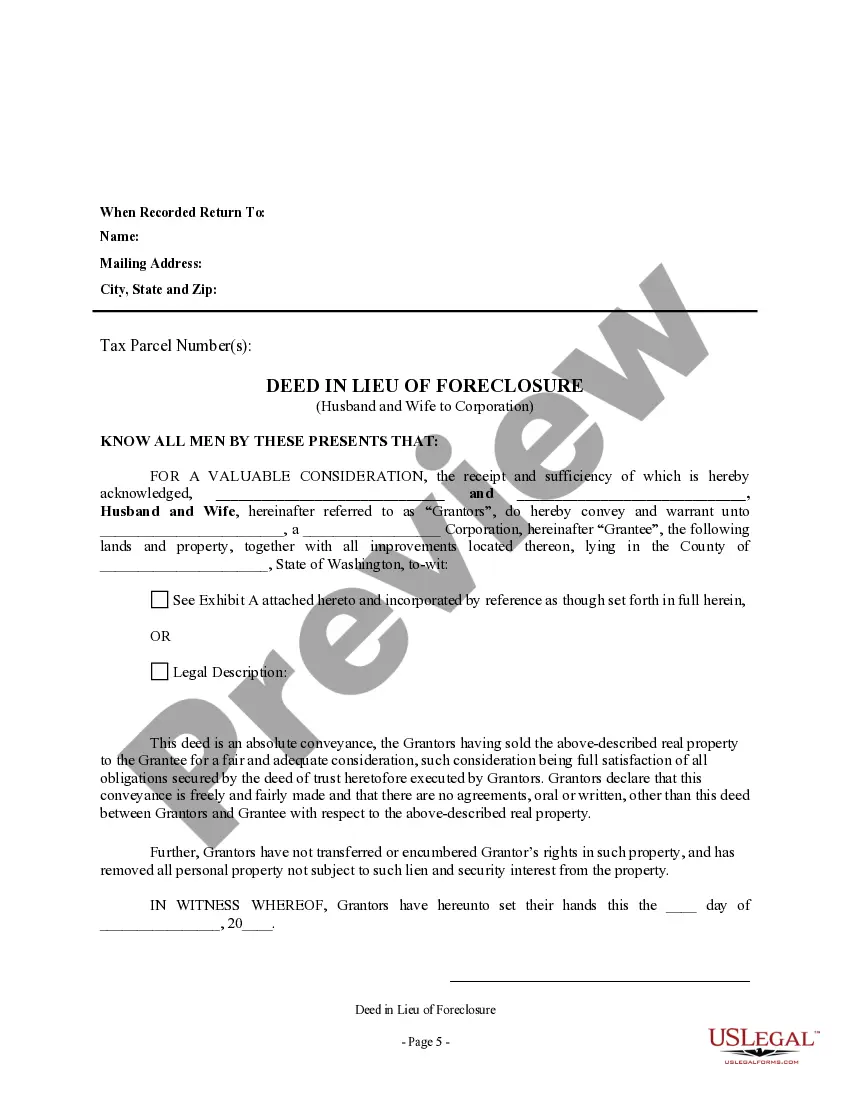

This form is used as a method for a lienholder of property to avoid a lengthy and expensive foreclosure process. With a deed in lieu of foreclosure, a foreclosing lienholder agrees to have the ownership interest transferred to the bank/lienholder as payment in full. The debtor simply deeds the property to the bank as a substitute for foreclosure.

Washington Deed in Lieu of Foreclosure - Husband and Wife to Corporation

Description

How to fill out Washington Deed In Lieu Of Foreclosure - Husband And Wife To Corporation?

Out of the large number of services that provide legal samples, US Legal Forms provides the most user-friendly experience and customer journey when previewing templates prior to buying them. Its extensive library of 85,000 templates is grouped by state and use for efficiency. All the documents available on the service have already been drafted to meet individual state requirements by qualified legal professionals.

If you have a US Legal Forms subscription, just log in, search for the template, press Download and access your Form name in the My Forms; the My Forms tab holds all of your saved forms.

Stick to the tips below to obtain the document:

- Once you discover a Form name, make certain it is the one for the state you need it to file in.

- Preview the template and read the document description prior to downloading the sample.

- Search for a new sample through the Search field in case the one you’ve already found is not appropriate.

- Just click Buy Now and select a subscription plan.

- Create your own account.

- Pay with a credit card or PayPal and download the document.

After you have downloaded your Form name, you may edit it, fill it out and sign it in an online editor that you pick. Any form you add to your My Forms tab might be reused multiple times, or for as long as it remains the most up-to-date version in your state. Our service provides quick and simple access to templates that suit both attorneys and their clients.

Form popularity

FAQ

Final Thoughts On Deed In Lieu Of Foreclosure When you take a deed in lieu agreement, you transfer your home's deed to your lender voluntarily. In exchange, the lender agrees to forgive the amount left on your loan. A deed in lieu agreement won't stay on your credit report if a foreclosure will.

A deed in lieu of foreclosure is different from a short sale because it transfers the property to the lender instead of selling it to a new buyer.Similar to a short sale, a deed in lieu of foreclosure likely will not damage your credit as severely as a foreclosure or a bankruptcy.

Rather than deal with the foreclosure process, I would like to give you the deed to my home, in exchange for forgiveness on the loan. I do not have a second mortgage, and there are no other liens on the property. I have attached all relevant documents for the house and for my current economic situation.

The deed in lieu of foreclosure offers several advantages to both the borrower and the lender. The principal advantage to the borrower is that it immediately releases him/her from most or all of the personal indebtedness associated with the defaulted loan.

The waiting period on a conventional loan after a deed in lieu is 4 years, compared to 7 years on a conventional loan.

C. The purchaser must pay off both the mortgage and junior lienholders after the sale. What is a major disadvantage to lenders of accepting a deed in lieu of foreclosure?The lender gains rights to private mortgage insurance.

A hardship letter should Start by stating the purpose of the letter whether it is a loan modification or a short sale so the lender knows what homeowners want. It should say something like I need to restructure my mortgage and obtain a lower, fixed interest rate2026, in a way that force them to find out why.