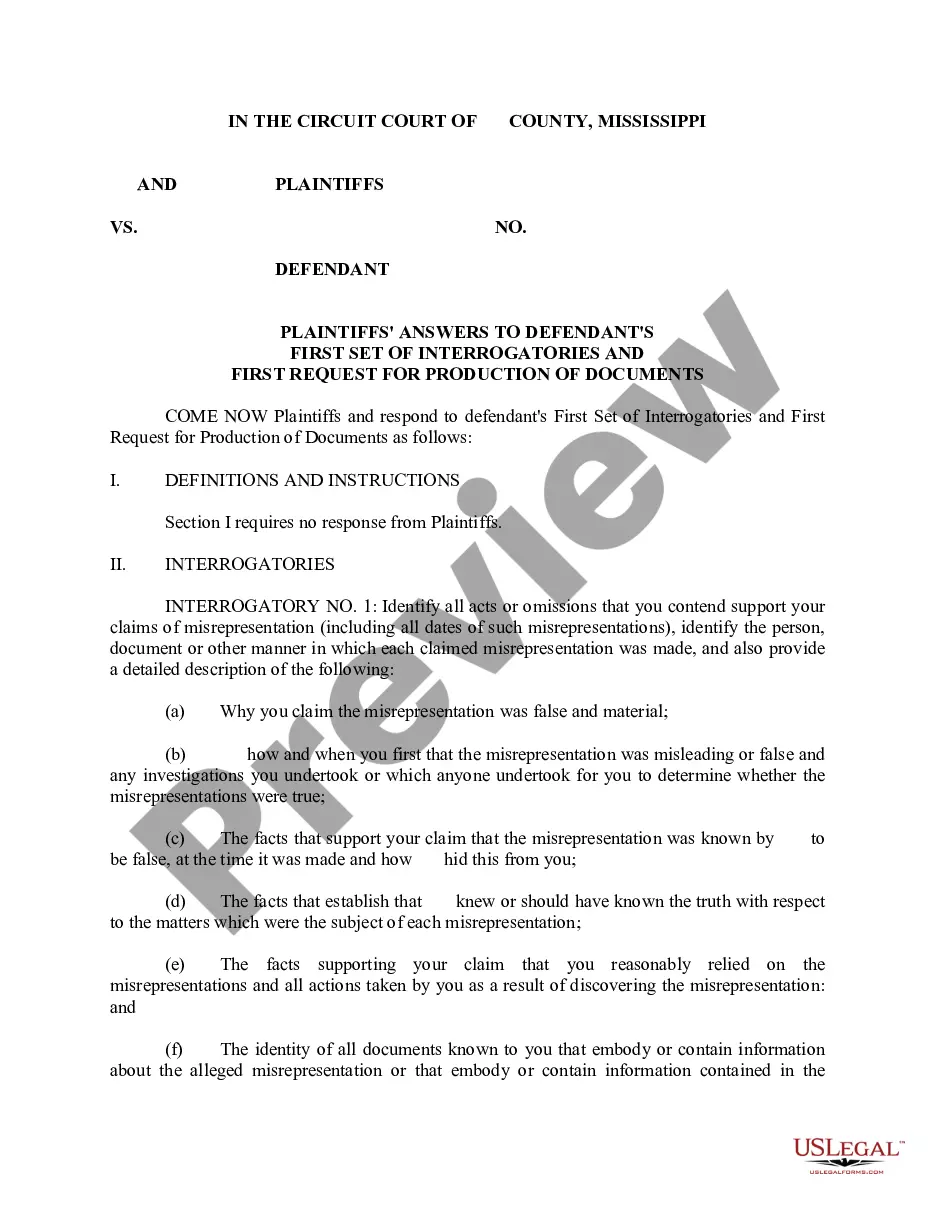

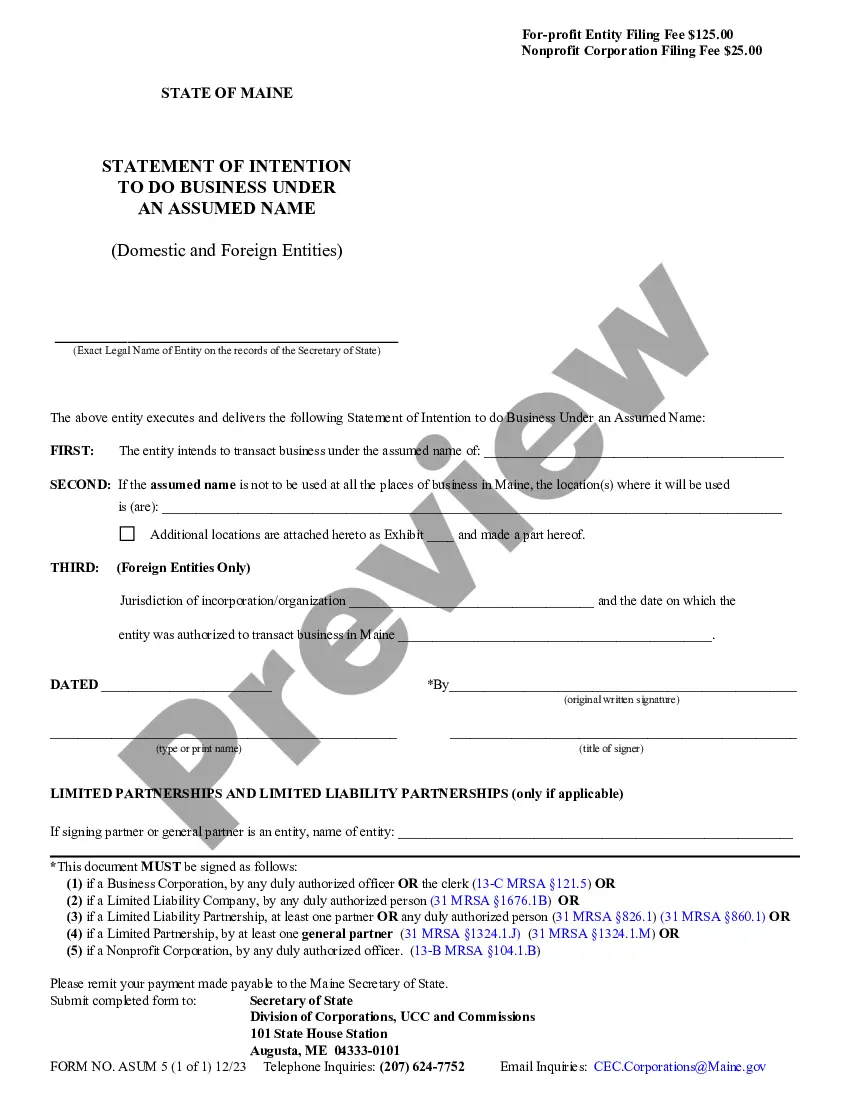

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Washington Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete

Description

How to fill out Contract With Consultant As Self-Employed Independent Contractor With Confidentiality Agreement And Covenant Not To Compete?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a diverse selection of legal form templates that you can download or print.

By using the website, you can discover thousands of forms for business and personal use, categorized by types, states, or keywords.

You can access the latest versions of forms such as the Washington Agreement with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Non-Compete Clause in just a few moments.

Read the form details to confirm that you have selected the correct form.

If the form does not meet your needs, utilize the Search field at the top of the screen to find one that does.

- If you possess a monthly subscription, sign in and download the Washington Agreement with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Non-Compete Clause via the US Legal Forms catalog.

- The Obtain button will appear on every form you view.

- You can access all previously downloaded forms from the My documents tab of your account.

- If you are interested in using US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have chosen the correct form for your city/state.

- Click the Preview button to examine the form's content.

Form popularity

FAQ

To get out of a non-compete clause in Washington state, begin by reviewing the agreement for any potential legal flaws. Consider talking to a lawyer who specializes in employment law for tailored advice. Additionally, using resources such as those provided by US Legal Forms can assist you in navigating your Washington Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete effectively.

Non-compete agreements can hold up in Washington state, but must align with specific legal standards. Factors like reasonableness and whether they protect legitimate business interests play a significant role in their enforcement. When establishing a Washington Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete, ensure it follows the guidelines to increase its validity.

Getting released from a non-compete agreement usually involves negotiating directly with the employer or the party who created the clause. Sometimes, they may agree to modify or release the terms for a valid reason. Seeking assistance from legal professionals familiar with the Washington Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete could enhance your chances.

In Washington state, non-compete agreements are generally enforceable under specific conditions. However, they must meet the criteria outlined in the state law to be upheld in court. If you are entering into a Washington Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete, it's important to ensure these agreements adhere to local regulations.

Yes, non-compete clauses can hold up in court, but their enforceability depends on several factors. Courts in Washington evaluate the reasonableness of these agreements in terms of duration and geographic scope. When drafting a Washington Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete, it’s crucial to ensure compliance with legal standards to improve enforceability.

To successfully challenge a non-compete clause, you should first review its terms and seek legal advice. Documenting any unreasonable aspects of the agreement strengthens your position. Utilizing the services of US Legal Forms can guide you through the process, ensuring you navigate your Washington Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete effectively.

The new non-compete law in Washington state enacted in 2020 requires that certain conditions be met for them to be enforceable. Specifically, it limits the income threshold and introduces stricter rules around when non-compete clauses can be applied. This is crucial for anyone entering a Washington Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete.

compete clause may become void if it lacks reasonable geographic scope or duration. If the agreement restricts a person from earning a livelihood or is deemed overly broad, a court may invalidate it. It's essential that any Washington Contract with Consultant as SelfEmployed Independent Contractor with Confidentiality Agreement and Covenant not to Compete complies with state laws.

Non-compete agreements can be enforceable on independent contractors, provided they meet legal requirements in Washington. The agreement must be clear, reasonable in scope, and promote legitimate business interests. If a noncompete clause seems overly restrictive, you may have grounds to contest it. To ensure that your non-compete agreements are both fair and enforceable, consider consulting legal experts or utilizing services like uslegalforms for guidance.

Yes, an independent contractor can have a non-compete clause included in their Washington Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete. Such clauses aim to protect proprietary information and business interests. However, the enforceability of these clauses often depends on how fair and reasonable they are. If you wish to explore this option, consider using platforms like uslegalforms to draft agreements that uphold your rights.