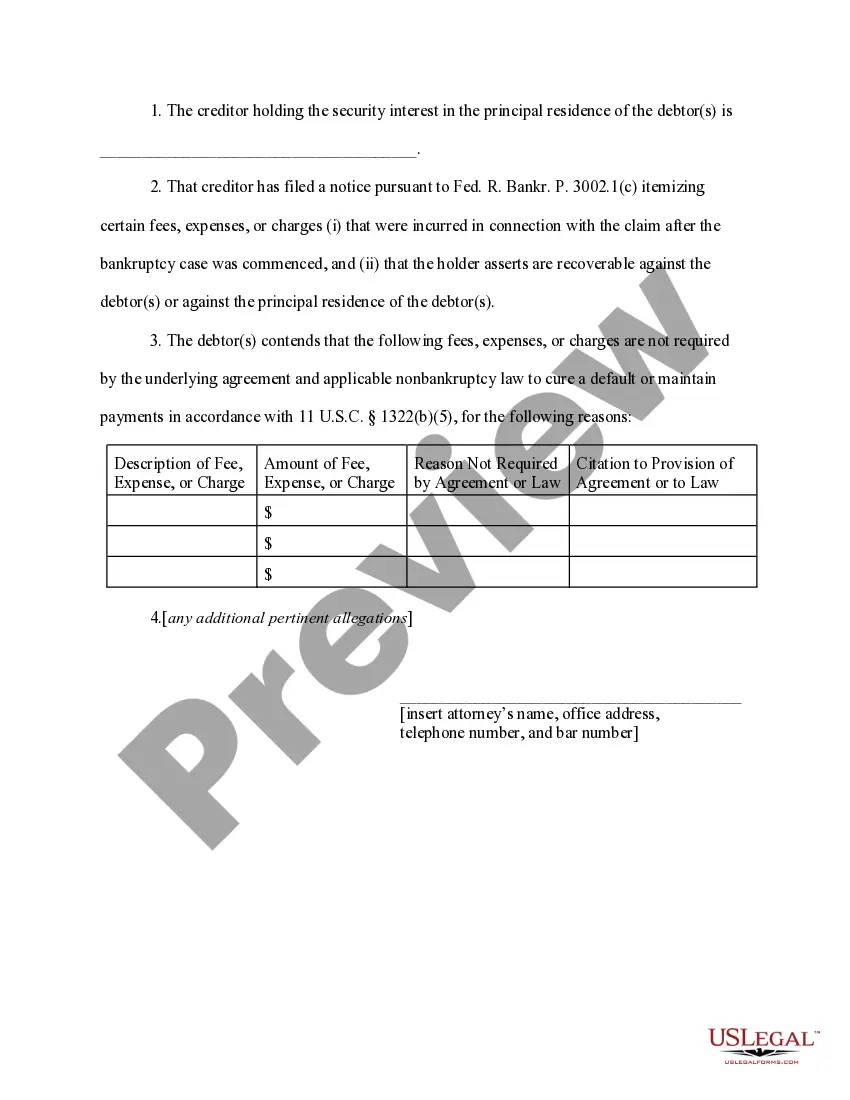

A Motion for Determination Regarding Postpetition Fees, Expenses, or Charges is a filing in a bankruptcy case that requires the court’s approval for fees, expenses, or charges incurred after the debtor has filed their bankruptcy petition. Generally, this motion is filed by either the debtor or the bankruptcy trustee. There are two types of Motion for Determination Regarding Postpetition Fees, Expenses, or Charges: (1) a motion to approve fees and expenses of the debtor's attorney, and (2) a motion to approve fees and expenses of the bankruptcy trustee. The motion for approval of the debtor's attorney fees and expenses is typically filed by the debtor's attorney, and contains a detailed list of all fees and expenses incurred in connection with the bankruptcy case. This motion is subject to the court’s review and approval. The motion for approval of the bankruptcy trustee's fees and expenses is typically filed by the bankruptcy trustee, and contains a detailed list of all fees and expenses incurred in connection with the administration of the bankruptcy estate. This motion is also subject to the court’s review and approval.

Motion for determination regarding postpetition fees, expenses, or charges

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Motion For Determination Regarding Postpetition Fees, Expenses, Or Charges?

How much time and resources do you usually spend on composing formal documentation? There’s a greater opportunity to get such forms than hiring legal specialists or spending hours browsing the web for an appropriate template. US Legal Forms is the leading online library that provides professionally drafted and verified state-specific legal documents for any purpose, like the Motion for determination regarding postpetition fees, expenses, or charges.

To acquire and prepare a suitable Motion for determination regarding postpetition fees, expenses, or charges template, follow these simple steps:

- Look through the form content to make sure it complies with your state regulations. To do so, check the form description or take advantage of the Preview option.

- If your legal template doesn’t meet your needs, locate a different one using the search bar at the top of the page.

- If you are already registered with our service, log in and download the Motion for determination regarding postpetition fees, expenses, or charges. If not, proceed to the next steps.

- Click Buy now once you find the right document. Choose the subscription plan that suits you best to access our library’s full opportunities.

- Register for an account and pay for your subscription. You can make a transaction with your credit card or via PayPal - our service is absolutely reliable for that.

- Download your Motion for determination regarding postpetition fees, expenses, or charges on your device and fill it out on a printed-out hard copy or electronically.

Another benefit of our library is that you can access previously purchased documents that you safely store in your profile in the My Forms tab. Get them at any moment and re-complete your paperwork as often as you need.

Save time and effort completing official paperwork with US Legal Forms, one of the most trusted web solutions. Sign up for us today!

Form popularity

FAQ

Post-petition debt is a debt you obtain after filing your bankruptcy case. These debts are not part of your bankruptcy case and will not be discharged. Any debt you acquire after filing for bankruptcy (even if your case is still pending) is considered post-petition, and you are responsible for paying it.

If there is a post petition mortgage fee noticed and allowed, and the mortgage is paid directly by the debtor/borrower, then usually it is a fee added to the debt that must simply be paid from the sale of the home or prior to release of mortgage down the road.

Prepetition: this term is often used to mean anything that occurred prior to your filing for bankruptcy protection. For example, the amount that may be behind on your house before you file bankruptcy would be called a pre-petition arrears.

Post-petition refers to anything that occurs after you've filed for bankruptcy. Conversely, the term ?pre-petition? is used to refer to anything that happened before you filed for bankruptcy. Only ?pre-petition? debts are dischargeable in bankruptcy.

When it comes to filing Chapter 7 bankruptcy, debts incurred before filing are called pre-petition debts, that debtors are discharged from, whereas debts incurred after a filing are post-petition payments, which debtors still must pay on.

Post-petition tax debts get special treatment in bankruptcy. The court always allows tax creditors to file claims for post-petition tax debts and then the claim gets priority in payment.

(1) Notice. The hold of the claim shall file and serve on the debtor, debtor's counsel, and the trustee a notice of any change that results in the payment amount, including any change that results from an interest-rate or escrow-account adjustment, not later than 21 days before a payment in the new amount is due.