then click about the type you will need.

Obtain access to the Washington Solid Waste Collection Ordinance with US Legal Forms, probably the most comprehensive library of lawful document layouts. Use thousands of expert and state-certain layouts that meet your small business or individual requirements and requirements.

Form popularity

FAQ

Washington law exempts most grocery type food from retail sales tax. However, the law does not exempt ?prepared food,? ?soft drinks,? or ?dietary supplements.? Businesses that sell these ?foods? must collect sales tax. In addition, all alcoholic items are subject to retail sales tax. Retail sales tax | Washington Department of Revenue wa.gov ? education ? industry-guides ? retail-... wa.gov ? education ? industry-guides ? retail-...

What is the refuse (solid waste collection) tax? It is a tax on the fees for the collection, transfer, storage, or disposal of solid waste. Refuse (solid waste) tax | Washington Department of Revenue wa.gov ? taxes-rates ? other-taxes ? refuse-sol... wa.gov ? taxes-rates ? other-taxes ? refuse-sol...

Washington State Department of Ecology's Washington State Department of Ecology's State Solid and Hazardous Waste Plan guides the management of waste and materials in the state, helping local governments stay in compliance with the statewide purposes, goals, and rules that establish minimum functional standards for solid waste handling in Chapter 70A. 205. Solid Waste Collection, Recycling, and Disposal - MRSC Municipal Research and Services Center ? public-works ? general-utility-topics Municipal Research and Services Center ? public-works ? general-utility-topics

Steps to Start Your Own Waste Management Business Pick a specialization. ... Analyze the market. ... Register your business. ... Look for Investment. ... Get all relevant permits and licenses. ... Purchase the necessary equipment. ... Hire qualified staff. ... Market your business. How to Start a Waste Management Business in 8 Easy Steps upperinc.com ? blog ? how-to-start-waste-m... upperinc.com ? blog ? how-to-start-waste-m...

3.6 percent. What is the tax applied to? The tax applies to the amount charged for the collection and disposal service. Determining whether solid waste collection or recycling/salvage is ... wa.gov ? education ? industry-guides ? deter... wa.gov ? education ? industry-guides ? deter...

Installing, repairing, cleaning, improving, constructing, and decorating real or personal property for others. Cleaning, fumigating, razing or moving structures, including painting and papering, cleaning and repairing furnaces and septic tanks, and snow removal. Services subject to sales tax | Washington Department of Revenue wa.gov ? taxes-rates ? retail-sales-tax ? service... wa.gov ? taxes-rates ? retail-sales-tax ? service...

Generally, cleaning services are subject to retail sales tax. However, if a company performs routine and repetitive ?janitorial services,? described in WAC 458-20-172, the company's receipts are not subject to retail sales tax. Specialized or non-repetitive cleaning services are taxable as retail sales. Interior cleaning services | Washington Department of Revenue wa.gov ? publications-subject ? tax-topics ? in... wa.gov ? publications-subject ? tax-topics ? in...

Any materials taken for disposal are subject to the solid waste collection tax. The tax is charged to and collected from the ultimate customer (the resident or business whose materials are picked up and hauled away by the company that collects the materials). Determining whether solid waste collection or recycling ... Washington Department of Revenue (.gov) ? education ? industry-guides ? det... Washington Department of Revenue (.gov) ? education ? industry-guides ? det...