Vermont Self-Employed Mechanic Services Contract

Description

How to fill out Self-Employed Mechanic Services Contract?

US Legal Forms - one of the largest repositories of legal documents in the United States - provides a range of legal template files that you can download or print.

By utilizing the website, you can discover thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can quickly find the latest versions of forms such as the Vermont Self-Employed Mechanic Services Contract.

If you already have a membership, Log In to access the Vermont Self-Employed Mechanic Services Contract within the US Legal Forms collection. The Download button will appear on each form you view. You can access all previously purchased forms in the My documents section of your account.

If you are satisfied with the form, confirm your selection by clicking the Purchase now button. Then, choose the pricing plan you prefer and provide your information to register for an account.

Process the transaction. Use your credit card or PayPal account to complete the payment. Choose the format and download the form to your device. Edit the form as needed. Fill out, modify, print, and sign the downloaded Vermont Self-Employed Mechanic Services Contract. Every template you add to your account does not expire, and you own it indefinitely. If you wish to download or print another copy, simply visit the My documents section and click on the form you need.

- To use US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have chosen the correct form for your city/county.

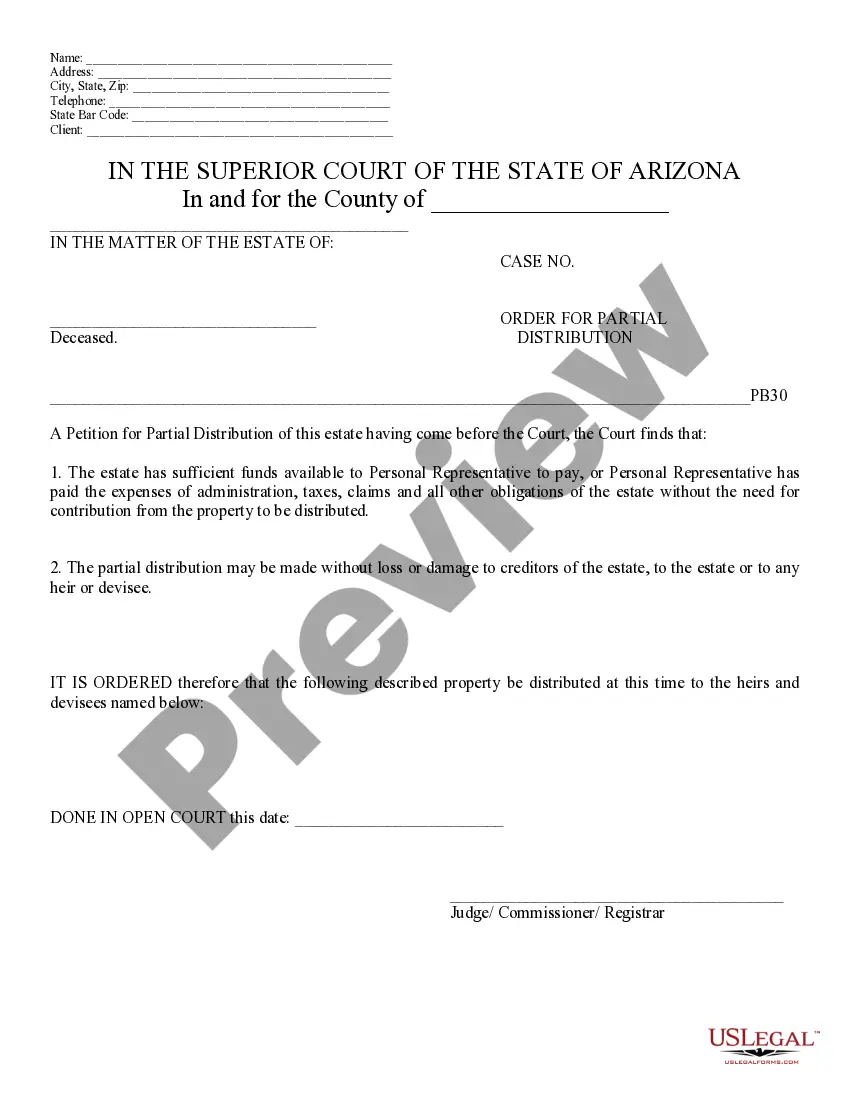

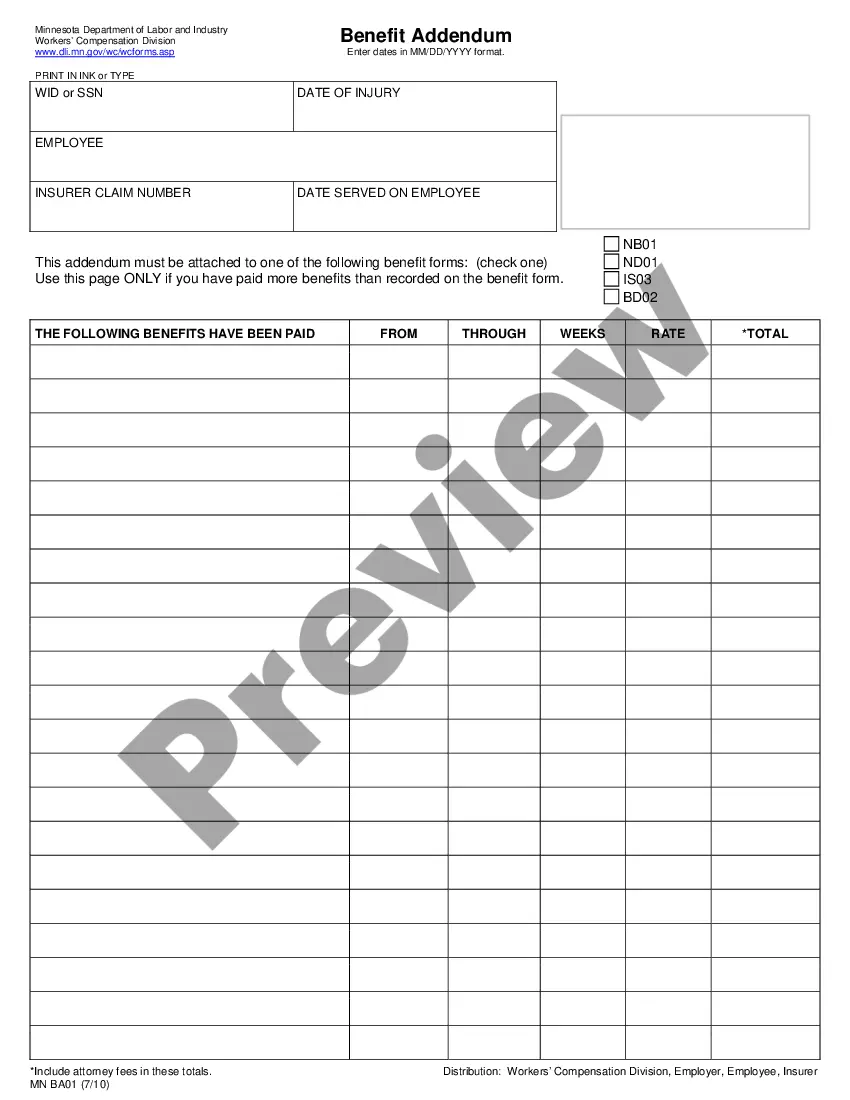

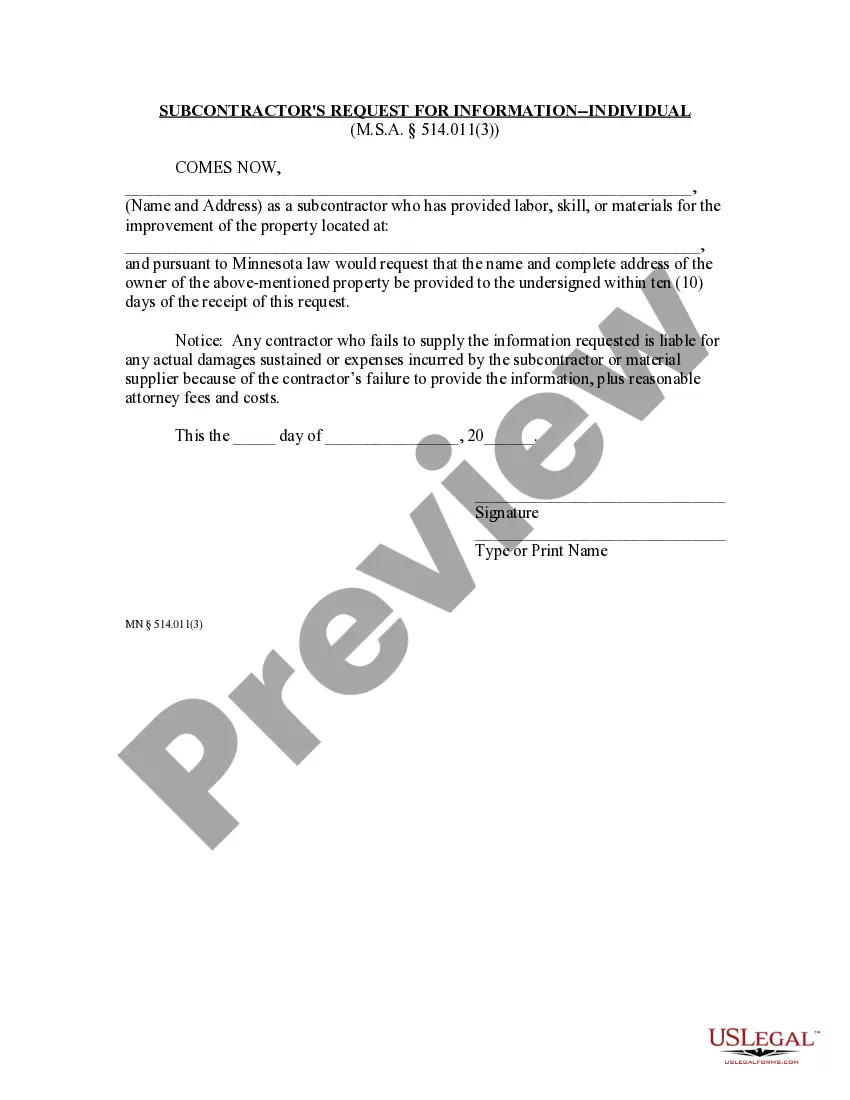

- Click the Preview button to view the form’s details.

- Read the form description to confirm you've selected the appropriate one.

- If the form does not meet your requirements, utilize the Search box at the top of the screen to find the one that does.

Form popularity

FAQ

The non-resident tax form for Vermont is the Form IN-151, specifically designed for those who earn income from Vermont while living in another state. When you operate as a self-employed mechanic under a Vermont Self-Employed Mechanic Services Contract, filling out this form ensures that you address your tax responsibilities accurately.

The form for non-resident income tax in Vermont is the Form IN-151. This form is necessary for non-residents who earn income from Vermont sources, including those working as self-employed mechanics. Utilizing this form will help you comply with tax obligations related to your Vermont Self-Employed Mechanic Services Contract.

employed person refers to any person who earns their living from any independent pursuit of economic activity, as opposed to earning a living working for a company or another individual (an employer).

More Definitions of Service Contractor Service Contractor means Individual/Firm/Company to whom contract has been awarded by company and will provide service to company as per procedure laid. Sample 1.

A contract that is used for appointing a genuinely self-employed individual such as a consultant (or a profession or business run by that individual) to carry out services for another party where the relationship between the parties is not that of employer and employee or worker.

Contracted Service Provider means a third party that enters into a contract with an agency to provide goods or services required by an agency for its operations.

What are 6 types of professional services contract agreements for consulting services?Time and materials contract.Fixed price services contract.Not to exceed (or time and materials with a cap) contract.Retainer-based services contract.Recurring service subscription.Managed services agreement.

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.