Washington Foundation Contractor Agreement - Self-Employed

Description

How to fill out Foundation Contractor Agreement - Self-Employed?

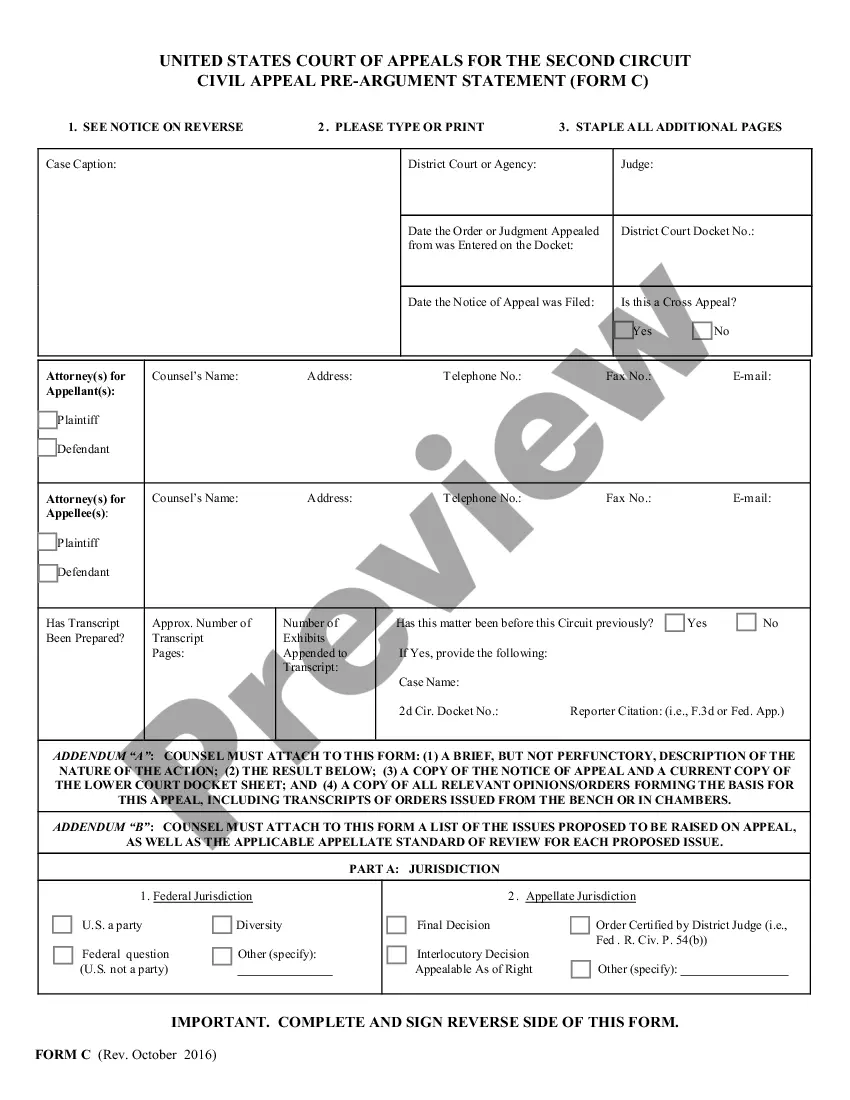

If you require to complete, retrieve, or print authentic document templates, utilize US Legal Forms, the premier compilation of official forms, accessible online. Take advantage of the site’s straightforward and convenient search feature to find the documents you need. Various templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to acquire the Washington Foundation Contractor Agreement - Self-Employed in just a few clicks.

If you are already a US Legal Forms user, Log In to your account and click on the Download button to obtain the Washington Foundation Contractor Agreement - Self-Employed. You can also access forms you previously downloaded in the My documents section of your account.

If you are using US Legal Forms for the first time, follow the instructions below: Step 1. Ensure you have selected the form for the correct region/country. Step 2. Utilize the Review option to examine the form’s content. Always remember to read the information. Step 3. If you are dissatisfied with the form, use the Search box at the top of the screen to find other templates within the legal form collection. Step 4. Once you have found the form you need, click on the Get now button. Choose the payment plan you prefer and enter your credentials to register for an account. Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment. Step 6. Select the format of the legal form and download it to your device. Step 7. Fill out, modify, and print or sign the Washington Foundation Contractor Agreement - Self-Employed.

Avoid altering or removing any HTML tags. Only synonymize plain text outside of the HTML tags.

- Each legal document template you acquire is yours permanently.

- You have access to every form you downloaded in your account.

- Check the My documents section and select a form to print or download again.

- Acquire and download, and print the Washington Foundation Contractor Agreement - Self-Employed with US Legal Forms.

- There are thousands of professional and state-specific forms available for your business or personal needs.

Form popularity

FAQ

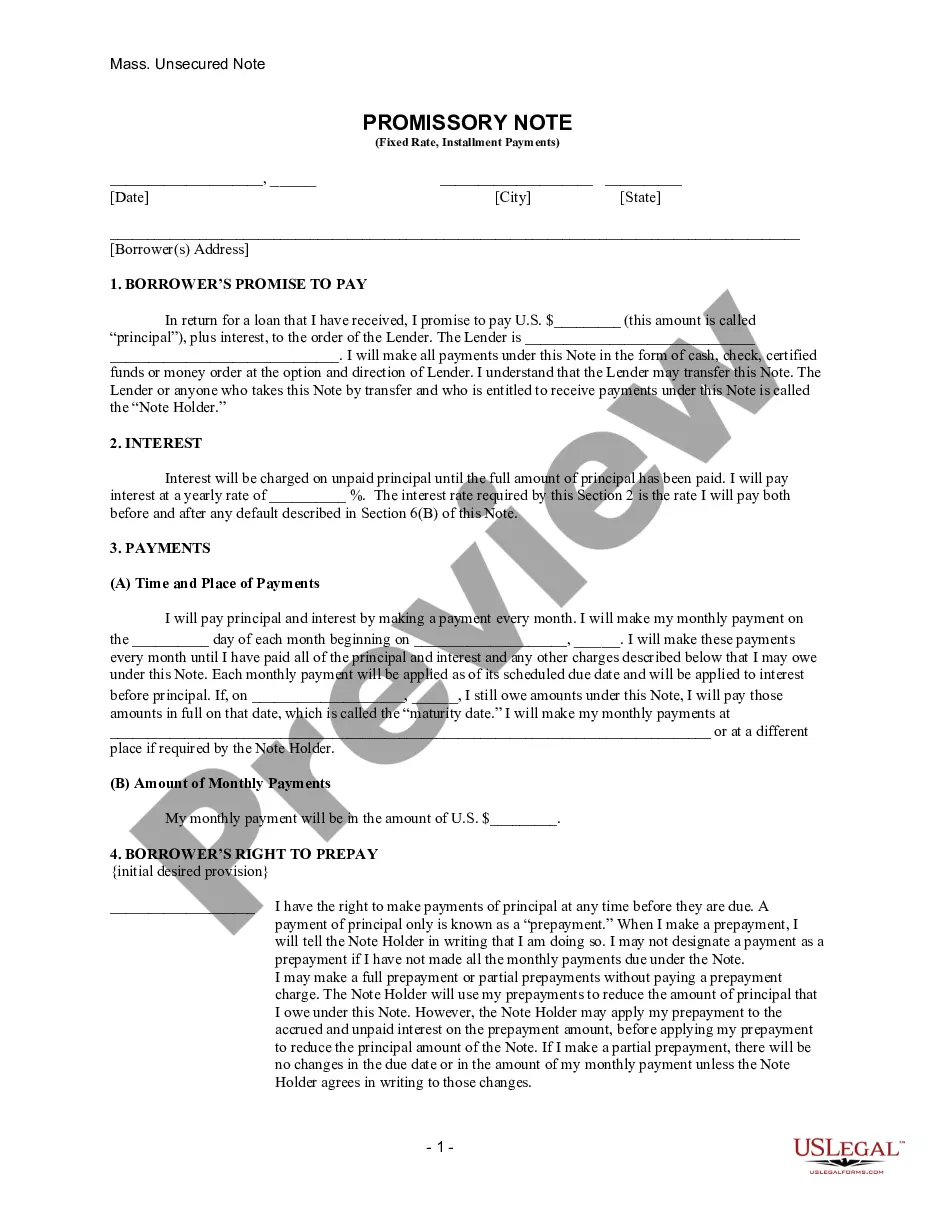

Proving independent contractor status involves several factors, such as demonstrating control over work hours and methods. Keep thorough records of contracts, payments, and communications to support your position. Additionally, using a Washington Foundation Contractor Agreement - Self-Employed can provide the necessary documentation to affirm your status in case of disputes. This agreement serves as a reference that clarifies the relationship and expectations.

Yes, an independent contractor qualifies as self-employed. This means they operate their own business and are responsible for their own taxes and expenses. Understanding this distinction is vital for accurate financial planning. Therefore, utilizing a Washington Foundation Contractor Agreement - Self-Employed is essential to clearly outline the terms of this relationship.

To create an independent contractor agreement, first define the roles and responsibilities of both parties. Next, outline the payment terms, project timeline, and deliverables. Including specific terms can help prevent misunderstandings. For a solid foundation, consider using a Washington Foundation Contractor Agreement - Self-Employed from uslegalforms, which provides a template tailored to your needs.

The terms 'self-employed' and 'independent contractor' can often be used interchangeably, though they carry slightly different connotations. Self-employed generally encompasses various business forms, including those with a Washington Foundation Contractor Agreement - Self-Employed. However, 'independent contractor' specifies a type of self-employment with a focus on contractual work relationships. Choosing the right term depends on the context in which you are describing your work.

Yes, a contractor falls into the self-employed category, as they do not work for one employer on a permanent basis. When you enter into a Washington Foundation Contractor Agreement - Self-Employed, it confirms your status as an independent worker. This status allows you more autonomy over your job functions and can result in diverse project opportunities.

To write an independent contractor agreement, outline the scope of work, payment terms, and deadlines clearly. Use key elements from a Washington Foundation Contractor Agreement - Self-Employed, such as contractor obligations, confidentiality provisions, and termination clauses. Providing a comprehensive agreement protects both parties and sets the tone for a successful working relationship.

A contractor is indeed considered self-employed, as they operate independently and execute their work based on agreements rather than under a company’s direct supervision. Under a Washington Foundation Contractor Agreement - Self-Employed, this independence allows contractors to set their own hours and choose their projects. Overall, being classified as self-employed offers flexibility and freedom, but it comes with the responsibility of managing your own taxes and business expenses.

Yes, receiving a 1099 form is a strong indicator that you are self-employed. This form is issued to independent contractors and signals that you have income from contract work, such as from a Washington Foundation Contractor Agreement - Self-Employed. It is crucial to keep track of these earnings for tax purposes, as self-employed individuals typically report their income differently than traditional employees.

Contract work can be considered a form of employment, but it typically does not fit the traditional employee-employer relationship. When you engage in contract work, especially as defined in a Washington Foundation Contractor Agreement - Self-Employed, you have more control over how you perform your tasks. This means that you work independently, which differentiates you from regular employees who have set schedules and oversight.

Being self-employed means you earn income from your own business rather than working for an employer. You typically have control over your work and schedule, allowing you to choose projects. If you engage in contracts like a Washington Foundation Contractor Agreement - Self-Employed, it can serve as evidence of your self-employed status.