Washington Corporate Guaranty - General

Description

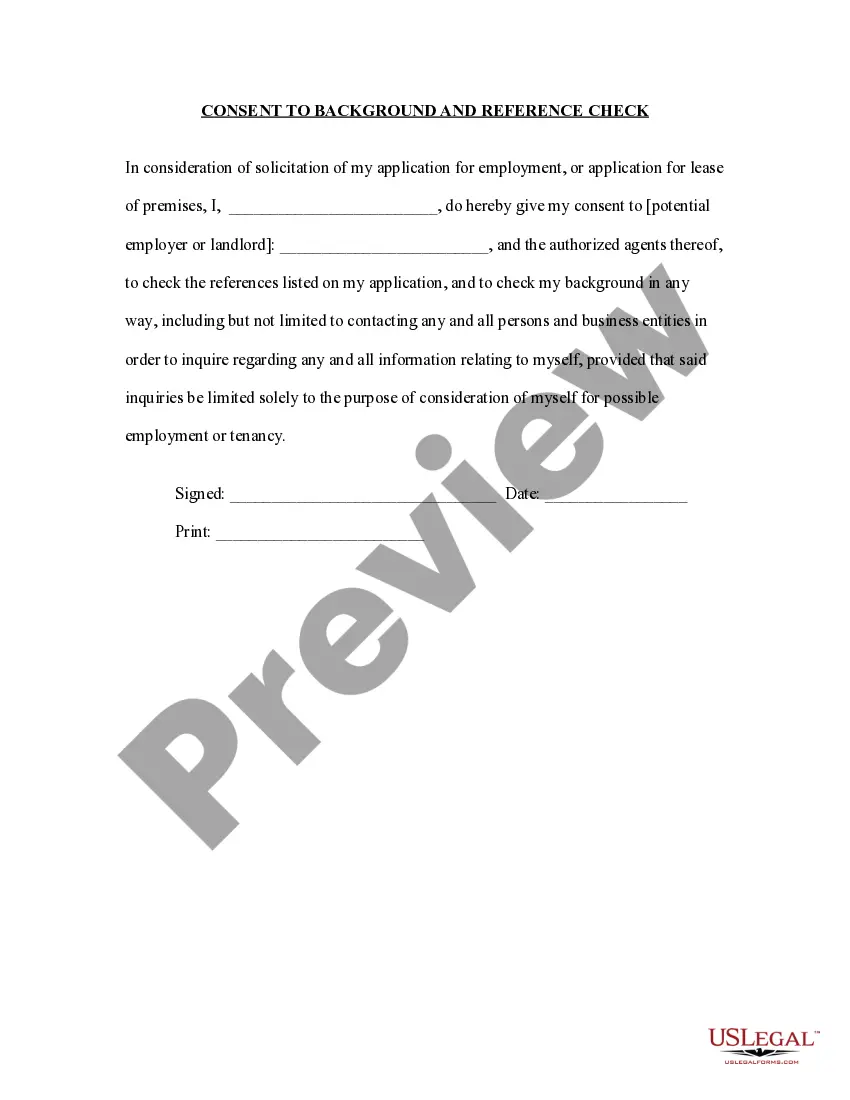

How to fill out Corporate Guaranty - General?

If you want to acquire, procure, or create authentic document templates, utilize US Legal Forms, the finest assortment of valid forms accessible online.

Leverage the site's user-friendly and efficient search to find the documents you require.

Multiple templates for business and personal purposes are categorized by regions and states, or keywords.

Step 4. Once you have located the form you need, click the Buy now button. Choose your preferred pricing plan and provide your credentials to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Use US Legal Forms to retrieve the Washington Corporate Guaranty - General in just a few clicks.

- If you are currently a US Legal Forms member, Log In to your account and click the Download button to obtain the Washington Corporate Guaranty - General.

- You can also access forms you previously purchased in the My documents section of your account.

- If you are using US Legal Forms for the first time, refer to the steps below.

- Step 1. Ensure you have selected the form for your specific city/state.

- Step 2. Utilize the Review option to examine the form’s details. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search bar at the top of the screen to find other versions of your legal form template.

Form popularity

FAQ

The Washington Life and Disability Insurance Guarantee Association provides financial protection for policyholders in the event that their life or disability insurance provider becomes insolvent. This association ensures that you can rely on your Washington Corporate Guaranty - General, even in uncertain times. It safeguards policyholders by covering claims and benefits that might otherwise go unpaid. Therefore, you can have peace of mind knowing that your coverage remains intact, despite potential challenges faced by insurers.

The best place to complain about a company depends on the nature of your complaint. For business-related issues, the Washington Attorney General’s Office often serves as a reliable platform for submission. You can also consider filing complaints with industry-specific regulatory agencies or consumer protection groups, all while keeping in mind the principles of Washington Corporate Guaranty - General to ensure your concerns are adequately addressed.

Filing a complaint against a company in Washington State begins with collecting all relevant information about the issue. You should determine the correct agency to handle your complaint, such as the Washington Attorney General's Office or other specialized boards. Once you have identified the correct agency, follow their guidelines for submitting your complaint, which often includes filling out a detailed form aligned with the Washington Corporate Guaranty - General standards.

Obtaining a Unique Business Identifier (UBI) in Washington is a straightforward process. You can start by visiting the Washington Secretary of State's website, where you will find an online application form. Completing the form requires basic information about your business; upon approval, you will receive your UBI, necessary for operating your business under the Washington Corporate Guaranty - General.

To file a complaint against a company in Washington state, you can start by gathering all necessary documents and evidence related to your case. Next, visit the website of the Washington Attorney General or the appropriate regulatory agency. You will find specific forms and guidelines to assist you in submitting your complaint using the Washington Corporate Guaranty - General framework.

After a complaint is filed against a company, the relevant authorities or regulatory bodies will review the details of the case. They will typically notify the company about the complaint and may require a response within a specified timeframe. Depending on the severity and nature of the complaint, the company may undergo an investigation. The process often aims to resolve the issue efficiently and uphold standards, which aligns with the principles of Washington Corporate Guaranty - General.

The current limit of the guaranty fund in Washington is set by the state legislation and typically provides coverage subject to specific caps for different types of insurance policies. This fund plays a vital role in protecting policyholders and maintaining trust in the insurance market. It’s a critical aspect of Washington Corporate Guaranty - General that you should not overlook. To stay informed and compliant, you can explore tools and resources offered by uslegalforms that break down these limits and help you stay updated.

The maximum benefit limit for state guaranty associations varies by state, but typically, it caps at around $500,000 for life insurance and $100,000 for health insurance claims. These associations ensure that policyholders receive benefits even if their insurance company faces bankruptcy. Understanding these limits helps you navigate the complexities of Washington Corporate Guaranty - General. For specific figures, consult the state’s regulatory agency or consider resources available through uslegalforms.

In Washington state, a DBA, or Doing Business As, is a registration that allows you to operate under a specific name, but it does not provide legal protection for personal assets. Conversely, an LLC, or Limited Liability Company, legally separates your personal assets from your business liabilities, providing more security. This distinction is crucial when considering how you wish to structure your business. Choosing the right entity can impact your compliance requirements and your approach to Washington Corporate Guaranty - General.