New Jersey Private Client General Asset Management Agreement

Description

How to fill out Private Client General Asset Management Agreement?

Have you ever been in a situation where you require documents for business or personal needs almost daily.

There are many authentic document templates accessible online, but finding versions you can rely on is challenging.

US Legal Forms provides thousands of form templates, including the New Jersey Private Client General Asset Management Agreement, designed to comply with state and federal regulations.

Once you find the correct form, simply click Get now.

Choose the pricing plan you desire, fill out the necessary details to create your account, and complete the purchase using PayPal or a credit card. Select a convenient file format and download your version. You can find all of the document templates you have purchased in the My documents section. You can obtain an additional copy of the New Jersey Private Client General Asset Management Agreement whenever you need it. Just click the appropriate form to download or print the template. Utilize US Legal Forms, one of the largest collections of official forms, to save time and avoid errors. This service provides accurately designed legal document templates that can be used for various purposes. Create your account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the New Jersey Private Client General Asset Management Agreement template.

- If you do not have an account and want to start using US Legal Forms, follow these instructions.

- Locate the form you need and ensure it is for the correct city/county.

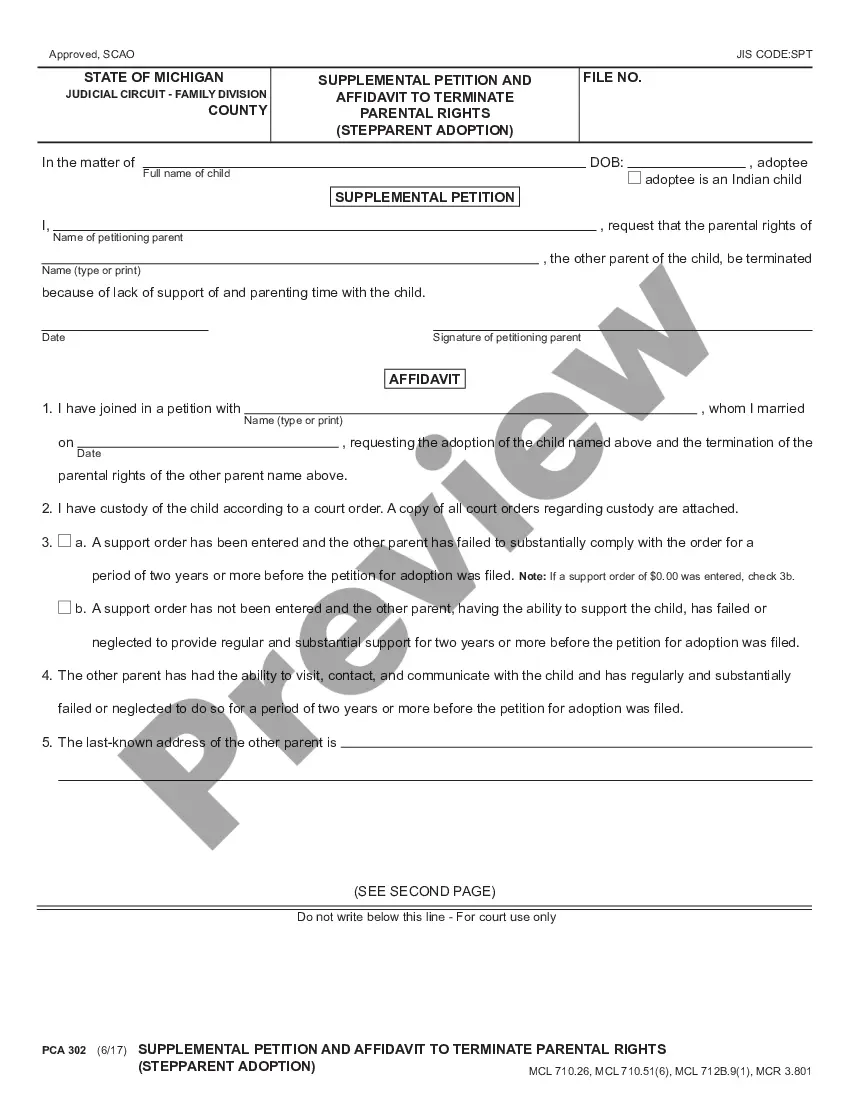

- Use the Review button to examine the form.

- Read the description to confirm you have selected the correct template.

- If the form is not what you are looking for, use the Search field to find the template that suits your requirements.

Form popularity

FAQ

The private fund regime in Jersey is a framework that governs the operation of private investment funds. It allows funds to operate with fewer restrictions while ensuring necessary protections for investors. This regime complements the New Jersey Private Client General Asset Management Agreement, facilitating a smooth and compliant investment process for private clients seeking bespoke asset management solutions.

Yes, a Jersey Private Fund (JPF) is regulated under Jersey's financial laws. These regulations ensure that the fund operates transparently and in the best interest of the investors. When dealing with investments, understanding the regulatory environment is vital, which is where the New Jersey Private Client General Asset Management Agreement can provide clarity and security for clients.

The Investment Management Agreement (IMA) defines the relationship between a client and an asset manager. This agreement outlines the terms under which the manager will manage assets on behalf of the client, including investment strategies and fees. It serves as a crucial foundation for ensuring compliance and protecting the client's interests, especially within the framework of the New Jersey Private Client General Asset Management Agreement.

The fiduciary rule in New Jersey mandates that financial advisers act in the best interest of their clients, prioritizing their clients’ financial well-being above their own. This rule is crucial for transparency and trust, especially when establishing a New Jersey Private Client General Asset Management Agreement. Adhering to this rule ensures that asset managers provide unbiased advice, fostering a secure environment for clients' investment decisions.

An asset management contract is a legal agreement that outlines the relationship between a client and their asset manager. This contract specifies the responsibilities of the asset manager to manage and grow the client's investments according to their financial goals. Within the framework of a New Jersey Private Client General Asset Management Agreement, clients can expect tailored strategies that align with their unique needs.

The purpose of a management agreement is to clearly delineate the responsibilities and expectations between parties involved in asset management. This agreement helps in promoting transparency, accountability, and effective collaboration. Using a New Jersey Private Client General Asset Management Agreement allows both parties to understand their roles and protects their interests.

An asset management agreement for natural gas defines the terms under which an asset management company manages a client's natural gas resources. This includes strategies for production, revenue collection, and compliance with industry regulations. By using a New Jersey Private Client General Asset Management Agreement, clients ensure that their natural gas assets are handled with care, aligning with their financial goals.

Asset management in oil and gas involves overseeing and optimizing resources, such as production equipment and financial assets, to maximize value. A key component includes managing risks associated with fluctuating prices and regulatory changes. With the New Jersey Private Client General Asset Management Agreement, clients can establish clear guidelines for how assets are maintained and managed effectively.

The NJ CBT-1065 is required for partnerships doing business in New Jersey. If your partnership is managed under a New Jersey Private Client General Asset Management Agreement, you will need to file this form. Proper disclosure is vital to ensure compliance with state tax regulations. To simplify this process, consider using tools and resources available through uslegalforms.

Residents who earn income in New Jersey must file a NJ 1040 if their income exceeds specific thresholds established by the state. If you’ve established a New Jersey Private Client General Asset Management Agreement, you must also report any income derived from it. Being proactive with your tax filing can help avoid issues later. We recommend reaching out to tax experts or use uslegalforms for assistance.