Washington Grantor Retained Annuity Trust

Description

How to fill out Grantor Retained Annuity Trust?

It is feasible to spend numerous hours online looking for the legitimate document template that complies with the state and federal requirements you need.

US Legal Forms provides thousands of legal documents that are evaluated by experts.

You can download or print the Washington Grantor Retained Annuity Trust from our service.

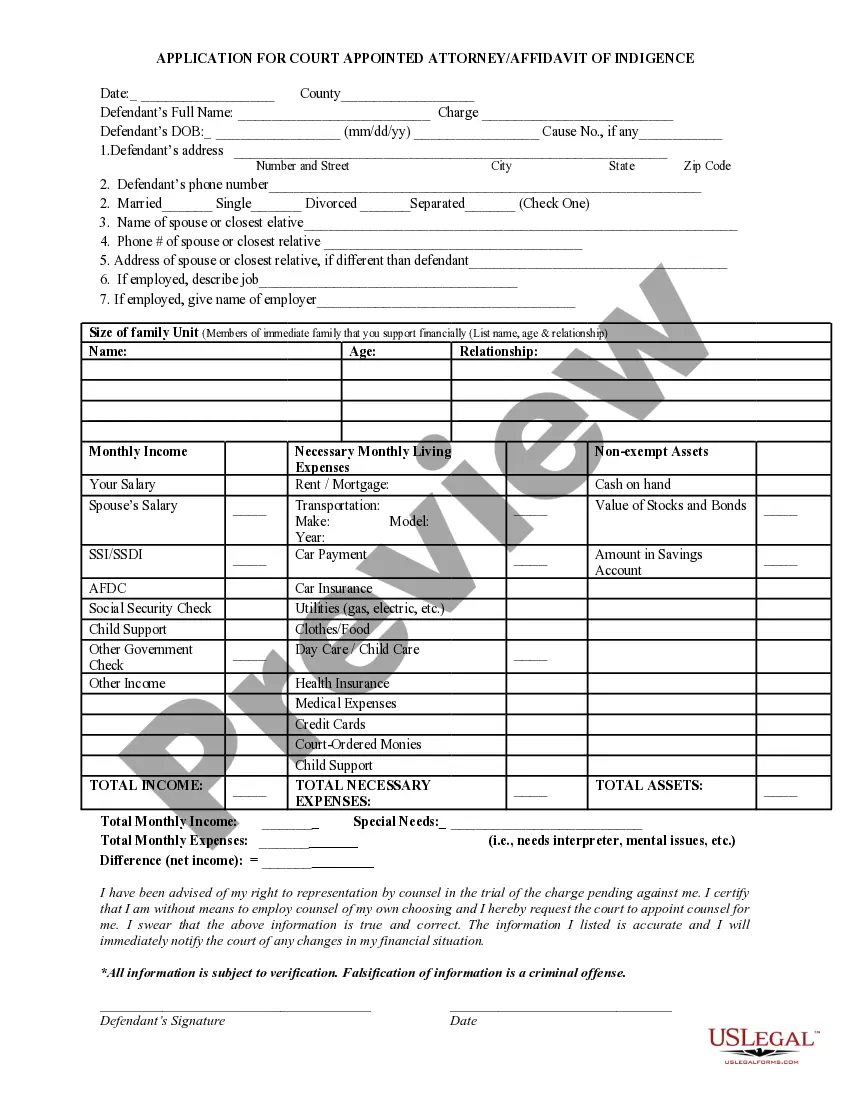

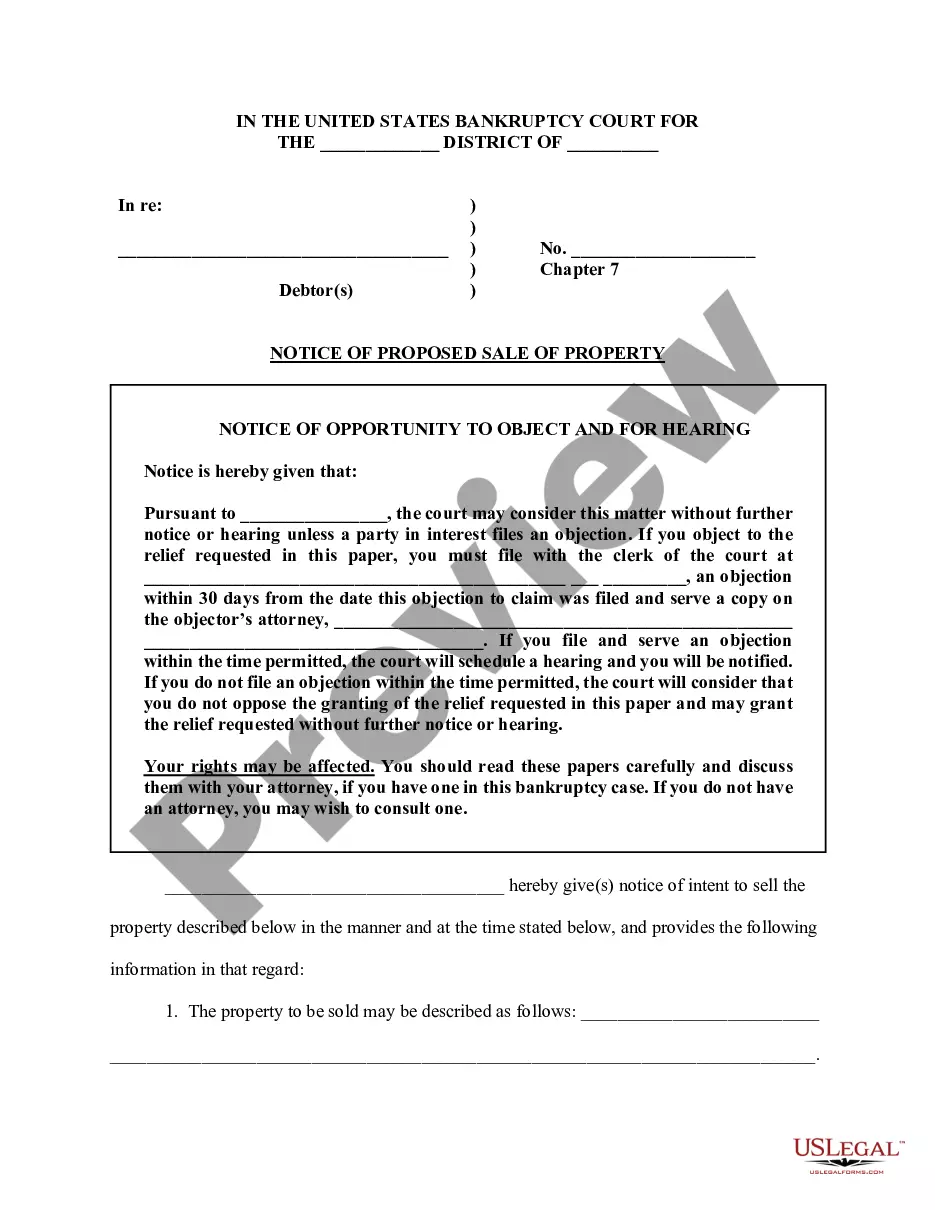

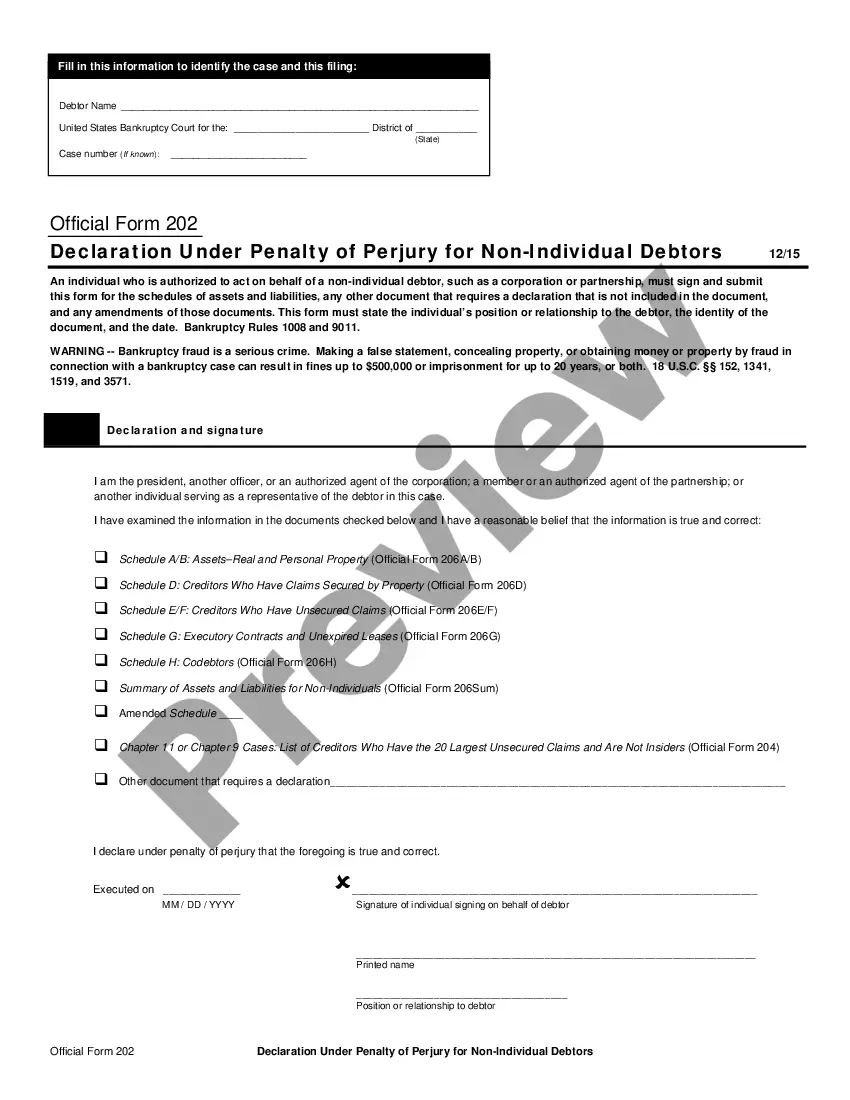

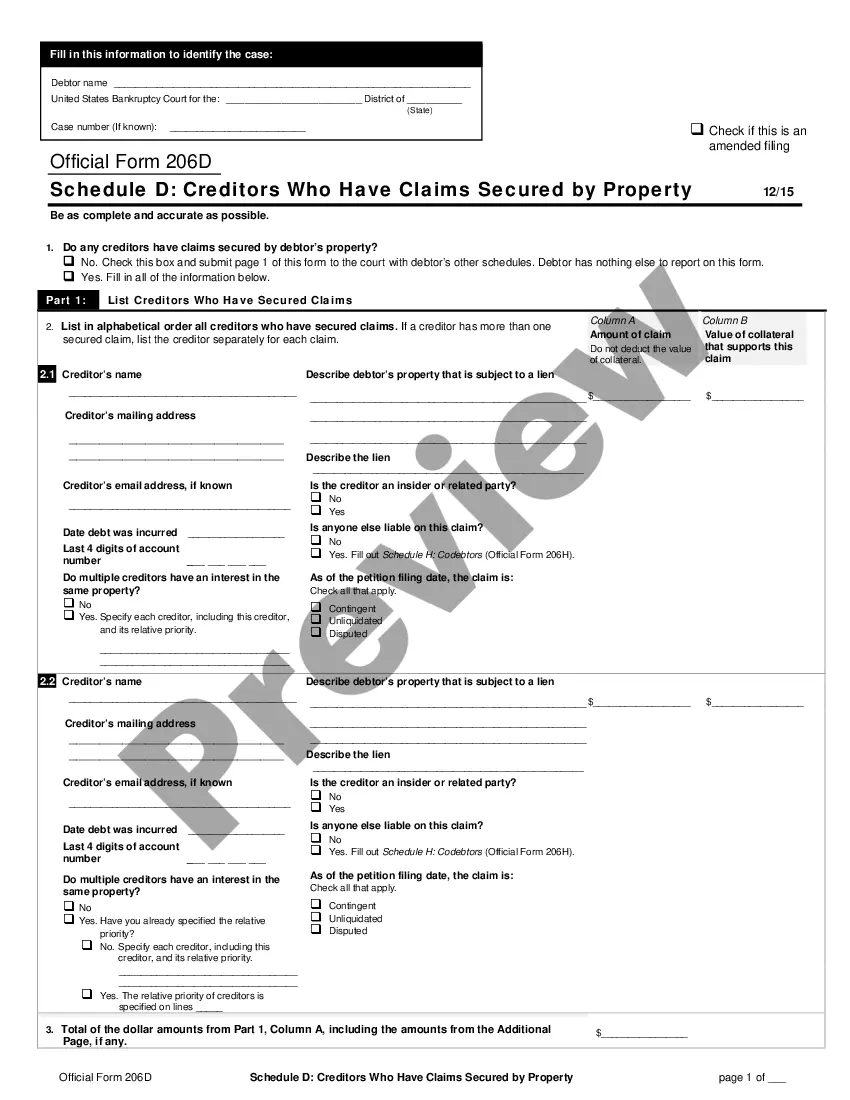

If available, use the Review button to go through the document template as well.

- If you already have a US Legal Forms account, you can Log In and click on the Download button.

- After that, you can fill out, modify, print, or sign the Washington Grantor Retained Annuity Trust.

- Every legal document template you acquire is yours permanently.

- To obtain another version of a purchased form, go to the My documents tab and click the appropriate button.

- If you are accessing the US Legal Forms site for the first time, follow the simple instructions below.

- First, make sure you have selected the correct document template for the state/region you choose.

- Review the form description to confirm you have chosen the right document.

Form popularity

FAQ

A Washington Grantor Retained Annuity Trust allows the grantor to receive fixed annuity payments for a specified term while transferring remaining assets to beneficiaries at a reduced tax rate. This structure helps to pass wealth to heirs while minimizing gift and estate taxes. The grantor retains the right to receive annual payments, making this an effective strategy for wealth management.

Tax Implications of the GRAT During the term of the GRAT, the Donor will be taxed on all of the income and capital gains earned by the trust, without regard to the amount of the annuity paid to the Donor.

Most warts will persist for one to two years if they are left untreated. Eventually, the body will recognize the virus and fight it off, causing the wart to disappear. While they remain, however, warts can spread very easily when people pick at them or when they are on the hands, feet or face.

Because the grantor may use a valuation formula, a GRAT allows the grantor to transfer a difficult to value asset without a significant risk of unexpected gift tax. The following is an example of how a valuation formula will reduce the risk of unexpected gift tax consequences when dealing with hard to value assets.

GRATs are irrevocable trusts that last for a specific period of time of at least two years. The term you choose depends on your goals and expectations for asset growth potential, but we typically recommend a term between two and five years.

If you don't treat your warts, they: Might not go away on their own. Might get worse and cause pain. Might spread to other people or other parts of your body.

In a GRAT, you receive a fixed amount from year to year (an annuity). In a GRUT, by contrast, you receive an amount equal to a fixed percentage of the trust assets (a unitrust).

Do gnats go away on their own? No, it's unlikely that gnats will go away on their own once they start reproducing. You will need to take proper measures to get rid of them, such as putting away your fruits, flushing out your drains, or changing the soil in your indoor plants' pots.

The annuity amount is paid to the grantor during the term of the GRAT, and any property remaining in the trust at the end of the GRAT term passes to the beneficiaries with no further gift tax consequences.

Pros. There are a number of benefits to setting up a GRAT. For one, the annuities can provide a steady stream of income for those who may need it in retirement. However, the main benefit of establishing a GRAT is the potential to transfer large amounts of money to a beneficiary while paying little-to-no gift tax.