Washington Speech Pathologist Agreement - Self-Employed Independent Contractor

Description

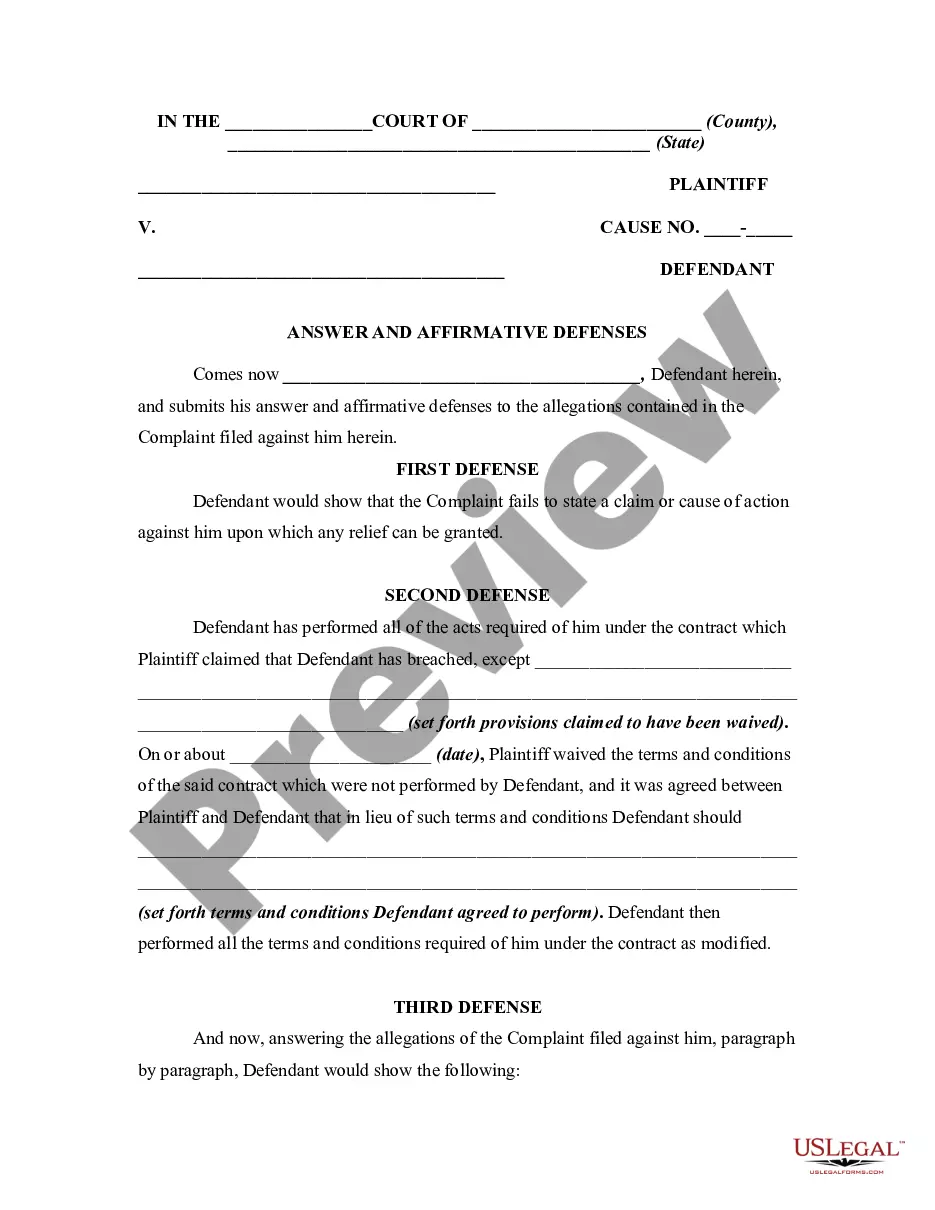

How to fill out Speech Pathologist Agreement - Self-Employed Independent Contractor?

Finding the correct legitimate document format can be a challenge.

Of course, there are numerous templates available online, but how do you locate the appropriate one you need.

Utilize the US Legal Forms website. The platform offers a vast array of templates, including the Washington Speech Pathologist Agreement - Self-Employed Independent Contractor, which you can employ for professional and personal purposes.

If the form does not meet your requirements, use the Search field to find the appropriate form. Once you are confident that the form is suitable, click the Get now button to obtain the form. Select the pricing plan you prefer and enter the necessary information. Create your account and complete your order using your PayPal account or Visa or Mastercard. Choose the document format and download the legal document to your device. Complete, edit, print, and sign the acquired Washington Speech Pathologist Agreement - Self-Employed Independent Contractor. US Legal Forms is the largest repository of legal forms where you can find a variety of document templates. Utilize the service to obtain professionally crafted documents that adhere to state regulations.

- All of the forms are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click on the Download button to access the Washington Speech Pathologist Agreement - Self-Employed Independent Contractor.

- Use your account to browse the legal forms you have purchased previously.

- Visit the My documents section in your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are some simple steps you can follow.

- First, ensure you have selected the correct form for your city/area. You can explore the form using the Review button and read the form description to confirm it is the right one for you.

Form popularity

FAQ

Being an independent contractor as a therapist means you run your own practice while providing services to clients. You have the freedom to set your own hours, choose clients, and manage business operations. This autonomy comes with responsibilities, like creating a solid Washington Speech Pathologist Agreement - Self-Employed Independent Contractor to ensure clarity and protect your interests.

You qualify as an independent contractor when you have control over how and when you perform your work, rather than being directed by an employer. Factors such as setting your own hours, providing your own tools, and working with multiple clients can solidify your contractor status. Thoroughly understanding these aspects can help you successfully establish a Washington Speech Pathologist Agreement - Self-Employed Independent Contractor.

An independent contractor (SLP) is a speech-language pathologist who provides services independently, rather than as an employee. They manage their own business operations, including setting rates and schedules. This allows for flexibility and potential higher earnings while ensuring adherence to professional standards through a Washington Speech Pathologist Agreement - Self-Employed Independent Contractor.

In Washington, independent contractors generally do not need workers' compensation coverage unless they are part of certain industries or have employees. However, as a self-employed independent contractor, having workers' comp can protect you from unexpected injuries while working. It is advisable to consult the Washington State Department of Labor and Industries for detailed information pertinent to your specific situation.

To create a Washington Speech Pathologist Agreement - Self-Employed Independent Contractor, start by outlining the services you will provide as a speech pathologist. Clearly state the terms, payment methods, and responsibilities for both parties. You can simplify this process by using platforms like USLegalForms, which provide templates designed specifically for independent contractors in Washington.

A basic independent contractor agreement outlines the essential terms of the relationship between the contractor and the client. It typically includes work descriptions, payment structures, and deadlines. By using a Washington Speech Pathologist Agreement - Self-Employed Independent Contractor template, you can streamline the process, ensuring all necessary information is included and legally binding. Consider leveraging USLegalForms for professional templates.

To write an independent contractor agreement, begin by outlining the nature of the work and the expectations of both parties. Make sure to include payment terms, duration of the contract, and how disputes will be handled. Incorporating the Washington Speech Pathologist Agreement - Self-Employed Independent Contractor helps secure your professional relationship and provides legal protection. USLegalForms can guide you through creating a compliant agreement.

Writing a contract as an independent contractor involves several key components. Start by clearly defining the scope of work, payment terms, and deadlines. It's vital to include your Washington Speech Pathologist Agreement - Self-Employed Independent Contractor details, ensuring both parties understand their obligations. Consider using resources like USLegalForms to simplify the process and make sure your contract meets legal standards.

In Washington state, independent contractors work on a project basis and maintain control over how they complete their tasks, unlike employees who follow specific guidelines set by their employer. This distinction affects benefits, taxes, and liability. Understanding the differences can help you when creating a Washington Speech Pathologist Agreement - Self-Employed Independent Contractor, ensuring clarity and legal compliance.

Filling out an independent contractor form involves gathering necessary information such as your name, address, and tax identification number. Make sure to state the services you will provide and the compensation details clearly. It's crucial to be thorough in your descriptions to prevent future disputes. For a seamless experience, consider using the Washington Speech Pathologist Agreement - Self-Employed Independent Contractor form available at US Legal Forms, which guides you through each essential step.