Washington Employee Payroll Records Checklist

Description

How to fill out Employee Payroll Records Checklist?

Are you currently in a circumstance where you need documents for either professional or personal purposes almost every day.

There are numerous valid document templates accessible online, but finding ones you can trust is not easy.

US Legal Forms offers a wide array of template documents, such as the Washington Employee Payroll Records Checklist, that are crafted to comply with both state and federal regulations.

When you find the correct form, click on Purchase now.

Select the payment plan you want, provide the necessary information to create your account, and complete your order using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Washington Employee Payroll Records Checklist template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for your specific city/county.

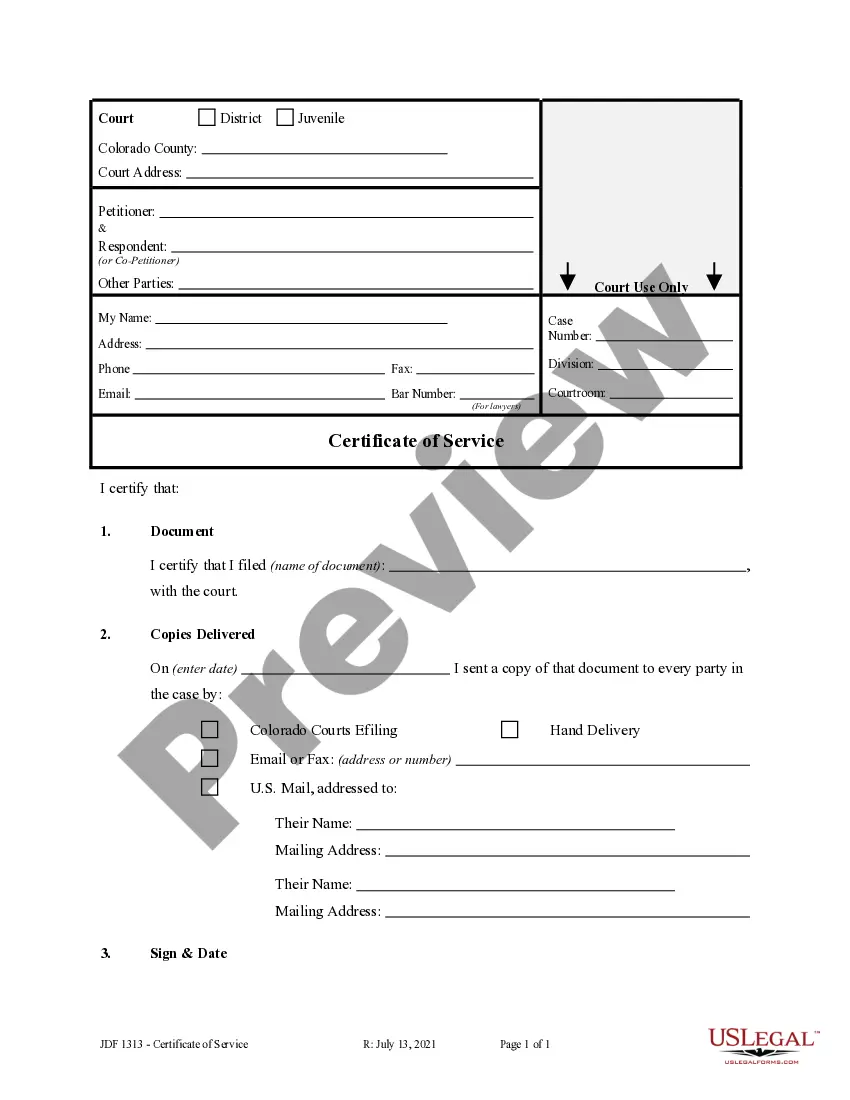

- Use the Preview option to review the document.

- Read the description to confirm that you have selected the correct document.

- If the form isn't what you are looking for, use the Lookup field to find the document that fits your needs and requirements.

Form popularity

FAQ

Payroll records contain information about the compensation paid to employees and any deductions from their pay. These records are needed by the payroll staff to calculate gross pay and net pay for employees. Payroll records typically include information about the following items: Bereavement pay. Bonuses.

What do employee payroll records include?General information. Employee name. Address.Tax withholding forms. Form W-4. State W-4 form.Time and attendance records. Time cards. Total hours worked each day and week.Payroll records. Pay rate.Termination/separation documents, if applicable. Final paycheck information.09-Jun-2021

Types of Employee RecordsBasic Information. This category includes personal information such as the employee's full name, social security number, address, and birth date.Hiring Documents.Job Performance and Development.Employment-Related Agreements.Compensation.Termination and Post-Employment Information.

You can store payroll records via paper or online files. Develop a recordkeeping system that works best for you. With paper-based recordkeeping, you can store files in locked cabinets. Be sure to label each of your folders so you can easily access your records.

The payroll register summarizes the payroll for one pay period and shows total earnings, payroll withholding's and net pay of all employees.

A payroll register is tool that records wage payment information about each employee gross pay, deductions, tax withholding, net pay and other payroll-related information for each pay period and pay date.

The documents commonly need for payroll recordkeeping include but are not limited to:Employee personal information.Employment information.Timesheets.Pay information.Tax documents.Deduction information.Paid and unpaid leave records.Direct deposit information.More items...

Generally, here are the documents you should include in each employee's payroll record:General information. Employee name. Address.Tax withholding forms. Form W-4. State W-4 form.Time and attendance records. Time cards.Payroll records. Pay rate.Termination/separation documents, if applicable. Final paycheck information.

Payroll records are the combined documents pertaining to payroll that businesses must maintain for each individual that they employ. This includes pay rates, total compensation, tax deductions, hours worked, benefit contributions and more.

Seven Types of Records an Employer Should Keep Under Fair Work LegislationGeneral Records.Wages & Pay Records.Payslip Records.Hours of Work Records.Leave Records.Superannuation Records.Termination Records.Recordkeeping with Cloud Payroll.