Minnesota Benefit Addendum for Workers' Compensation

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Minnesota Benefit Addendum For Workers' Compensation?

Obtain any template from 85,000 legal documents including Minnesota Benefit Addendum for Workers' Compensation online with US Legal Forms. Each template is crafted and refreshed by state-authorized legal experts.

If you possess a subscription, Log In. Once you are on the form’s page, click the Download button and navigate to My documents to retrieve it.

If you haven’t subscribed yet, adhere to the suggestions listed below.

With US Legal Forms, you will consistently have immediate access to the appropriate downloadable template. The service provides access to documents and categorizes them to streamline your search. Utilize US Legal Forms to acquire your Minnesota Benefit Addendum for Workers' Compensation quickly and effortlessly.

- Verify the state-specific prerequisites for the Minnesota Benefit Addendum for Workers' Compensation you wish to utilize.

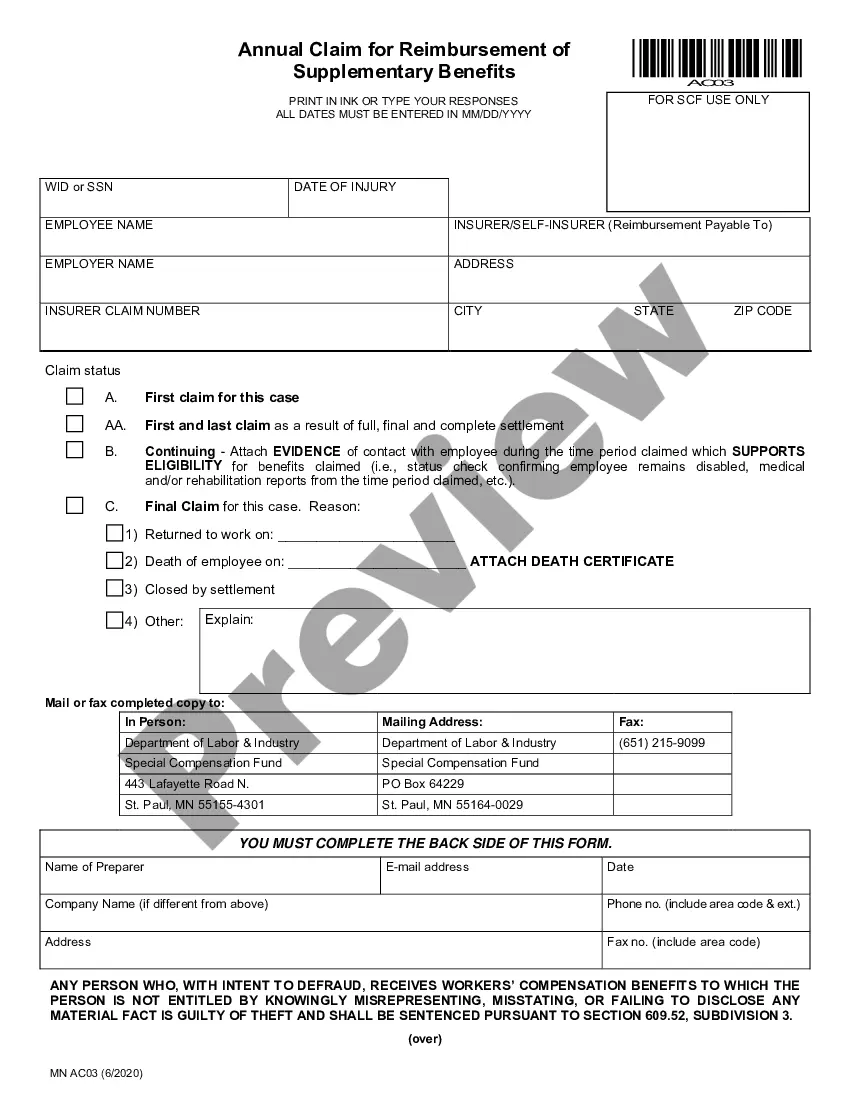

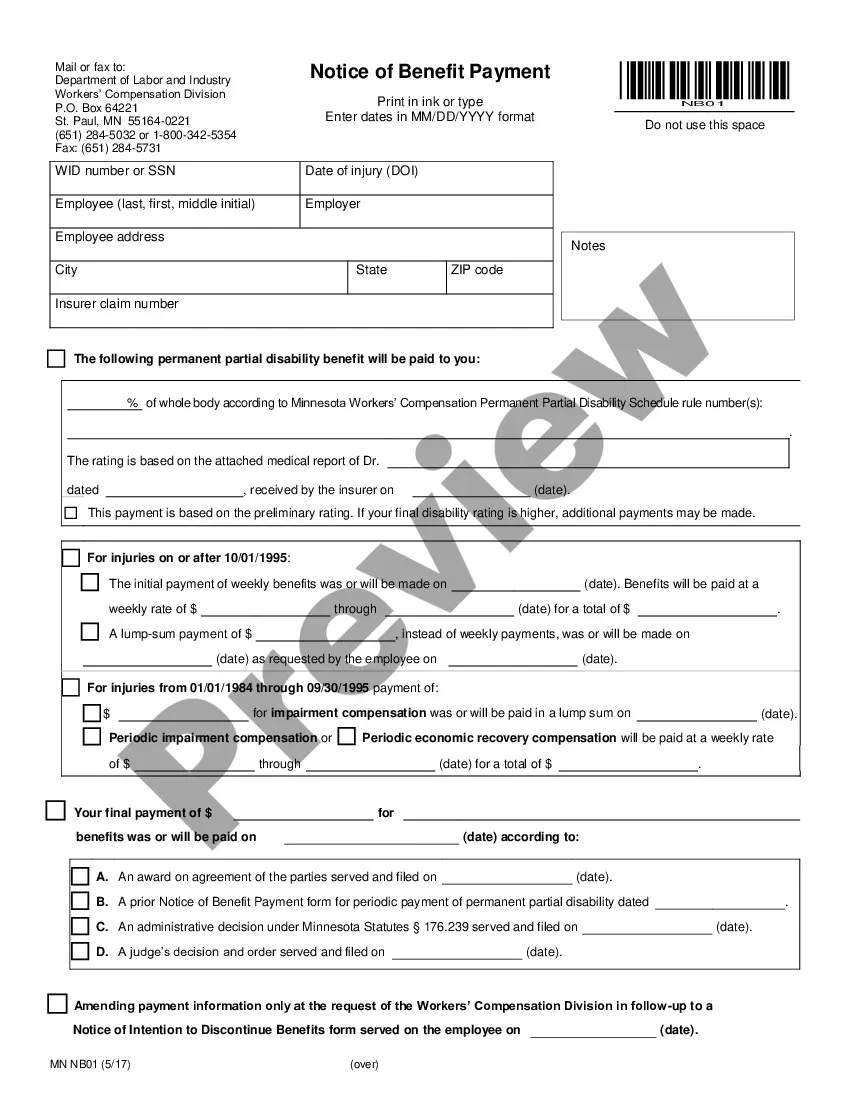

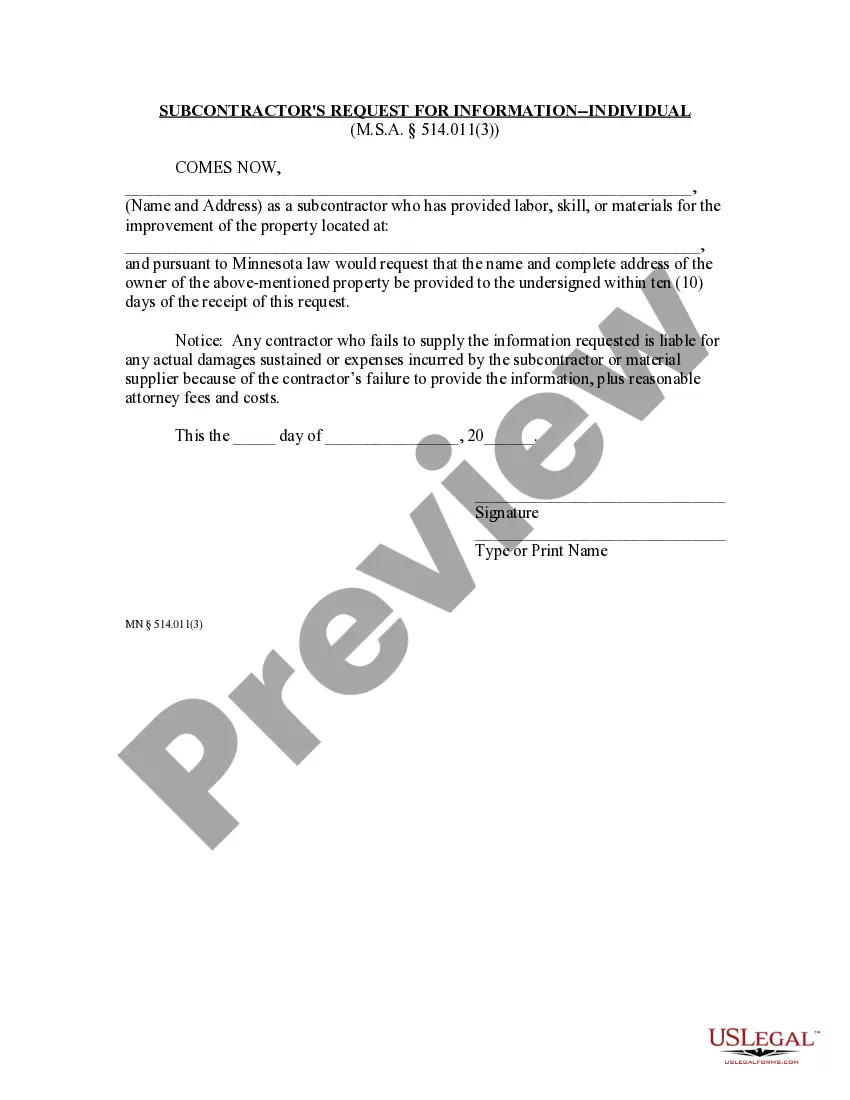

- Browse through the description and preview the template.

- Once you are confident that the sample meets your needs, simply click Buy Now.

- Select a subscription plan that suits your financial situation.

- Establish a personal account.

- Make payment in one of two suitable methods: by credit card or through PayPal.

- Choose a format to download the document in; two options are available (PDF or Word).

- Download the document to the My documents section.

- When your reusable template is downloaded, print it or save it to your device.

Form popularity

FAQ

Minnesota does not have a right to work law, which means employees that are part of a unionized workforce must join the union or make "fair share" payments equivalent to the cost of union dues.

The minimum compensation rate is $130 per week, or your actual wage if it is lower than $130. The maximum number of weeks you can receive temporary total disability benefits is 130. The second major type of wage loss benefit is temporary partial disability (TPD) benefits.

Can my employer require me to work overtime and fire me if I refuse to work overtime? The employer has the authority to establish the work schedule and determine the hours to be worked. There are no limits on the overtime hours the employer can schedule.

Minnesota employers must provide both rest and meal breaks. Although employees must be paid for shorter breaks they are allowed to take during the day, employers are not required to provide these breaks in the first place.

State Minimum Wage Minnesota law requires an employer to pay an employee a minimum hourly wage and overtime after 48 hours of work each week.

Once the 500-week period ends, your employer will seek to suspend or terminate your workers' compensation benefits, but you may still have the right to continue receiving benefits if your injuries persist.

What are the maximum hour rules? Minnesota has no maximum hour work rules, except for minors. How should overtime be calculated? In Minnesota, an employee must receive overtime at one-and-a-half times the employee's regular rate of pay for all hours worked in excess of 48 in a week (Minn.

The maximum time frame for temporary total disability benefits is 130 weeks. Compensation time depends on your injury, but you may be able to predict the results by consulting with your doctor regarding healing time and any rehabilitation time.

Workers' compensation is a no-fault system designed to provide benefits to employees who are injured as a result of their employment activities.Because it is a no-fault system, the employee does not need to prove negligence on the part of the employer to establish liability.