Washington Shareholders Agreement

Description

How to fill out Shareholders Agreement?

Are you currently in the place in which you need to have documents for sometimes enterprise or specific purposes just about every day? There are tons of legal document layouts available on the Internet, but locating kinds you can trust is not easy. US Legal Forms offers a large number of type layouts, such as the Washington Shareholders Agreement, which can be published in order to meet state and federal demands.

If you are already acquainted with US Legal Forms internet site and possess a free account, basically log in. Following that, you may download the Washington Shareholders Agreement format.

Unless you come with an profile and need to begin using US Legal Forms, follow these steps:

- Obtain the type you need and ensure it is for the correct metropolis/area.

- Use the Preview switch to examine the shape.

- Read the explanation to ensure that you have selected the right type.

- If the type is not what you`re searching for, make use of the Search field to discover the type that meets your requirements and demands.

- Whenever you discover the correct type, simply click Get now.

- Choose the pricing prepare you would like, fill out the required information and facts to generate your money, and buy the order utilizing your PayPal or credit card.

- Select a practical data file format and download your version.

Locate all the document layouts you may have bought in the My Forms menus. You can aquire a extra version of Washington Shareholders Agreement any time, if needed. Just click on the required type to download or print the document format.

Use US Legal Forms, probably the most extensive assortment of legal forms, to conserve time as well as steer clear of errors. The support offers expertly created legal document layouts which you can use for a variety of purposes. Create a free account on US Legal Forms and initiate producing your life a little easier.

Form popularity

FAQ

However, drafting a shareholder agreement requires careful consideration of a range of critical issues, such as ownership structure, transferability of shares, voting rights, management structure, decision-making procedures, dividend distribution, dispute resolution mechanisms, confidentiality, termination provisions, ...

We have 5 steps. Step 1: Decide on the issues the agreement should cover. ... Step 2: Identify the interests of shareholders. ... Step 3: Identify shareholder value. ... Step 4: Identify who will make decisions - shareholders or directors. ... Step 5: Decide how voting power of shareholders should add up.

For a shareholders' agreement to be validly executed, it cannot be signed electronically. A copy of the document must be provided to each shareholder and company director. Each shareholder must sign each copy of the shareholders' agreement in the presence of a witness.

Purpose of shareholder agreement 1.2 The Shareholders are entering into this Shareholder Agreement to provide for the management and control of the affairs of the Corporation, including management of the business, division of profits, disposition of shares, and distribution of assets on liquidation.

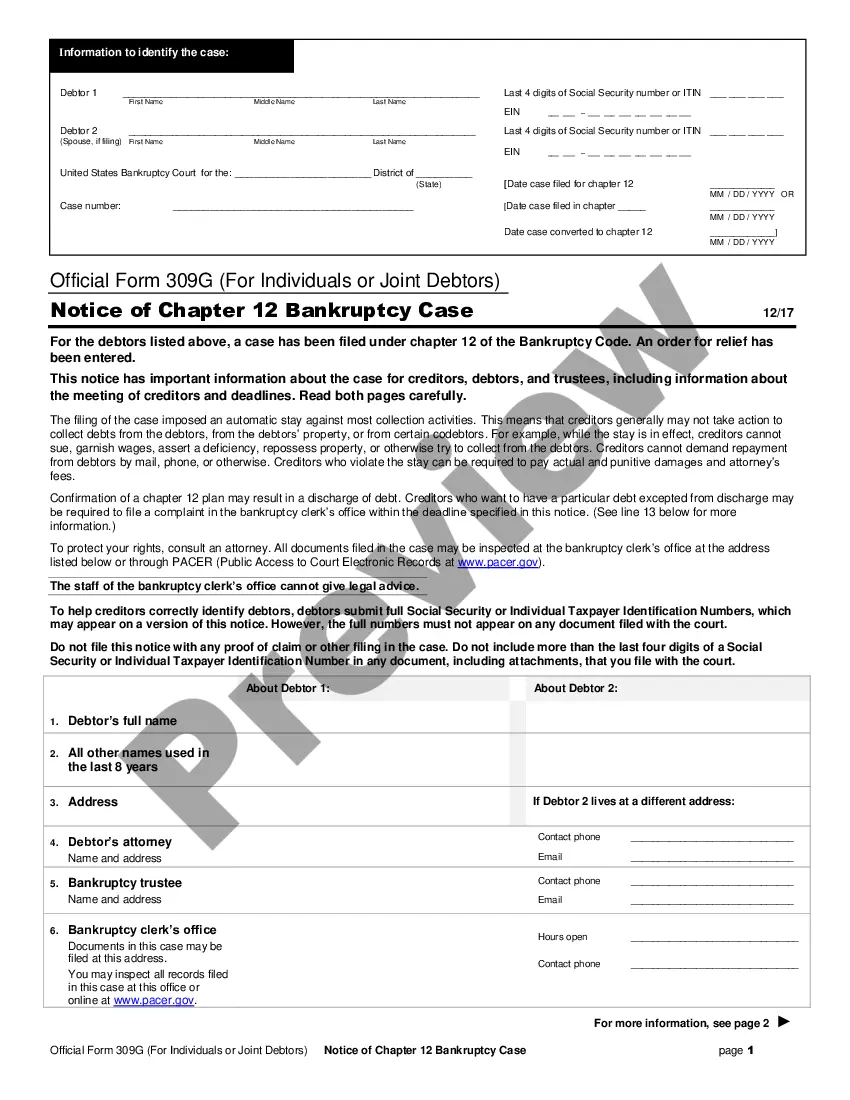

A shareholders' agreement includes a date; often the number of shares issued; a capitalization table that outlines shareholders and their percentage ownership; any restrictions on transferring shares; pre-emptive rights for current shareholders to purchase shares to maintain ownership percentages (for example, in the ...

Sign to make it legal Deeds must be executed (ie signed) in a certain way in order to be legally binding. To sign your Shareholders' Agreement, you should: Print a copy of the Shareholders' Agreement for each shareholder and one for the company directors. All shareholders should sign each copy of the Agreement.

A good shareholders agreement should set out the decisions a shareholder-director may and may not make without agreement from others. These are known as reserved matters. Disclosure of decision making is also important. A shareholder-director may be able to make decisions that aren't reported to other shareholders.

The shareholders agreement should set out matters that are reserved for the board and those matters that will require shareholder approval. It will also set out the level of majority required to pass a particular resolution. Decisions reserved for the board typically relate to the day?to?day management of the company.