Washington Personal Guaranty - General

Description

How to fill out Personal Guaranty - General?

If you wish to acquire, obtain, or print authentic document templates, utilize US Legal Forms, the largest selection of legal forms accessible online.

Employ the website's straightforward and user-friendly search feature to find the documents you require.

Various templates for business and personal purposes are categorized by categories and jurisdictions, or keywords.

Step 4. Once you have located the form you require, click on the Purchase now button. Select the payment plan you prefer and provide your information to create your account.

Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the transaction.

- Utilize US Legal Forms to obtain the Washington Personal Guaranty - General with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Buy button to secure the Washington Personal Guaranty - General.

- You can also access forms you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have chosen the form for the correct state/country.

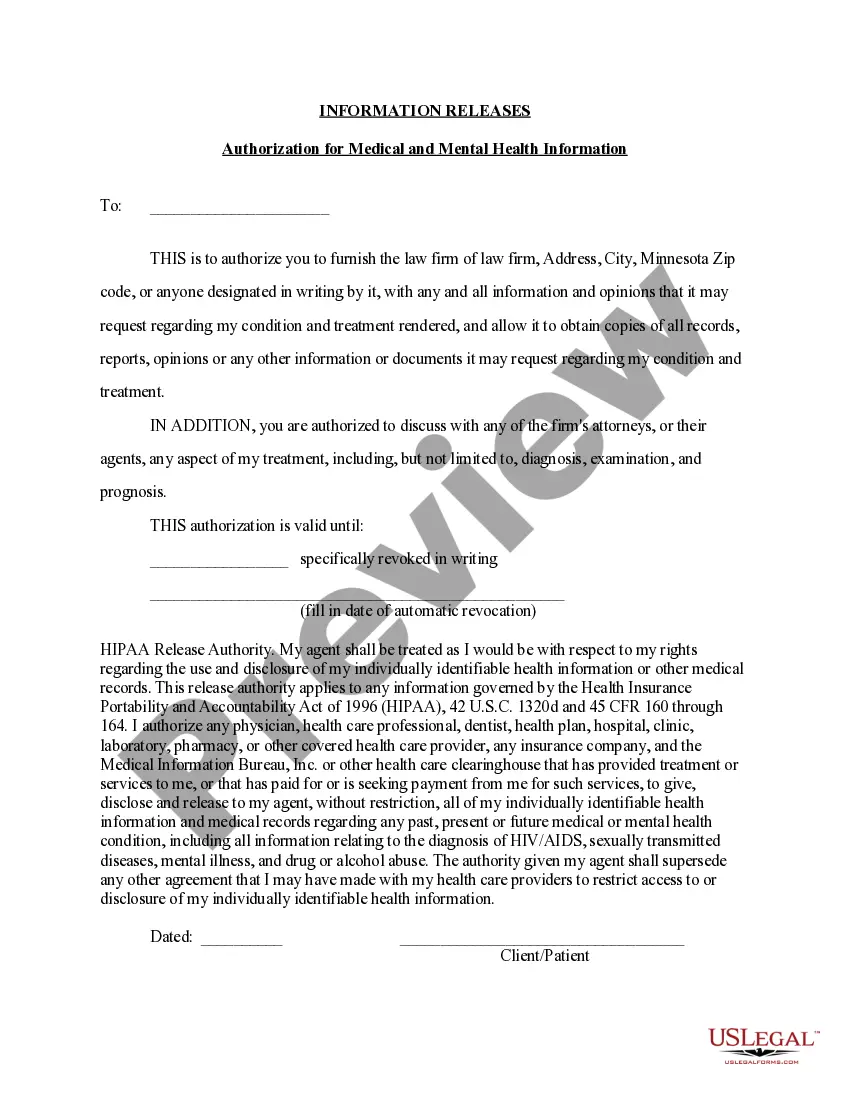

- Step 2. Use the Preview option to examine the content of the form. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other templates in the legal form format.

Form popularity

FAQ

The Washington Life and Disability Insurance Guaranty Association provides protection for policyholders in the event an insurance company becomes insolvent. This association safeguards your financial interests, ensuring that you receive benefits under your Washington Personal Guaranty - General policies. By covering certain claims, it helps maintain trust and stability in the insurance market. Essentially, it acts as a safety net, allowing you to have peace of mind knowing you are protected.

Filling out a personal guarantee requires attention to detail and clarity. Start by writing your full name, indicating your relationship to the borrower, and clearly stating the amount you are guaranteeing. To streamline the process and ensure accuracy, you might want to utilize US Legal Forms, which provides preformatted documents suitable for Washington Personal Guaranty - General.

The current limit of the guaranty fund in Washington is crucial for your financial security in case of an insurance company insolvency. Presently, this limit stands at $500,000 for claims of life insurance and similar policies. This financial backing assures you that when dealing with the Washington Personal Guaranty - General, your interests are protected. Make sure to stay informed about any updates to these limits for your peace of mind.

State guaranty associations provide a safety net for policyholders when an insurance company fails. In Washington, the maximum benefit limit can vary, but it generally protects consumers up to $500,000. This coverage helps ensure that individuals with policies under the Washington Personal Guaranty - General can recover a significant portion of their claims. Always verify the latest limits, as they may change periodically.

If you need to file a complaint with the Washington State Attorney General, start by visiting their official website. There, you will find a complaint form that you can fill out with your concerns. It is important to provide specific information and any supporting documentation to help your case. This process assists in addressing issues related to the Washington Personal Guaranty - General effectively.

Filing a claim with Washington National Insurance Company is a straightforward process. First, gather all necessary documentation related to your policy and the incident. Next, contact their claims department via phone or through their website, where you can complete an online form. Be sure to provide clear details, as this helps expedite your claim and ensures you receive your benefits under the Washington Personal Guaranty - General.

The term personal guarantee refers to an individual's legal promise to repay credit issued to a business for which they serve as an executive or partner. Providing a personal guarantee means that if the business becomes unable to repay the debt, the individual assumes personal responsibility for the balance.

If you sign a personal guarantee, you are personally liable for the loan balance or a portion thereof. If your business later defaults on the loan, anyone who signed the personal guarantee can be held responsible for the remaining balance, even after the lender forecloses on the loan collateral.

A guarantor can be any party, including an individual or another organization, with a credit history. A common purpose of a personal guarantee is to allow a loan to be extended to an organization or person with either no credit history or one with a credit rating that is too poor to qualify for a loan.

By agreeing to a personal guarantee, the business borrower is agreeing to be 100 percent personally responsible for repayment of the entire loan amount, in addition to any collection, legal, or other costs related to the loan.