Washington Option For the Sale and Purchase of Real Estate - Residential Home

Description

How to fill out Option For The Sale And Purchase Of Real Estate - Residential Home?

Are you currently in a situation where you need documents for either business or personal purposes every single day.

There are numerous legal document templates accessible online, but finding ones you can trust is not easy.

US Legal Forms offers a vast array of form templates, including the Washington Option For the Sale and Purchase of Real Estate - Residential Home, which are drafted to meet federal and state requirements.

Select a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents menu. You can obtain another copy of Washington Option For the Sale and Purchase of Real Estate - Residential Home at any time if needed. Just follow the required form to download or print the document template.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- Then, you can download the Washington Option For the Sale and Purchase of Real Estate - Residential Home template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct area/state.

- Use the Preview button to view the form.

- Review the details to make sure you have selected the right form.

- If the form is not what you are looking for, use the Search field to locate the form that fits your needs and specifications.

- If you find the suitable form, click Buy now.

- Choose the pricing plan you prefer, fill in the required information to create your account, and finalize the purchase with your PayPal or Visa or Mastercard.

Form popularity

FAQ

Washington first-time homebuyer loan programs620 minimum credit score.Maximum 50 percent debt-to-income ratio.Annual income under $145,000.

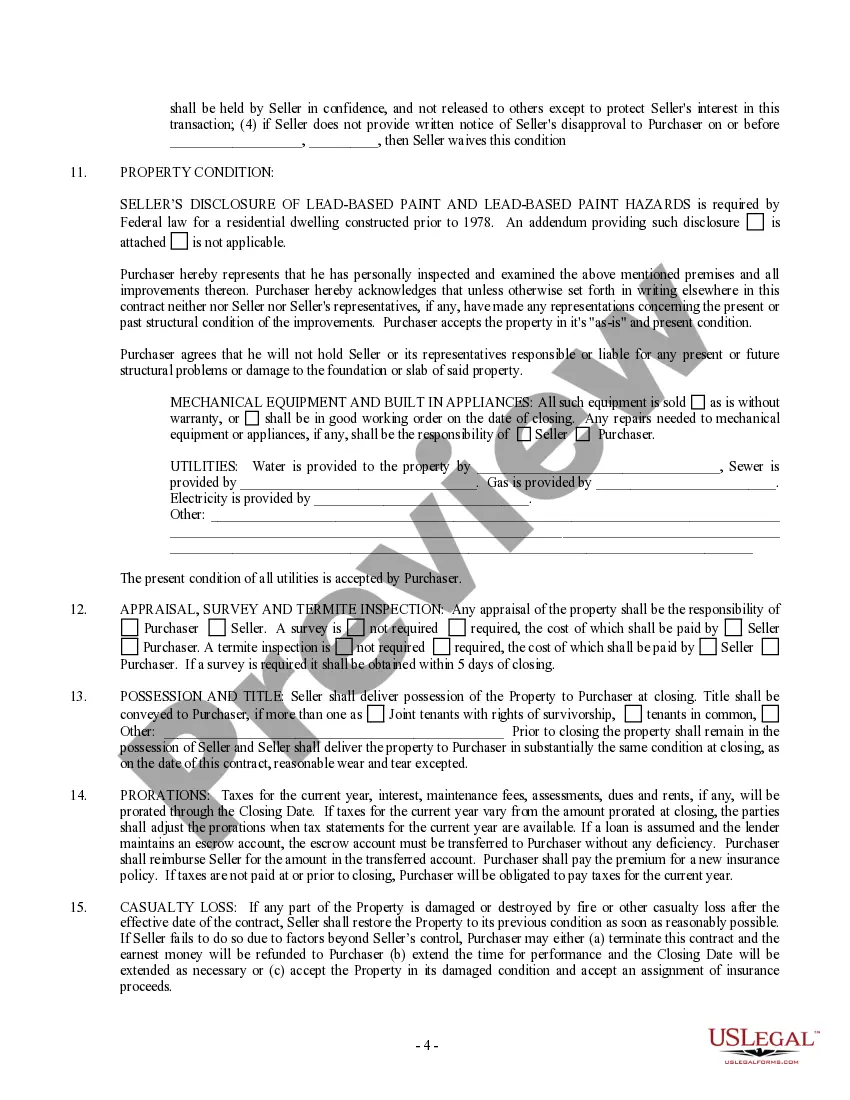

Washington's Seller Disclosure Statute, RCW 64.06, originally passed in 1994, required Sellers of real property to disclose material defects on a Seller Disclosure Statement, which quickly became known as a Form 17.

Washington courts have repeatedly affirmed the legal principal of caveat emptor, meaning buyer-beware. A buyer should make sure to investigate any defects it learns of both in areas where the defect is known to exist and throughout the entirety of the home.

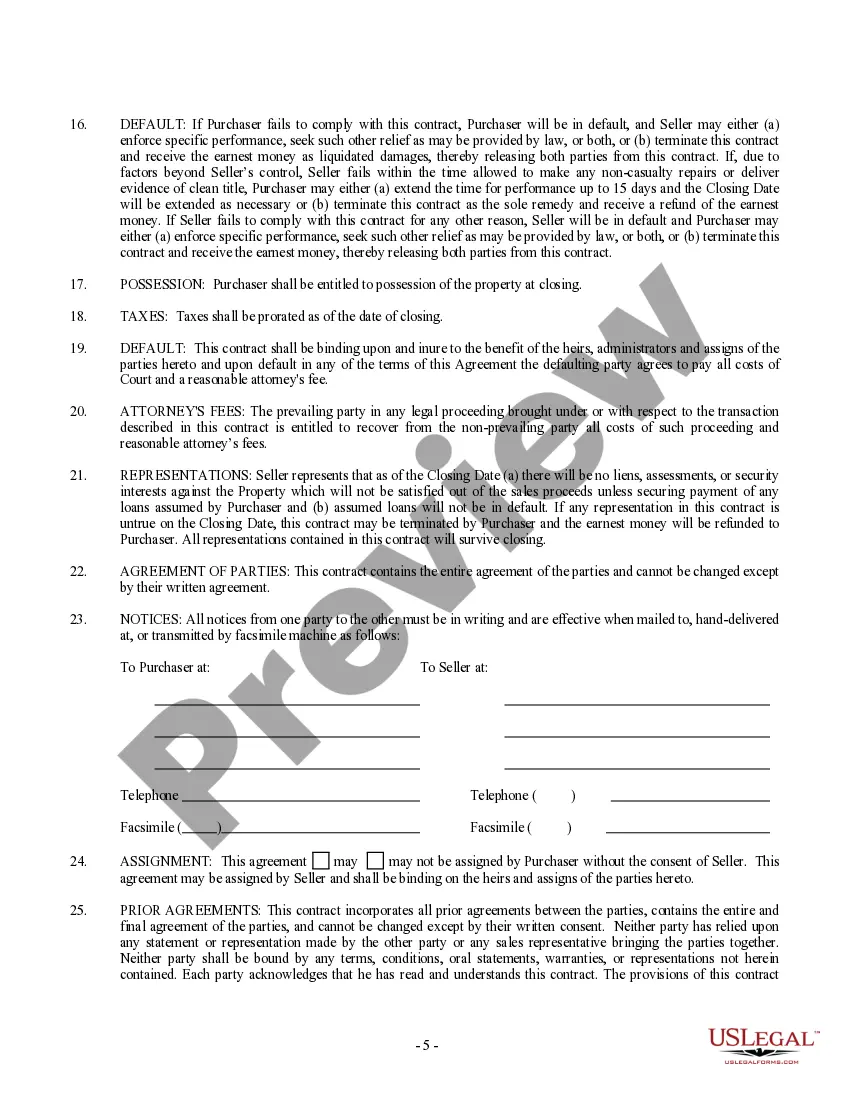

(1) "Contract" or "real estate contract" means any written agreement for the sale of real property in which legal title to the property is retained by the seller as security for payment of the purchase price.

What Credit Score is Needed to Buy a House in Washington State? Generally speaking, lenders require a minimum credit score of 620. However, you may be able to qualify for an FHA loan with a credit score of 580 or even 500.

While sellers don't have a duty to inspect their home or look for defects, they do have a duty to disclose defects that affect the value, physical condition, or title to the property. Sellers should consider disclosure to be a form of insurance.

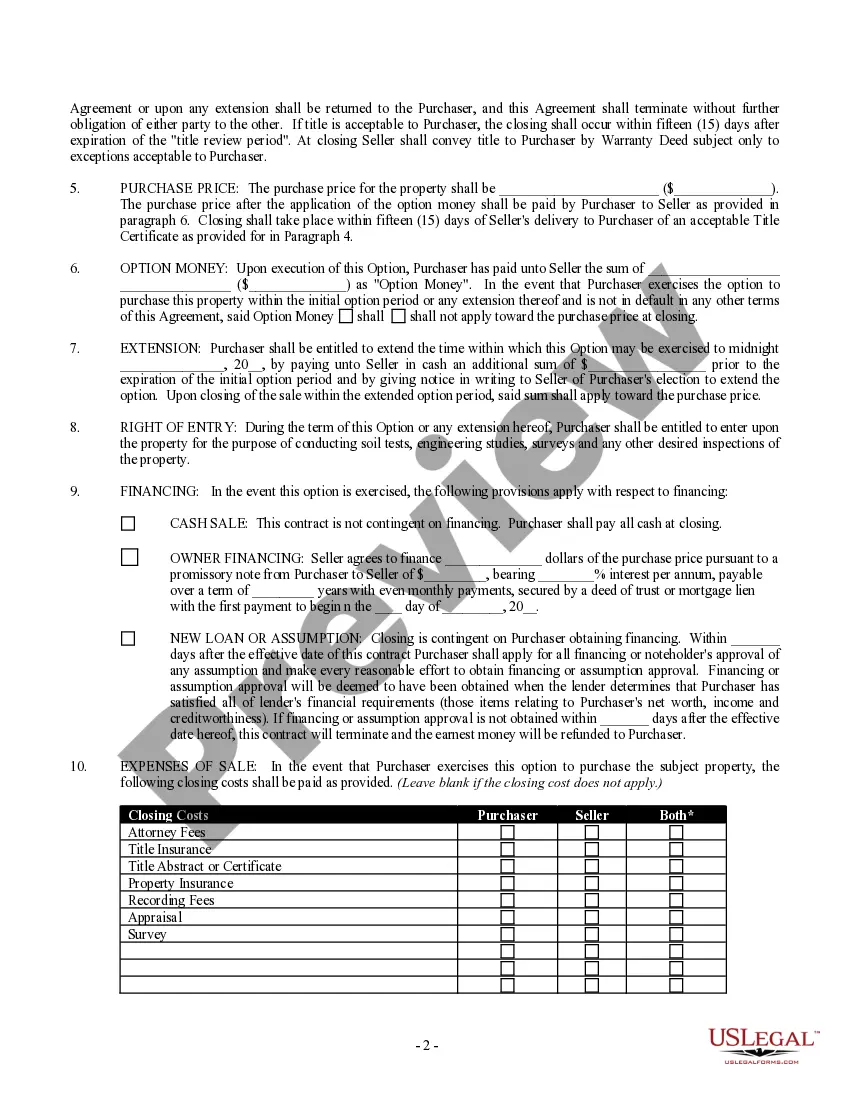

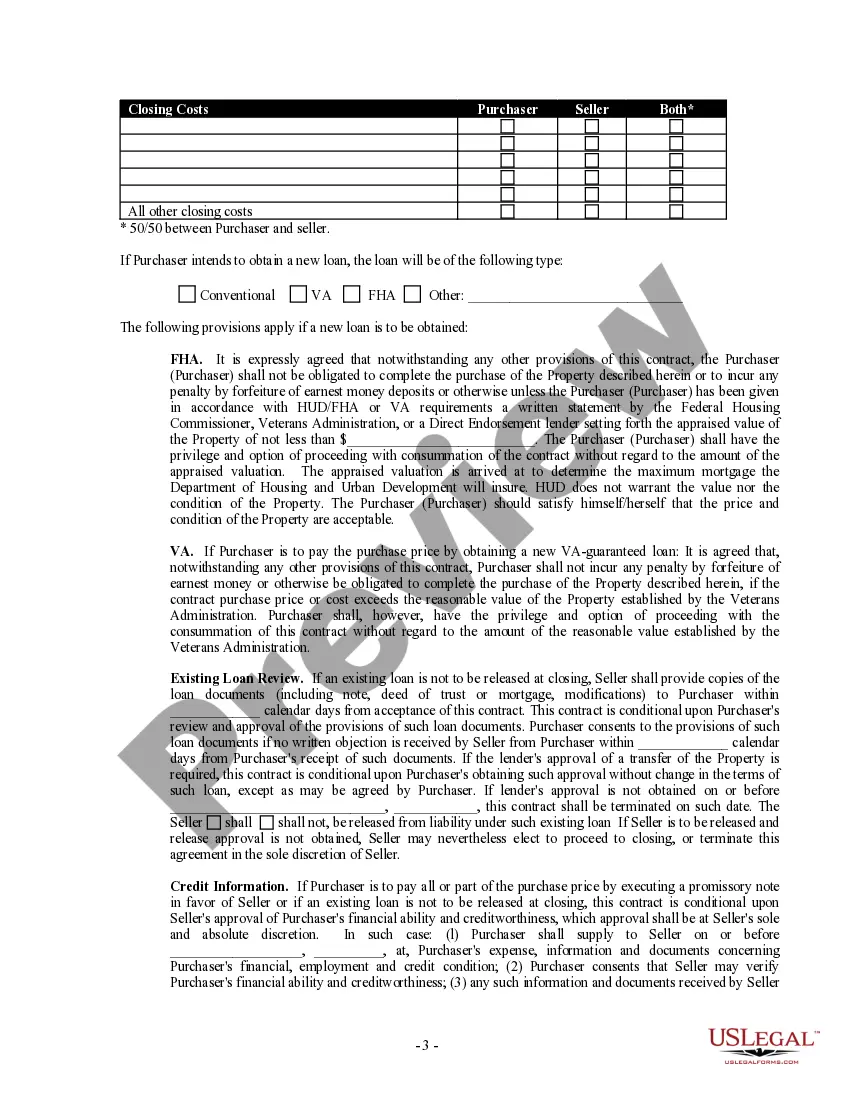

The basics: What is an option contract in real estate? In the simplest terms, a real-estate option contract is a uniquely designed agreement that's strictly between the seller and the buyer. In this agreement, a seller offers an option to the buyer to purchase property at a fixed price within a limited time frame.

Here are the basic requirements to buy a house in Washington State and get a mortgage.Stable employment with the same employer for 1-2+ years.Ability to repay with a debt-to-income ratio of 36% or less.Cash reserves to pay for closing costs and other expenses.Satisfactory credit score.More items...?

Washington first-time home buyer programs Assume you'll need a credit score of 640 or better for these, but you may get away with one as low as 620 if your debt-to-income ratio is low. You'll also have to complete an approved home buyer education course to be eligible.

In the state of Washington, you, as a residential home seller, are required by law to disclose certain details about a residential property you are trying to sell. These disclosures are important because buyers want to know as much as possible about a property before they make such an important purchase.