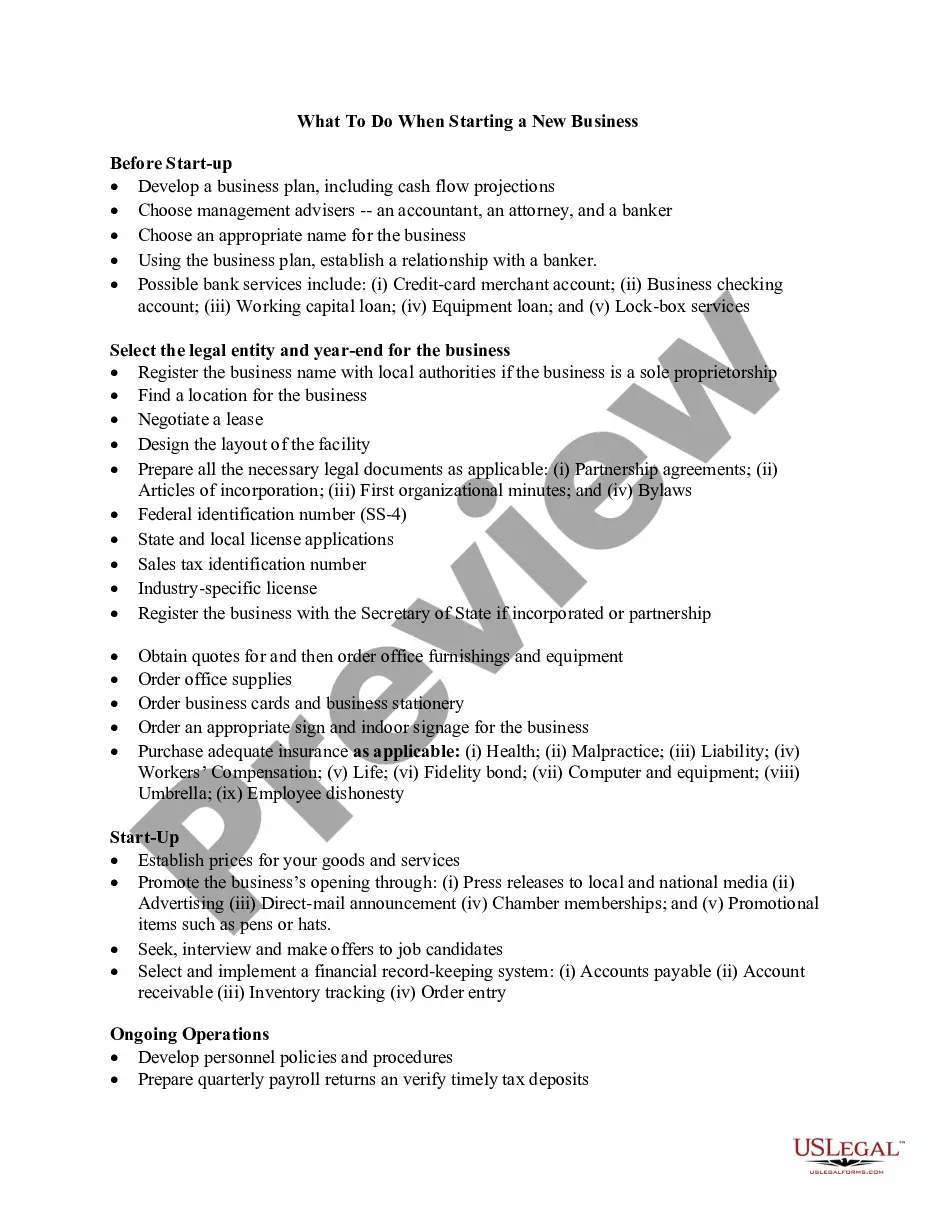

Washington Business Start-up Checklist

Description

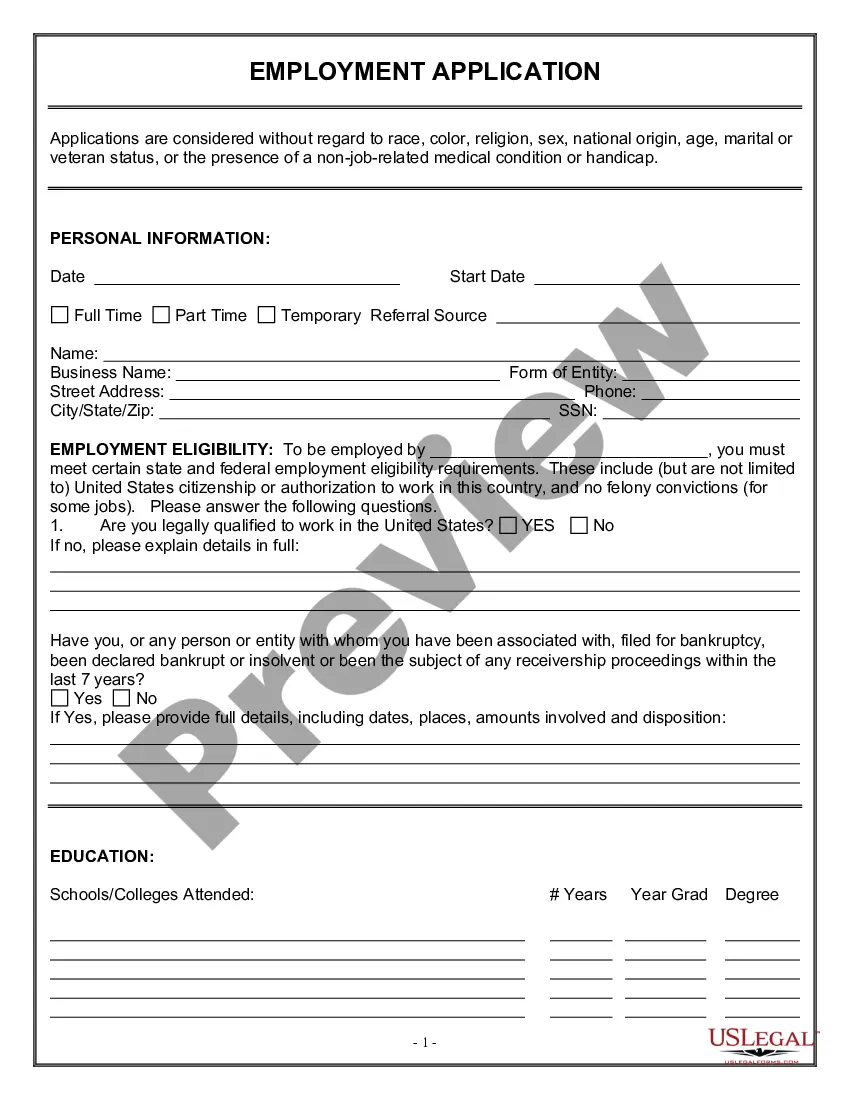

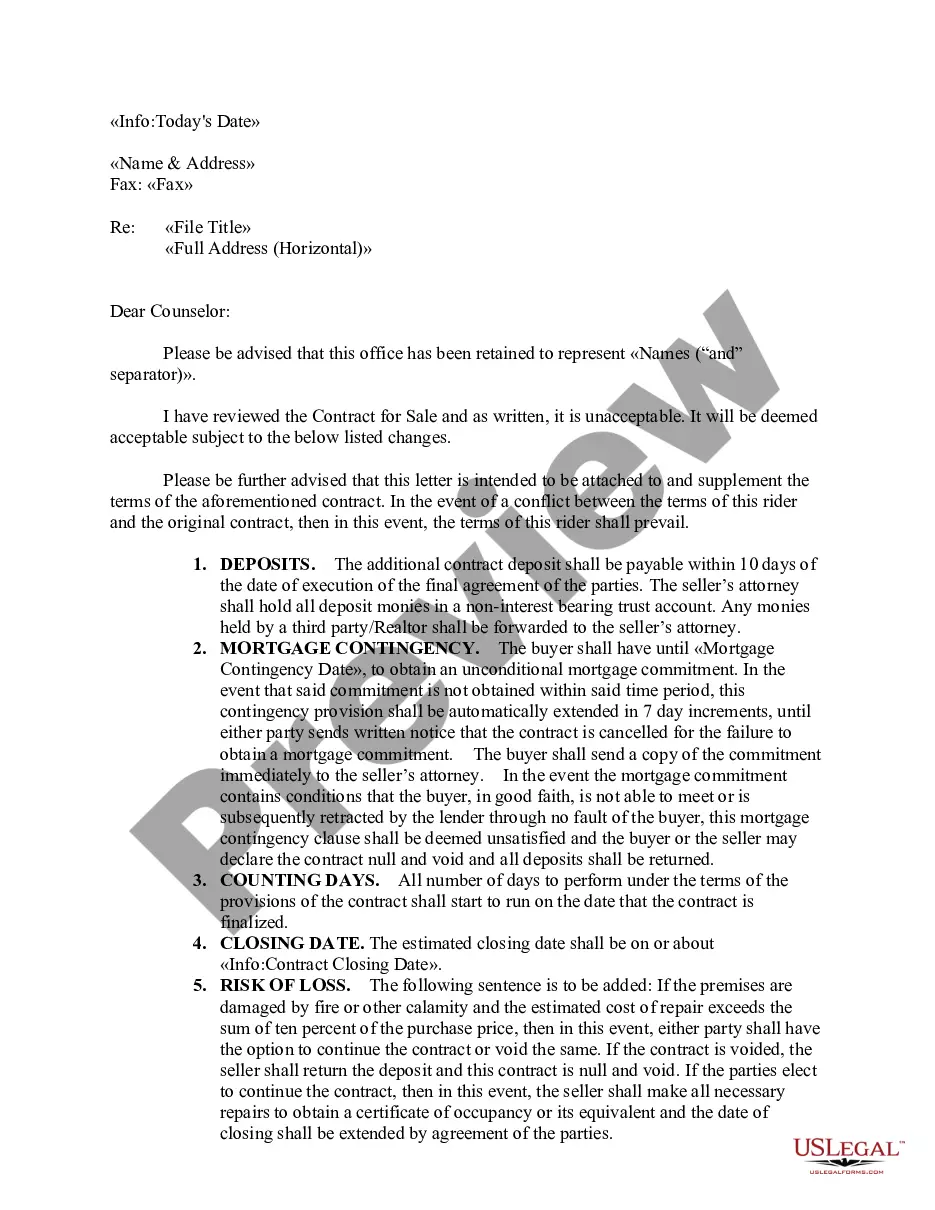

How to fill out Business Start-up Checklist?

Finding the appropriate legal document template can be quite challenging.

Of course, there are numerous templates accessible online, but how do you locate the legal form you need.

Utilize the US Legal Forms website. This service provides thousands of templates, including the Washington Business Start-up Checklist, which can be utilized for both business and personal purposes.

You can view the form using the Preview button and review the form details to ensure it is the right one for you.

- All forms are reviewed by professionals and comply with federal and state requirements.

- If you are already registered, Log In to your account and click the Download button to obtain the Washington Business Start-up Checklist.

- Use your account to search for the legal forms you may have purchased previously.

- Go to the My documents tab in your account to obtain another copy of the document you need.

- If you are a new customer of US Legal Forms, here are simple instructions for you to follow.

- First, ensure you have selected the appropriate form for your region.

Form popularity

FAQ

To obtain a Unified Business Identifier (UBI) in Washington state, you need to register your business with the Washington Secretary of State. You can complete this process online or by submitting a paper application. Having a UBI is an essential step in your Washington Business Start-up Checklist, as it enables you to conduct business legally and efficiently.

Any business, including home-based businesses, must obtain a local city or county business license. This is a basic license that allows the holder to engage in business activities within the local jurisdiction.

Washington is one of these states. Virtually all businesses in Washington need to obtain a Washington state business license. To get your license, all you have to do is complete the Washington state Business License Application and pay a $19 fee. You can apply online or by mail.

What constitutes running a business from home?take responsibility for its success or failure.have a number of customers at the same time.make decisions over how, when, and where you work.hire staff to help.provide equipment to do the work yourself.complete unsatisfactory work in your own time.More items...?

You're allowed to run a business out of your home in Seattle as long as it doesn't interfere with other residents in the neighborhood. The home occupation rules in our Seattle Municipal Code (SMC) contain limits designed to minimize the impact your commercial activity has on your residential neighborhood.

Business Plan. Almost every business needs a little funding to get started.Partnership Agreement.LLC Operating Agreement.Buy/Sell Agreement.Employment Agreement.Employee Handbook.Non-Disclosure Agreement.Non-Compete Agreement.More items...

In Washington State, starting a home business means that you have to ensure that you notify all the proper agencies of your new home-based business and abide by the Washington State guidelines for the business you would like to create. Research home-based business ideas and try to pinpoint what makes them successful.

How much does a Washington business license cost? A Washington business license costs $90, plus $10 to renew it each year. The cost of other licenses and permits varies.

DefinitionDoing business in Washington. A corporation or business entity is "doing business in Washington state" for purposes of RCW 42.17A. 405 if it conducts continuous or substantial activities in Washington state of such character as to give rise to a legal obligation.

The standard filing fee for forming a limited partnership, profit corporation, or LLC is $180 and $30 for a nonprofit corporation. Additional fees may apply if expedited filing is desired (we generally recommend expediting the filing for quick confirmation but it is usually an additional $50).