Washington Account Stated Between Partners and Termination of Partnership

Description

How to fill out Account Stated Between Partners And Termination Of Partnership?

Finding the right lawful document design can be quite a battle. Naturally, there are tons of web templates available online, but how do you find the lawful kind you require? Make use of the US Legal Forms website. The services provides a huge number of web templates, like the Washington Account Stated Between Partners and Termination of Partnership, that you can use for company and private needs. Every one of the types are checked out by specialists and meet federal and state specifications.

If you are already registered, log in to the accounts and then click the Download key to have the Washington Account Stated Between Partners and Termination of Partnership. Make use of accounts to check throughout the lawful types you have bought formerly. Proceed to the My Forms tab of the accounts and get another backup of the document you require.

If you are a fresh user of US Legal Forms, here are straightforward recommendations that you should follow:

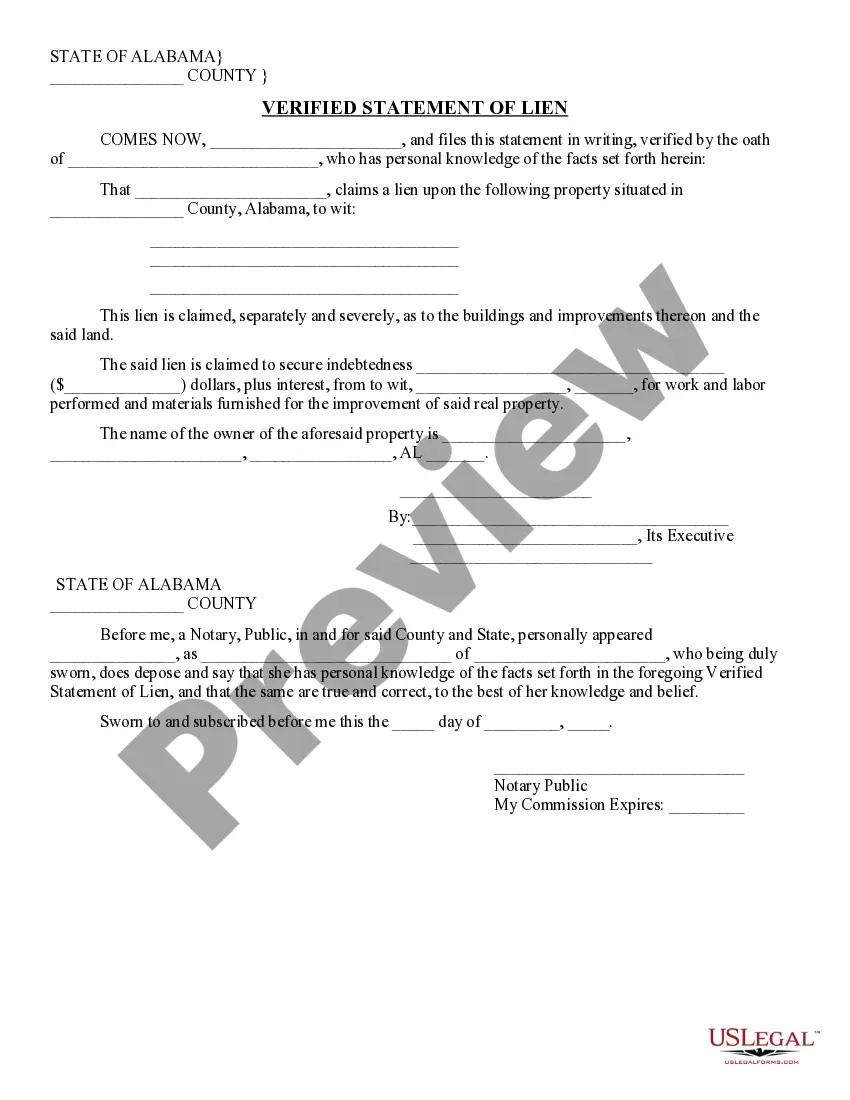

- Very first, make certain you have chosen the right kind for your metropolis/county. It is possible to examine the form using the Review key and read the form explanation to make sure this is basically the best for you.

- When the kind fails to meet your requirements, use the Seach area to obtain the right kind.

- When you are sure that the form is suitable, select the Purchase now key to have the kind.

- Opt for the costs program you want and type in the required information and facts. Build your accounts and pay for the order utilizing your PayPal accounts or charge card.

- Select the document structure and acquire the lawful document design to the device.

- Full, edit and print out and sign the received Washington Account Stated Between Partners and Termination of Partnership.

US Legal Forms may be the greatest collection of lawful types in which you can see numerous document web templates. Make use of the company to acquire expertly-produced files that follow express specifications.

Form popularity

FAQ

Final Dissolution Steps Submit your certificate of dissolution to WA state. Cancel any permits, licenses, or other registrations. Pay outstanding debts. Liquidate or distribute assets as outlined in the dissolution agreement. Pay final taxes and close out relevant bank accounts from your partnership.

A State Registered Domestic Partnership can be terminated in several ways. If the partners marry, the partnership is automatically dissolved. If both partners wish to dissolve the partnership, they must file a termination in a court of law. And if one partner dies, the partnership is considered terminated.

In this way, domestic partnerships and civil unions are more alike than either are to marriage. Some states, such as Florida, New York, and Texas do not provide for domestic partnerships at the state level.

How to Write a Business Partnership Agreement name of the partnership. goals of the partnership. duration of the partnership. contribution amounts of each partner (cash, property, services, future contributions) ownership interests of each partner (assets) management roles and terms of authority of each partner.

Final Dissolution Steps Submit your certificate of dissolution to WA state. Cancel any permits, licenses, or other registrations. Pay outstanding debts. Liquidate or distribute assets as outlined in the dissolution agreement. Pay final taxes and close out relevant bank accounts from your partnership.

A State Registered Domestic Partnership can be terminated in several ways. If the partners marry, the partnership is automatically dissolved. If both partners wish to dissolve the partnership, they must file a termination in a court of law. And if one partner dies, the partnership is considered terminated.

5 Key Steps in Dissolving a Partnership Review your partnership agreement. While some partnerships don't require a formal or written agreement, most partners choose to have one anyway for protection. ... Discuss with other partners. ... File dissolution papers. ... Notify others. ... Settle and close out all accounts.

Termination of a domestic partnership does not dissolve a marriage. In certain limited circumstances, a registered domestic partnership may be terminated by filing a Notice of Termination of Domestic Partnership with the California Secretary of State.