Washington State has two Instructions for completing the Workers' Compensation Employer's Quarterly Report: 1. Quarterly Report of Wages Paid: This form requires employers to report all wages paid to employees during the reporting period. Employers must include each employee’s name, Social Security Number, and wages paid for the quarter. This form must be completed and submitted to the Washington State Department of Labor and Industries by the end of the quarter. 2. Report of Workers’ Compensation Claims: This form requires employers to report any workers’ compensation claims filed during the reporting period. Employers must include the date of injury, employee name, type of injury, and amount of claim. This form must be completed and submitted to the Washington State Department of Labor and Industries by the end of the quarter. Both forms must be completed and submitted to the Washington State Department of Labor and Industries by the end of the quarter. Failure to submit the forms can result in late fees and penalties.

Washington Instructions for completing the Workers' Compensation Employer's Quarterly Report

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Washington Instructions For Completing The Workers' Compensation Employer's Quarterly Report?

Handling official documentation requires attention, precision, and using well-drafted blanks. US Legal Forms has been helping people countrywide do just that for 25 years, so when you pick your Washington Instructions for completing the Workers' Compensation Employer's Quarterly Report template from our library, you can be certain it complies with federal and state laws.

Dealing with our service is simple and quick. To get the necessary paperwork, all you’ll need is an account with a valid subscription. Here’s a brief guide for you to find your Washington Instructions for completing the Workers' Compensation Employer's Quarterly Report within minutes:

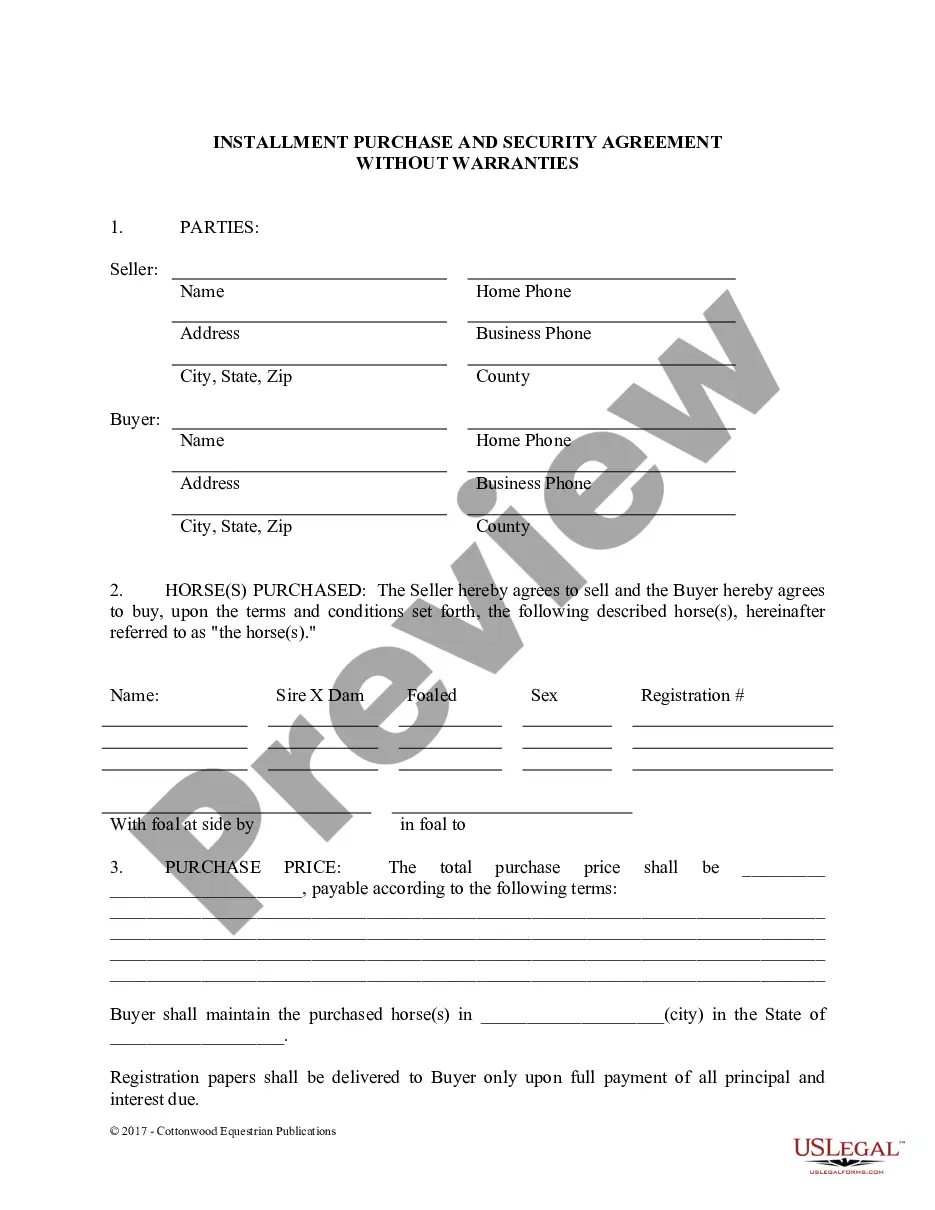

- Make sure to attentively examine the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Search for another formal blank if the previously opened one doesn’t suit your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the Washington Instructions for completing the Workers' Compensation Employer's Quarterly Report in the format you need. If it’s your first experience with our service, click Buy now to proceed.

- Create an account, decide on your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to save your form and click Download. Print the blank or upload it to a professional PDF editor to prepare it electronically.

All documents are drafted for multi-usage, like the Washington Instructions for completing the Workers' Compensation Employer's Quarterly Report you see on this page. If you need them one more time, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and prepare your business and personal paperwork rapidly and in total legal compliance!

Form popularity

FAQ

5 a.m. ? 9 p.m. Exception: Youth 14-17 years old are allowed to work 7 days a week in dairy, livestock, hay harvest, and irrigation during school and non-school weeks.

Here's how L&I calculates the premium rate for each of the business's risk classifications: Multiplying the business's experience factor by the sum of the Accident Fund, Medical Aid Fund, and Stay at Work base rates, and then. Adding the base rate for the Supplemental Pension Fund.

Important: Employers by law must report to L&I the death or in-patient hospitalization of any worker (within 8 hours) and any non-hospitalized amputation or loss of eye (within 24 hours) due to an on-the-job injury by calling 1-800-423-7233.

Online via our FileFast tool. By phone: 1-877-561-FILE (3453) At your doctor's office (if you complete the Report of Accident at your doctor's office, the doctor files the form for you)

Washington State Form F212-055-000 - Quarterly Report for Industrial Insurance. Washington State Forms 5208A and 5208B, Employer's Quarterly Tax and Wage Detail Reports.

L&I manages all claims and pays benefits out of an insurance pool called the Washington State Fund. The fund is financed by premiums paid by employers and employees, not by general revenue taxes.

Washington State Form F212-055-000 - Quarterly Report for Industrial Insurance - CFS Tax Software, Inc.