The Fair Credit Reporting Act (FCRA) is designed to help ensure that credit bureaus furnish correct and complete information to businesses to use when evaluating your application. Your rights include:

The right to receive a copy of your credit report. The copy of your report must contain all of the information in your file at the time of your request.

The right to know the name of anyone who received your credit report in the last year for most purposes or in the last two years for employment purposes.

Any company that denies your application must supply the name and address of the credit bureau they contacted, provided the denial was based on information given by the credit bureau.

The right to a free copy of your credit report when your application is denied because of information supplied by the credit bureau. Your request must be made within 60 days of receiving your denial notice.

If you contest the completeness or accuracy of information in your report, you should file a dispute with the credit bureau and with the company that furnished the information to the bureau. Both the credit bureau and the furnisher of information are legally obligated to investigate your dispute.

A right to add a summary explanation to your credit report if your dispute is not resolved to your satisfaction.

Washington Request for Disclosure of Reasons for Increasing Charge for Credit Regarding Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency

Description

How to fill out Request For Disclosure Of Reasons For Increasing Charge For Credit Regarding Credit Application Where Action Was Based On Information Not Obtained By Reporting Agency?

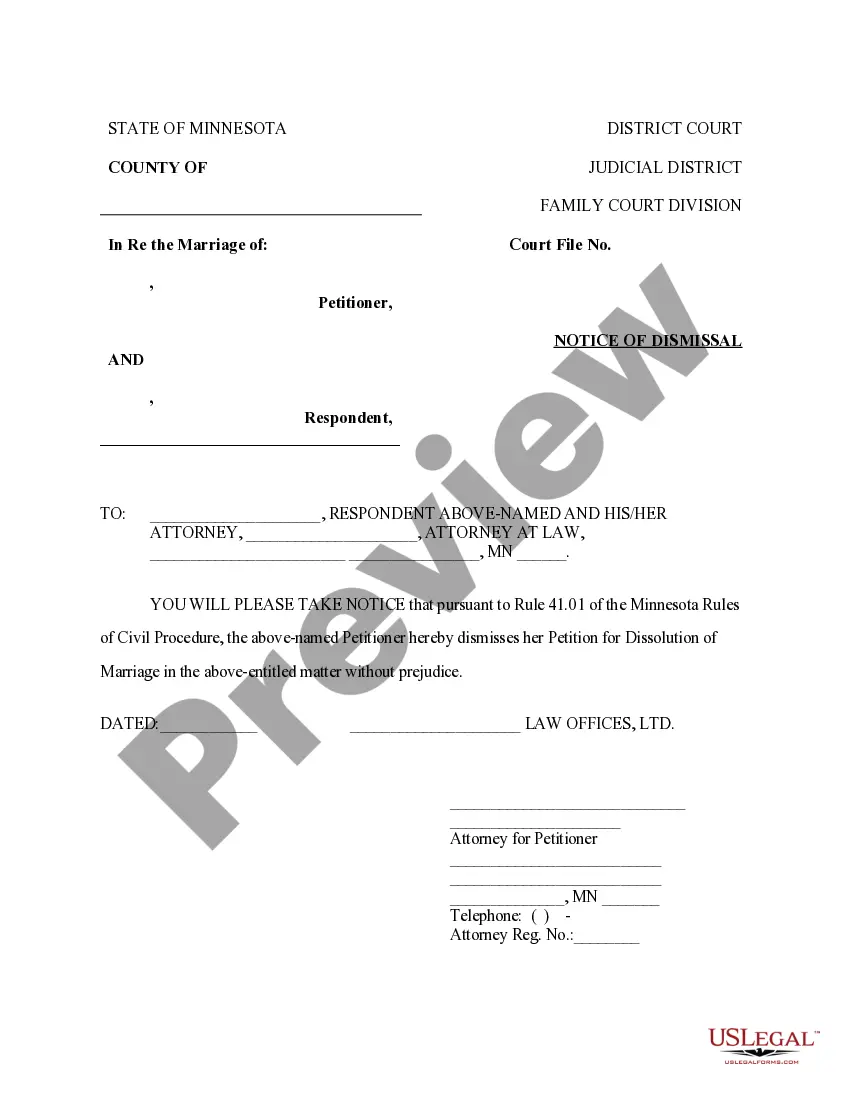

Choosing the right lawful document format can be a struggle. Needless to say, there are plenty of layouts available on the Internet, but how would you discover the lawful form you need? Use the US Legal Forms internet site. The assistance provides 1000s of layouts, such as the Washington Request for Disclosure of Reasons for Increasing Charge for Credit Regarding Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency, which you can use for company and private requirements. Each of the forms are inspected by specialists and meet up with state and federal specifications.

If you are presently authorized, log in in your accounts and then click the Obtain button to have the Washington Request for Disclosure of Reasons for Increasing Charge for Credit Regarding Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency. Make use of your accounts to look with the lawful forms you may have ordered earlier. Proceed to the My Forms tab of your accounts and acquire yet another duplicate of the document you need.

If you are a whole new end user of US Legal Forms, here are basic guidelines so that you can follow:

- Initial, make certain you have chosen the right form for the city/state. You are able to look through the shape while using Preview button and read the shape outline to make certain this is the best for you.

- If the form fails to meet up with your expectations, utilize the Seach area to get the appropriate form.

- When you are sure that the shape would work, click the Purchase now button to have the form.

- Opt for the costs prepare you need and enter the required info. Make your accounts and purchase an order using your PayPal accounts or charge card.

- Opt for the document file format and obtain the lawful document format in your system.

- Complete, revise and print and sign the received Washington Request for Disclosure of Reasons for Increasing Charge for Credit Regarding Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency.

US Legal Forms is definitely the biggest collection of lawful forms for which you can discover numerous document layouts. Use the service to obtain appropriately-made files that follow condition specifications.

Form popularity

FAQ

The FCRA gives you the right to be told if information in your credit file is used against you to deny your application for credit, employment or insurance. The FCRA also gives you the right to request and access all the information a consumer reporting agency has about you (this is called "file disclosure").

612(f)(1)(A) of the Fair Credit Reporting Act, which became effective in 1997, provides that a consumer reporting agency may charge a consumer a reasonable amount for making a disclosure to the consumer pursuant to Section 609 of the Act.

Section 609 of the FCRA gives consumers the right to request all information in their credit files and the source of that information. Consumers also have the right to know any prospective employer who has accessed their credit report within the last two years.

Section 623(a)(6). If a furnisher learns that it has furnished inaccurate information due to identity theft, it must notify each consumer reporting agency of the correct information and must thereafter report only complete and accurate information.

It may also include employment information, present and previous addresses, whether they have ever filed for bankruptcy or owe child support, and any arrest record. In some, but not all, instances, consumers must have initiated a transaction or agreed in writing before the credit bureau can release their report.

The Fair Credit Reporting Act (FCRA) , 15 U.S.C. § 1681 et seq., governs access to consumer credit report records and promotes accuracy, fairness, and the privacy of personal information assembled by Credit Reporting Agencies (CRAs).

Section 611(e) of the Fair Credit Reporting Act: Federal Trade Commission Program Referring Consumer Complaints About Possible Act Violations To The Three Nationwide Consumer Reporting Agencies, and Securing Complaint Resolution Information From Them: Tags: Privacy and Security. Credit Reporting.

Notice is not required if: The transaction does not involve credit; A credit applicant accepts a counteroffer; A credit applicant expressly withdraws an application; or.