Vermont Assignment of Overriding Royalty Interest (No Proportionate Reduction)

Description

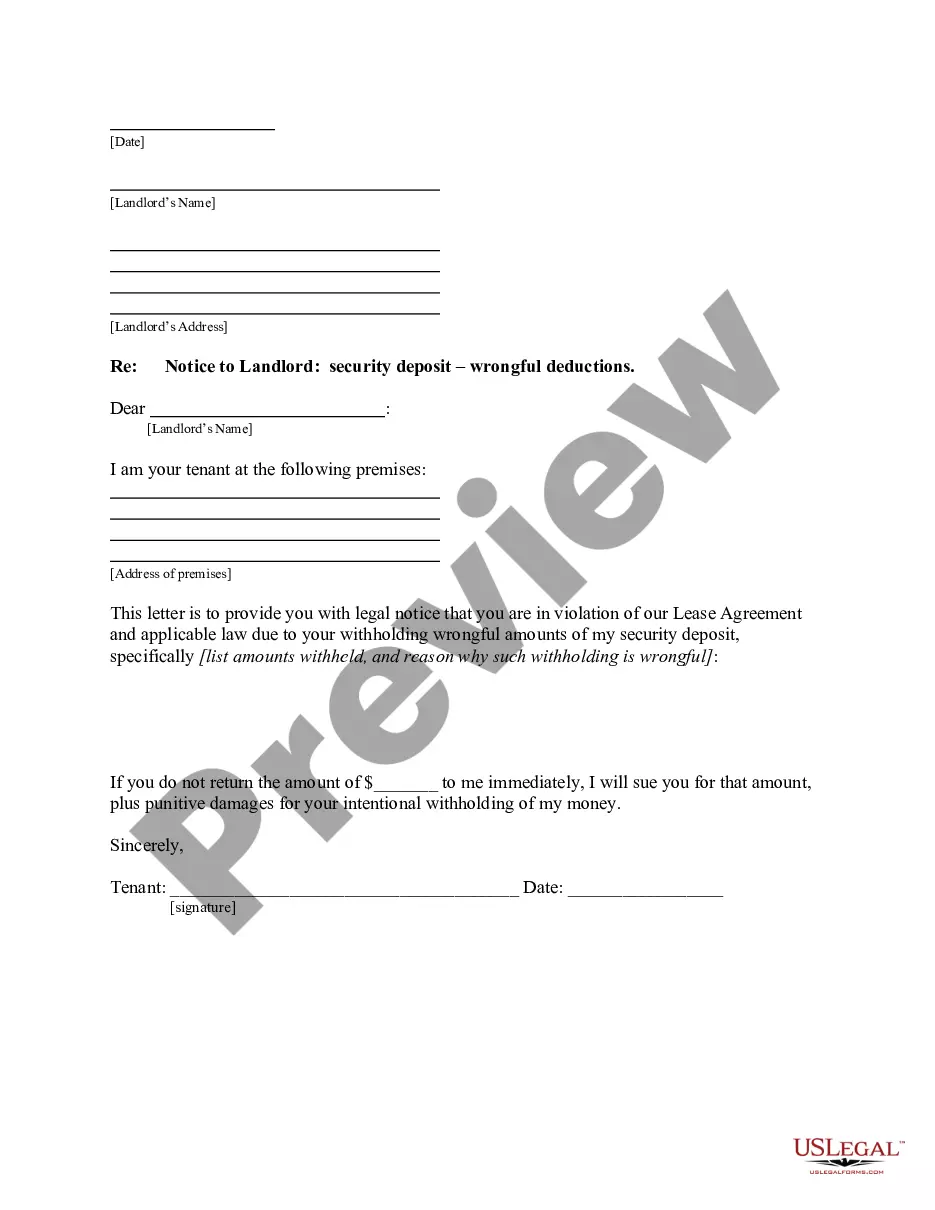

How to fill out Assignment Of Overriding Royalty Interest (No Proportionate Reduction)?

Choosing the right legitimate papers template can be quite a struggle. Obviously, there are plenty of themes available on the net, but how would you get the legitimate type you want? Make use of the US Legal Forms site. The services provides 1000s of themes, such as the Vermont Assignment of Overriding Royalty Interest (No Proportionate Reduction), that can be used for business and private needs. All of the kinds are checked by pros and satisfy federal and state requirements.

In case you are presently listed, log in to the accounts and click on the Down load button to have the Vermont Assignment of Overriding Royalty Interest (No Proportionate Reduction). Use your accounts to search from the legitimate kinds you may have purchased in the past. Visit the My Forms tab of your accounts and have another duplicate of the papers you want.

In case you are a new user of US Legal Forms, allow me to share simple directions that you can follow:

- First, be sure you have selected the correct type for your city/area. You are able to look through the form using the Review button and look at the form information to guarantee this is the best for you.

- In the event the type does not satisfy your expectations, use the Seach discipline to obtain the proper type.

- Once you are positive that the form would work, click the Get now button to have the type.

- Pick the prices program you would like and enter the needed information. Build your accounts and purchase an order with your PayPal accounts or Visa or Mastercard.

- Pick the file file format and obtain the legitimate papers template to the system.

- Total, edit and print and indicator the received Vermont Assignment of Overriding Royalty Interest (No Proportionate Reduction).

US Legal Forms will be the greatest catalogue of legitimate kinds where you will find different papers themes. Make use of the service to obtain skillfully-manufactured files that follow state requirements.

Form popularity

FAQ

To calculate the number of net royalty acres I'm selling, I use this formula: [acres in tract] X [% of minerals owned] X 8 X [royalty interest reserved in lease] X [fraction of royalty interest being sold]. 640 acres X 25% X 8 X 1/4 X 1/2 = 160 net royalty acres.

A gross overriding royalty entitles the owner to a share of the market price of the mined product as at the time they are available to be taken less any costs incurred by the operator to bring the product to the point of sale.

Overriding Royalty Interest (ORRI) A royalty in excess of the royalty provided in the Oil & Gas Lease. Usually, an override is added during an intervening assignment. ORRIs are created out of the working interest in a property and do not affect mineral owners.

Calculating Overriding Royalty Interest An ORRI is a straight percentage. For example, a 2% override would appear on the royalty statement as 0.02 interest in the proceeds from the sale of the leased hydrocarbons.

Overriding Royalty Interests To calculate the ORRI, multiply the gross production revenue by the ORRI interest percentage, and the figure gotten is what the ORRI owner is entitled to.

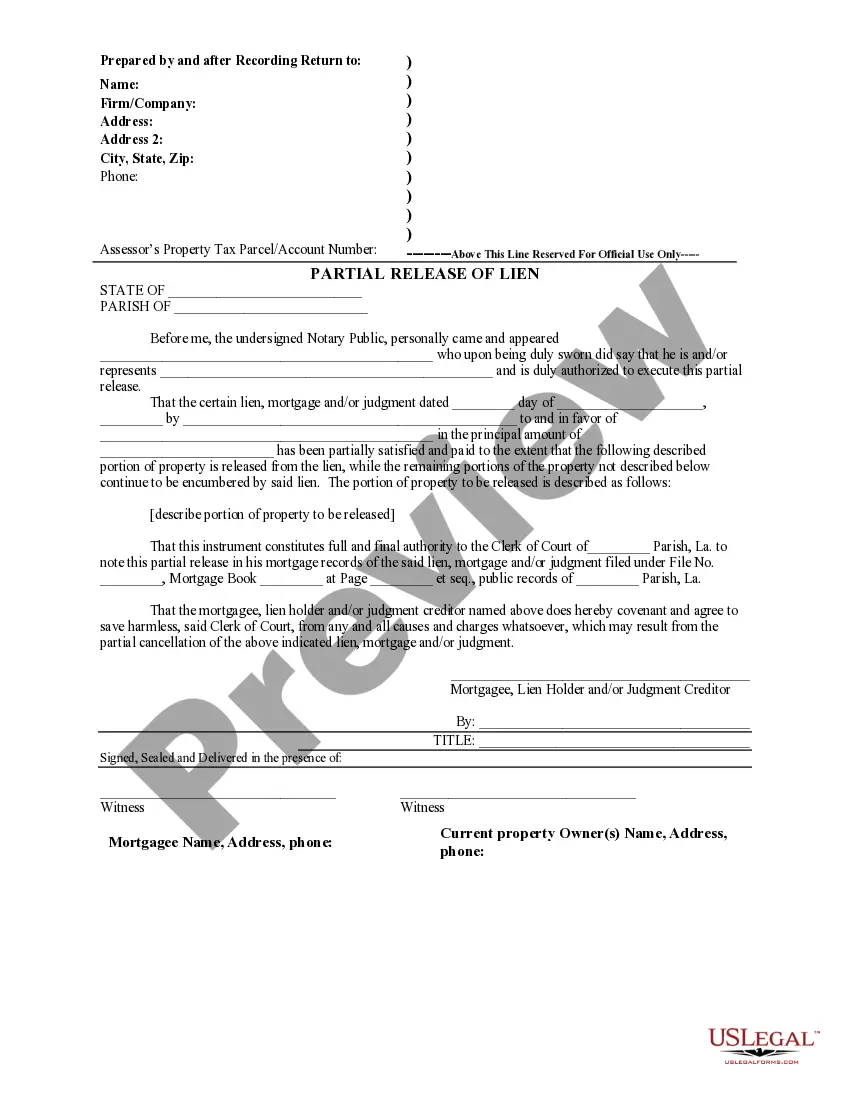

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

Overriding royalty interest: Unlike mineral and royalty interests, an overriding royalty interest runs with a lease and not with the land. Therefore, they only remain in effect for as long as a lease is in effect and they expire when a lease expires.