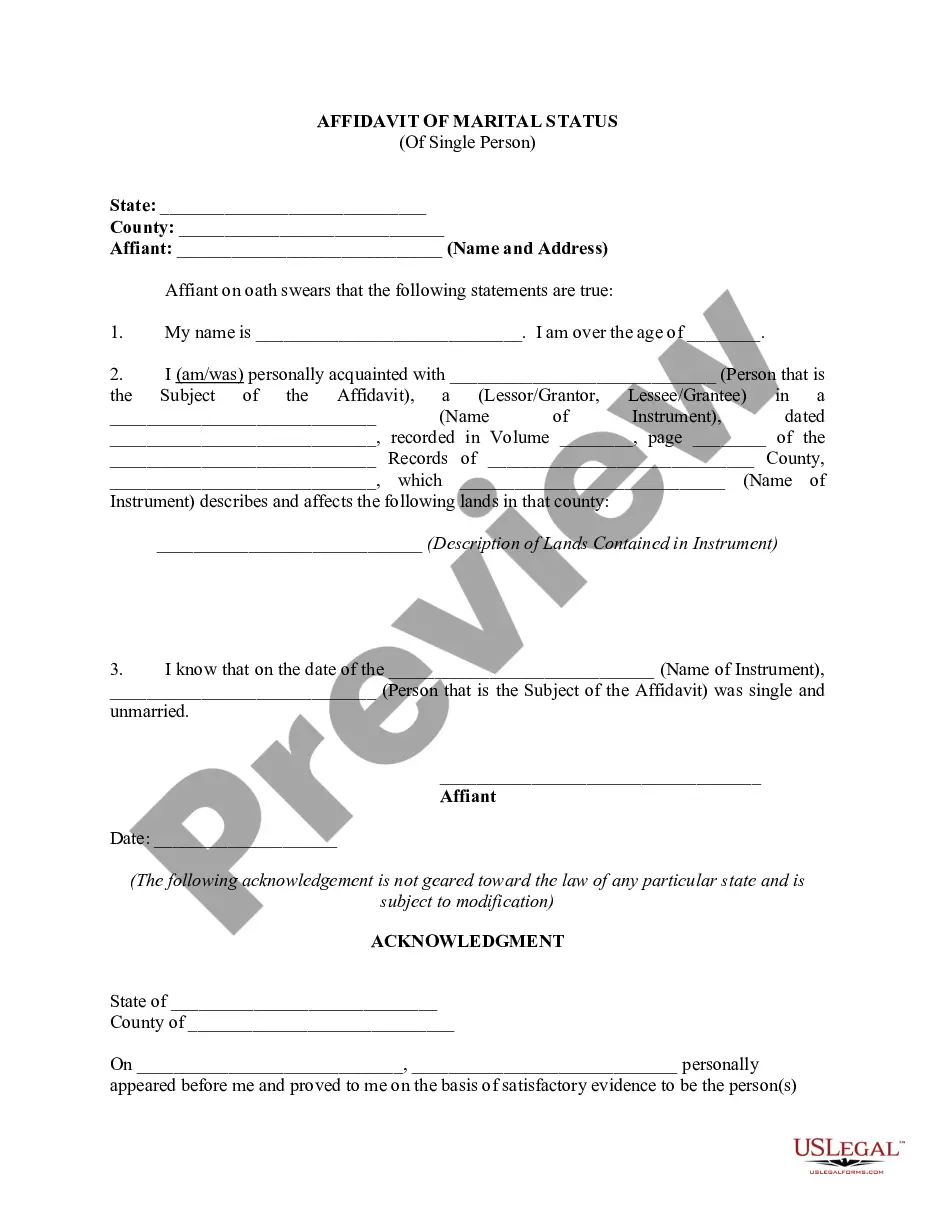

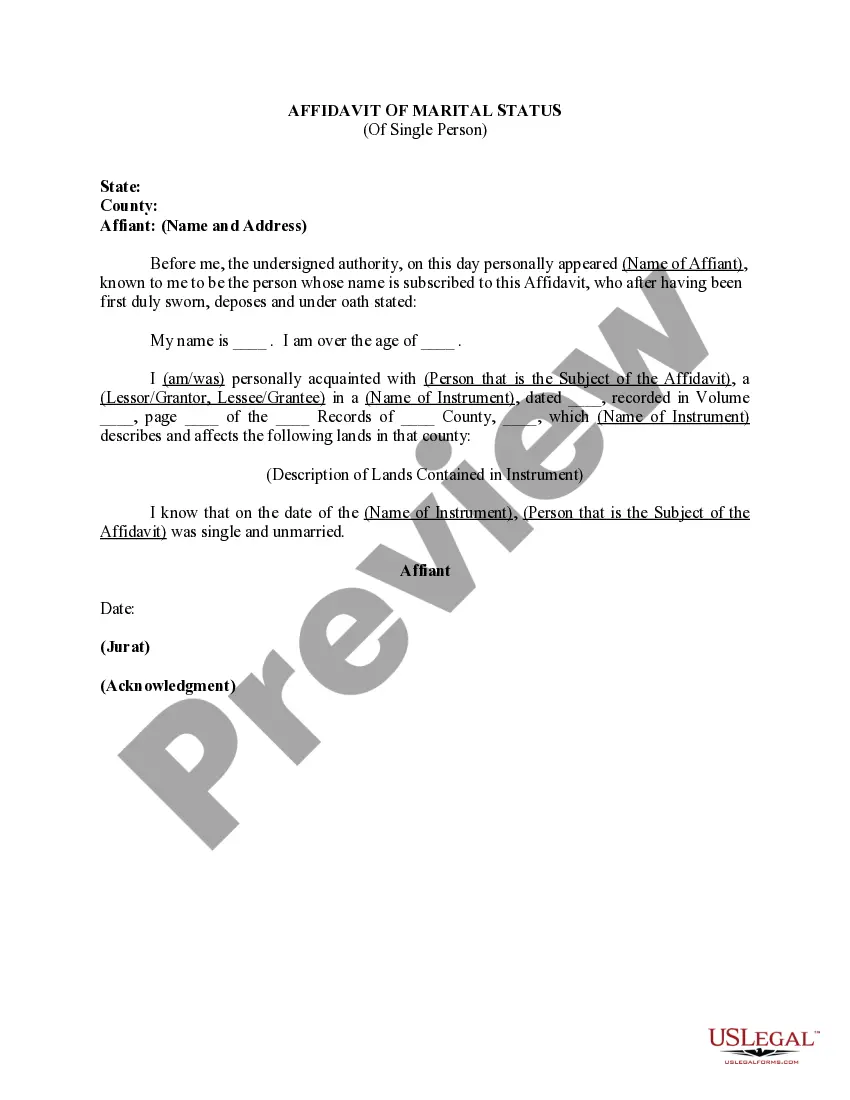

Vermont Affidavit of Marital Status (Of Single Person)

Description

How to fill out Affidavit Of Marital Status (Of Single Person)?

Are you presently in a place the place you need papers for sometimes company or person purposes nearly every day time? There are a lot of authorized record themes available on the Internet, but getting kinds you can depend on isn`t effortless. US Legal Forms provides a large number of form themes, just like the Vermont Affidavit of Marital Status (Of Single Person), that are published to satisfy federal and state specifications.

Should you be currently knowledgeable about US Legal Forms site and also have an account, just log in. After that, you are able to obtain the Vermont Affidavit of Marital Status (Of Single Person) template.

If you do not have an profile and would like to begin using US Legal Forms, follow these steps:

- Find the form you will need and ensure it is for your appropriate city/county.

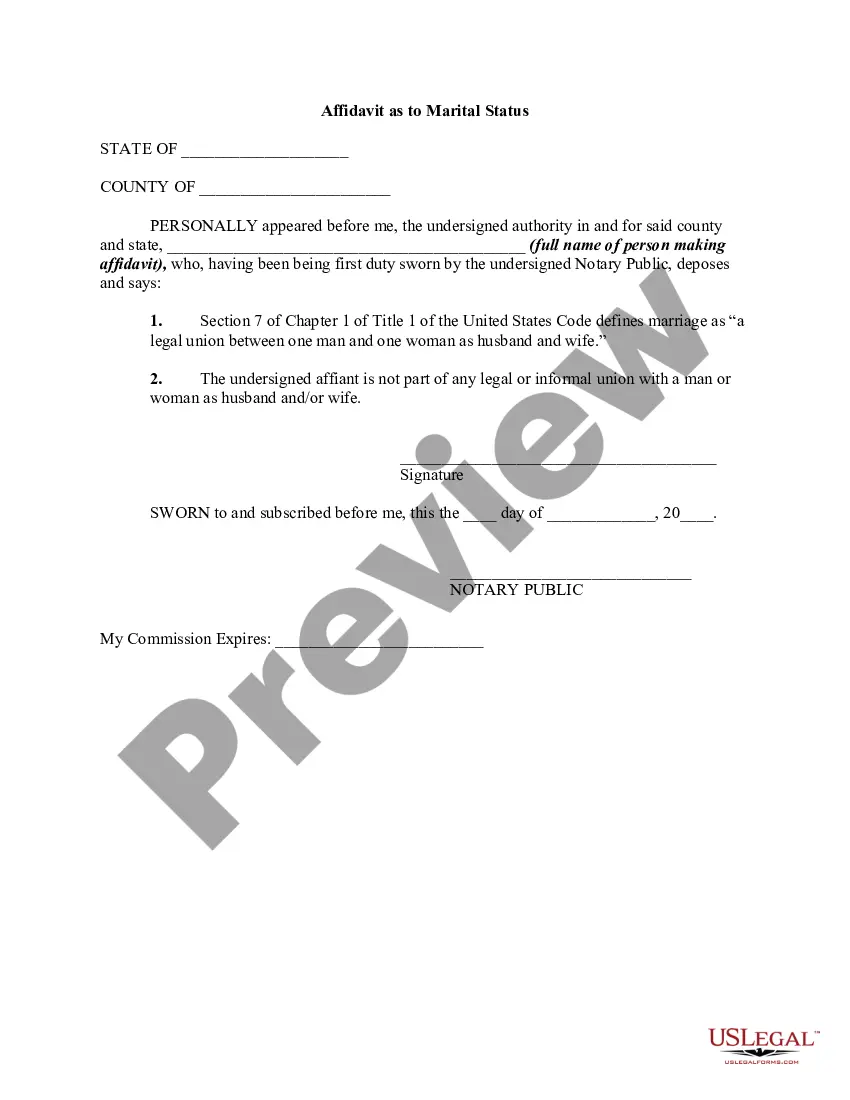

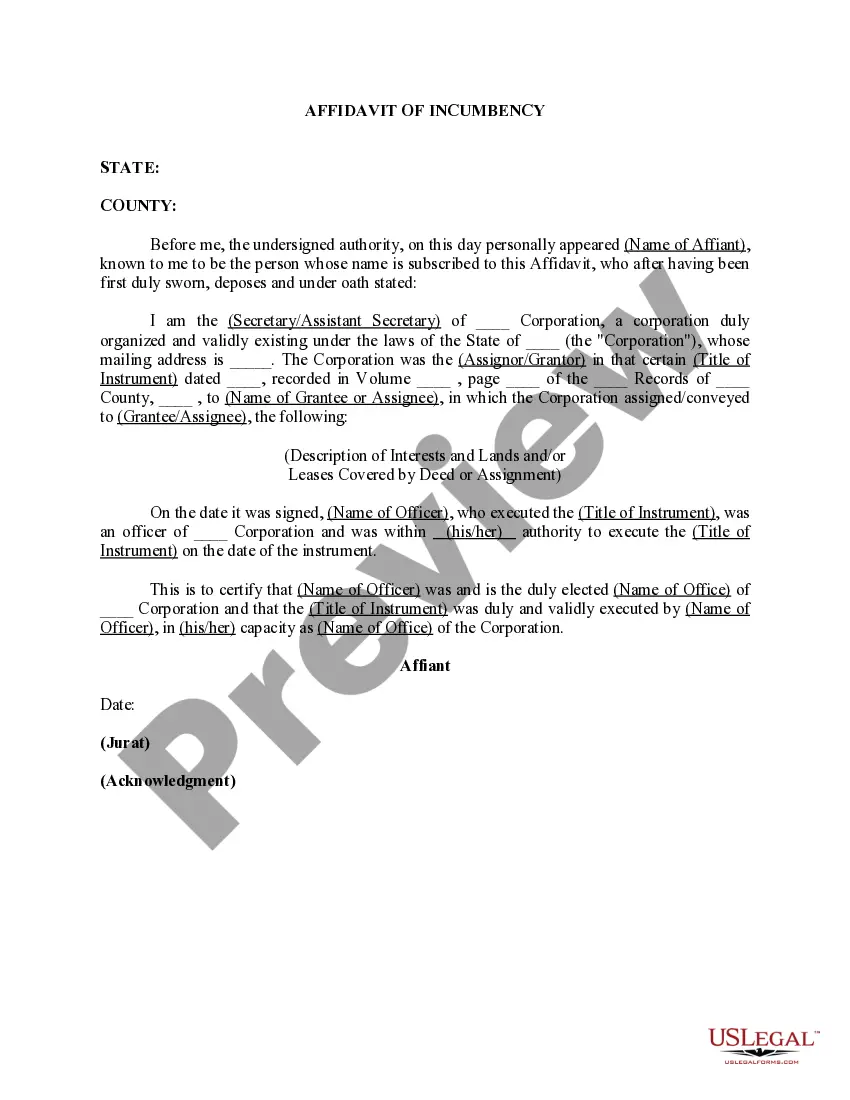

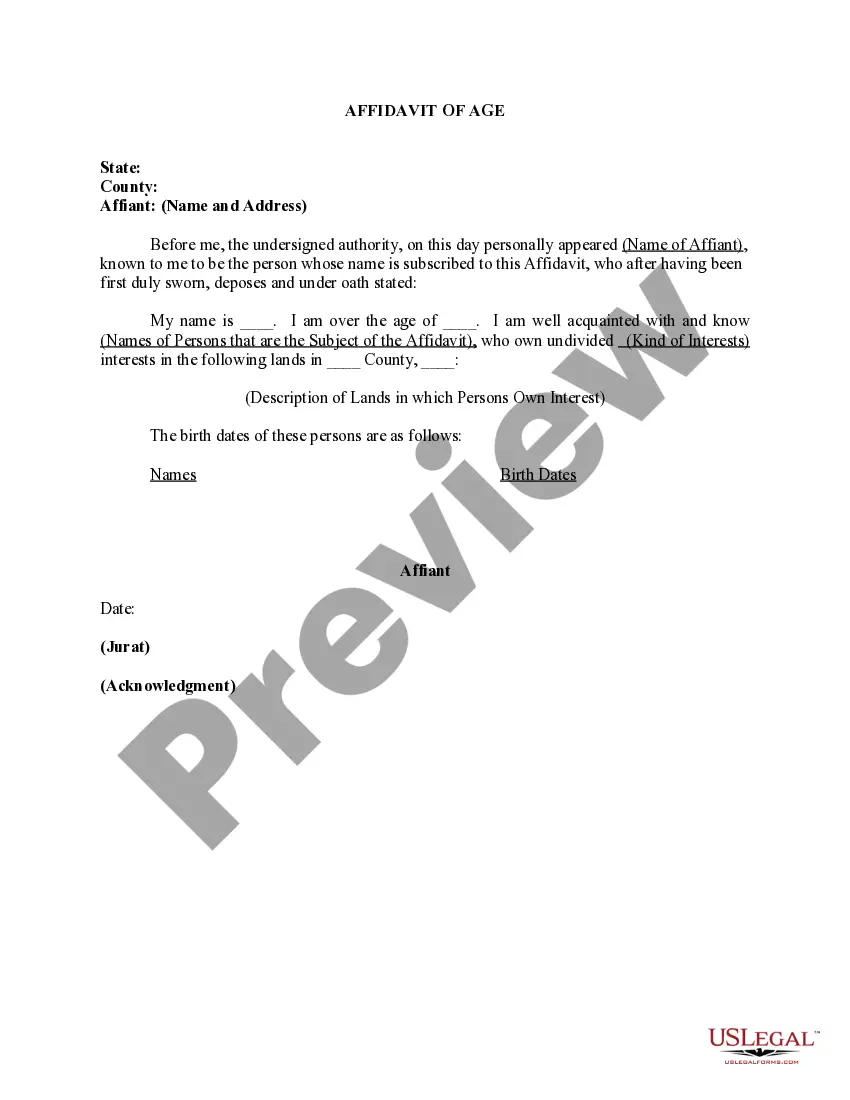

- Use the Review switch to examine the shape.

- See the description to ensure that you have selected the appropriate form.

- In the event the form isn`t what you are trying to find, take advantage of the Lookup field to discover the form that fits your needs and specifications.

- Whenever you find the appropriate form, just click Purchase now.

- Pick the rates program you would like, submit the desired information and facts to produce your money, and buy an order with your PayPal or charge card.

- Select a practical data file formatting and obtain your version.

Get all of the record themes you possess purchased in the My Forms food list. You can aquire a additional version of Vermont Affidavit of Marital Status (Of Single Person) anytime, if possible. Just select the essential form to obtain or printing the record template.

Use US Legal Forms, the most considerable collection of authorized varieties, in order to save time as well as avoid blunders. The service provides expertly produced authorized record themes which can be used for a variety of purposes. Create an account on US Legal Forms and commence generating your daily life a little easier.

Form popularity

FAQ

Single is the basic filing status for unmarried people who do not qualify to file as head of household. If you were not married on the last day of the tax year and you do not qualify to use any other filing status, then you must file your tax return as single. See the tax rates for single filers.

Married: W-4 married status should be used if you are married and are filing jointly. Married, but withhold at higher Single rate: This status should be used if you are married but filing separately, or if both spouses work and have similar income.

How does the IRS know if you are married? You tell them by the filing status declared on your tax return. If your married you file either a married filing jointly or married filing separately. They are the only filing statuses available to a married person.

If you're filing separately as a married individual, you can't file Single. Single filing status is reserved for individuals who aren't married. If you're legally separated or divorced, you can also use single filing status when completing your tax return.

If the officiate does not reside in Vermont, or is not recognized by the State of Vermont, they must file for a permit from a Probate Court in the county where the marriage will take place. In addition, any person over the age of 18 may register with the Secretary of State to become a temporary officiant to a marriage.

To qualify as married in the eyes of the IRS you need to get legally married on or before the last day of the tax year. If you can legally file as married, then you must. Married individuals cannot file as single or as the head of a household.

Married filing jointly. Married filing separately. Head of household. Qualifying widow(er) with dependent child.

You usually must be married to file together. However, if you are non-married but want to file a joint return, it is possible you can use married filing jointly if you're considered married under a common law marriage recognized by either of these: The state where you live. The state where the common-law marriage began.