Washington Self-Employed Auto Detailing Services Contract

Description

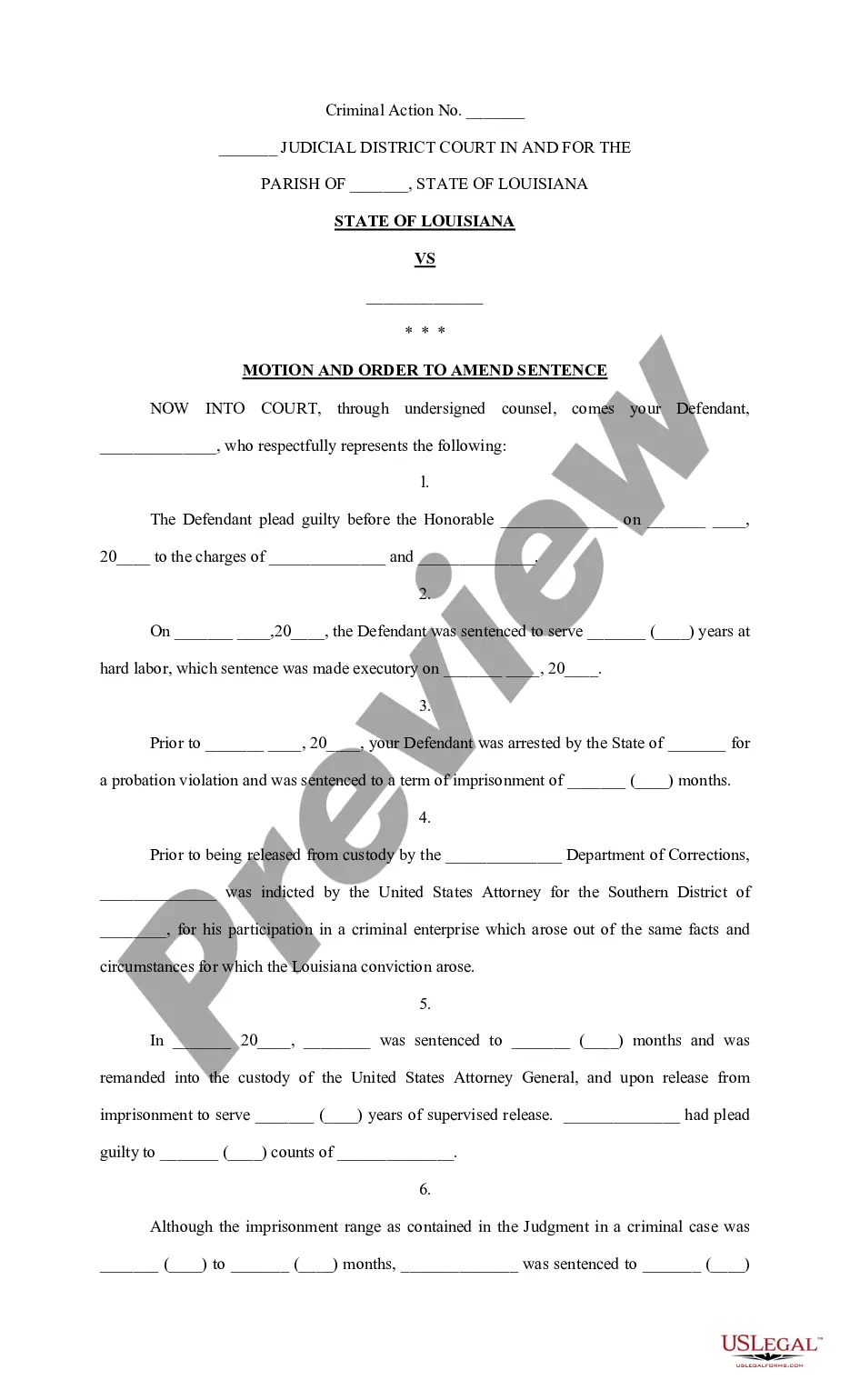

How to fill out Self-Employed Auto Detailing Services Contract?

US Legal Forms - among the largest collections of legal documents in the United States - offers a variety of legal form templates that you can download or create. By using the website, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can find the latest versions of forms like the Washington Self-Employed Auto Detailing Services Contract in moments.

If you already have a subscription, Log In and download the Washington Self-Employed Auto Detailing Services Contract from your US Legal Forms library. The Download option will appear on each form you view. You have access to all previously purchased forms from the My documents section of your account.

If you are using US Legal Forms for the first time, here are simple steps to get started: Ensure you have chosen the correct form for your city/state. Select the Review option to examine the form's content. Check the form summary to confirm that you have selected the right document. If the form does not suit your needs, use the Search bar at the top of the screen to find one that does. If you are satisfied with the form, confirm your choice by clicking the Purchase now button. Then, choose the payment plan you prefer and provide your details to register for the account. Process the transaction. Use your Visa or Mastercard or PayPal account to complete the transaction. Select the format and download the form to your device. Make edits. Fill, modify, print, and sign the downloaded Washington Self-Employed Auto Detailing Services Contract. Every template you added to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or create another copy, simply go to the My documents section and click on the form you want.

- Access the Washington Self-Employed Auto Detailing Services Contract with US Legal Forms, one of the most comprehensive collections of legal document templates.

- Utilize a vast number of professional and state-specific templates that meet your business or personal requirements and needs.

Form popularity

FAQ

Becoming an independent contractor in Washington involves several steps. First, you need to decide on a business structure and register your business with the state. Next, create a detailed contract, such as a Washington Self-Employed Auto Detailing Services Contract, which outlines your services, payment terms, and responsibilities. Finally, ensure you comply with all local regulations and tax obligations to operate legally and successfully.

To start as an independent contractor in Washington, you need to register your business and obtain any necessary licenses or permits. Additionally, you should establish a solid contract, like a Washington Self-Employed Auto Detailing Services Contract, to define the terms of your work. This contract will serve as a foundation for your business relationships and help you avoid potential disputes.

The 7 minute rule in Washington state refers to the time limit for performing certain tasks before they can be classified as billable work. For independent contractors, this means that if a task takes less than seven minutes to complete, it may not be charged to the client. Understanding this rule is crucial when drafting your Washington Self-Employed Auto Detailing Services Contract to ensure clarity on billing practices.

To be classified as an independent contractor in Washington, you must operate your own business and have control over your work. This means you set your own hours, determine your methods, and can work for multiple clients simultaneously. It's essential to have a clear contract, such as a Washington Self-Employed Auto Detailing Services Contract, to outline your responsibilities and protect both you and your clients.

In Washington, detailing cars without the appropriate licenses can lead to legal issues. While some services might not require a specific license, others do, depending on the scope of work and local regulations. It is essential to understand the requirements and ensure compliance when operating under a Washington Self-Employed Auto Detailing Services Contract. Doing so protects both your business and your clients.

Self-employed auto detailers in Washington can earn a varied income depending on their experience, client base, and services offered. On average, they may make between $50,000 to $70,000 annually. Additionally, those who establish a solid reputation and secure contracts, such as a Washington Self-Employed Auto Detailing Services Contract, often see increased earnings through repeat business and referrals.

The taxation of contract labor in Washington state can depend on the nature of the services provided. If your Washington Self-Employed Auto Detailing Services Contract involves services that are taxable, you may be required to collect sales tax from your clients. It is essential to understand the specific tax obligations that apply to your situation. Consulting with a tax expert or using tools from uslegalforms can help clarify your responsibilities.

In Washington state, certain services are taxable, including those related to repair or improvement of tangible personal property. If your Washington Self-Employed Auto Detailing Services Contract includes such services, you should be aware that sales tax may apply. It is beneficial to familiarize yourself with the Washington Department of Revenue guidelines to identify taxable services accurately. Resources like uslegalforms can provide valuable insights.

A contract becomes legally binding in Washington state when it includes an offer, acceptance, and consideration. Additionally, both parties must have the legal capacity to enter into the agreement, and the contract's purpose must be lawful. If you are drafting a Washington Self-Employed Auto Detailing Services Contract, make sure to include these essential elements to ensure enforceability. Using platforms like uslegalforms can help simplify this process.

In Washington state, maintenance contracts may be subject to sales tax depending on the services provided. If your Washington Self-Employed Auto Detailing Services Contract includes both taxable and non-taxable services, it is important to clearly outline these in your agreement. This clarity helps ensure compliance with state tax regulations. For detailed guidance, consult a tax professional or refer to resources like uslegalforms.