Washington Mutual Release of Claims

Description

How to fill out Mutual Release Of Claims?

It is feasible to spend time online attempting to locate the valid document template that fulfills the federal and state requirements you need.

US Legal Forms offers thousands of valid forms that are reviewed by professionals.

You can easily download or print the Washington Mutual Release of Claims from my service.

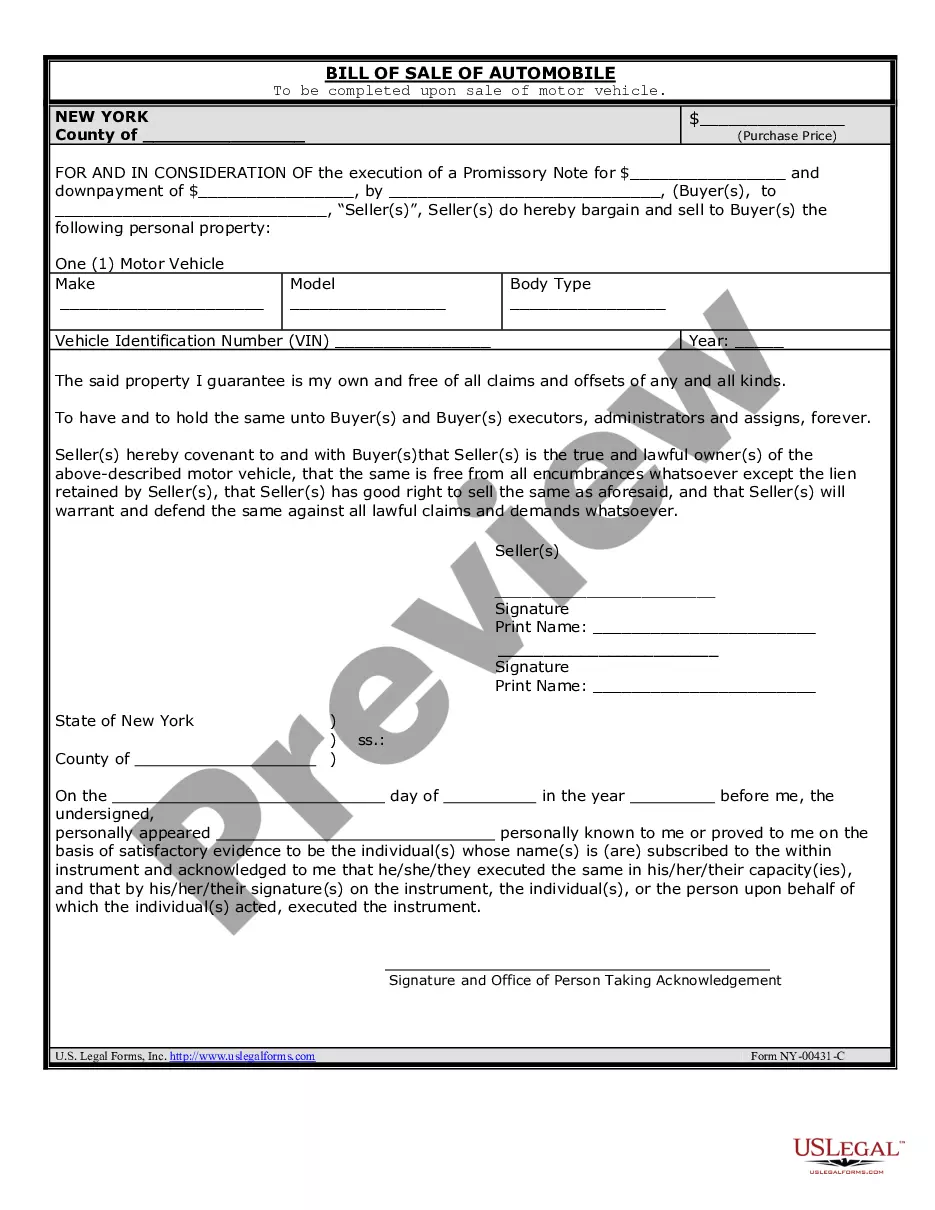

If available, use the Preview option to review the document template as well.

- If you possess a US Legal Forms account, you can Log In and then select the Download option.

- After that, you can fill out, edit, print, or sign the Washington Mutual Release of Claims.

- Every legal document template you obtain is yours permanently.

- To obtain another copy of a purchased form, go to the My documents tab and click the corresponding option.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have selected the correct form template for the state/city of your choice.

- Check the form description to confirm you have chosen the right document.

Form popularity

FAQ

JPMorgan Chase took over all Washington Mutual mortgage operations following its collapse. This transition ensures that existing mortgage holders still have access to account services and support. If you have concerns regarding your mortgage or related claims, we recommend looking into the resources provided by Washington Mutual Release of Claims.

While Washington Mutual and Chase are not the same, Washington Mutual's operations are now integrated into Chase. Essentially, the brand and its original structure are no longer in existence, but services continue under the Chase name. For claims or inquiries about past accounts, consult the Washington Mutual Release of Claims for guidance.

Yes, all branches and operations of Washington Mutual are now part of JPMorgan Chase. After WaMu's failure, Chase acquired its assets and liabilities. If you are interested in how this affects claims, the Washington Mutual Release of Claims can provide you with essential information about your options.

Washington Mutual, commonly known as WaMu, faced severe financial challenges during the 2008 financial crisis. It ultimately went into receivership, leading to its assets being sold to JPMorgan Chase. If you're seeking information on claims related to WaMu, we suggest exploring resources associated with Washington Mutual Release of Claims.

Yes, Washington Mutual checks remain valid today. They can still be cashed or deposited, provided they are within the bank's specified time limits. If you encounter issues with a check, consider using the Washington Mutual Release of Claims as a resource to clarify your rights and options.

A mutual release is a legal agreement in which two or more parties agree to relinquish their rights to pursue specific claims against each other. This document is essential in dispute resolution, as it ensures that all parties fully understand their commitments. For those involved in such agreements, using the Washington Mutual Release of Claims can provide you with a solid foundation.

To write a mutual termination letter, clearly state the intentions of both parties to terminate the agreement. Explain the reasons for termination and reference any previous discussions about the issue. Including a mutual release clause can help protect both parties from future claims, which is critical for the Washington Mutual Release of Claims.

In the UK, a settlement agreement is a legally binding document that outlines the terms of the settlement reached between parties, often resolving disputes out of court. This document typically includes mutual releases and waivers similar to the Washington Mutual Release of Claims, ensuring that both parties forgo any future claims regarding the matter at hand.

A mutual release and discharge is a legal agreement whereby parties agree to release each other from any future claims related to a specific matter. This document serves as confirmation that both parties have settled their differences fully and cannot revisit those claims later. If you are involved in such matters, consider addressing the Washington Mutual Release of Claims.

The mutual release and waiver clause is a provision in a contract where both parties agree to release each other from legal claims. This clause helps prevent further disputes by acknowledging that each party waives their rights to pursue claims covered under the agreement. Understanding this clause is critical when dealing with Washington Mutual Release of Claims.