Washington Personal Property Security Agreement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

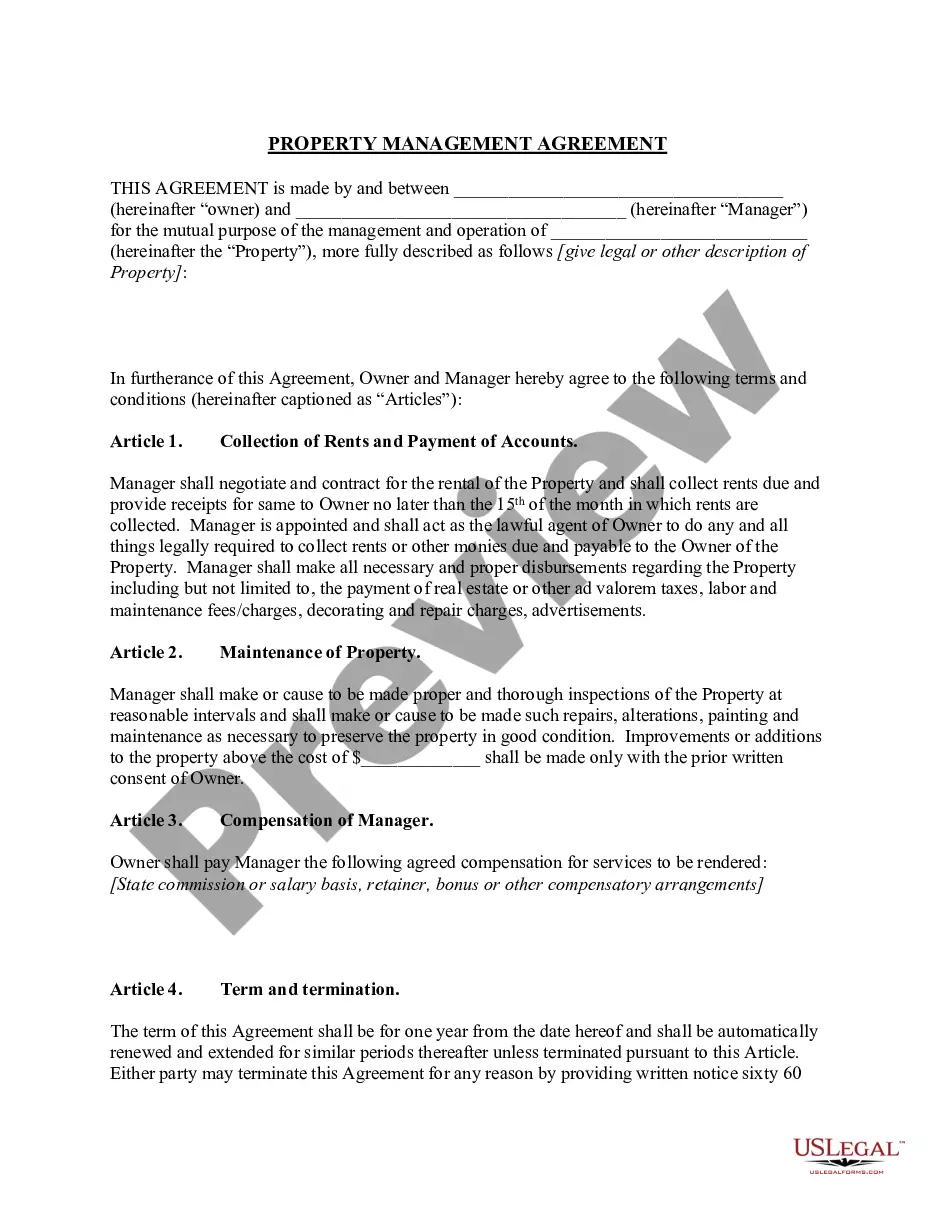

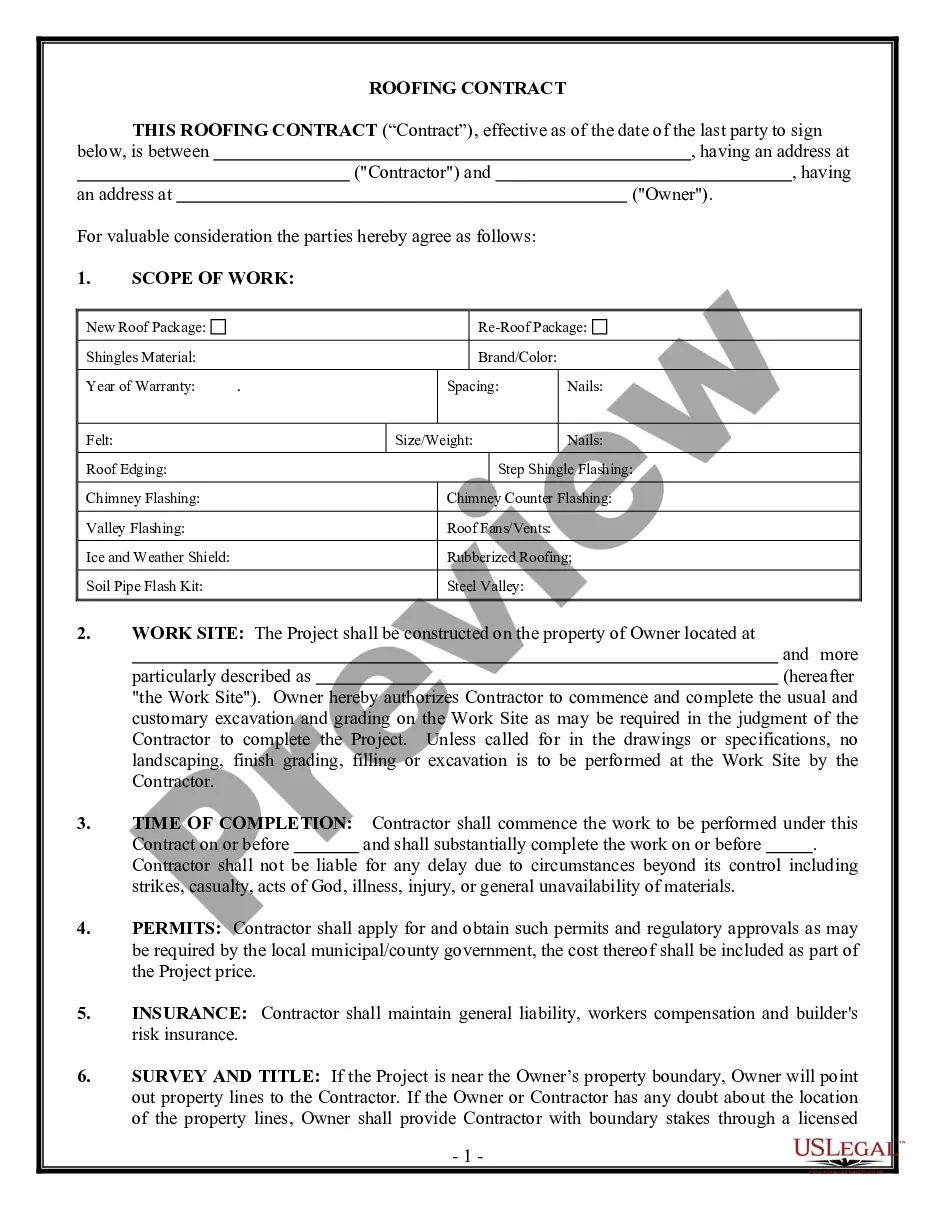

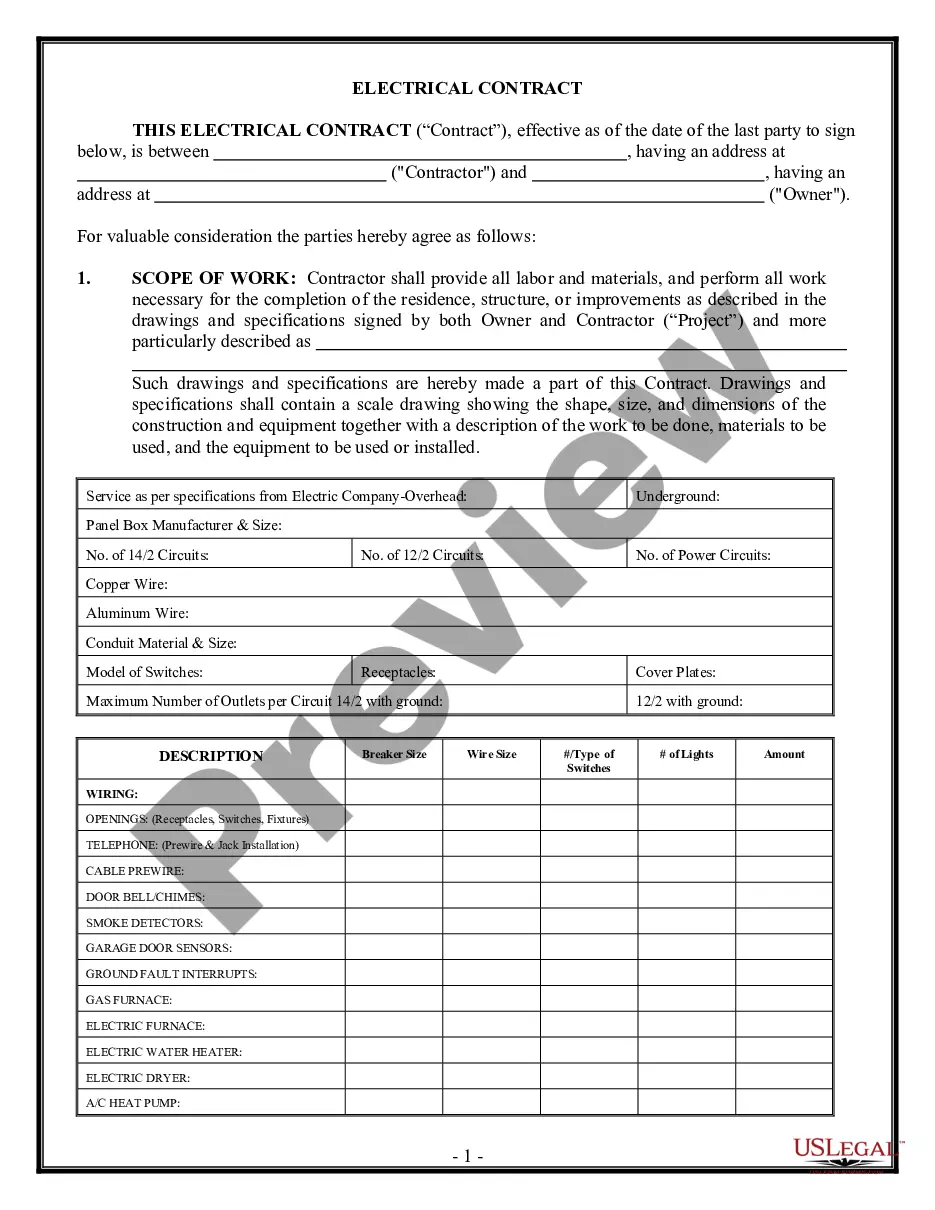

Looking for another form?

How to fill out Washington Personal Property Security Agreement?

How much time and resources do you often spend on drafting official documentation? There’s a greater opportunity to get such forms than hiring legal experts or spending hours browsing the web for a proper blank. US Legal Forms is the leading online library that provides professionally designed and verified state-specific legal documents for any purpose, like the Washington Personal Property Security Agreement.

To get and complete an appropriate Washington Personal Property Security Agreement blank, adhere to these simple instructions:

- Look through the form content to make sure it meets your state requirements. To do so, read the form description or take advantage of the Preview option.

- If your legal template doesn’t meet your requirements, find another one using the search bar at the top of the page.

- If you already have an account with us, log in and download the Washington Personal Property Security Agreement. Otherwise, proceed to the next steps.

- Click Buy now once you find the right blank. Select the subscription plan that suits you best to access our library’s full opportunities.

- Register for an account and pay for your subscription. You can make a payment with your credit card or through PayPal - our service is totally safe for that.

- Download your Washington Personal Property Security Agreement on your device and fill it out on a printed-out hard copy or electronically.

Another benefit of our library is that you can access previously acquired documents that you securely keep in your profile in the My Forms tab. Get them anytime and re-complete your paperwork as often as you need.

Save time and effort completing official paperwork with US Legal Forms, one of the most trustworthy web services. Sign up for us now!

Form popularity

FAQ

A security agreement may be oral if the secured party (the lender) has actual physical possession of the collateral.

Security agreements are a necessary part of the business world, as lenders would never extend credit to certain companies without them. In the event that the borrower defaults, the pledged collateral can be seized by the lender and sold.

Certain specific requirements are required for the security agreement to form the foundation for a valid security interest, namely 1) it must be signed, 2) it must clearly state that a security interest is intended, and 3) it must contain a sufficient description of the collateral subject to the security interest.

A ?SECURITY AGREEMENT? is an agreement that. creates or provides for an interest in personal property. that secures payment or performance of an obligation.

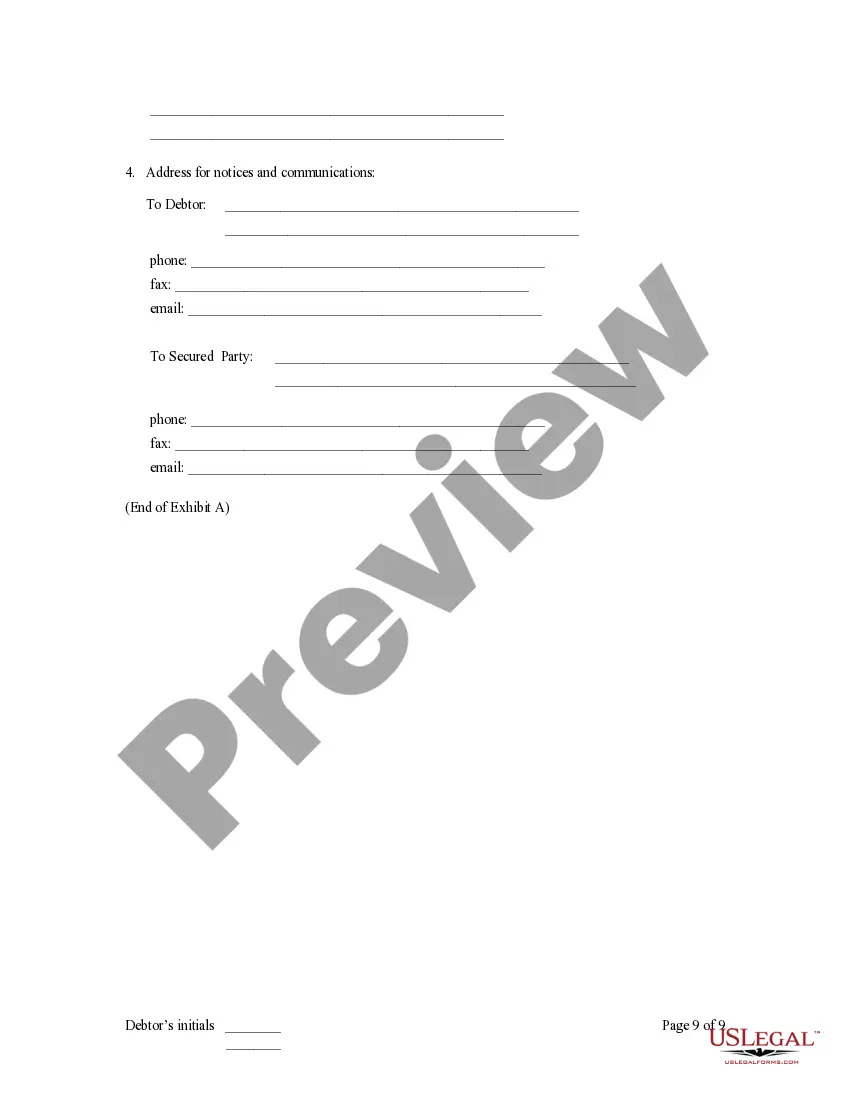

The security agreement must: be signed (or authenticated) by the debtor and the owner of the property, contain a description of the collateral and. make it clear that a security interest is intended.

A statute of frauds within UCC Article 9 requires the security agreement be in writing. An exception to this requirement is when a security interest is pledged.

In general: (1) the creditor must give value, (2) the debtor must have rights in the collateral, and (3) there must be a security agreement or other action indicating an intent to convey a security interest. Once the security interest has ?attached,? it is effective between the debtor and the creditor.

Signature Required. A signature of the debtor, and the owner of the collateral if the owner is different party, must sign the security agreement in order for the security agreement to be effective. This is obviously important, and it is a strict rule.