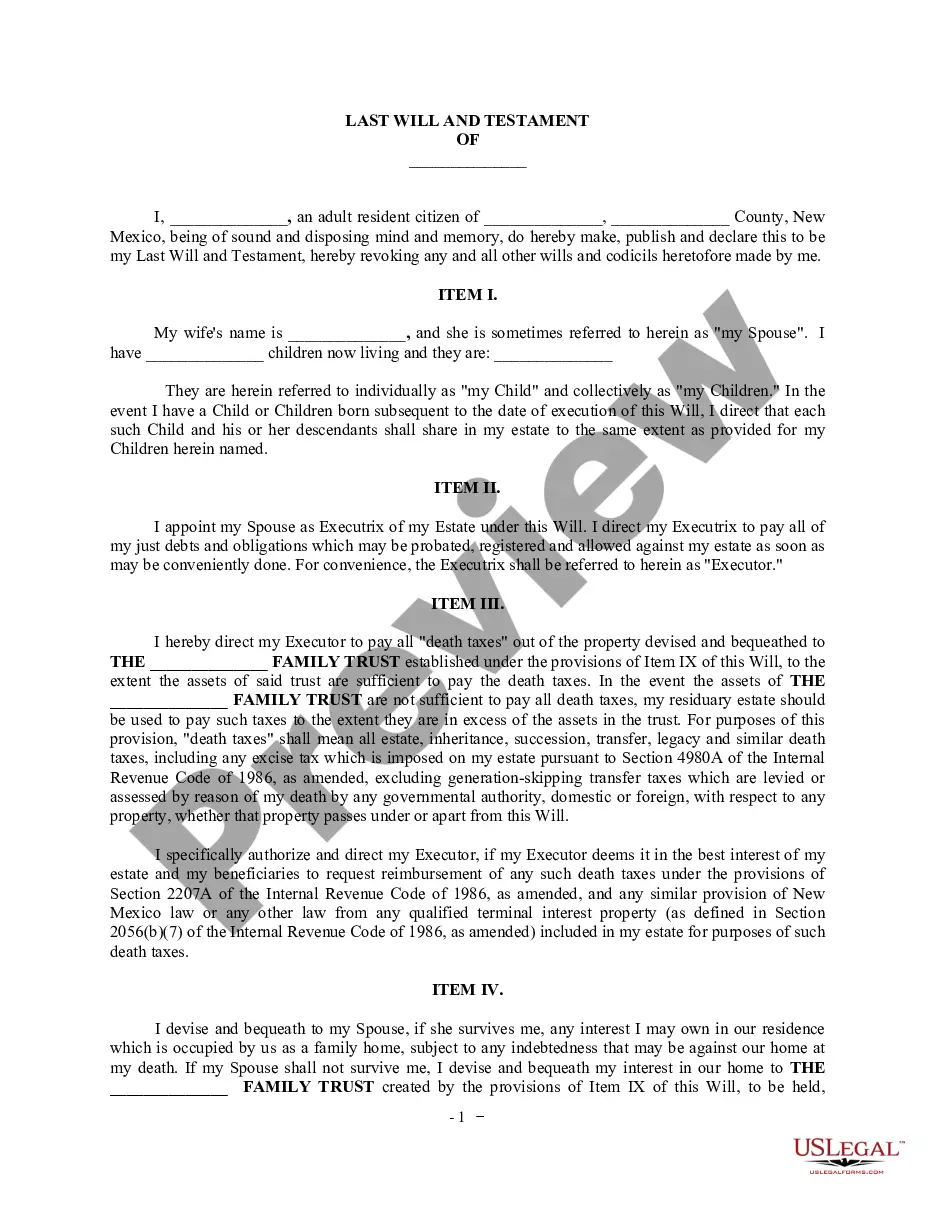

Washington Sales Receipt

Description

How to fill out Sales Receipt?

Are you in a position where you require documents for either organizational or personal reasons on a nearly daily basis.

There are numerous official document templates accessible online, but finding ones you can trust is challenging.

US Legal Forms offers a vast array of template forms, including the Washington Sales Receipt, which can be customized to comply with both federal and state regulations.

Once you find the correct form, click on Purchase now.

Select the pricing plan you desire, complete the required information to create your account, and pay for the order using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Washington Sales Receipt template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for your specific area/state.

- Use the Review button to check the form.

- Examine the details to ensure you have selected the right form.

- If the form is not what you're searching for, use the Search field to find a form that meets your needs and requirements.

Form popularity

FAQ

To sell your car privately in Washington state, you will need a few key documents. These include the vehicle title, a completed bill of sale, and a Washington Sales Receipt to document the sale. Additionally, ensure that you transfer the title properly to the new owner to avoid any complications.

Washington does not mandate a bill of sale for every transaction, but it is advised for clarity and protection. Especially for vehicle sales, a Washington Sales Receipt can simplify the process and offer proof of the transaction. It is always wise to have this document to avoid any potential issues later.

If you don't have a bill of sale, you may face challenges proving ownership during a transaction. It's important to create a Washington Sales Receipt or find a suitable template to capture the details of the sale. Platforms like uslegalforms can provide easy solutions for generating necessary documents to safeguard your transaction.

A sales receipt and a bill of sale serve similar purposes but differ slightly in their applications. A Washington Sales Receipt specifically records a payment transaction, while a bill of sale documents the transfer of ownership. Understanding these distinctions can help you choose the right document for your sales needs.

Proof of sale in Washington state usually takes the form of a bill of sale or a Washington Sales Receipt. This document serves as evidence that a transaction occurred, detailing the involved parties and item specifics. A strong proof of sale can be crucial if disputes arise, thus safeguarding your interests.

Failing to report the sale of a vehicle in Washington state can result in fines and penalties from the Department of Licensing. It may also lead to unresolved tax obligations. To avoid issues, ensure that you report the sale and provide the buyer with a Washington Sales Receipt to document the transaction properly.

Setting up sales tax collection in Washington requires registering your business with the appropriate state authorities. Once registered, implement a system in your point-of-sale software to automatically calculate and collect sales tax at the time of checkout. Make sure to issue a Washington Sales Receipt that highlights tax amounts collected.

To claim sales tax in Washington, you must file a sales tax return with the state either monthly or quarterly, depending on your business's revenue. Include total sales, sales tax collected, and any exemptions you’ve applied to specific sales. Make sure to keep copies of your Washington Sales Receipts as proof of tax collected.

Collecting sales tax in Washington involves applying the current state tax rate to transactions and ensuring you issue a Washington Sales Receipt that reflects this. Regularly check for any updates to tax rates as local jurisdictions may impose their own. This transparency in your transactions will help maintain trust with your customers.

Yes, residents of Washington state who meet specific income thresholds must file a state tax return. This requirement ensures that everyone contributes fairly to state services and infrastructure. If you have questions about your filing requirements, consider using the Washington Sales Receipt to track your purchases and income accurately. This can simplify the process and help you stay compliant.