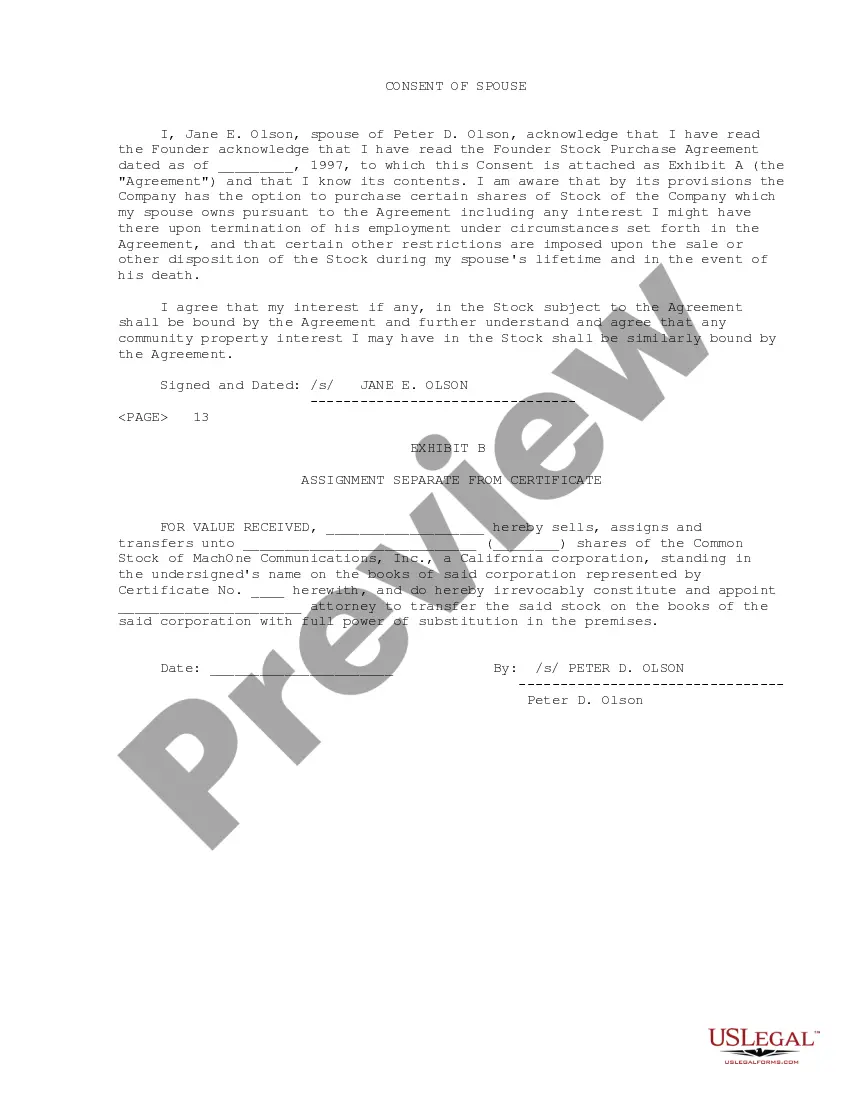

Washington Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson

Description

How to fill out Sample Founder Stock Purchase Agreement Between MachOne Communications, Inc. And Peter D. Olson?

If you want to total, down load, or produce legal papers layouts, use US Legal Forms, the largest selection of legal kinds, which can be found on the web. Use the site`s easy and hassle-free research to obtain the papers you require. A variety of layouts for company and specific purposes are categorized by classes and says, or keywords and phrases. Use US Legal Forms to obtain the Washington Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson within a few clicks.

Should you be presently a US Legal Forms buyer, log in to your accounts and click on the Obtain key to get the Washington Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson. You can also entry kinds you earlier saved within the My Forms tab of the accounts.

If you work with US Legal Forms initially, refer to the instructions under:

- Step 1. Be sure you have selected the shape to the correct metropolis/nation.

- Step 2. Use the Review solution to look over the form`s content. Do not neglect to read through the outline.

- Step 3. Should you be unsatisfied with the type, make use of the Research discipline near the top of the screen to discover other types of the legal type template.

- Step 4. Upon having found the shape you require, click the Buy now key. Opt for the rates prepare you favor and add your references to sign up for an accounts.

- Step 5. Method the transaction. You should use your bank card or PayPal accounts to complete the transaction.

- Step 6. Select the structure of the legal type and down load it on the product.

- Step 7. Complete, modify and produce or sign the Washington Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson.

Every single legal papers template you buy is yours permanently. You have acces to every type you saved with your acccount. Click the My Forms portion and select a type to produce or down load again.

Be competitive and down load, and produce the Washington Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson with US Legal Forms. There are many skilled and express-specific kinds you may use for the company or specific demands.

Form popularity

FAQ

A Restricted Stock Purchase Agreement (RSPA) is an agreement issuing restricted stock. RSPAs are typically granted to founders to prevent the founder from leaving the company prematurely and taking a lot of the ownership with her. The RSPA establishes when the shares will fully vest and belong to the founder. Restricted Stock Purchase Agreement (RSPA) - Vela Wood Vela Wood ? glossary-term ? restricted-stoc... Vela Wood ? glossary-term ? restricted-stoc...

RSUs. Restricted stock awards (RSAs) and restricted stock units (RSUs) are two alternatives to stock options (such as ISOs and NSOs) that companies can use to compensate their employees. While stock options offer employees the ?option? to buy shares at a fixed price, RSAs and RSUs are grants of stock. RSA vs RSU: Key Differences & Tax Treatments - Carta Carta ? blog ? breaking-down-rsas-and-rsus Carta ? blog ? breaking-down-rsas-and-rsus

A: The most common provisions included in restricted stock purchase agreements are restrictions on when and how stock can be sold or transferred; non-compete agreements; rights of first refusal; and termination clauses which allow either party to terminate the agreement under specified conditions. Step-by-Step Guide to Drafting a Restricted Stock Purchase Agreement genieai.co ? blog ? step-by-step-guide-to-dr... genieai.co ? blog ? step-by-step-guide-to-dr...

RSUs are a type of restricted stock (which may also be known as ?letter stock? or ?restricted securities?). Restricted stock is company stock that cannot be fully transferable until certain restrictions have been met. These can be performance or timing restrictions, similar to restrictions for options. RSU vs. stock options: What's the difference? - Empower empower.com ? the-currency ? money ? sto... empower.com ? the-currency ? money ? sto...

An RSPA will typically allow the Company to buyback shares from the founder through a repurchase option. The repurchase option can be triggered by a number of events, including the founder being fired or force to quit. Single / Double Trigger Acceleration.

Consult a business attorney to help write your stock purchase agreement or review it and make suggestions before you present it to your investor. A stock purchase agreement typically includes the following information: Your business name. The name and mailing address of the entity buying shares in your company's stocks.

A Restricted Stock Purchase Agreement (RSPA) is an agreement issuing restricted stock. RSPAs are typically granted to founders to prevent the founder from leaving the company prematurely and taking a lot of the ownership with her. The RSPA establishes when the shares will fully vest and belong to the founder.

This agreement allows the founders to document their initial ownership in the Company, including standard transfer restrictions and any vesting provisions with respect to their shares.