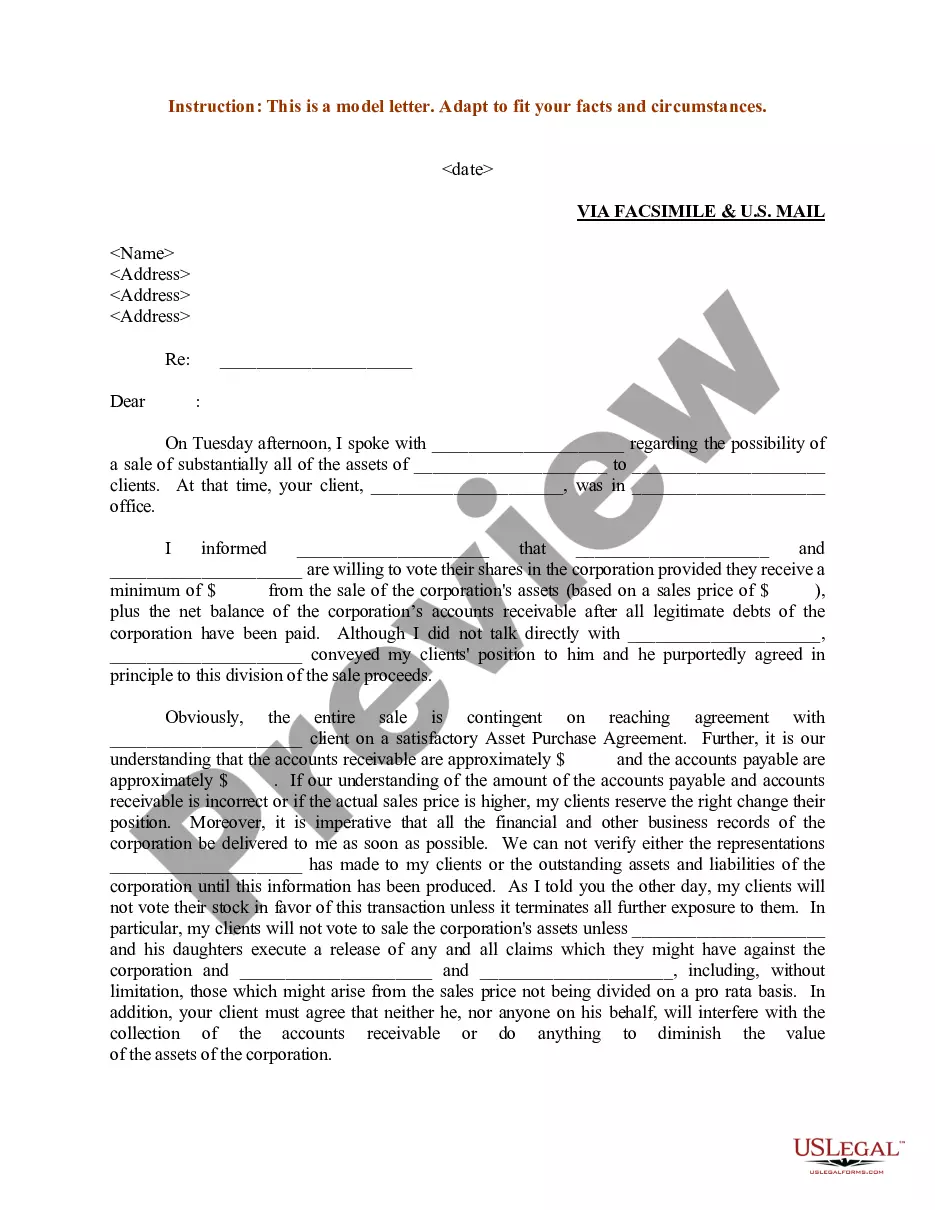

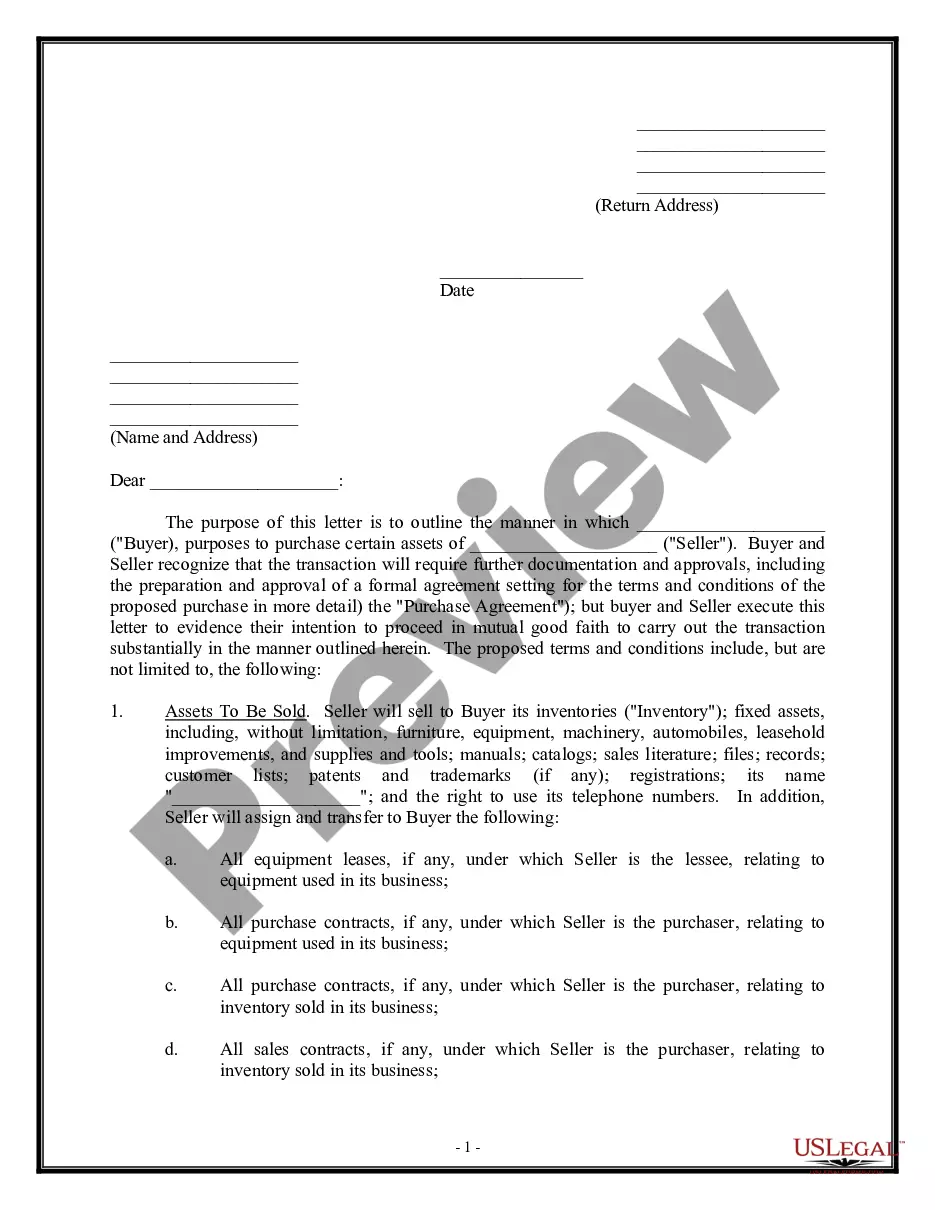

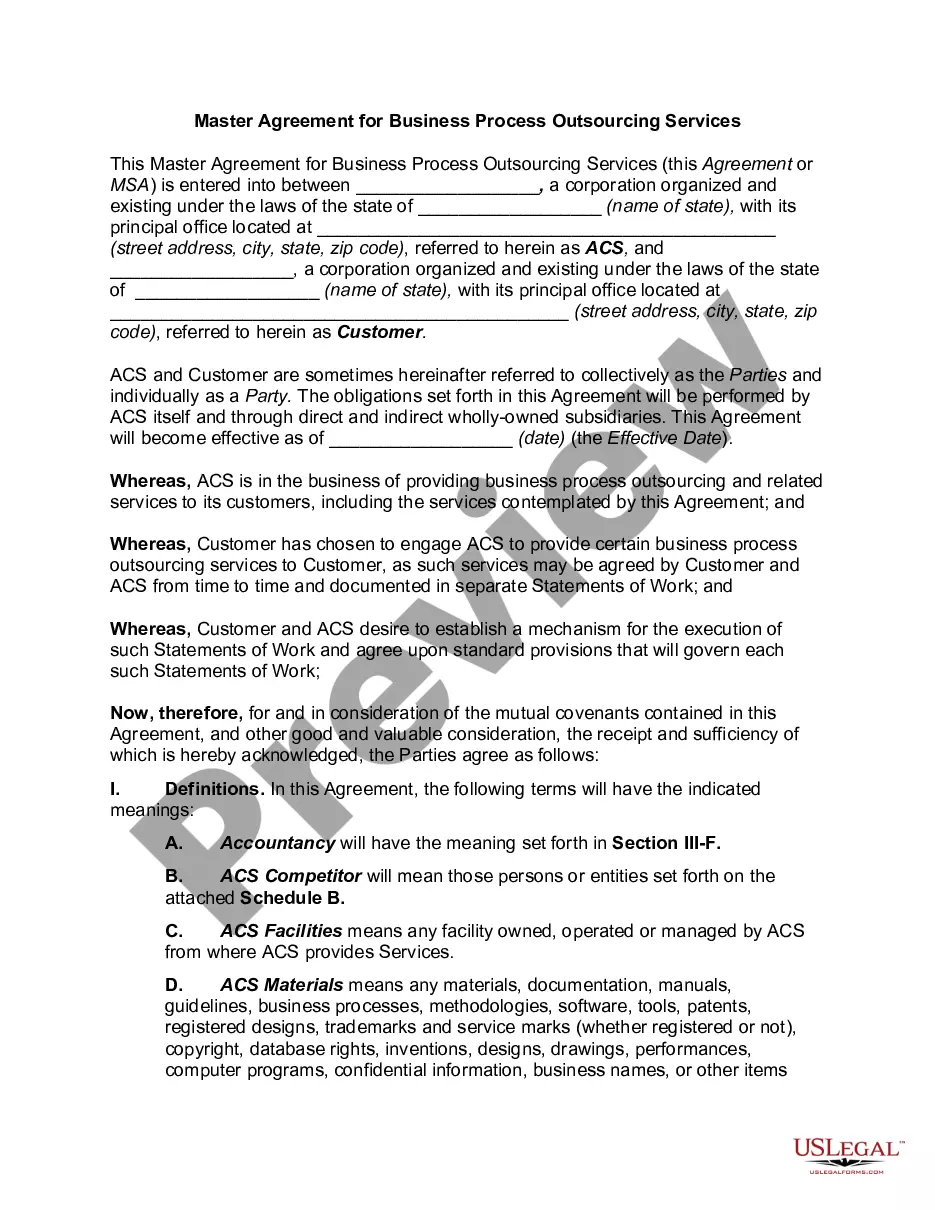

Letter re: sale of assets - Asset Purchase Transaction. The purpose of this letter is to outline the manner in which Buye, purposes to purchase certain assets of Selller. Buyer and Seller recognize that the transaction will require further documentation and approvals, including the preparation and approval of a formal agreement setting for the terms and conditions of the proposed purchase in more detail the "Purchase Agreement"); but buyer and Seller execute this letter to evidence their intention to proceed in mutual good faith.

Washington Letter regarding sale of assets - Asset Purchase Transaction

Description

How to fill out Letter Regarding Sale Of Assets - Asset Purchase Transaction?

It is feasible to invest numerous hours online attempting to locate the legal document template that meets the state and federal requirements you desire.

US Legal Forms offers thousands of legal documents that have been evaluated by experts.

You can indeed obtain or create the Washington Letter regarding the sale of assets - Asset Purchase Transaction from my services.

First, ensure that you have selected the correct document template for the region/city of your choice. Read the form details to confirm you have chosen the appropriate form. If available, use the Preview button to view the document template as well.

- If you already possess a US Legal Forms account, you may Log In and then click the Download button.

- Afterward, you may complete, edit, create, or sign the Washington Letter regarding the sale of assets - Asset Purchase Transaction.

- Every legal document template you acquire is yours permanently.

- To obtain another version of an acquired form, visit the My documents tab and then click the associated button.

- If you are utilizing the US Legal Forms website for the first time, follow the simple instructions below.

Form popularity

FAQ

In an asset acquisition, the buyer is able to specify the liabilities it is willing to assume, while leaving other liabilities behind. In a stock purchase, on the other hand, the buyer purchases stock in a company that may have unknown or uncertain liabilities.

Buyers often prefer asset sales because they can avoid inheriting potential liability that they would inherit through a stock sale. They may want to avoid potential disputes such as contract claims, product warranty disputes, product liability claims, employment-related lawsuits and other potential claims.

In an asset purchase or acquisition, the buyer only buys the specific assets and liabilities listed in the purchase agreement. So, it's possible for there to be a liability transfer from the seller to the buyer. Undocumented and contingent liabilities, however, are not included.

While buyer's counsel typically prepares the first draft of an asset purchase agreement, there may be circumstances (such as an auction) when seller's counsel prepares the first draft.

In an asset purchase, the buyer agrees to purchase specific assets and liabilities. This means that they only take on the risks of those specific assets. This could include equipment, fixtures, furniture, licenses, trade secrets, trade names, accounts payable and receivable, and more.

Buying assets of a business entails purchasing items such as property, fixtures, equipment, and customer and client goodwill. This results in the previous owner's business ceasing to exist. Your business takes over with all the old business' assets.

In an asset sale, you retain the legal entity of the business and only sell the business' assets. For example, say you run a rental car company owned by Harry Smith Pty Ltd. You decide that you need to sell 50% of your fleet to upgrade your vehicles and want to sell those vehicles in one transaction to one buyer.

Provisions of an APA may include payment of purchase price, monthly installments, liens and encumbrances on the assets, condition precedent for the closing, etc. An APA differs from a stock purchase agreement (SPA) under which company shares, title to assets, and title to liabilities are also sold.

In an asset sale, the seller retains possession of the legal entity and the buyer purchases individual assets of the company, such as equipment, fixtures, leaseholds, licenses, goodwill, trade secrets, trade names, telephone numbers, and inventory.

In an asset sale, a firm sells some or all of its actual assets, either tangible or intangible. The seller retains legal ownership of the company that has sold the assets but has no further recourse to the sold assets. The buyer assumes no liabilities in an asset sale.