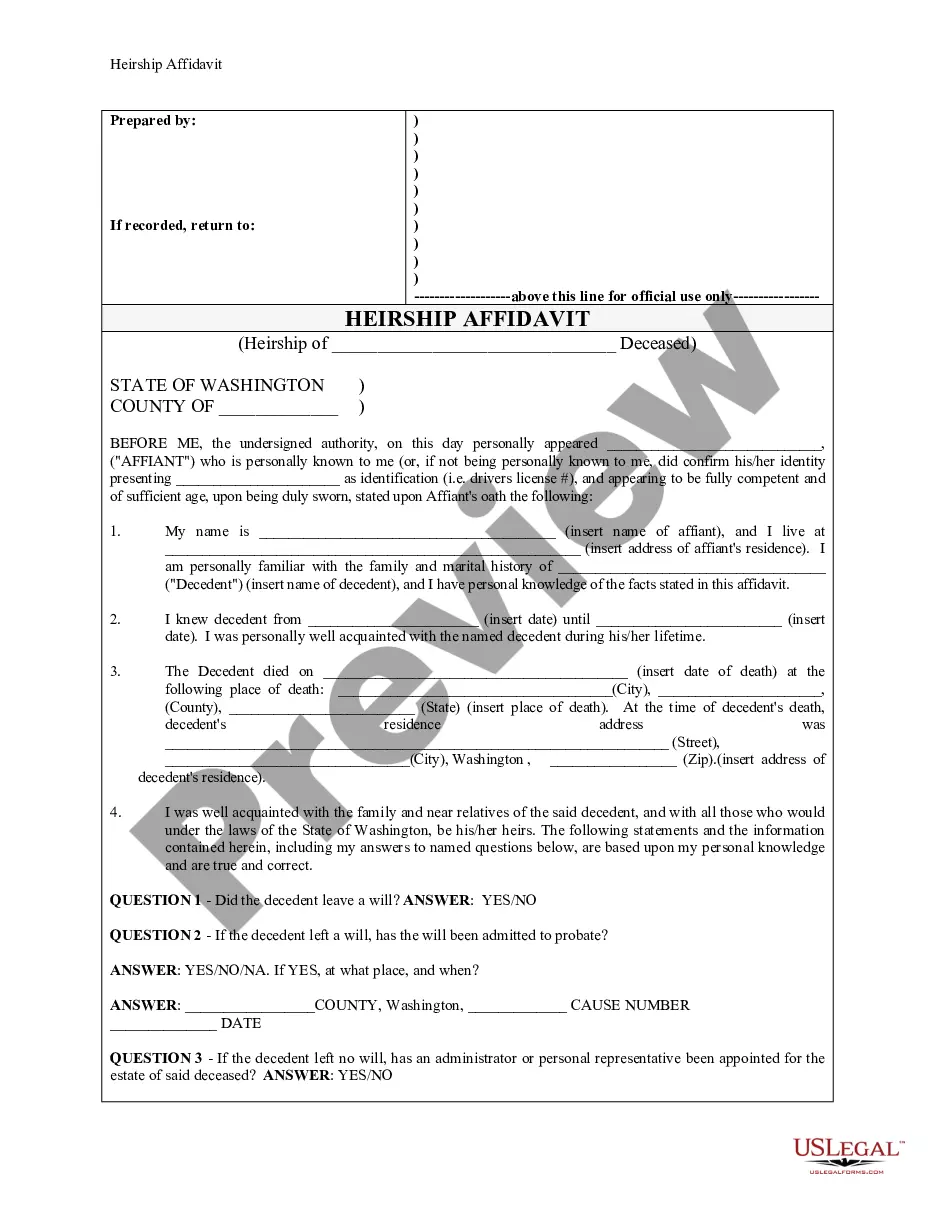

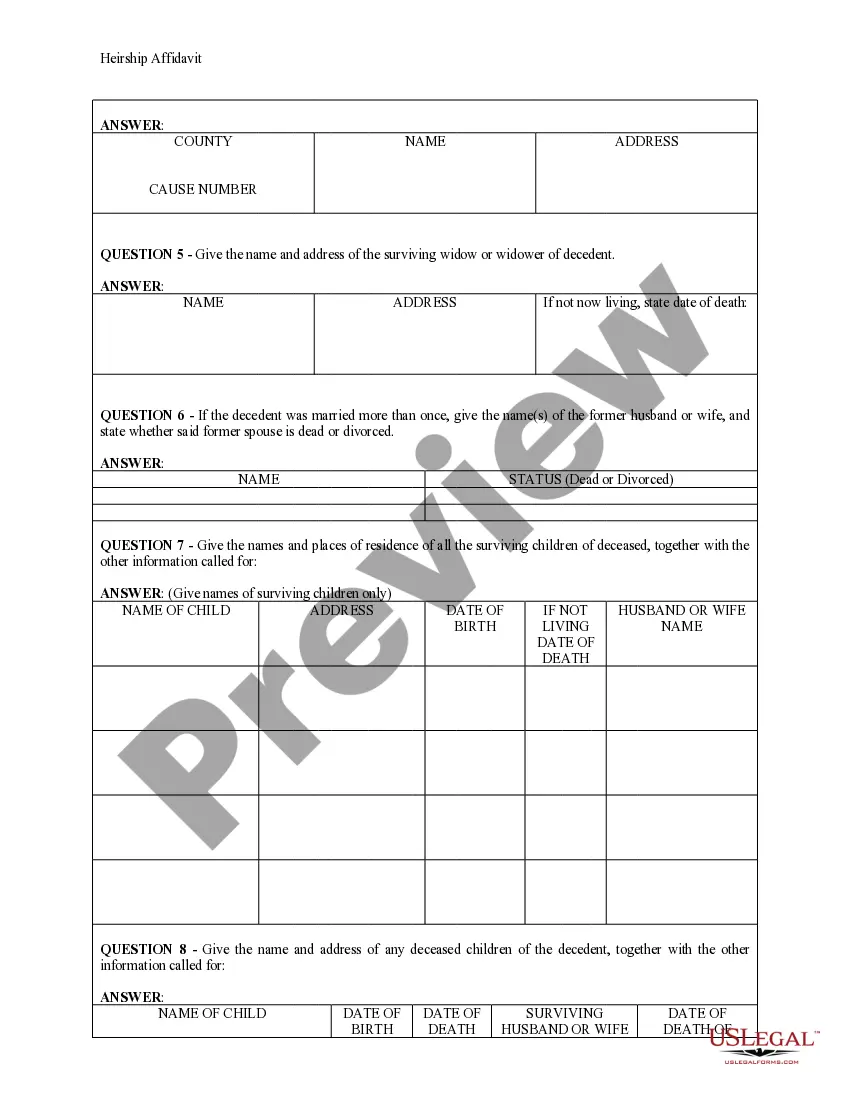

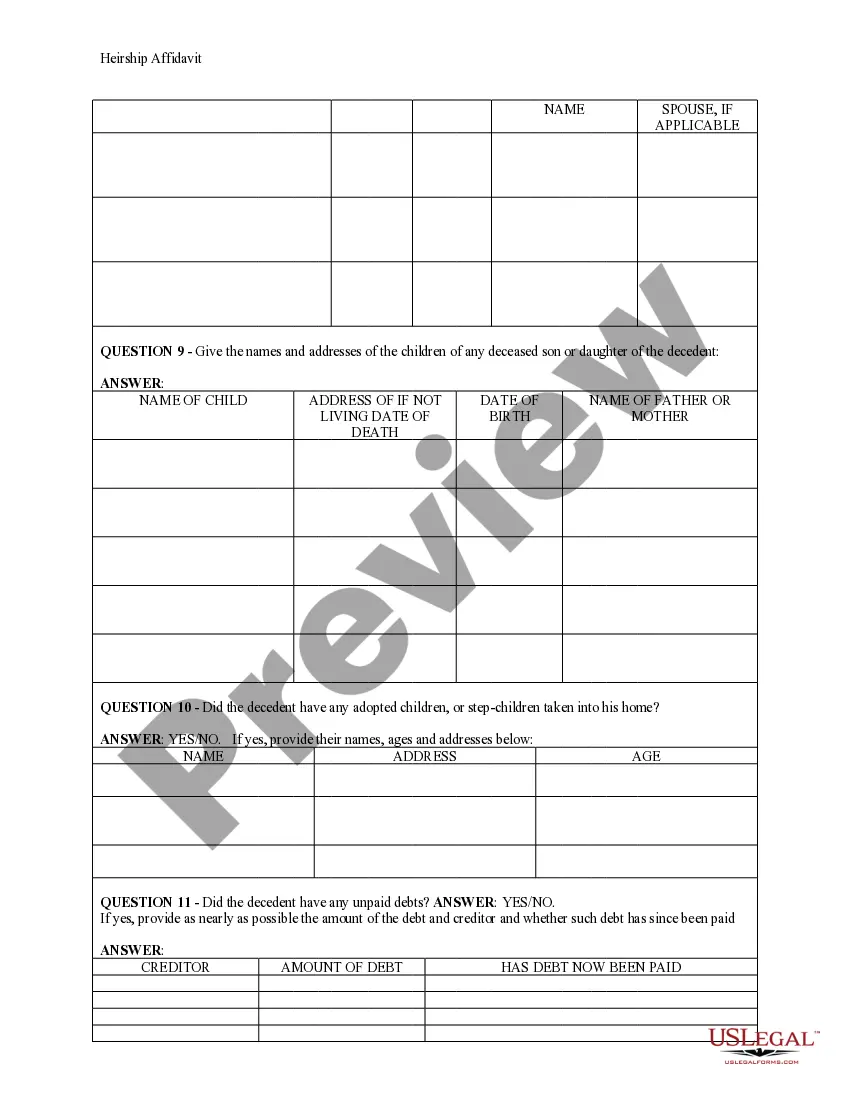

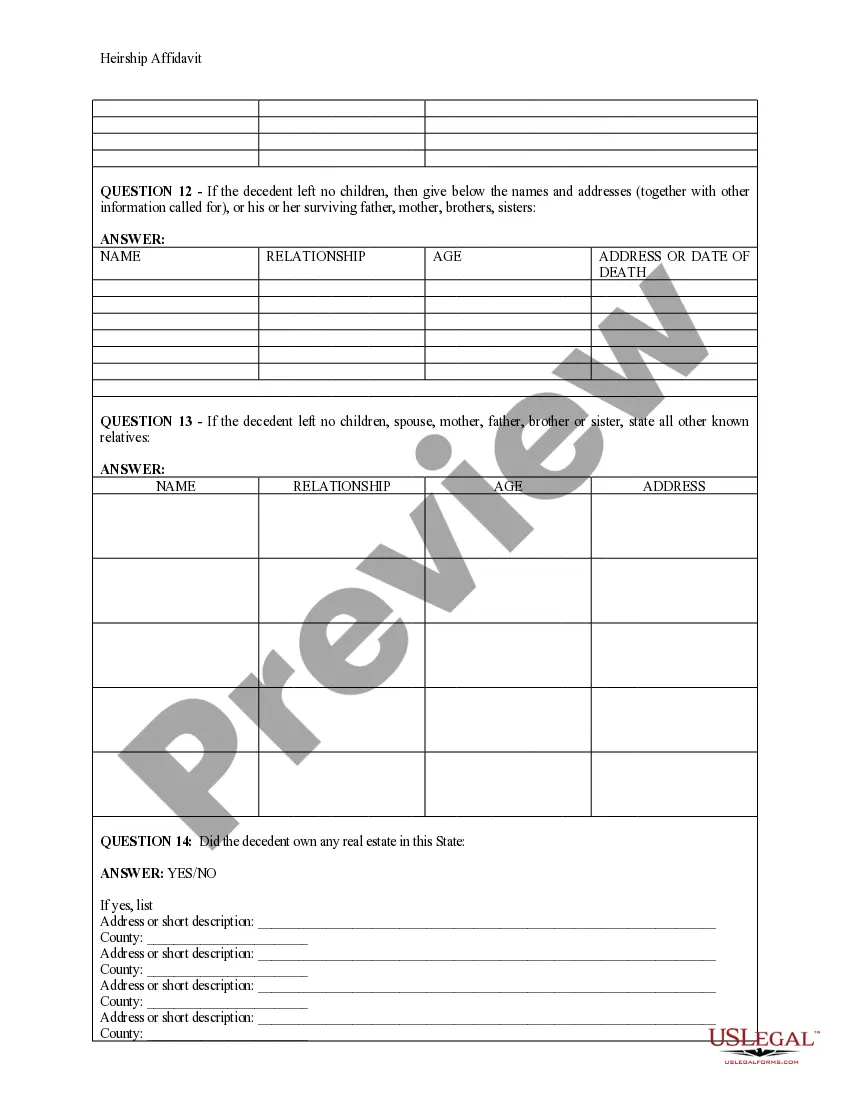

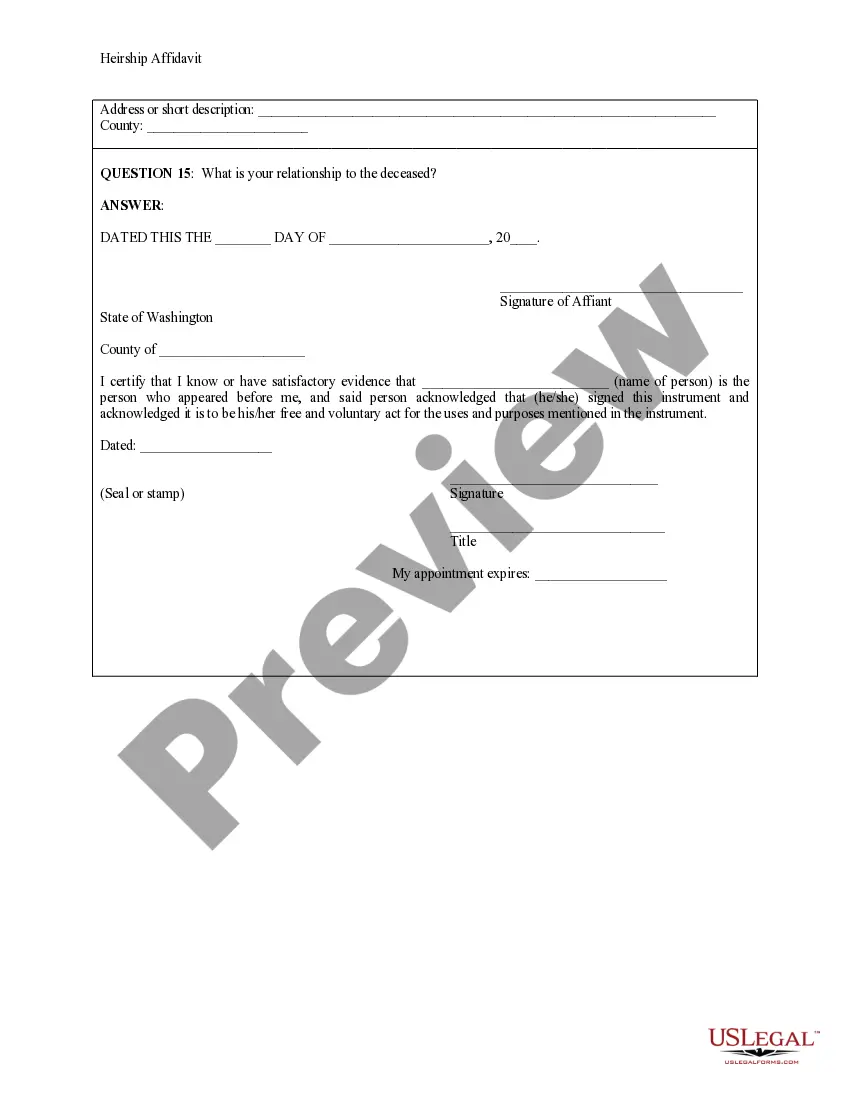

This Heirship Affidavit form is for a person to complete stating the heirs of a deceased person. The Heirship Affidavit is commonly used to establish ownership of personal and real property. It may be recorded in official land records, if necessary. Example of use: Person A dies without a will, leaves a son and no estate is opened. When the son sells the land, the son obtains an heirship affidvait to record with the deed. The person executing the affidavit should normally not be an heir of the deceased, or other person interested in the estate.

Washington Heirship Affidavit - Descent

Description

How to fill out Washington Heirship Affidavit - Descent?

Out of the multitude of platforms that offer legal samples, US Legal Forms provides the most user-friendly experience and customer journey while previewing templates before buying them. Its complete library of 85,000 samples is categorized by state and use for simplicity. All of the documents on the service have been drafted to meet individual state requirements by licensed lawyers.

If you have a US Legal Forms subscription, just log in, search for the template, hit Download and get access to your Form name in the My Forms; the My Forms tab holds all your saved forms.

Keep to the tips listed below to obtain the form:

- Once you discover a Form name, make certain it’s the one for the state you need it to file in.

- Preview the template and read the document description just before downloading the template.

- Search for a new template using the Search field if the one you have already found isn’t correct.

- Click on Buy Now and choose a subscription plan.

- Create your own account.

- Pay using a credit card or PayPal and download the template.

Once you have downloaded your Form name, it is possible to edit it, fill it out and sign it in an online editor that you pick. Any form you add to your My Forms tab might be reused multiple times, or for as long as it continues to be the most updated version in your state. Our platform offers easy and fast access to templates that suit both lawyers as well as their clients.

Form popularity

FAQ

When you use a small estate affidavit , you have to pay the decedent's bills before paying money to anyone else. For example, the decedent might have owed money to a credit card company when they died. If you use the small estate affidavit, you must give money from the estate to pay the credit card company.

Does an affidavit of heirship need to be recorded in Texas? Yes, after the affidavit is signed and executed, it must be filed with the county deed records where the decedent's real property is located.

1. This form should be completed by someone other than an Heir. This person should be someone who is familiar with the family history of the deceased (decedent), and who will obtain no benefit from the Estate. The person who fills out the form is referred to as the AFFIANT.

Harris County Civil Courthouse. 201 Caroline, Suite 800. (713) 274-8585.

An affidavit of heirship must be filed with the real property records in the county where the land is located. Call the county clerk and ask how much their filing fees are. The filing fees vary from county to county.

An affidavit of heirship should be signed by two disinterested witnesses. To qualify as a disinterested witness, one must be knowledgeable about the deceased and his or her family history, but cannot benefit financially from the estate.

In most states, however, there is the option to use a small estate affidavit when the assets of the estate are under a certain dollar amount, which varies by state. An attorney is not required to file a small estate affidavit, although it may be helpful to consult with one prior to filing the small estate affidavit.

Maximum $100,000. Laws Section 11.62.010. Step 1 Write in your name at the top (successor's name) Step 2 Write in the state and county. Step 3 Write in your name again. Step 4 Write in the name of the decedent in Section 1 as well as decedent's SSN. Step 5 Write in your name and address.

A fee of $15 for the first page and $4 for each additional page is common. Ask if you can file the two affidavits of heirship as one document. Some counties let you file the two affidavits of heirship as one document if the decedent and property descriptions are the same.